A detailed guide on the actuarial summary fact sheets form

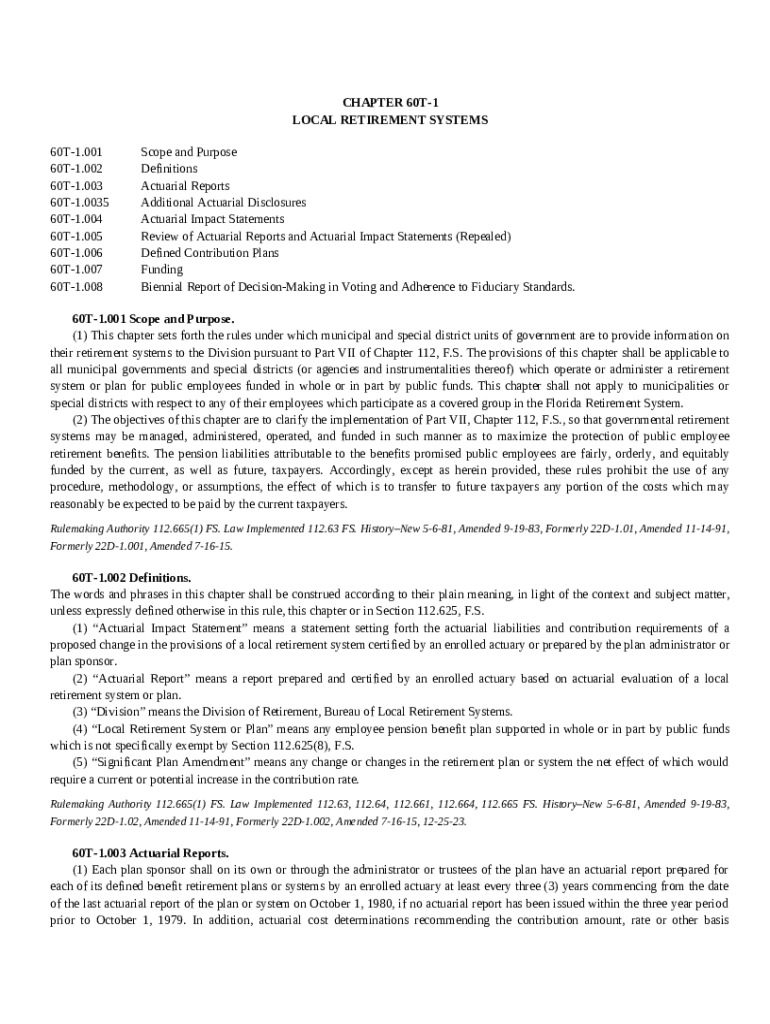

Overview of the actuarial summary fact sheets form

The actuarial summary fact sheets form is an essential document utilized across various sectors of financial services, notably in insurance and pension planning. Its primary purpose is to provide a concise, clear summary of actuarial data and assumptions which underpin financial projections and risk assessments. This form ensures that stakeholders have accessible and well-organized information at their fingertips, enabling informed decision-making.

The importance of this form cannot be underestimated. By consolidating critical data points into one document, it significantly enhances the ability of professionals to analyze trends, project future outcomes, and prepare for regulatory reviews. For organizations, transparency and clarity in reporting facilitate trust with clients and regulatory bodies alike.

Purpose and Importance of the Actuarial Summary: Capture essential data for informed decision-making.

Key Components of the Actuarial Summary Fact Sheets: Summarize actuary assumptions, reserves, and projections.

Benefits of Using the Actuarial Summary Fact Sheets in Document Management: Streamline communications among stakeholders.

Understanding the actuarial summary

Actuarial summaries serve as crucial documentation that encapsulates the core findings derived from complex actuarial methods. These summaries are crafted by professionals who have deep competencies in statistical analysis and risk management. They are typically utilized to guide business decisions concerning pricing, strategy development, and assessing reserve liabilities.

The target audience for actuarial summary fact sheets extends beyond just actuaries. Financial analysts, risk managers, and executives in organizations that rely on these summaries should familiarize themselves with this essential tool. Common scenarios where these summaries come into play include annual reports, financial audits, and performance reviews, all of which benefit from the organized presentation of actuarial insights.

Definition and Role of Actuarial Summaries: Summarize complex actuarial data for clarity.

Who Should Use the Actuarial Summary Fact Sheets?: Includes financial analysts, actuaries, and risk managers.

Common Uses and Scenarios for the Actuarial Summary: Annual reports, audits, and reviews.

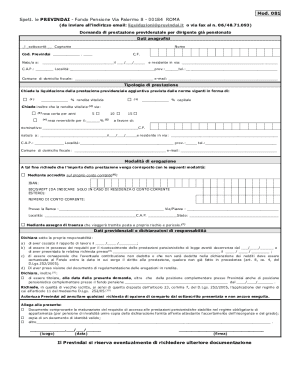

Filling out the actuarial summary fact sheets

Completing an actuarial summary fact sheet requires careful attention to detail. Begin by gathering all historical data, statistical reports, and any supplementary documentation that will inform your summary. This ensures that the provided data is not only comprehensive but also accurate.

