Understanding the convertible promissory note form: A comprehensive guide

Understanding convertible promissory notes

A convertible promissory note is a type of debt instrument that allows an investor to provide funds to a startup or existing business with the potential to convert that debt into equity at a later date. This mechanism serves to bridge the gap between debt financing and equity financing, making it an attractive financing option for many startups looking to raise capital without immediate dilution of ownership.

The primary role of convertible notes in funding is to provide companies with a quick way to raise funds, as they typically involve less negotiation than traditional equity funding. Investors are often attracted to these notes because they offer the potential for conversion into equity at favorable rates, often tied to future valuation metrics.

Flexibility for startups seeking initial funding.

Potential for early investors to benefit from favorable equity terms.

Simple and efficient way to raise capital.

The structure of a convertible promissory note

A convertible promissory note consists of essential components that establish the terms under which the debt is issued and the conditions for conversion into equity. Understanding these components is crucial for both issuers and investors.

The principal amount defines the loan amount borrowed by the business. It is important to set this amount based on the company's needs and expected future growth. The maturity date refers to the timeline in which the debt is due, usually within one to three years, providing a specific deadline for conversion or repayment. Interest rates on convertible notes can be fixed or variable, impacting the returns for investors.

The total amount of money that is borrowed.

The date by which the note must be repaid or converted.

Determination of how interest is accrued, either as fixed or variable.

The terms of conversion are another critical aspect. These include the type of equity the note converts into, such as common or preferred shares. Valuation caps and discounts offer security for investors by establishing the maximum valuation at which their notes can convert, and incentivizing early investment through lower conversion prices respectively.

Distinction between common and preferred shares.

Maximum company valuation in which the note can convert.

Percentage reduction on the future equity valuation at conversion.

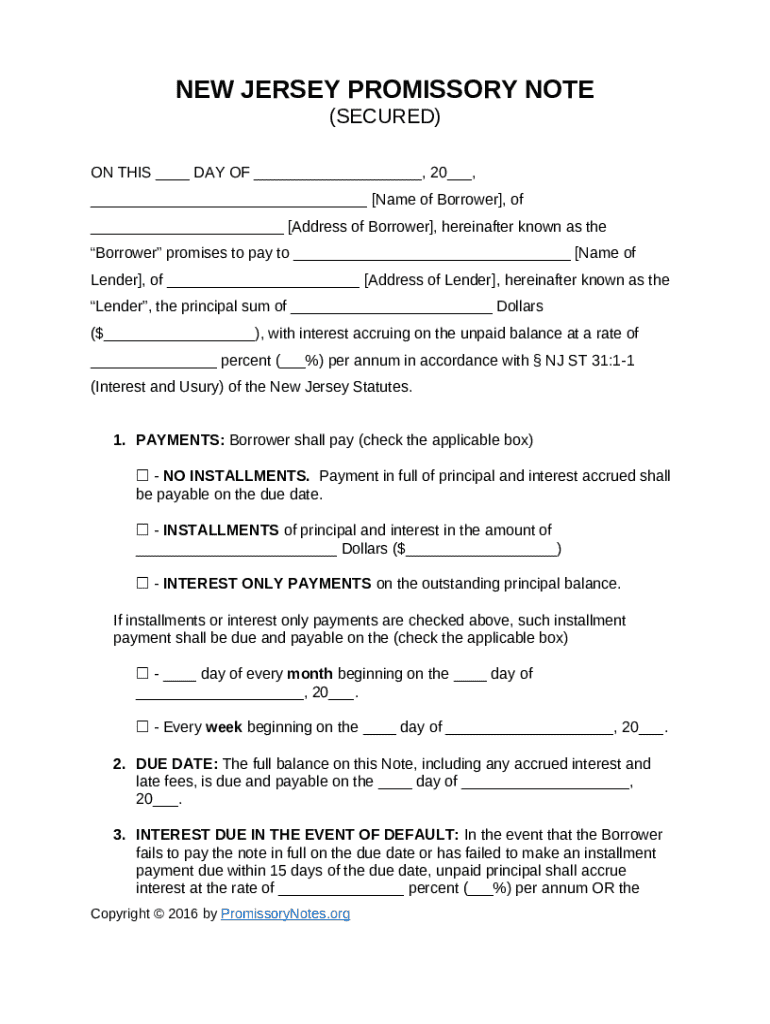

Legal considerations

Drafting a convertible promissory note requires a thorough understanding of the legal landscape. The jurisdiction in which the note is created can significantly influence the interpretation and enforcement of its terms. It's essential to be aware of local laws and regulations pertaining to debt instruments to ensure that the promissory note complies with all legal requirements.

