Get the free Limited-Partnership-Indemnification-Agreement. ...

Get, Create, Make and Sign limited-partnership-indemnification-agreement

How to edit limited-partnership-indemnification-agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out limited-partnership-indemnification-agreement

How to fill out limited-partnership-indemnification-agreement

Who needs limited-partnership-indemnification-agreement?

Comprehensive Guide to Limited Partnership Indemnification Agreement Forms

Understanding limited partnership indemnification agreements

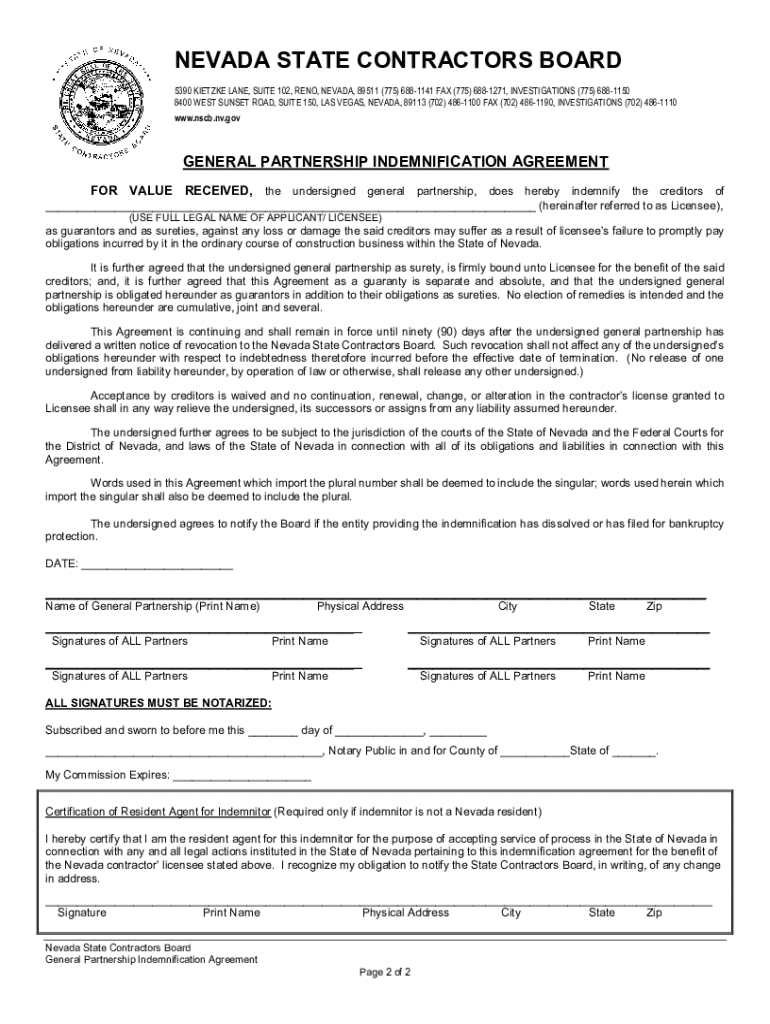

A limited partnership indemnification agreement is a legal document that specifies the responsibilities and protections afforded to partners within a limited partnership structure. This type of agreement serves to safeguard partners from potential liabilities arising from the actions of the partnership, particularly those that may occur in a business context. Indemnification is crucial as it delineates who is financially responsible for claims or losses associated with the partnership's operations.

The importance of indemnification cannot be overstated, as it fosters trust and collaborative dynamics among partners. By clearly assigning the responsibility for certain risks, partners can focus on growing their business without the constant fear of unforeseen liabilities impacting their financial wellbeing.

Legal implications are profound. Partners must be aware that the agreements are subject to state laws, which may dictate the extent to which indemnification can be enforced. This highlights the importance of crafting a well-thought-out limited partnership indemnification agreement that accurately reflects intentions and adheres to legal stipulations.

Key elements of a limited partnership indemnification agreement

Understanding the key components of a limited partnership indemnification agreement is essential for partners looking to protect their interests. First, the agreement should clearly delineate the names and roles of all parties involved. This clarity ensures that there is no ambiguity regarding who is indemnified and under what circumstances.

The scope of indemnification is another vital aspect. This includes defining the types of claims that are indemnifiable, such as negligence or wrongful acts. Furthermore, the agreement should outline any limitations and exclusions to indemnification, which may include specific situations or conditions under which indemnity will not apply.

Procedures for filing claims should also be included, detailing how one partner may seek indemnification from another. Lastly, the duration of the indemnification obligations is critical, as it specifies how long the protections will last, which can be until the dissolution of the partnership or for a defined period after a claim arises.

