Get the free ct tr 1 form - fill online, printable, fillable, blank

Get, Create, Make and Sign ct tr 1 form

Editing ct tr 1 form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct tr 1 form

How to fill out ct tr 1 form

Who needs ct tr 1 form?

Comprehensive Guide to the CT TR 1 Form

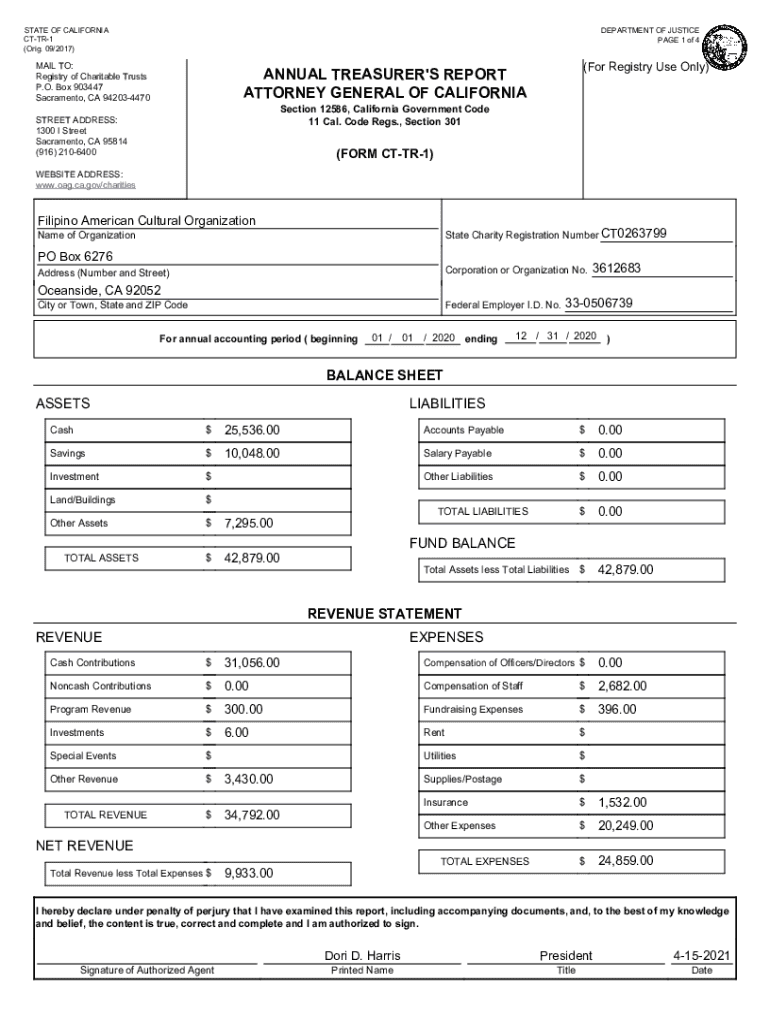

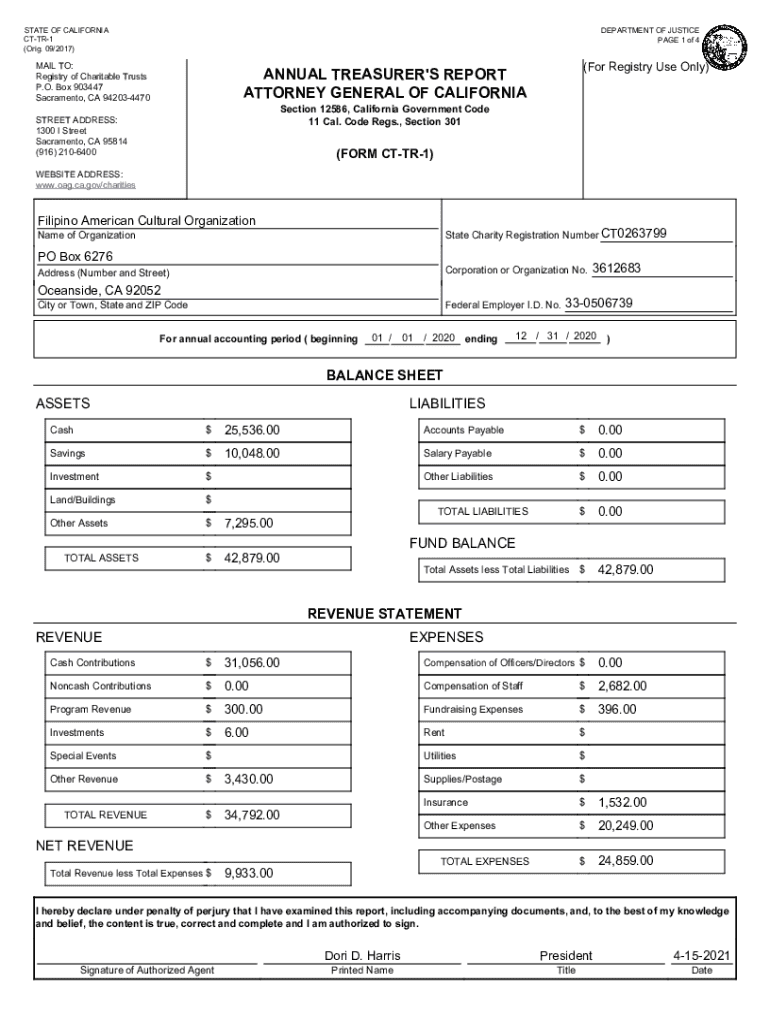

Overview of CT TR 1 Form

The CT TR 1 Form is a crucial document widely used for tax purposes within Connecticut. This form serves as a declaration for taxpayers to report their personal information and financial details, paving the way for accurate tax assessments. Understanding its purpose is essential for both individuals and teams aiming to comply with state regulations.

