Get the free Group Level Term Life Insurance EFT Authorization Form - IEEE

Get, Create, Make and Sign group level term life

Editing group level term life online

Uncompromising security for your PDF editing and eSignature needs

How to fill out group level term life

How to fill out group level term life

Who needs group level term life?

Understanding the Group Level Term Life Form: A Comprehensive Guide

Understanding group level term life insurance

Group level term life insurance provides a collective coverage that protects a defined group—like employees in a company or members of an organization—against the financial risks associated with unexpected death. The primary purpose of this type of insurance is to ensure that the beneficiaries receive a lump-sum payout upon the policyholder's passing, securing their financial future.

Unlike individual term life insurance, which is tailored to an individual’s specific needs and requires underwriting based on personal health conditions, group level term life insurance is generally offered without individual health assessments. Members of the group typically receive standardized coverage, simplifying the application process and making it more accessible.

The importance of life insurance for financial security

Life insurance is pivotal for financial security, ensuring that your loved ones are not burdened with debt or financial instability when you’re no longer around. Group level term life insurance is an effective tool in this regard, and its presence in financial planning cannot be understated. This type of insurance typically offers a straightforward, affordable means of protecting the future of your dependents.

Often, group term insurance is particularly beneficial in various situations, such as when employees are navigating difficult financial times or when they are the primary breadwinners. The coverage provided gives them peace of mind, knowing their loved ones are protected even in unforeseen circumstances.

How to obtain group level term life insurance

Acquiring group level term life insurance entails a few straightforward steps, beginning with understanding eligibility requirements. Generally, any organization—be it a corporation, association, or union—can offer this insurance to its members or employees as part of their compensation package or benefits program.

For employers and groups, key considerations might include the size of the organization, the demographic makeup of the workforce, and desired coverage amounts. Once these factors are assessed, the application process can commence. Here are the steps for obtaining group level term life insurance.