How to create a limited partnership indemnification agreement

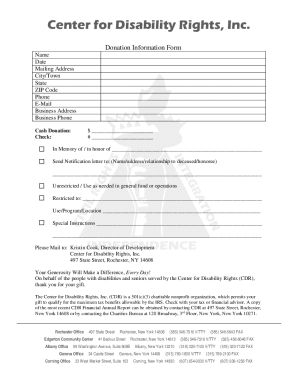

Drafting a limited partnership indemnification agreement can be simplified by following a structured approach. Start by gathering all necessary information, such as the identities of the partners, the nature of the partnership, and the specific risks that need coverage. Understanding the unique dynamics of your partnership will ensure the agreement is tailored to your needs.

Next, decide whether to use a template or create the document from scratch. Utilizing a template can save time and ensure that you cover all relevant points. Platforms like pdfFiller provide user-friendly tools for document creation that can ease the drafting process significantly.

Essential sections to include in your agreement are a description of the partnership structure, detailed indemnification clauses, and stipulations regarding governing law and jurisdiction, which is particularly important for partnerships operating across state lines. This creates a reliable framework that is legally sound and mutually beneficial.

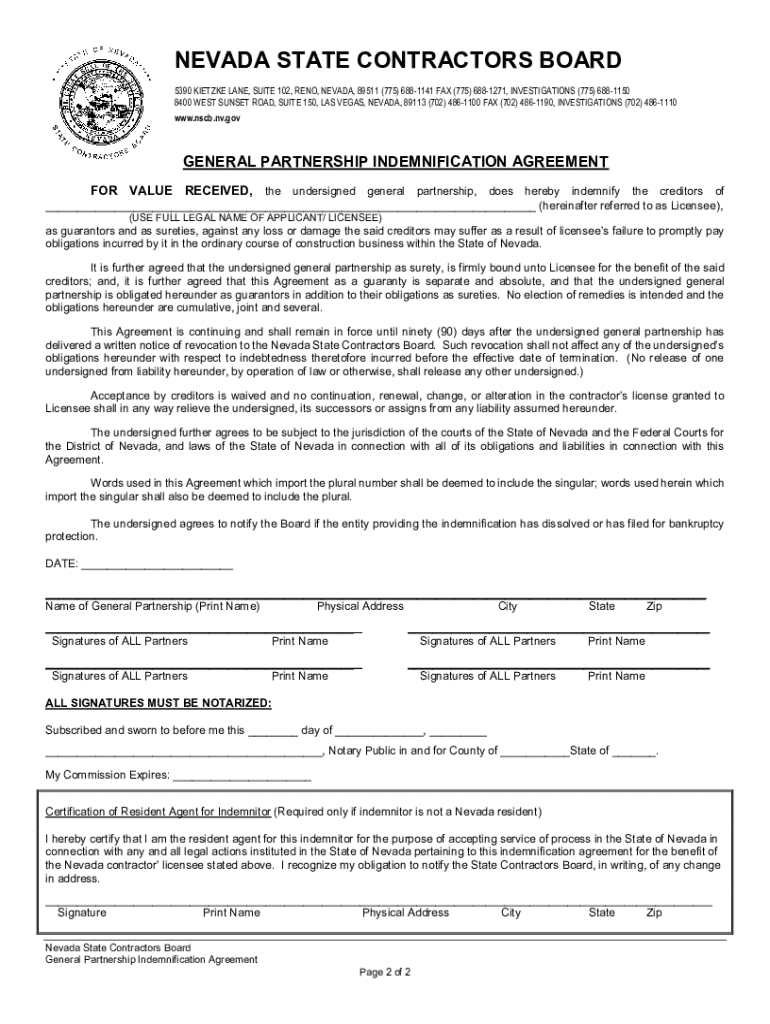

Sample limited partnership indemnification agreement

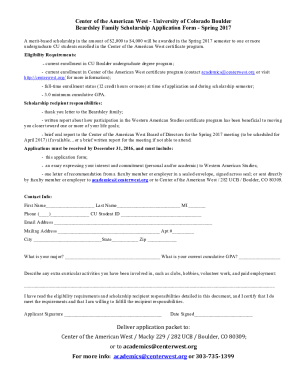

For practical application, accessing a sample limited partnership indemnification agreement can be invaluable. Templates are available that provide a comprehensive foundation which can be customized to reflect the specific needs and circumstances of your partnership. When reviewing these samples, pay special attention to key provisions like the scope and limitations of indemnification.

