Get the free VOLUNTARY LIFE AND AD&D INSURANCE

Get, Create, Make and Sign voluntary life and adampd

How to edit voluntary life and adampd online

Uncompromising security for your PDF editing and eSignature needs

How to fill out voluntary life and adampd

How to fill out voluntary life and adampd

Who needs voluntary life and adampd?

How-to Guide for Voluntary Life and AD& Form: A Comprehensive Resource

Overview of voluntary life and AD&

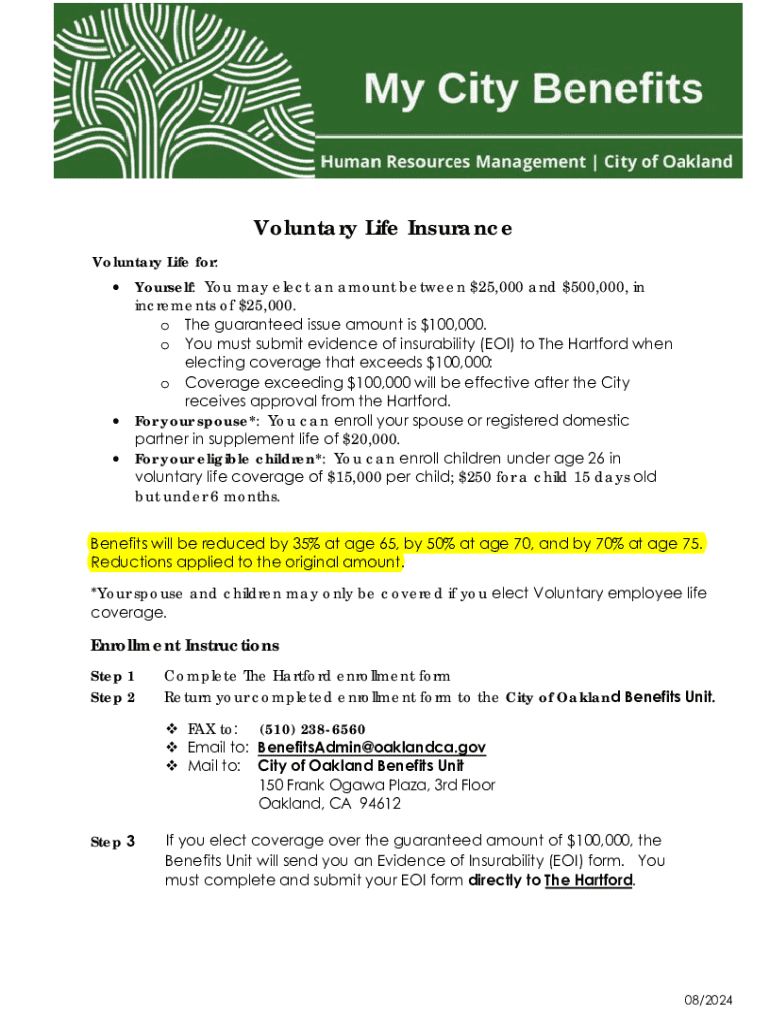

Voluntary life insurance is often a critical component of personal financial planning, allowing individuals to secure additional financial protection for their loved ones beyond basic life insurance provided by employers.

Unlike employer-paid life insurance, which is typically provided automatically at little to no cost, voluntary life insurance is an optional benefit for which employees can pay premiums. This distinction allows individuals to tailor their coverage according to their specific needs and financial situations.

Understanding Accidental Death and Dismemberment (AD&) insurance

AD&D insurance serves as a financial safeguard in the event of unexpected accidents leading to death or severe injuries resulting in dismemberment. This type of coverage ensures that beneficiaries receive a predetermined payout in these unfortunate circumstances, enhancing financial stability.

Common myths surrounding AD&D insurance include the misconception that it covers all types of accidental injuries. In reality, AD&D policies have specific exclusions, and it's crucial for policyholders to understand the fine print to avoid surprises.

Importance of the voluntary life and AD& form

Completing the voluntary life and AD&D form is the first step toward securing vital coverage, offering significant advantages for individuals and families. This insurance helps cover financial obligations such as mortgage payments, children's education, and daily living expenses in the event of unexpected loss.

The potential financial protections afforded by voluntary life and AD&D insurance are substantial. For many, this form represents not just a safety net—it embodies peace of mind knowing that their loved ones will be supported through challenging times.

