The Ultimate Guide to Advance Long-Term Management Trust Form

Understanding the advance long-term management trust form

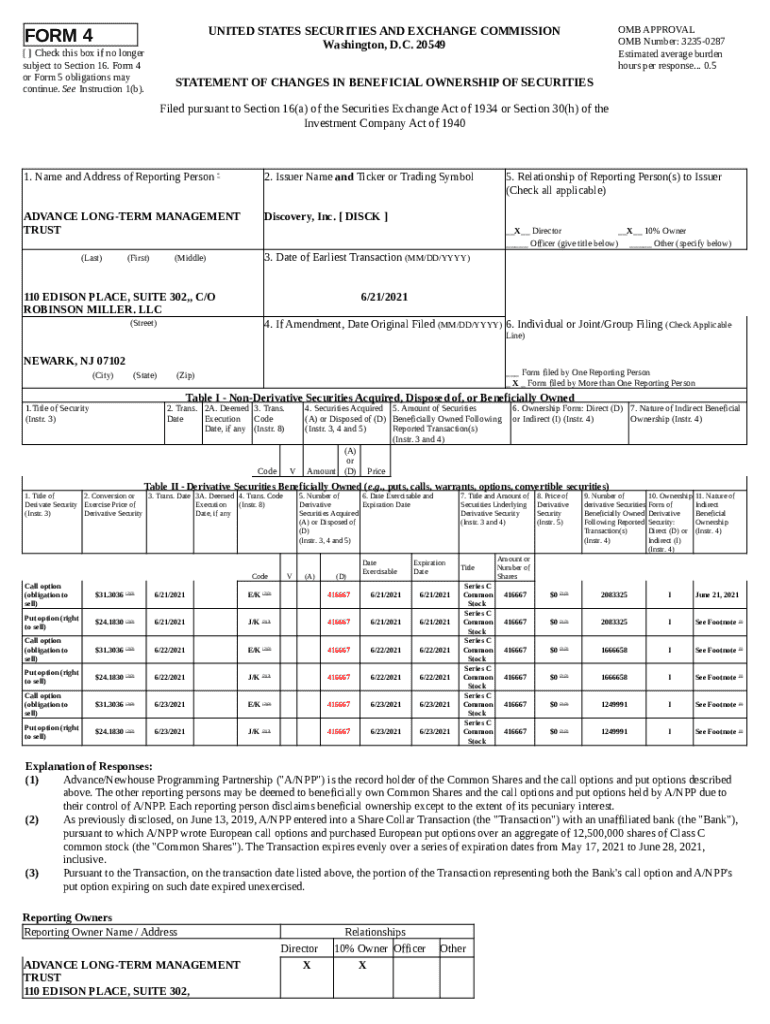

Trust forms play a critical role in financial planning, especially for those looking to protect their assets and ensure their wishes are honored over the long-term. The advance long-term management trust form specifically addresses the need for effective management of assets, healthcare, and other critical decisions when an individual is unable to make those decisions themselves due to various reasons such as illness or incapacity.

At its core, the advance long-term management trust form allows individuals to appoint a trustee who will manage their assets according to predefined instructions. Key components of this form include provisions for asset management, healthcare directives, and instructions concerning beneficiaries. This ensures that personal and financial interests are preserved and respected, even when the individual cannot advocate for themselves.

Who should use the advance long-term management trust form?

The target audience for the advance long-term management trust form includes both individuals who want to secure their future and teams focused on client financial planning. Specifically, this form is suitable for individuals approaching retirement age, those with complex family dynamics, or anyone with significant assets. It serves as a strategic tool for creating a legacy, minimizing familial disputes, and ensuring the security of dependents.

There are several scenarios that may necessitate the use of an advance long-term management trust form. For example, individuals with chronic illnesses may wish to designate someone to manage their affairs, while business owners may want to protect their company’s future in the event of their incapacity. The benefits of using the form extend to various stakeholders, including family members and advisors, as it provides clarity and direction during difficult times.

Key features of the advance long-term management trust form

One standout feature of the advance long-term management trust form is its comprehensive document structure. It is designed to facilitate robust information capture, allowing users to clearly outline their wishes regarding asset distribution and management. This clarity is essential for reducing ambiguity and potential conflicts among family members or heirs.

Additionally, the form is enhanced by interactive tools that provide easy navigation through its layers of information. A user-friendly design further contributes to efficient completion, making the document accessible even for those who may not be tech-savvy. The combination of comprehensive content and easy usability is what sets the advance long-term management trust form apart from standard legal documents.

