A comprehensive guide to the advance payment clearance template form

Understanding advance payments

Advance payments are funds disbursed to employees or teams before the actual expenses are incurred. This financial practice enables employees to access necessary funds without delays, ensuring that they can fulfill their professional obligations efficiently. The primary purpose of advance payment clearance forms is to document and standardize the process of issuing these initial funds. Companies use these forms to track spending and ensure transparency and accountability in financial procedures.

Using advance payments effectively can enhance budgeting and cash flow management. They allow for real-time financial adaptability, which is particularly beneficial when strategic investments or immediate expenditures are necessary, such as business travel or event organization. While advance payments ensure smooth operations, they also necessitate a systematic approach to manage and clear these funds.

Key components of the advance payment clearance template form

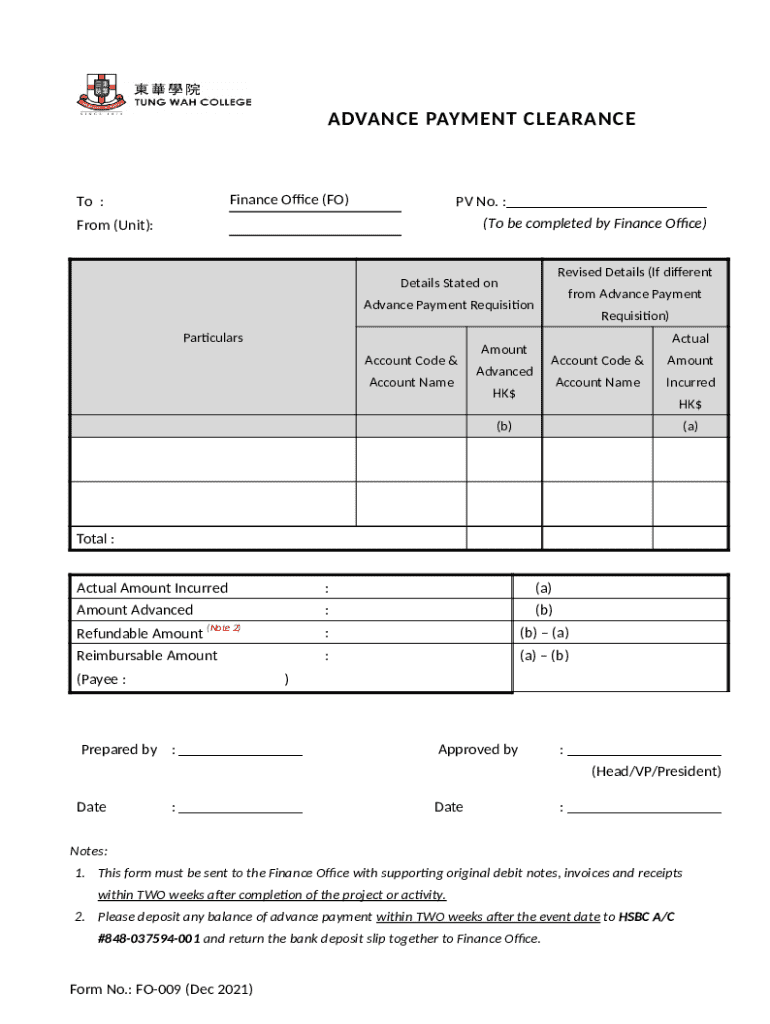

The advance payment clearance template form comprises several key sections that guide users on how to submit their requests accurately. The first section typically includes Personal Information, where employees must fill in their name, department, and contact details. This information is crucial for identifying the requester and ensuring appropriate tracking.

Next is the Payment Details section, which specifies the amount requested and the purpose of the advance. It is here where users need to articulate why the funds are necessary. The Justification of Expenses section follows, demanding a detailed statement explaining the nature of the expenses to provide clarity and context.

In addition, the form mandates Attachments Required, where users must include supporting documentation, like receipts or event itineraries. Each section plays an essential role in the approval process, as clarity and thorough justification can significantly impact the speed and likelihood of gaining approval.

Eligibility criteria for advance payment requests

Eligibility for advance payment requests typically extends to individual employees and teams whose roles necessitate out-of-pocket expenses. Certain departments, like Sales or Marketing, often utilize advance payments more frequently due to the nature of their responsibilities, which may involve travel, events, and exhibitions.

Specific job roles are generally more likely to qualify, including those directly involved in project management, client relations, or event coordination. Eligible expenses for reimbursement can cover a variety of costs including:

Expenses incurred during business travel such as flights, lodging, and meals.

Acquisition of tools or technology necessary for work tasks.

Costs associated with organizing, attending, or participating in business events.

