Get the free High-Deductible Health Plans and Health Savings Accounts

Get, Create, Make and Sign high-deductible health plans and

How to edit high-deductible health plans and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out high-deductible health plans and

How to fill out high-deductible health plans and

Who needs high-deductible health plans and?

Understanding High-Deductible Health Plans and Form Management

Understanding high-deductible health plans (HDHP)

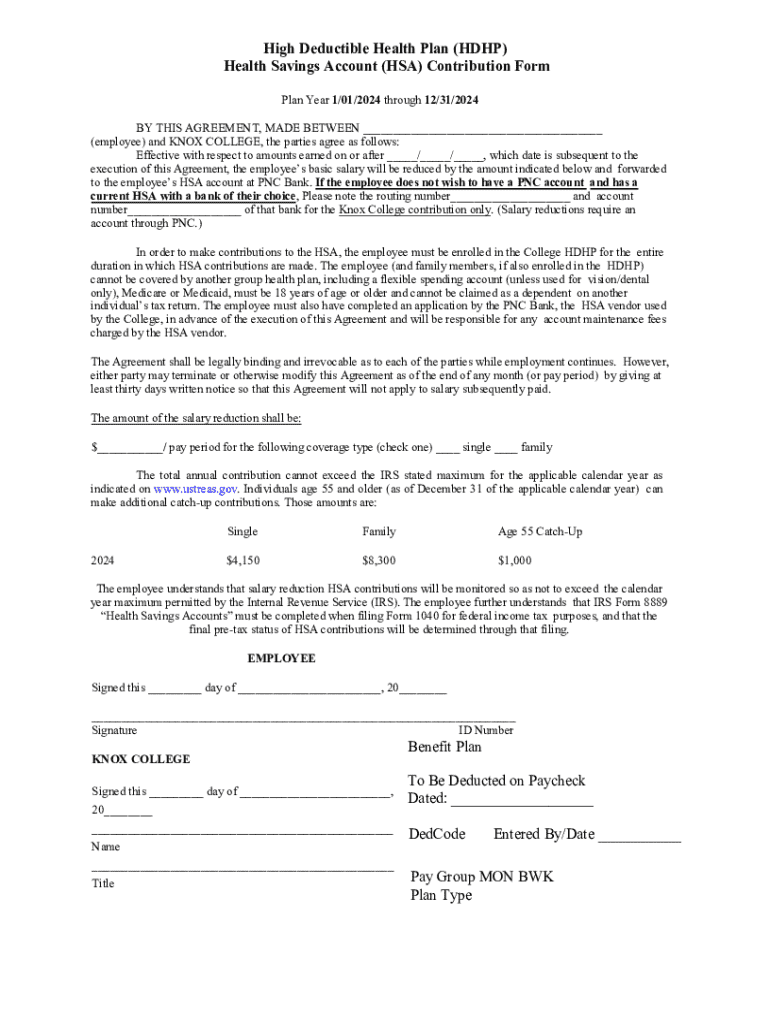

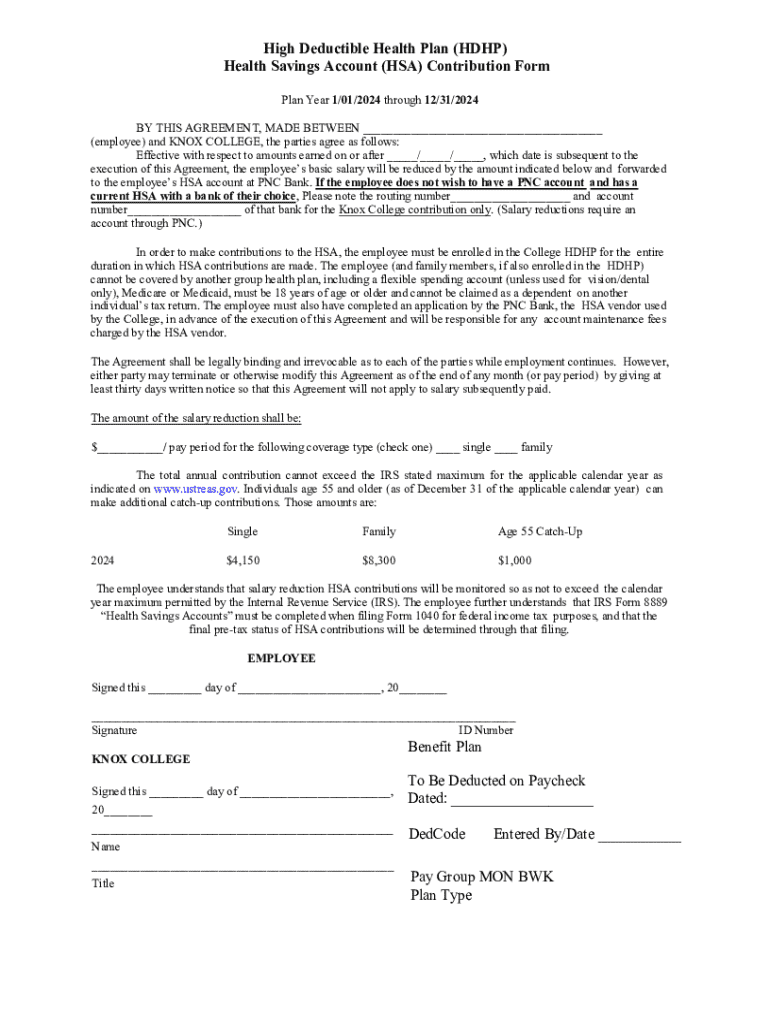

High-Deductible Health Plans (HDHPs) are health insurance plans characterized by higher deductibles and lower premiums compared to traditional health insurance options. To qualify as an HDHP in 2023, an individual must have a yearly deductible of at least $1,500, while family plans require a minimum deductible of $3,000. The key features that distinguish these plans include the out-of-pocket maximum limits, which cannot exceed $7,500 for individual coverage and $15,000 for family coverage.

HDHPs come in two primary types: the individual HDHP, which provides coverage for a single person, and the family HDHP, accommodating multiple family members under one plan. One of the significant differences between HDHPs and traditional plans lies in the cost-sharing structure, where policyholders may pay higher out-of-pocket costs until they meet their deductible before insurance kicks in.

Benefits of choosing a high-deductible health plan

Choosing a high-deductible health plan offers several benefits, particularly in terms of cost savings. HDHPs often feature lower premium costs, making them an attractive option for healthy individuals or families who don't anticipate needing extensive medical care. These plans also present the potential for lower overall expenses when individuals actively manage their healthcare costs.

