Get the free Understanding Form 1042-S

Get, Create, Make and Sign understanding form 1042-s

How to edit understanding form 1042-s online

Uncompromising security for your PDF editing and eSignature needs

How to fill out understanding form 1042-s

How to fill out understanding form 1042-s

Who needs understanding form 1042-s?

Understanding Form 1042-S: A Comprehensive Guide

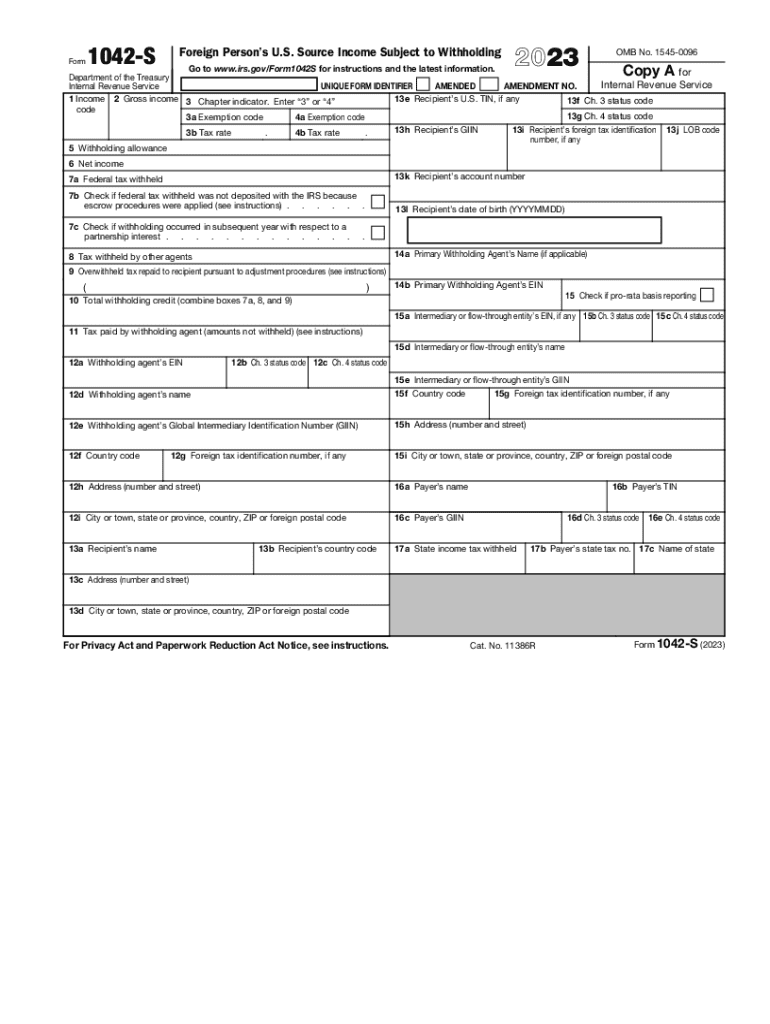

Overview of Form 1042-S

Form 1042-S is an essential document utilized in the reporting of income paid to foreign individuals and entities. This form is crucial for compliance with U.S. tax obligations and reporting requirements. Its primary purpose is to delineate payments made that are subject to withholding under U.S. tax law, including but not limited to interest, dividends, royalties, and other types of fixed or determinable annual or periodic income.

Understanding form 1042-S is particularly vital in the realm of international taxation, as it aids both the IRS and foreign recipients in tracking income and withholding tax obligations. Unlike other tax forms such as Forms 1099 or W-2, which serve different taxpayer populations, Form 1042-S is specifically tailored to foreign recipients, ensuring the reporting of U.S. income provided to non-resident aliens and foreign entities.

Who needs to file Form 1042-S?

Entities that are considered withholding agents, which includes U.S. businesses and financial institutions making payments to foreign individuals or entities, are mandated to file Form 1042-S. If payments are made to foreign persons that fall under U.S. tax obligations, the withholding agent is responsible for reporting such payments, thereby reflecting their tax withholding.

Exemptions from filing include foreign entities that meet specific qualifications, such as certain government entities or foreign organizations specifically exempt from U.S. tax on the income received. However, it is important to understand that even if certain recipients are exempt from withholding, the requirement to file Form 1042-S may still apply based on the nature of the payment.

