Understanding the Nevada Self-Insured Association Template Form

Understanding the Nevada Self-Insured Association

A self-insured association is a collective of organizations that join together to self-fund their insurance needs, managing risk and protecting their members from potential financial losses. In Nevada, self-insurance is crucial for many organizations looking to retain greater control over their risk management strategies.

The importance of self-insurance in Nevada cannot be overstated. With a diverse range of industries, from mining to tourism, the need for customized risk management solutions is significant. Self-insured associations allow entities to pool resources, enhance their bargaining power, and focus on specific coverage tailored to their unique operational risks.

Joining the Nevada Self-Insured Association provides numerous benefits, including shared risk, reduced insurance costs, and improved claims handling. Members can collaborate on best practices, share insights on compliance requirements, and access dedicated legal resources, which can significantly enhance their operational efficiency.

Overview of the Nevada Self-Insured Association Template Form

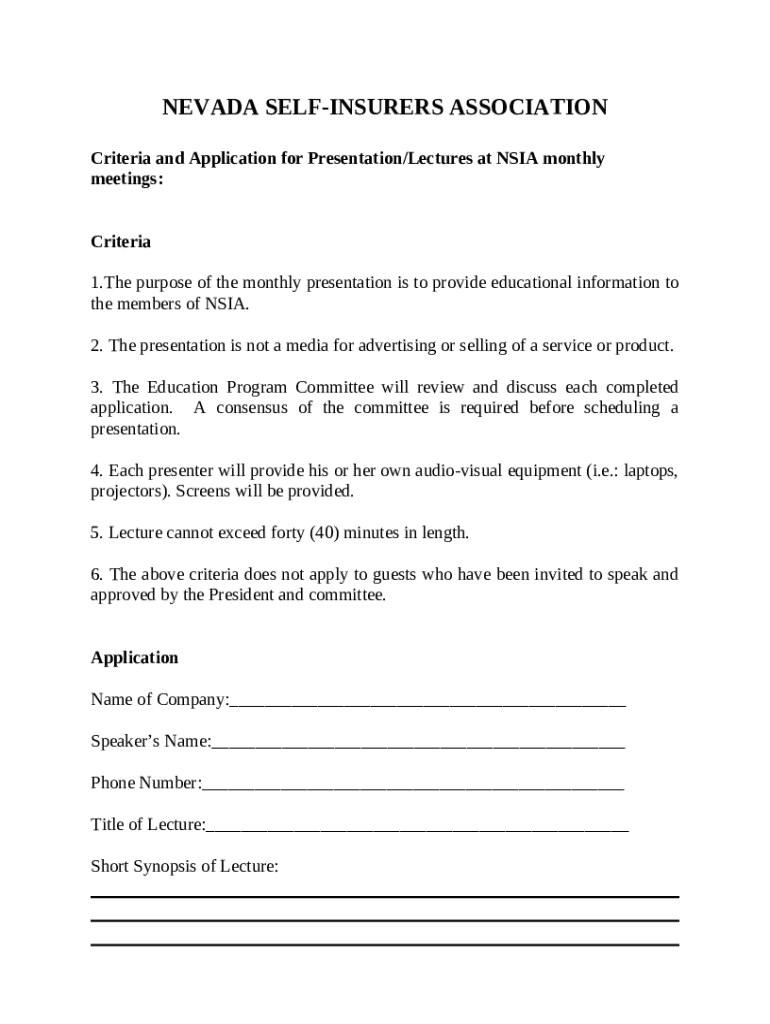

The Nevada Self-Insured Association template form serves as the foundational document required for organizations looking to join the association. This template is designed to streamline the application process, ensuring that all necessary information is collected uniformly, which aids in faster processing and approval.

Key components of the template include organizational details, financial data, previous insurance history, and risk management practices. Each of these segments is crucial for assessing the suitability of an organization for the association. The eligibility requirements for using this template typically include having a minimum number of employees, specific financial stability thresholds, and a history of claims management.

Step-by-step guide to filling out the Nevada Self-Insured Association template form

Filling out the Nevada Self-Insured Association template form can be straightforward if you follow a structured approach. Here’s a breakdown of the steps you should follow to ensure accurate completion.

3.1. Gathering required information

Begin by collecting essential information about your organization. This includes detailing your organization's structure, industry type, and size. Additionally, you will need financial statements for at least the past three years, as well as previous insurance policy documents to illustrate your claims history.