Both individuals and teams, such as businesses or nonprofits, find the CT TR 1 Form important for maintaining transparency and ensuring they meet their tax obligations efficiently. By accurately filling out this form, users can prevent costly errors and potential legal issues.

Utilizing pdfFiller for the CT TR 1 Form enhances this process by providing tools that simplify the completion and submission of the form. With pdfFiller, users can easily edit, sign, and submit their documents, along with access to various templates, making the entire procedure hassle-free.

Who needs the CT TR 1 Form?

The CT TR 1 Form is required for individuals and entities looking to establish their taxable status in Connecticut. Anyone who is planning to engage in business activities, or who has income subject to state tax, will find the need to complete this form.

Common use cases include businesses registering for a new tax identification number, nonprofits applying for tax-exempt status, and individuals claiming various deductions. These scenarios highlight the importance of the CT TR 1 Form as a foundational document in the state tax system.

Examples of scenarios that typically require the CT TR 1 Form include opening a new retail shop, forming a consultancy service, or registering a charitable organization. Understanding these contexts helps ensure compliance and accurate dealings with state revenue agencies.

Step-by-step guide to completing the CT TR 1 Form

Completing the CT TR 1 Form can seem daunting, but following a structured process can ease this task. This guide breaks down the process into manageable sections, ensuring users provide accurate information efficiently.

Section 1: Basic information input

In this section, users will be asked to input their basic information, including name, contact details, and entity type. These details are essential for correctly identifying the taxpayer and ensuring the form is processed appropriately.

To maximize accuracy, double-check all entries and ensure consistency with any supporting documents you may have.

Section 2: Financial data

Moving to financial data, users will report income, expenses, and deductions. This section is vital as it provides a clear picture of your financial standing, which influences tax obligations.

Common mistakes include failing to include all sources of income or incorrect calculations. A meticulous review at this stage can save future headaches.

Section 3: Supporting documents

This section requires users to attach supporting documents that substantiate the information provided. These may include profit and loss statements, bank statements, and prior tax returns.

Using pdfFiller, uploading and managing these documents is straightforward. Users can simply drag and drop files into their form or utilize the upload button.

Section 4: Review and submission process

Before final submission, a thorough review of the CT TR 1 Form is critical. This ensures that all information is complete and accurately reflects financial realities.

Once satisfied, users can click the submit button within pdfFiller to finalize their CT TR 1 Form electronically. This ensures swift processing and record-keeping.

Interactive features of pdfFiller

pdfFiller goes beyond simple form filling. Its interactive features enhance collaboration and speed up the overall process, particularly within teams.

These capabilities not only simplify the task of completing the CT TR 1 Form but also contribute to an organized and efficient workflow.

Frequently asked questions (FAQs) about CT TR 1 Form

Understanding the common questions surrounding the CT TR 1 Form can clarify misconceptions and promote effective usage.

Additional resources for users

For users looking to further enhance their experience with the CT TR 1 Form, numerous resources are available. pdfFiller offers a wide range of related forms, templates, and document management tools.

Users can access training and support resources directly on pdfFiller, ensuring they consistently utilize the platform's full potential while maintaining compliance with data management best practices.

Testimonials and success stories

Real-world experiences highlight the positive impact of using the CT TR 1 Form in conjunction with pdfFiller. For instance, a small business team streamlined their document processes dramatically by utilizing the platform’s editing and collaboration features.

Users have relayed feedback on how pdfFiller's functionality has improved their accuracy and speed in handling tax forms, ultimately leading to enhanced efficiency in their operations.

Updates and changes to the CT TR 1 Form

Understanding any updates to the CT TR 1 Form is crucial for users to remain compliant. Recent amendments may include changes in required information or filing procedures that could affect the submitted form.

It is wise to periodically check for such updates on the pdfFiller platform, which strives to keep users informed of any developments regarding tax forms and requirements.

Comparison with similar forms

When considering the CT TR 1 Form, it is helpful to be aware of similar forms that may apply to other tax-related situations. Forms such as the CT-1040 or CT-1065 cater to different taxpayer needs, and knowing when to use each is vital.

pdfFiller simplifies managing these forms across a single platform, making it easier for users to navigate their tax obligations without confusion.

Accessibility and mobile solutions

Accessing the CT TR 1 Form is convenient across various devices. pdfFiller ensures that users can fill out, edit, and manage their forms from any location—whether on a desktop, tablet, or smartphone.

The platform also emphasizes security and privacy in document management, offering encryption and compliance with regulations to protect users' sensitive information while leveraging the flexibility of mobile solutions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my ct tr 1 form in Gmail?

How do I make changes in ct tr 1 form?

How do I fill out the ct tr 1 form form on my smartphone?

What is ct tr 1 form?

Who is required to file ct tr 1 form?

How to fill out ct tr 1 form?

What is the purpose of ct tr 1 form?

What information must be reported on ct tr 1 form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.