Engaging with legal advisors well-versed in securities law can help in identifying potential pitfalls and misunderstandings. Common issues arise from ambiguous terms and conditions, which can lead to disputes in interpretation and enforcement.

Ensure compliance with local laws governing debt and convertible securities.

Consult professionals before drafting to avoid common pitfalls.

Creating your convertible promissory note

Creating a convertible promissory note can be straightforward when using a structured approach. By following a step-by-step guide, individuals can ensure that they cover all necessary elements in their document.

First, selecting an appropriate template is crucial. Utilizing platforms like pdfFiller can streamline this process with customizable templates designed for convertible promissory notes. Next, accurately inputting key information such as the principal amount, interest rate, and maturity date is essential to avoid future disputes.

Choose an appropriate template from pdfFiller.

Fill in principal, interest, and maturity details accurately.

Define the conversion scenarios and options.

Get the document reviewed by a legal professional.

Interactive tools and resources

Platforms like pdfFiller offer valuable document creation tools that simplify the process of drafting a convertible promissory note. These tools allow users to easily edit and customize templates to suit their needs while ensuring that key elements are not overlooked.

Additionally, integrating eSign solutions can facilitate legal signing, expediting the entire process. Collaboration features also enhance teamwork by enabling easy sharing with stakeholders for feedback, thus ensuring everyone is aligned and that no detail is missed.

Customize templates easily with online tools.

Streamline the signing process for legal compliance.

Share documents with stakeholders for input and feedback.

Managing your convertible promissory note

Once a convertible promissory note is created and executed, proper management becomes essential. This involves not only secure storage of documents but also active monitoring of maturity dates and conversion deadlines.

If modifications to the terms and conditions are required in the future, it’s important to follow established procedures for amending the original note. This ensures legality and maintains clarity between all parties involved.

Store and organize documents securely.

Keep track of maturity dates and conversion opportunities.

Follow set procedures for any necessary changes to terms.

Case studies and practical examples

Examining real-life scenarios surrounding convertible promissory notes can provide pivotal insights into potential outcomes and lessons learned. Successful conversions often highlight how effective structuring and negotiation can lead to positive results for both companies and investors.

However, instances of problematic notes can serve as cautionary tales, illustrating the importance of thorough comprehension of terms and maintaining vigilance when dealing with investments. Industry-specific dynamics can also influence how convertible notes are approached, creating variance in strategy between startups and well-established companies.

Examples where favorable terms led to beneficial outcomes.

Insights gained from challenges faced in note structures.

Differentiated approaches based on business maturity.

Expert insights and recommendations

Accessing legal and financial advice from industry experts can significantly enhance the understanding of convertible promissory notes. Professionals can provide clarity on complex issues and common questions, helping both issuers and investors navigate potential pitfalls.

It's essential to keep abreast of market trends relating to convertible notes. Understanding the evolving landscape can provide companies with a competitive advantage and help investors make informed decisions.

Seek guidance from qualified professionals to avoid pitfalls.

Address typical concerns raised by notes drafted.

Staying updated on developments in convertible note structures.

FAQs on convertible promissory notes

Common concerns regarding convertible promissory notes often revolve around the implications if a note isn’t converted. Questions arise about the potential consequences for investors and the issuing company. Additionally, there may be tax implications for investors upon conversion, warranting careful consideration before entering agreements.

Understanding the impact on both parties if conversion doesn’t occur.

Evaluating potential tax responsibilities related to investments.

Conclusion

In summary, a thorough understanding of the convertible promissory note form is essential for both startups and investors. Clarity in the terms established within these notes is paramount to ensure future success and compliance with legal standards. Moreover, leveraging platforms like pdfFiller can enhance document management capabilities, allowing users to create, edit, sign, and collaborate seamlessly.