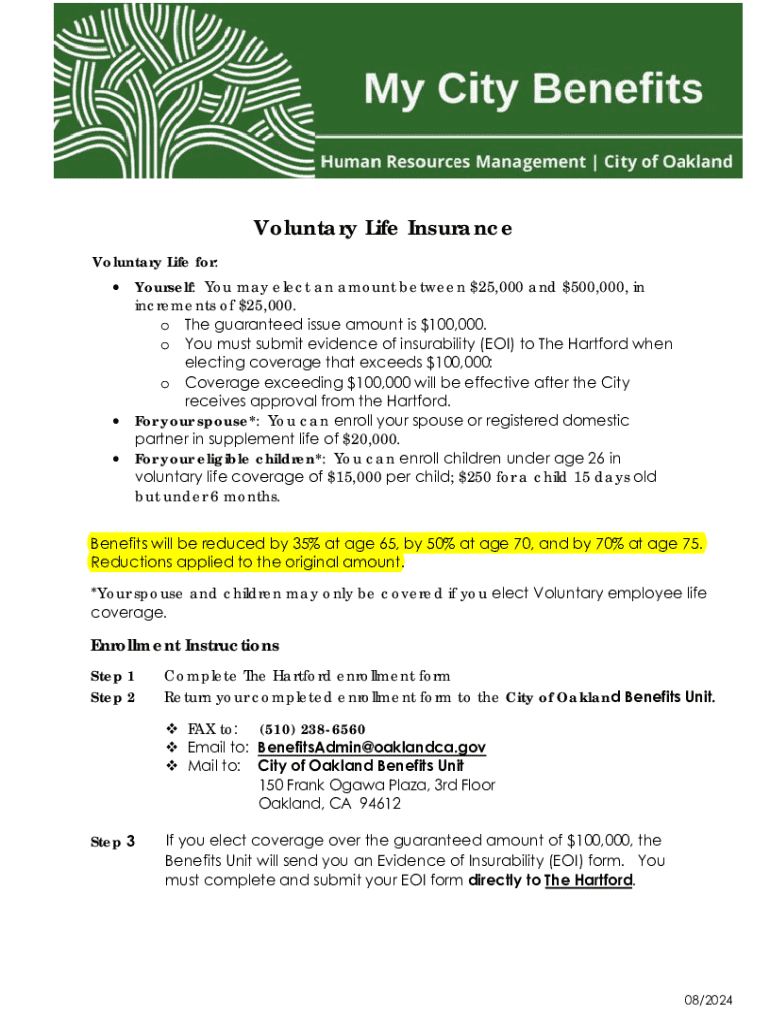

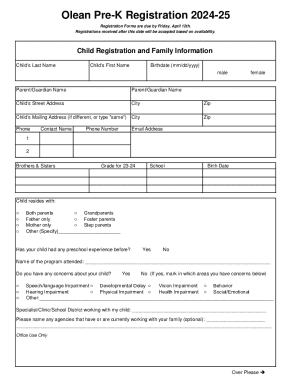

Eligibility and enrollment criteria

Eligibility for voluntary life and AD&D coverage often extends to employees and sometimes their spouses or dependents, though specific criteria can vary by employer. Generally, employees must be in active employment and meet certain age requirements.

Conditions for coverage acceptance can include health assessments or the completion of a medical questionnaire. This process is crucial, as it informs the insurer about potential risks before issuing a policy.

Navigating the voluntary life and AD& form

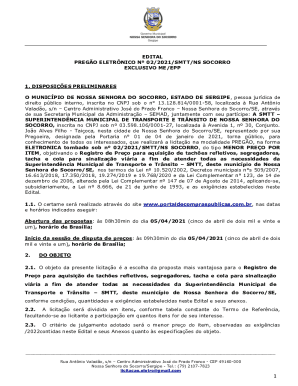

Finding the correct form is a critical part of the enrollment process. The voluntary life and AD&D form can typically be accessed online through pdfFiller, where users can download the most recent version to ensure they have the latest information and features.

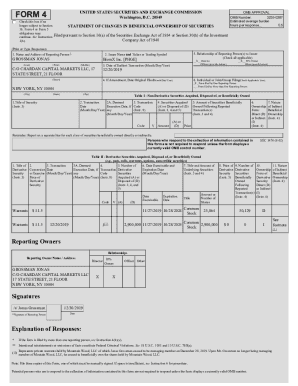

Step-by-step guide to filling out the form

Editing and modifying the voluntary life and AD& form

Updating your form is straightforward using pdfFiller’s editing tools. Users can easily modify existing documents without cumbersome manual adjustments. Features such as text editing, highlighting, and annotation streamline the revision process.

To maintain organization, it's important to save different versions of your form. Version control can help track changes over time and ensure all parties access the correct information.

E-signing your voluntary life and AD& form

E-signatures have become increasingly important in the digital process of completing forms. Not only are they legally binding, but they also provide a convenient way to finalize documents without the need for physical signatures.

To use pdfFiller for e-signing, simply follow the step-by-step guide provided within the platform, which takes users from signing through to sending the completed form securely.

Managing your voluntary life and AD& coverage

After submitting your form, it's essential to know what to expect. Generally, applicants will receive a confirmation of their submission along with information on when coverage becomes active. Keeping track of the application status is vital; many companies offer online portals for this purpose.

For renewals or changes to existing policies, users should follow specific procedures laid out by their providers. It's advisable to review coverage regularly to ensure it remains adequate for changing life circumstances.

Common pitfalls to avoid when completing the form

Completing the voluntary life and AD&D form accurately is crucial to avoiding delays in processing. Common errors include incorrect personal information, absence of required signatures, and incomplete beneficiary data.

Understanding the limits and exclusions in coverage is also essential. Reviewing key terms before submitting the form can prevent misunderstandings regarding what is and isn’t covered.

Support and troubleshooting

If you encounter challenges while completing your voluntary life and AD&D form, accessing customer support through pdfFiller is straightforward. They offer various contact modes, ensuring assistance is available whenever needed.

Frequently asked questions can often resolve common concerns. Reviewing these can provide clarity on processes and policies, aiding users in finding immediate answers.

Sharing and collaborating on the form

Collaborating with family members or financial advisors on the voluntary life and AD&D form can enhance accuracy and thoroughness. pdfFiller provides features that allow users to seamlessly share their document for input.

Best practices for collecting feedback include establishing clear review guidelines and actively communicating changes to ensure everyone is aligned.

Additional tools and features on pdfFiller

Beyond the voluntary life and AD&D form, pdfFiller offers a plethora of document management solutions. Users can explore additional templates that might be relevant for life insurance and related documentation.

Integrating pdfFiller with other applications can enhance user experience, facilitating smoother document management, and making it an indispensable tool for personal and professional use.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my voluntary life and adampd directly from Gmail?

How can I edit voluntary life and adampd from Google Drive?

How do I edit voluntary life and adampd on an Android device?

What is voluntary life and adampd?

Who is required to file voluntary life and adampd?

How to fill out voluntary life and adampd?

What is the purpose of voluntary life and adampd?

What information must be reported on voluntary life and adampd?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.