When inputting data, focus on crucial fields such as mortality rates, discount rates, expenses, and any other assumptions that affect projections. Be meticulous—common errors include data entry mistakes or miscalculating key ratios. To avoid such mishaps, double-check your information against original sources or formulas, and utilize available checking tools.

Gathering Necessary Information and Documentation: Compile historical data, statistics, and assumptions.

Inputting Data Accurately: Focus on mortality rates, discount rates, and expenses.

Common Mistakes to Avoid When Filling Out the Form: Data entry errors and miscalculations.

Effective data entry can be further enhanced through the use of interactive tools available on platforms like pdfFiller. These resources help track revisions and validate input, ensuring that you maintain a high level of accuracy.

Editing the actuarial summary fact sheets

Editing an actuarial summary fact sheet is crucial for maintaining the integrity and accuracy of the document. Tools such as pdfFiller offer features that simplify the editing process, allowing users to make necessary adjustments without losing track of previous data or formatting.

To review and make changes, utilize version history and annotation tools. This functionality not only tracks alterations but also facilitates collaboration among team members, ensuring that multiple viewpoints can be incorporated without confusion.

Utilizing pdfFiller’s Editing Features: Simplify adjustments and formatting.

How to Review and Make Changes: Use version history for tracking adjustments.

Collaborating with Team Members on Changes: Incorporate feedback easily.

Signing the actuarial summary

eSigning the actuarial summary is not just a procedural formality; it’s an affirmation of the document's accuracy and compliance with regulatory standards. This digital signature protects both the signer’s credibility and the integrity of the data.

To eSign using pdfFiller, follow a simple process. Ensure that any previous collaborations are finalized, input your secure signature, and validate the document as needed. Being compliant with legal standards during eSigning reduces risks related to data integrity and enhances stakeholder trust.

The Importance of eSigning the Actuarial Summary: Affirms accuracy and compliance.

Step-by-Step Guide to eSigning with pdfFiller: Ensure signatures are valid and secure.

Ensuring Compliance: Adhere to legal aspects of digital signatures.

Managing your actuarial summaries

Proper management of your actuarial summaries ensures easy access and organizational efficiency. By using cloud-based systems like pdfFiller, you can store, share, and access your documents anywhere with internet connectivity. This flexibility allows for critical time-saving benefits.

To optimize retrieval, organize documents categorically or by project. Using consistent naming conventions also aids in quickly locating specific summaries. When managing sensitive data, employing best practices for document security and privacy is imperative to protect against unauthorized access.

Storing, Sharing, and Accessing the Actuarial Summaries from Anywhere: Utilize cloud-based storage.

Organizing Your Documents for Easy Retrieval: Implement naming conventions and categories.

Best Practices for Document Security and Privacy: Protect sensitive information.

Frequently asked questions (FAQs)

Common queries about the actuarial summary fact sheets often revolve around their proper use and the handling of sensitive information. Users are advised to familiarize themselves with document security protocols to alleviate concerns about data breaches and non-compliance with regulations.

If issues arise with the actuarial summary form, promptly consulting support from tools like pdfFiller or engaging in user communities can provide quick resolutions. It's essential to stay informed about any updates or changes in processes.

Common Queries Regarding the Actuarial Summary Fact Sheets: Usage FAQs and data handling.

Addressing User Concerns About Data Security and Compliance: Using protective measures.

Troubleshooting Issues with the Actuarial Summary Form: Quick resolutions via support.

Additional insights for effective use of the actuarial summary

Case studies and success stories shed light on the practical benefits of utilizing actuarial summary fact sheets. For instance, organizations that adopted streamlined documentation processes experienced increased efficiency in reporting and improved stakeholder engagement.

Emerging trends in actuarial documentation are leaning towards more automation and integrated analytics, allowing for real-time insights and adaptive strategies. Keeping abreast of these developments will serve users well in optimizing their data management practices.

Case Studies or Success Stories: Showcase benefits of streamlined documentation.

Current Trends in Actuarial Documentation and Reporting: Focus on automation and analytics.

Future Developments in the Actuarial Summary Form Tools: Enhancements to foster efficiency.

Contact and support information

Using pdfFiller offers a direct line to support for any challenges users might face while utilizing actuarial summary fact sheets. Whether it’s through their customer service channels, community forums, or educational resources, users can quickly get the assistance they need to navigate the platform.

Engaging with the user community provides invaluable insights, while feedback channels allow for ongoing improvement of the tools. This ecosystem supports users in maximizing their use of the actuarial summary forms and enhances the overall user experience.

How to Reach pdfFiller Support for Assistance: Multiple channels for quick help.

User Community and Feedback Channels: Engage with fellow users for insights.

Opportunities for User Engagement and Updates: Stay informed about the latest tools.