Common variations may include adjustments based on the type of limited partnership, whether it is a family business, an investment partnership, or a joint venture. Each of these may require nuanced changes to the indemnification language to ensure that all partners are appropriately covered.

Checklist for a valid limited partnership indemnification agreement

When finalizing your limited partnership indemnification agreement, it’s critical to verify essential components such as clarity in the identities of all parties involved, comprehensive scope of indemnification, and specific claim procedures outlined clearly. Ensuring that all partners understand their roles and responsibilities is key to preventing future disputes.

Common pitfalls to avoid include vague definitions, incomplete procedures for claiming indemnity, and overlooking the importance of jurisdiction in the governing law clause. Engaging legal counsel to review the agreement can ensure compliance with state laws and regulations, safeguarding against any legal vulnerabilities.

When to utilize a limited partnership indemnification agreement

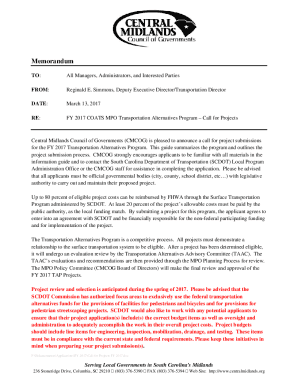

The necessity of a limited partnership indemnification agreement can arise in various scenarios. For instance, if your partnership is involved in high-risk activities, such as investments or development projects, having indemnification provisions in place becomes crucial. These agreements act as a valuable risk management strategy, allowing partners to limit their exposure to unforeseen legal claims.

Additionally, the relationship between indemnification and overall partnership agreements is significant. Indemnification clauses should not exist in isolation but must align with other areas of the partnership agreement to ensure a holistic approach to liability and risk management. This comprehensive strategy enables partners to focus on business operations with reduced anxiety about individual liabilities.

Interactive tools for managing your indemnification agreement

Managing a limited partnership indemnification agreement effectively requires utilizing robust document management tools. pdfFiller offers an integrated platform that allows users to create, edit, and sign documents seamlessly. The ability to collaborate in real-time fosters effective communication among partners, ensuring that everyone remains aligned on important agreements.

Features such as eSigning and document tracking add another layer of efficiency. Partners can manage their agreements securely, ensuring that all revisions are documented and accessible. Storing these documents in a cloud-based system enhances security and accessibility, enabling partners to retrieve necessary documentation at any time, from anywhere.

Frequently asked questions (FAQs)

Understanding common queries can further aid partners in navigating limited partnership indemnification agreements. One frequent question is the difference between indemnification and liability; indemnification pertains to the financial responsibility for claims, while liability identifies who is legally accountable for those claims. Ensuring that all partners have a mutual understanding of indemnity terms is crucial in circumventing disputes in the future.

Additionally, partners may wonder what happens if a party refuses to accept indemnification. In such cases, it’s advisable to consult legal counsel to determine appropriate actions to enforce the agreement. Lastly, partners should be aware that terms of indemnification can be amended after the agreement is signed, provided there is mutual consent and documentation of those changes.

Support options for limited partnership indemnification agreements

It is crucial that partners have access to reliable support when dealing with limited partnership indemnification agreements. pdfFiller offers various resources to access legal advice, ensuring that partners fully comprehend their rights and obligations within these agreements. Engaging legal professionals for comprehensive reviews can further safeguard against unintended consequences resulting from poorly drafted agreements.

By utilizing customer support for document issues, partners can address any technical challenges in using pdfFiller effectively. Legal professionals can also assist in negotiating terms that best serve the partnership’s interests, enhancing overall security within the partnership structure.

Managing your limited partnership documents with pdfFiller

The comprehensive document creation platform provided by pdfFiller stands out as an exceptional solution for managing limited partnership documents effectively. Through features that facilitate real-time collaboration, partners can develop and maintain critical documents collectively, blending various inputs to produce a finalized agreement.

Secure eSigning capabilities ensure that each partner can approve documents promptly, streamlining processes that may otherwise introduce delays. Document tracking features allow partners to visualize the progress of their agreements and maintain organized records, which is essential for legal compliance and financial clarity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify limited-partnership-indemnification-agreement without leaving Google Drive?

How can I fill out limited-partnership-indemnification-agreement on an iOS device?

How do I edit limited-partnership-indemnification-agreement on an Android device?

What is limited-partnership-indemnification-agreement?

Who is required to file limited-partnership-indemnification-agreement?

How to fill out limited-partnership-indemnification-agreement?

What is the purpose of limited-partnership-indemnification-agreement?

What information must be reported on limited-partnership-indemnification-agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.