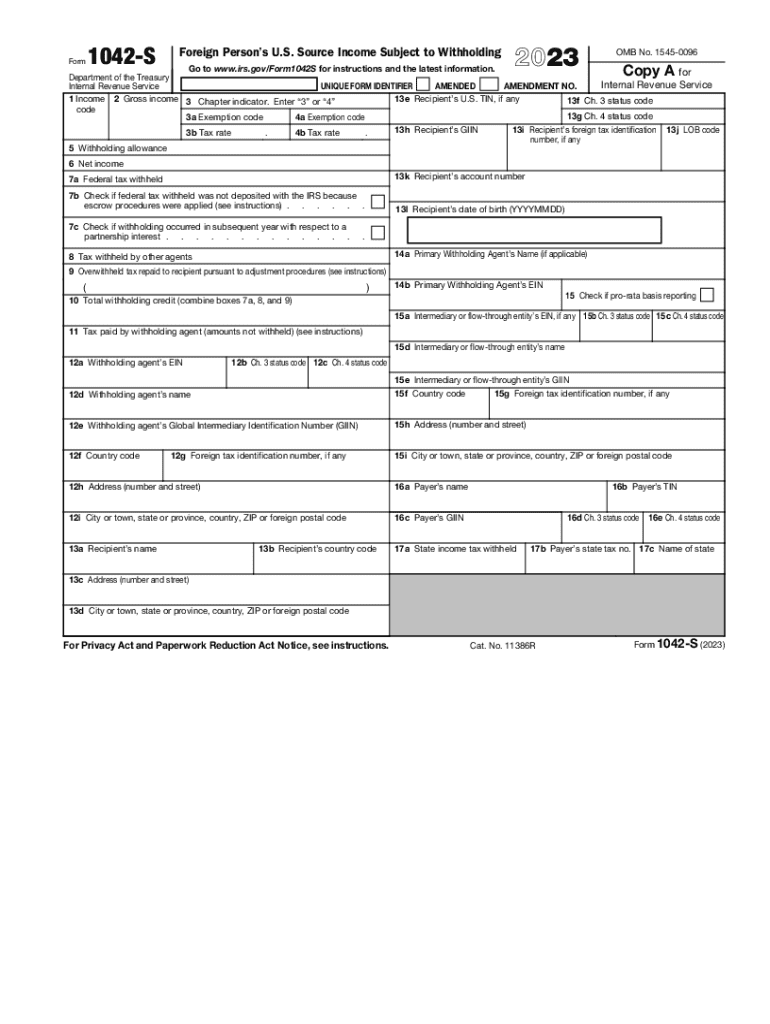

Key components of Form 1042-S

Form 1042-S comprises various boxes, each providing essential information regarding the income that the form is reporting. Understanding these components can help both filers and recipients accurately complete and interpret the form. Below is a breakdown of those critical boxes.

Filing process for Form 1042-S

Filing Form 1042-S requires careful attention to detail and adherence to specific deadlines. Follow these steps to ensure a smooth filing process:

Common errors to avoid during filing include incorrect income codes, failure to provide recipient's TIN, or calculation errors in tax withheld. Double-checking your entries can save time and prevent potential penalties.

Tax reporting and compliance implications

Both businesses and individuals must comply with stringent reporting obligations concerning Form 1042-S. For businesses, neglecting to file or misreporting can trigger audits and penalties, reinforcing the necessity for accurate records and timely submissions.

Addressing errors on Form 1042-S can be accomplished by submitting an amended form. It’s critical to take action quickly upon realization of an error to prevent issues with the IRS. Accuracy is paramount not only for compliance but also for fostering a transparent tax reporting relationship with foreign counterparts.

Tools and resources for filling out Form 1042-S

Taking advantage of available tools can simplify the process of filling out Form 1042-S. Platforms like pdfFiller offer interactive tools and resources that streamline document management and enhance user experience.

Additional considerations

Understanding the nuances of Form 1042-S requires awareness of how it interacts with other forms like Form 1042 and Form 1042-T. These forms often work in conjunction, with the 1042-S reporting individual payments and the 1042 summarizing all payments to foreign persons.

In instances where deadlines are missed, proactive measures should be taken, such as filing as soon as possible and addressing any potential penalties directly with the IRS. Organizations with specific structures, like non-resident partnerships or intermediaries, should seek professional guidance to navigate their unique responsibilities under U.S. tax law.

FAQs about Form 1042-S

Form 1042-S often leads to questions from both filers and recipients. Clarifying common queries can aid in navigating this complex area of tax reporting.

Support services for filing Form 1042-S

For individuals or businesses seeking additional help with Form 1042-S, various support services are available. Professional assistance can streamline tax compliance and provide expert insights into complex international tax regulations.

Related topics and advanced insights

Insight into the broader context of international taxation and reporting is invaluable for anyone dealing with Form 1042-S. Familiarizing oneself with related forms such as 1042, 1099, and the W-8 series can enhance understanding of the overall tax landscape.

Further, emerging trends in international taxation, including tax automation solutions provided by platforms like pdfFiller, can bring efficiency and clarity to document management processes.

Information for accountants and tax professionals

Tax professionals play a critical role in advising clients on the specific implications and filing requirements of Form 1042-S. Keeping abreast of the latest IRS guidelines and best practices for international tax compliance enables accountants to serve their clients effectively.

Best practices include maintaining accurate records, ensuring timely filings, and offering informed guidance regarding applicable exemptions and withholding responsibilities. Being proactive not only mitigates risks for clients but also enhances overall compliance.

Conclusion

Understanding Form 1042-S is paramount for anyone engaged in international business or transactions involving foreign individuals. This form not only plays a critical role in tax compliance but also in establishing transparent financial relationships across borders.

Utilizing platforms like pdfFiller can significantly enhance the management and submission process of Form 1042-S, ensuring users remain compliant while effectively managing their documentation needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit understanding form 1042-s from Google Drive?

Can I sign the understanding form 1042-s electronically in Chrome?

How do I complete understanding form 1042-s on an Android device?

What is understanding form 1042-s?

Who is required to file understanding form 1042-s?

How to fill out understanding form 1042-s?

What is the purpose of understanding form 1042-s?

What information must be reported on understanding form 1042-s?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.