One significant advantage of HDHPs is the access to a Health Savings Account (HSA). HSAs allow individuals to save money tax-free for qualified medical expenses, providing a financial cushion to offset the higher out-of-pocket costs associated with HDHPs. Additionally, HDHPs typically cover preventive care services at no cost, encouraging individuals to receive necessary screenings and vaccinations without incurring out-of-pocket expenses.

Navigating the high-deductible health plan form

Completing the high-deductible health plan (HDHP) enrollment form can seem daunting. Understanding the required information is crucial for a smooth enrollment process. Essential sections of the form typically include personal information, plan selection, dependent information, and health information disclosure.

To complete the HDHP enrollment form, follow these steps:

It's essential to be aware of special enrollment periods, which may allow individuals to sign up for coverage outside the normal enrollment window. Understanding these nuances can lead to better healthcare coverage choices.

Health savings accounts (HSA) and their connection to HDHPs

A Health Savings Account (HSA) is a tax-advantaged savings account specifically designed for individuals enrolled in a high-deductible health plan. To be eligible for an HSA, you must have a qualifying HDHP, no other health coverage that isn't an HDHP, and not be claimed as a dependent on someone else’s tax return.

For 2023, the contribution limits for HSAs are $3,850 for individual coverage and $7,750 for family coverage, with an additional $1,000 catch-up contribution allowed for individuals aged 55 and older. HSAs offer notable tax advantages: contributions are tax-deductible, the funds grow tax-deferred, and withdrawals for qualified medical expenses are tax-free.