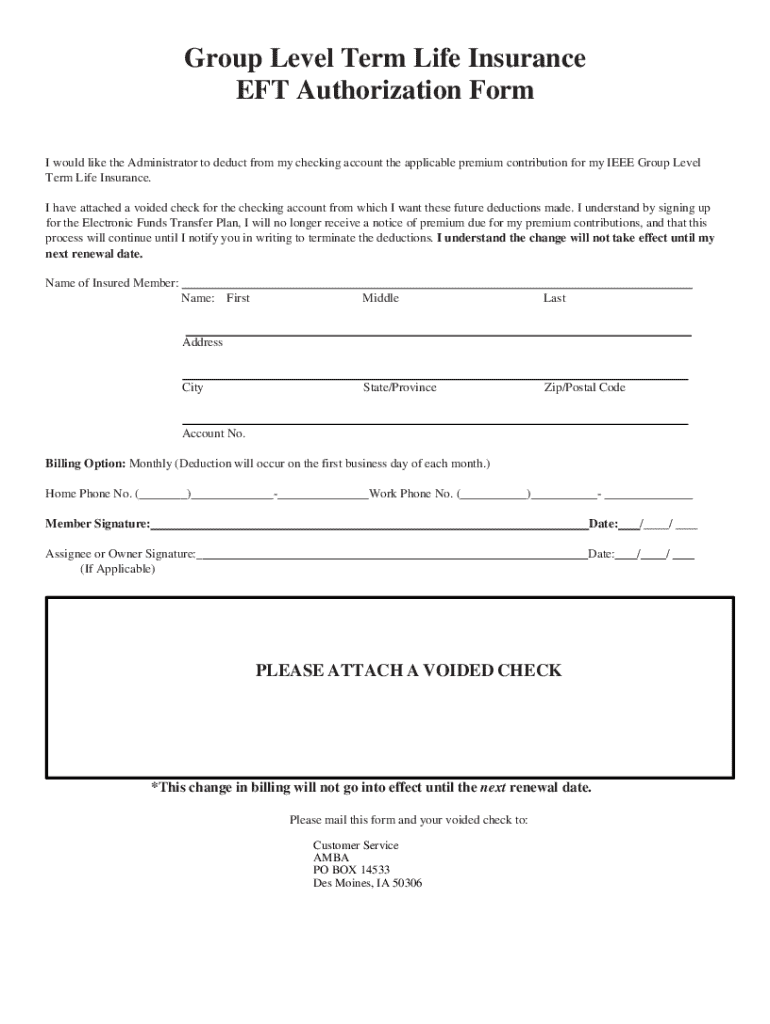

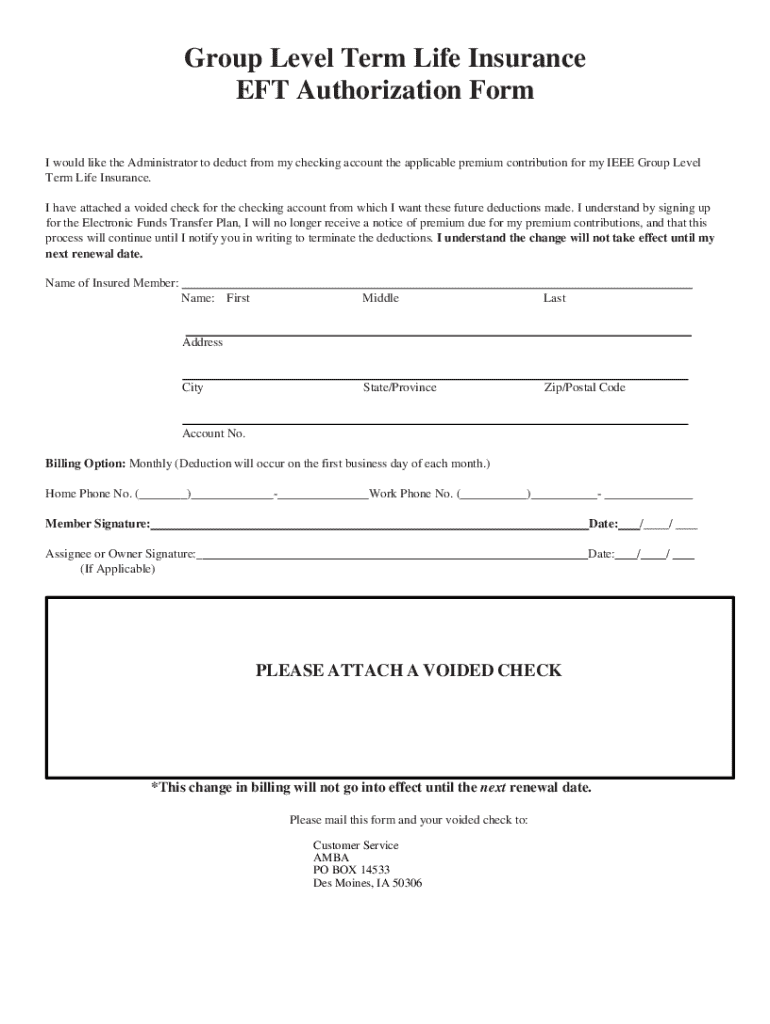

Filling out the group level term life form

Filling out the group level term life form is a critical step that determines the effectiveness and applicability of your insurance coverage. The process can be made easier through interactive tools and templates available online. It is crucial to ensure accurate and complete information is provided to avoid issues down the line.

Essential information required in the form typically includes personal information about the insured individuals, beneficiary selections, and choices regarding coverage amounts. Below are tips on how to accurately complete the form and some common pitfalls to avoid.

Managing your group level term life policy

Managing your group level term life policy is just as important as obtaining it. Making updates or changes, such as adding new beneficiaries or adjusting coverage amounts, ensures that the policy remains relevant as circumstances evolve. Regularly reviewing policy details can help in effectively addressing the needs of both employers and insured members.

When it comes to filing claims, understanding the step-by-step process is crucial for beneficiaries. It typically involves notifying the insurance provider, submitting the necessary documentation, and completing a claim form. Clarifying these procedures upfront helps ensure smooth transactions when handling such sensitive matters.

Additional benefits of group level term life insurance

Group level term life insurance offers additional advantages beyond basic coverage, presenting significant cost-efficiency compared to individual policies. This accessibility not only facilitates a more extensive safety net for employees but also enhances overall team morale, fostering a supportive work environment where members feel recognized and valued.

Moreover, this type of insurance often comes with access to additional resources, including counseling services and financial planning assistance, which can further enrich the lives of insured members. These benefits help in building a cooperative atmosphere among employees, enhancing both member satisfaction and retention.

Frequently asked questions

As you navigate through the landscape of group level term life insurance, several commonly asked questions arise. Many potential policyholders wonder about the medical exam requirements, coverage duration, and implications for leaving the group. Understanding these foundational elements can alleviate some uncertainties.

For instance, in many cases, coverage is available without rigorous medical examinations, making it accessible to a broader group of individuals. Should a member leave the group or organization, typically, their coverage ends unless other arrangements are made. It’s vital to know how this group insurance impacts existing individual coverage to make informed decisions.

Support and resources

Navigating insurance forms can be complex, but pdfFiller provides tools and resources designed to simplify the process. From document editing to eSigning, pdfFiller empowers users to manage their group level term life forms effectively, ensuring that the required documentation remains organized and accessible.

The platform also offers collaborations among teams for efficient management of insurance policies, maintaining clarity on coverage. Moreover, its educational resources delve into the intricacies of life insurance and financial planning, arming users with knowledge to make informed choices.

Conclusion: empowering you with group level term life insurance

Group level term life insurance is more than just a policy; it represents a commitment to financial security for individuals and groups. At pdfFiller, we are dedicated to empowering users with seamless tools for managing their life insurance forms and documents effortlessly. By exploring the various resources available, you can ensure that your insurance needs are met with ease.

The integration of robust document management solutions within pdfFiller enables you to create, fill, and modify vital forms without hassle. Don’t hesitate to explore the impactful features available at pdfFiller and ensure that you are well-prepared for any eventuality.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get group level term life?

How do I fill out group level term life using my mobile device?

How do I fill out group level term life on an Android device?

What is group level term life?

Who is required to file group level term life?

How to fill out group level term life?

What is the purpose of group level term life?

What information must be reported on group level term life?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.