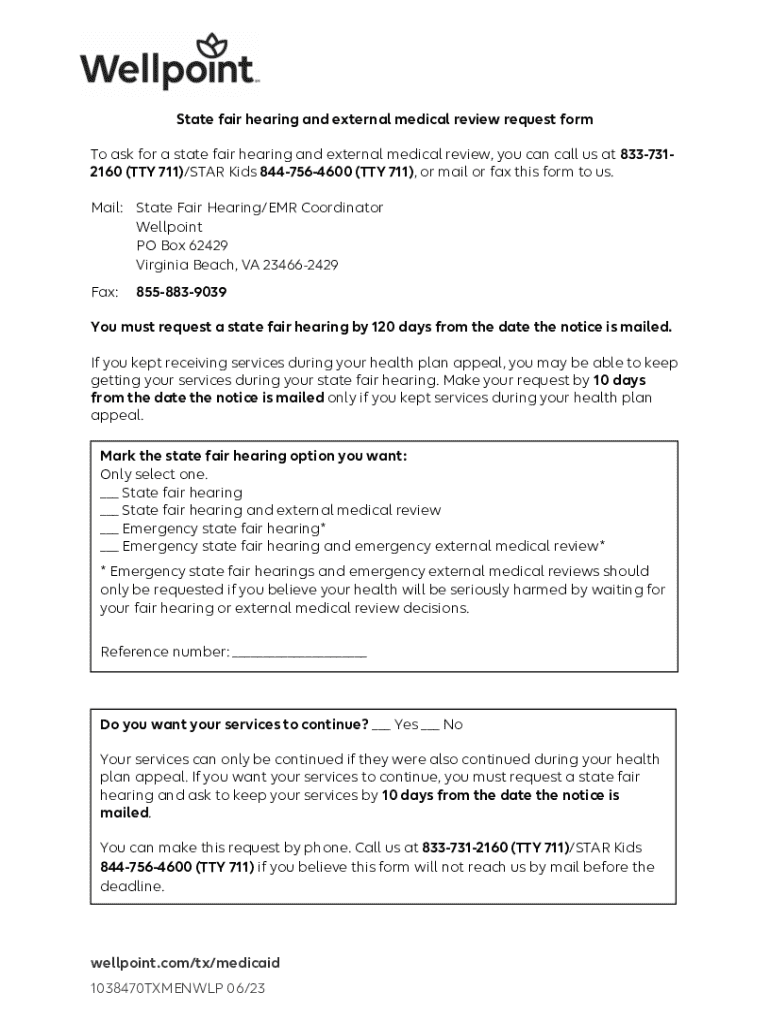

Get the free How to File a State Fair Hearing/External Medical Review

Get, Create, Make and Sign how to file a

Editing how to file a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out how to file a

How to fill out how to file a

Who needs how to file a?

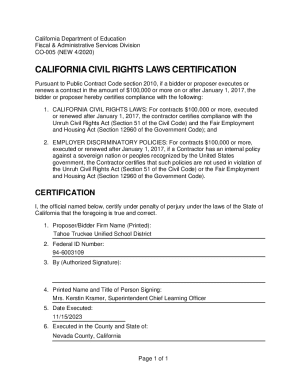

How to file a form: A comprehensive guide

Understanding forms

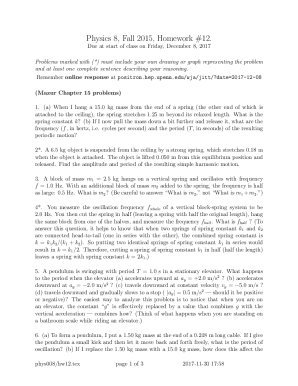

A form is a structured document containing spaces to fill out information. Forms are essential tools used in various scenarios, including government applications, business transactions, and tax reporting.

Importance of filing forms correctly

Accurate form filing is crucial for several reasons. When forms are not filled out correctly, it can lead to severe consequences, such as application rejections, fines, or legal complications. For example, failing to accurately report income on tax forms can result in audits and penalties.

On the other hand, precise filing facilitates smooth processing and timely approvals. It can also create a positive impression on government agencies or potential business partners. Accurate documentation demonstrates professionalism and reliability, which can be beneficial in numerous contexts.

Preparations before filing a form

Before embarking on the form-filing journey, gather relevant documents, as this will help streamline the process. Missing documentation can lead to delays or complications.

Additionally, familiarize yourself with the form’s requirements, such as age restrictions or residency status. Knowing what financial information is needed and any particular details pertinent to the form will enhance the likelihood of a successful submission.

Step-by-step guide on how to file a form

Filing a form can seem daunting, but breaking it down into clear steps makes the process manageable. Start by gathering all necessary materials to support your form completion.

Submission options for forms

After completing the form, understand your submission options. Multiple methods exist based on the form type, each with its advantages.

After filing: what to expect

Once you have submitted your form, it is crucial to know what happens next. Acknowledgment of successful submission is usually provided, especially for electronic filings. Keep this for your records as confirmation.

Revising a form: when and how

Mistakes can happen, necessitating revisions. Understanding when to revise and how to go about it is key. Common reasons for revision include clerical errors and changes in personal circumstances.

Common FAQs about filing forms

Filing forms can raise several questions. Being informed can reduce anxiety and ensure proper filing.

Advanced features for a smooth filing experience

To simplify the form-filing process, consider utilizing advanced digital tools. These can enhance your efficiency and accuracy.

Conclusion about filing forms

Filing a form is an essential skill in both personal and professional realms. Key points to remember include confirming the required information, maintaining thoroughness through the process, and utilizing tools that can assist in accurate completion.

Encouragement for accurate and timely filing underscores the importance of attention to detail, which can prevent issues down the line. By following this guide closely, you'll increase your confidence in navigating the complexities of form filing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit how to file a from Google Drive?

How do I complete how to file a online?

Can I edit how to file a on an Android device?

What is how to file a?

Who is required to file how to file a?

How to fill out how to file a?

What is the purpose of how to file a?

What information must be reported on how to file a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.