Utilizing your HSA wisely can lead to substantial savings on healthcare costs. Qualified medical expenses include out-of-pocket costs for deductibles, copays, dental care, vision services, and various other healthcare-related fees.

Health reimbursement arrangements (HRA) overview

Health Reimbursement Arrangements (HRAs) are employer-funded plans that reimburse employees for their out-of-pocket medical expenses. Unlike HSAs, where the account belongs to the individual, HRAs are owned by the employer, and unused funds may not carry over year-to-year in all cases.

HRAs can work in conjunction with HDHPs, providing additional financial support. Employers allocate a certain amount of funds for employees to spend on qualifying medical expenses. However, eligibility for reimbursement is contingent upon the program established by the employer, so it’s essential to understand the specific rules governing your HRA.

Frequently asked questions (FAQs) about HDHPs and forms

As you navigate high-deductible health plans and the accompanying forms, several common inquiries often arise. Understanding the requirements and processes can enhance your experience.

Cost considerations and financial planning with HDHPs

Financial planning for a high-deductible health plan involves strategic budgeting. With higher out-of-pocket maximums, it's critical to prepare for potential medical emergencies. Understanding your financial limits can help you manage your health expenses effectively.

One effective strategy is to maximize the benefits of your HSA. Contributing the maximum allowable amount not only provides immediate tax benefits but also offers long-term savings potential, as the funds can be invested and grow over time. Additionally, it’s wise to set aside a specific budget each month to cover anticipated healthcare expenses not covered by your HDHP.

When facing unexpected medical services, having a solid financial plan enables you to leverage your HSA and avoid financial strain.

Impact on healthcare decisions

High-deductible health plans significantly influence how individuals approach healthcare decisions. Consumers are encouraged to price shop for services, as the out-of-pocket costs vary widely among facilities. This proactive approach can lead to substantial savings, particularly for non-emergency medical procedures.

Understanding preventive services is also crucial. With HDHPs often covering preventive care at no cost, individuals are incentivized to maintain regular check-ups and screenings. Balancing the cost of care with the quality of services received becomes essential under an HDHP model, pushing consumers to be more informed about their healthcare choices.

Tools for managing your HDHP and forms

Managing your high-deductible health plan efficiently often involves utilizing document management solutions. Online tools offer functionalities that allow users to manage their health-related forms effortlessly. Using pdfFiller, individuals can edit HDHP forms online, e-sign documents, and collaborate with healthcare providers.

Being able to track healthcare expenses and HSA contributions simplifies your financial planning efforts. Maintaining organized records of expenditures can significantly ease the burden during tax season and ensure you stay within your budget for healthcare costs.

Emerging issues with high-deductible health plans

The landscape of high-deductible health plans continues to evolve, with significant trends in adoption rates among consumers. People are more frequently turning to HDHPs as a means to manage healthcare costs in an economy marked by rising healthcare prices.

Potential changes in legislation could further impact the design and accessibility of HDHPs. Keeping abreast of developments in healthcare reform is vital to understanding how these plans may adapt to meet changing regulatory environments and consumer needs.

Get help with your high-deductible health plan

Navigating a high-deductible health plan and associated forms can be complex. Fortunately, numerous resources are available for individuals and teams seeking assistance. Most insurance companies provide dedicated support to answer enrollment questions and clarify coverage specifics.

For form-related assistance, utilizing platforms like pdfFiller can streamline your experience. Access member tools designed for HDHP management and reach out to support teams when in need of help.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify high-deductible health plans and without leaving Google Drive?

How do I make edits in high-deductible health plans and without leaving Chrome?

How do I fill out high-deductible health plans and using my mobile device?

What is high-deductible health plans and?

Who is required to file high-deductible health plans and?

How to fill out high-deductible health plans and?

What is the purpose of high-deductible health plans and?

What information must be reported on high-deductible health plans and?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.