Step-by-step guide to filling out the advance long-term management trust form

Filling out the advance long-term management trust form requires careful preparation to ensure all necessary information is gathered. Start by creating a documentation checklist that includes items such as identification, details about your assets and liabilities, and any existing legal documents. Key financial data to include may encompass bank account information, property valuations, and investment portfolios.

Once you have your documents ready, proceed to fill out the form section by section. Here's a breakdown of each segment:

Trust Establishment Details – Include essential information such as the trust's name and purpose.

Trustee Information – Provide details about the appointed trustee(s) and their powers.

Beneficiary Information – List all beneficiaries entitled to receive assets and any specific distribution instructions.

Assets and Liabilities – Document all assets under the trust's management as well as any outstanding liabilities.

Common mistakes to avoid during completion include overlooking necessary signatures, failing to provide complete beneficiary details, and neglecting to update the form with any life changes such as marriage or divorce. Taking your time and being meticulous will ensure the form reflects your true intentions.

Editing and customizing the advance long-term management trust form

Using pdfFiller's editing tools provides an efficient way to customize the advance long-term management trust form to fit specific needs. The text editing features allow individuals to make modifications, adding new sections or removing unnecessary content as they see fit. This flexibility is crucial for adapting the form as personal or legal circumstances evolve.

Making changes to existing forms can be straightforward with pdfFiller, as it provides intuitive options for editing. Users can easily save their modifications and export the form in various formats, ensuring that it can be shared with relevant parties, like legal advisors or family members.

Ensuring security and compliance with the advance long-term management trust form

Document security is paramount in trust management, as breach of confidentiality can have grave consequences. The advance long-term management trust form includes eSigning features, which ensure that users can securely sign their documents digitally, maintaining the integrity of the form throughout the process.

Additionally, compliance with legal standards is essential for the validity of the trust document. When completing the advance long-term management trust form, users must ensure that all legal requirements specific to their jurisdiction are met. This includes proper witness signatures or notarization, which often depend on local laws governing trusts.

Collaborating on the advance long-term management trust form

Collaboration is crucial when it comes to filling out the advance long-term management trust form, especially if decision-making is shared amongst family members or legal teams. pdfFiller allows multiple users to collaborate on the same document seamlessly. This feature encourages transparent communication and offers a platform where stakeholders can contribute their input in real time.

Tracking changes and comments is essential for maintaining a clear record of edits and discussions. Utilizing best practices for team collaboration, such as assigning roles to reviewers and setting deadlines for feedback, can help streamline the process. This structured approach not only improves form accuracy but also facilitates consensus among all parties involved.

Managing your advance long-term management trust form with pdfFiller

pdfFiller simplifies managing advance long-term management trust forms with its cloud-based document management system. Users can easily organize and store their forms, ensuring quick access when needed. This organizational capability is particularly beneficial for individuals who require frequent updates or changes to their trust forms, as information can be conveniently retrieved from anywhere.

Moreover, pdfFiller supports multi-device access, allowing users to work on their trust documents from various devices including tablets, smartphones, and laptops. This flexibility means that crucial updates can be made on the go, enhancing the overall efficiency of managing one’s trust documentation.

Common FAQs about the advance long-term management trust form

As users navigate the ins and outs of the advance long-term management trust form, several common questions often arise. Frequently asked questions include inquiries about the differences between a trust and a will, how to modify an existing trust, and what steps to take if a trustee is unavailable. Understanding these topics can help demystify the trust creation process.

To troubleshoot common issues, users can refer to support resources offered by pdfFiller, which include guides, tutorials, and customer service assistance. These resources help ensure that individuals feel confident navigating the trust management landscape.

Conclusion: Elevating your trust management with pdfFiller

Utilizing the advance long-term management trust form via pdfFiller not only streamlines the document-creating process but also elevates trust management as a whole. The benefits of employing pdfFiller’s robust features, including editing, signing, and secure collaboration options, enhance user experience and improve the accuracy of important legal documents.

With its commitment to user-friendly design and advanced functionality, pdfFiller serves as an invaluable resource for individuals and teams looking to navigate the complexities of trust management. As users explore additional features and tools for document management, they gain greater control over their financial and personal futures.

Visual aids and interactive tools

To further aid understanding of the advance long-term management trust form, pdfFiller provides a variety of visual aids and interactive tools. Infographics explain the trust management process, showcasing how to effectively manage a trust and highlighting common pitfalls to avoid. These visuals can serve as a reference guide throughout the document completion process.

Interactive samples of the advance long-term management trust form offer practical examples that users can engage with to familiarize themselves with the document structure. Additionally, video tutorials are available to walk users through the features of pdfFiller, empowering them to leverage the platform fully for their document management needs.