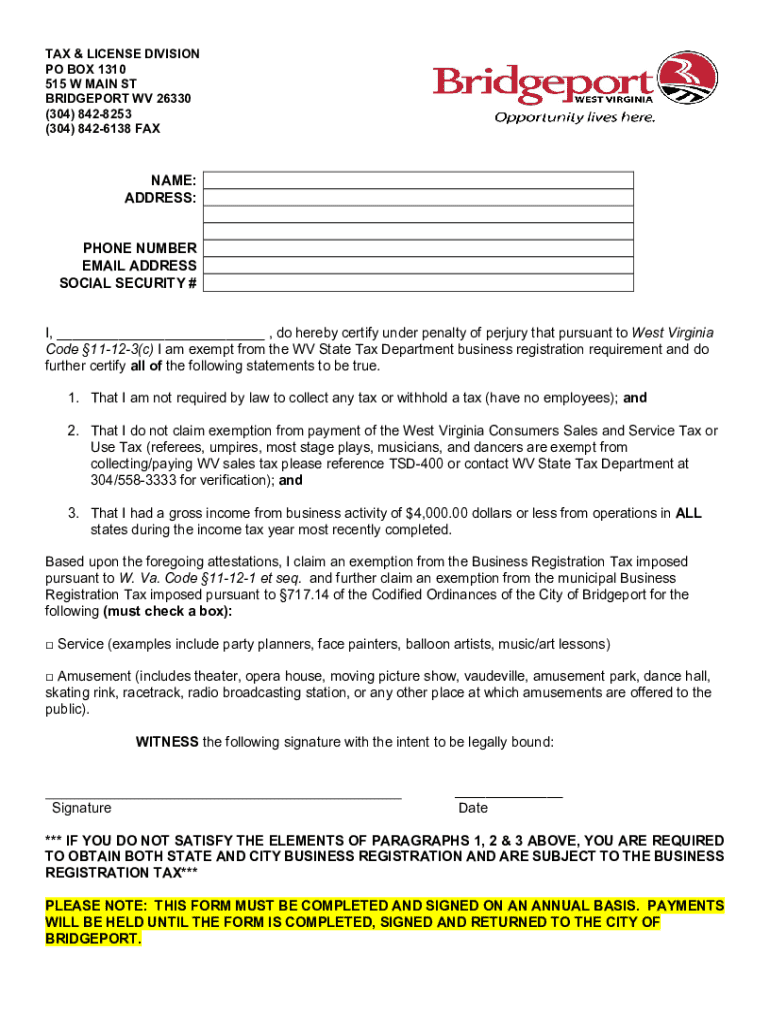

Get the free West Virginia State Tax Division Phone Numbers

Get, Create, Make and Sign west virginia state tax

How to edit west virginia state tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out west virginia state tax

How to fill out west virginia state tax

Who needs west virginia state tax?

Your Comprehensive Guide to the West Virginia State Tax Form

Understanding West Virginia State Taxation

West Virginia's taxation system plays a vital role in funding state services, including education, infrastructure, and public safety. State tax compliance is crucial; failure to adhere can result in penalties and loss of public services. In 2021, West Virginia generated over $5 billion in tax revenue, with personal income tax and sales tax being the most significant contributors.

There are various types of taxes in West Virginia, including:

The West Virginia State Tax Form: An Overview

The West Virginia State Tax Form is the official document used by residents to report their earnings, calculate taxes owed, and claim deductions or credits. This form must be filed annually by individuals and businesses who meet the reporting requirements. Understanding this form is essential for compliant tax filing.

Key features of the form include:

Step-by-step guide to completing the West Virginia State Tax Form

Filing your West Virginia State Tax Form doesn't have to be overwhelming. Follow these steps to ensure accurate completion.

Step 1: Gather Required Documents. You will need the following documents:

Step 2: Accessing the form is simple. The West Virginia State Tax Form can be found on the official state tax department website, and it’s available for easy download in PDF format.

Step 3 involves filling out each section accurately: the Personal Information Section requires basic identification details, while the Income Reporting Section needs all sources of income along with any eligible deductions. Understanding tax brackets will help calculate your taxes owed in the Tax Calculation Section.

Step 4: Utilize interactive tools, like those available on pdfFiller, to ensure accuracy in filling out your form.

Finally, Step 5 emphasizes reviewing and double-checking your information before submission. A checklist can be helpful here.

Electronic filing of the West Virginia State Tax Form

Electronic filing of your West Virginia State Tax Form offers numerous advantages. Firstly, it leads to faster processing times and quicker refunds, letting you receive your money sooner. Furthermore, e-filing generally results in fewer errors due to built-in error-checking features.

To file online using pdfFiller, follow these steps: access the form through pdfFiller, fill in your details using their interactive features, and finally submit it directly through the platform. It’s a straightforward process designed for efficiency.

Payment options for any tax due

If you owe taxes, West Virginia offers several convenient payment options. You can pay via credit card, e-check, or through direct bank transfer. These methods allow you to schedule payments, alleviating some of the stress associated with tax dues.

Be aware of late payment penalties, which can accumulate quickly. Failing to make payments on time can result in onerous fees and interest accrual, so staying informed and proactive is crucial.

Common issues and how to resolve them

Many filers encounter common issues when completing the West Virginia State Tax Form. Errors such as incorrect Social Security Numbers or mismatched income figures can lead to delays or penalties. If you make a mistake, correcting it promptly is essential.

For further assistance, the West Virginia Tax Department provides resources and support. Here’s how you can reach out:

Utilizing pdfFiller for efficient document management

pdfFiller enhances your tax filing experience significantly. With its robust features, users can streamline document creation and collaboration, allowing for a smooth workflow when preparing your West Virginia State Tax Form.

Post-filing, managing your forms is just as crucial. pdfFiller allows you to store and retrieve tax documents with ease, ensuring that you keep your records organized for future reference.

Additional resources for West Virginia tax filers

To aid in your tax filing experience, several vital resources are available. The West Virginia State Tax Department's official website is an invaluable source of information, including tax publications and guides that can help you navigate the tax landscape effectively.

Additionally, local workshops and webinars can provide interactive learning experiences for filers seeking more comprehensive support.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send west virginia state tax for eSignature?

How do I execute west virginia state tax online?

How do I edit west virginia state tax on an iOS device?

What is west virginia state tax?

Who is required to file west virginia state tax?

How to fill out west virginia state tax?

What is the purpose of west virginia state tax?

What information must be reported on west virginia state tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.