Step-by-step instructions for filling out the advance payment clearance template form

Filling out the advance payment clearance template form correctly is vital for a successful request. Here’s a step-by-step guide that will help streamline your submission process:

Gather necessary information and documents: Ensure you have all relevant details including personal identification and estimates for your requested payment.

Filling out personal information: Complete the required fields with your name, contact information, and department accurately.

Detailing payment needs: Clearly specify the amount you are requesting and provide a concise rationale for this need.

Providing justification for the advance: Write a clear and thorough explanation highlighting the significance of the requested funds.

Attaching supporting documents: Include any documentation necessary to support your request, such as receipts or travel itineraries.

Submitting the form for approval: Ensure that all sections are filled out completely before submission to avoid delays.

Best practices for smooth advance payment requests

Ensuring accurate and complete submissions for advance payments can significantly improve the likelihood of approval. First, double-check your figures and supporting documentation for consistency. Use clear language and detail in your justifications. Common mistakes include incomplete forms or lack of attachments, so reviewing the entire form before submission is recommended.

Adhering to submission timelines is also important. Some organizations may have specific periods in which they process requests, so ensure that you are aware of these timelines to prevent unnecessary delays. Proper adherence to protocol can aid in avoiding complications and result in smoother processing of payments.

The approval process for advance payment requests

The approval process for advance payment requests typically involves several stages, from initial submission to final approval. After submitting your advance payment clearance template form, the document often goes through an administrative review or approval queue where it is analyzed by either a direct supervisor or an accounting department representative.

Different stakeholders play key roles in this process; management assists in verifying the necessity of the request, while finance departments ensure alignment with budgetary constraints. On average, approval can take anywhere from a few days to up to a week, depending on the organization’s policies and workload.

Clearing an advance payment: Procedures and responsibilities

Once you have received an advance payment, clearing it involves a follow-up procedure where expenses are reconciled against the advance provided. Employees must submit receipts and any relevant documentation that justifies the expenditure. This submission is an important accountability measure.

Responsibilities are typically split between the employee and the approving manager; employees must maintain accurate records of how the funds were used, while managers are tasked with validating the appropriateness of the expenses claimed. Adhering to these responsibilities ensures transparency in financial procedures.

Frequently asked questions (FAQs)

While navigating the advance payment clearance template form may seem straightforward, various questions often arise. For instance, if your advance request is denied, it is recommended to seek feedback on the reasons for the denial. You can then revise your request accordingly.

Another common inquiry is about modifying your request after submission; typically, alterations are allowed as long as the form has not yet been processed. Regarding the frequency of advance requests, most organizations establish guidelines on how often advances can be requested, which you should familiarize yourself with. Additionally, should your expenses exceed the advance amount, you will usually need to submit a request for reimbursement to cover the remaining costs.

Interactive tools and resources for managing advance payments

Managing financial documents like advance payment clearance template forms becomes substantially easier with interactive tools. Platforms such as pdfFiller allow users to access electronic forms, enabling efficient completion and submission. The platform also offers tools for tracking expenses, ensuring users can maintain oversight of their financial activities.

Moreover, pdfFiller provides collaboration options, making it simple for teams to work together on submissions and approvals. This functionality is essential for organizations that prioritize teamwork and streamline their financial processes, ultimately reducing administrative burdens.

Contact information for assistance

When you have questions about the advance payment clearance template form or require further clarification, it is advisable to reach out to your organization's designated finance department or HR representative. These personnel are equipped to offer guidance or troubleshooting.

In addition, pdfFiller offers comprehensive customer support services. Their team can assist users in navigating their platform and ensuring a seamless experience when managing documents. Always ensure you have the right contact information on hand to make the process smoother.

Accessibility features

To cater to all users, the advance payment clearance template form is designed with accessibility in mind. It can be used effortlessly across various devices, ensuring that individuals can access it from smartphones, tablets, or computers. Such versatility is crucial in today's work environment where remote access is a common requirement.

For users with disabilities, pdfFiller includes features such as text-to-speech, screen reader compatibility, and intuitive navigation, making it easier for individuals to manage their documents effectively. This commitment to accessibility ensures inclusivity and enhances usability for everyone.

Other useful templates related to advance payments

Beyond the advance payment clearance template form, various other templates can assist in managing financial requests. For example, standard reimbursement forms can be used post-expenditure to account for any residual costs. Understanding the differences between advance payment forms and these standard forms will help streamline financial processes, ensuring maximum efficiency.

Links to related forms are often available on organizational websites, streamlining access for employees. Getting familiar with each format can aid in determining the most appropriate method for submitting financial requests based on the situation.