3.2. Accessing the template

To find the Nevada Self-Insured Association template form, navigate to the official state website or utilize pdfFiller's platform where it is available in a user-friendly format. Users can access the template online or download it in PDF form, ensuring that you have the latest version.

3.3. Completing the form

When completing the form, pay careful attention to each section. Provide accurate numerical data, and ensure that all necessary signatures are included. Be aware of common pitfalls such as mathematical errors in your financial data or omitting required supplementary documents. Completing this form accurately is vital to avoid delays.

3.4. Reviewing your entries

After completing the form, take the time to review your entries meticulously. It’s advisable to double-check all data against the required documents to ensure consistency. Verifying the accuracy of your submission before sending it saves time and complications later in the process.

Editing and managing your template form with pdfFiller

PdfFiller enhances the management of your Nevada Self-Insured Association template form with its interactive editing capabilities. Users can make real-time edits, ensuring that changes are captured instantaneously and are well-documented.

4.1. Utilizing pdfFiller’s tools

Utilizing pdfFiller's tools allows you to annotate or comment on specific sections of the form. This functionality is particularly useful for teams, providing a platform for collaborative input and ensuring all stakeholders can contribute to the form’s accuracy.

4.2. Saving and storing your form

With cloud-based storage options, pdfFiller provides peace of mind for document management. Users can organize their documents effectively, ensuring easy access and retrieval when needed. An organized filing system also makes preparing for audits and compliance checks considerably easier.

Signing and submitting the Nevada Self-Insured Association template form

The process of signing and submitting the Nevada Self-Insured Association template form is simplified through electronic signature solutions. This method not only speeds up the process but also enhances security.

5.1. eSignature solutions

With pdfFiller, signing the document electronically is straightforward. The platform provides robust security measures to protect your identity and ensures that all signatures are legally valid, meeting all requirements set by the state of Nevada.

5.2. Submission process

Once the form is completed and signed, it is crucial to follow the correct submission process. The finalized document can be submitted online through the Nevada self-insured association’s designated portal, or directly to relevant administrative offices. Expect a timeline of 4-6 weeks for review and feedback post submission.

Frequently asked questions (FAQs)

When dealing with the Nevada Self-Insured Association template form, several common queries may arise that could hinder the process for potential members. Many individuals wonder about the legal requirements behind the form, especially in terms of declarations and disclosures. The compliance needs are strictly regulated by the state, necessitating that applicants present a clear financial picture.

Troubleshooting submission issues is another frequent concern. Organizations might encounter problems related to electronic submissions or missing documentation. Understanding the submission protocol and requirements will be essential, and keeping detailed records will aid in resolving any issues that arise.

Insights on compliance and regulatory guidelines

Compliance with Nevada Revised Statutes is critical for all self-insured associations. Not only must entities adhere to these statutes, but maintaining transparency in financial reporting and managing claims efficiently are also necessary for alignment with legal standards.

Organizations should regularly review the guidelines set forth by state authorities and ensure that they are familiar with all compliance requirements. Leveraging legal support, whether internal or outsourced, can provide ongoing guidance, helping entities navigate the complexities of self-insured operations.

Local resources and support networks

Nevada has numerous state agencies responsible for overseeing self-insurance associations. Connecting with these agencies ensures organizations stay up-to-date with regulatory changes and compliance initiatives. Engaging in industry networking opportunities can also provide valuable insights and support.

Additionally, organizations have access to webinars and workshops focusing on enhancing knowledge about self-insurance. These educational resources can be pivotal in optimizing risk management strategies and ensuring adherence to industry best practices.

Best practices for managing self-insured programs

To manage self-insured programs effectively, organizations should adopt prudent risk management practices. Regularly reviewing potential risks, establishing a strong risk mitigation framework, and ensuring a culture of safety within the organization are vital steps.

Stable funding is essential for maintaining operational integrity. Strategies for monitoring claims and financial performance coupled with periodic audits will ensure that the self-insured program remains sustainable. Transparency in reporting is crucial for nurturing stakeholder trust and abiding by compliance standards.

Leveraging pdfFiller for enhanced document management

PdfFiller offers a comprehensive suite of features tailored for managing forms like the Nevada Self-Insured Association template form. By streamlining the document creation and editing process, pdfFiller empowers users to maintain compliance efficiently and effectively.

Collaboration among teams is facilitated through pdfFiller, as it allows for easy sharing and simultaneous edits. This capability ensures that all team members can contribute strategically and transparently to the completion of vital documentation.