Get the free Individual Income Tax - DOR

Get, Create, Make and Sign individual income tax

How to edit individual income tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out individual income tax

How to fill out individual income tax

Who needs individual income tax?

A comprehensive guide to the individual income tax form

Understanding individual income tax forms

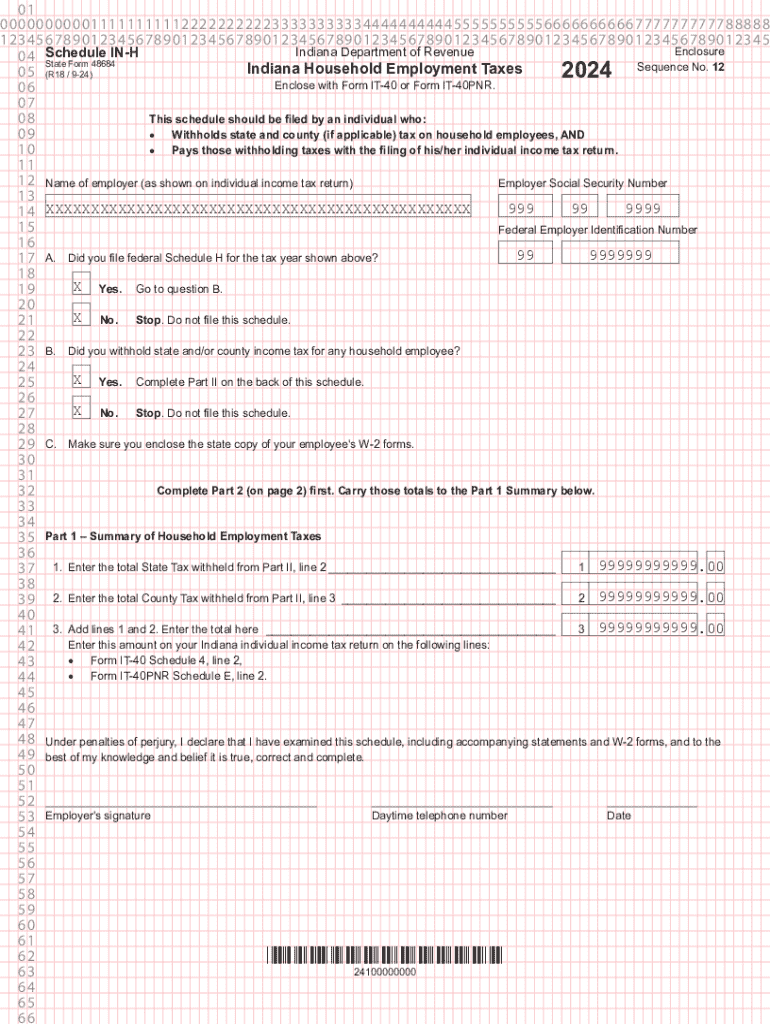

An individual income tax form is a crucial document required by the IRS for reporting an individual’s income, deductions, and tax obligations. This form enables the government to assess how much you owe in taxes or if you are entitled to a refund based on your earnings and applicable deductions.

Filing your tax returns accurately is paramount for compliance with federal laws. Mistakes can lead not only to delays in processing your return but also to penalties if the IRS finds discrepancies in your reported income or deductions. Therefore, understanding the nuances of the individual income tax form is essential.

Key components of the individual income tax form

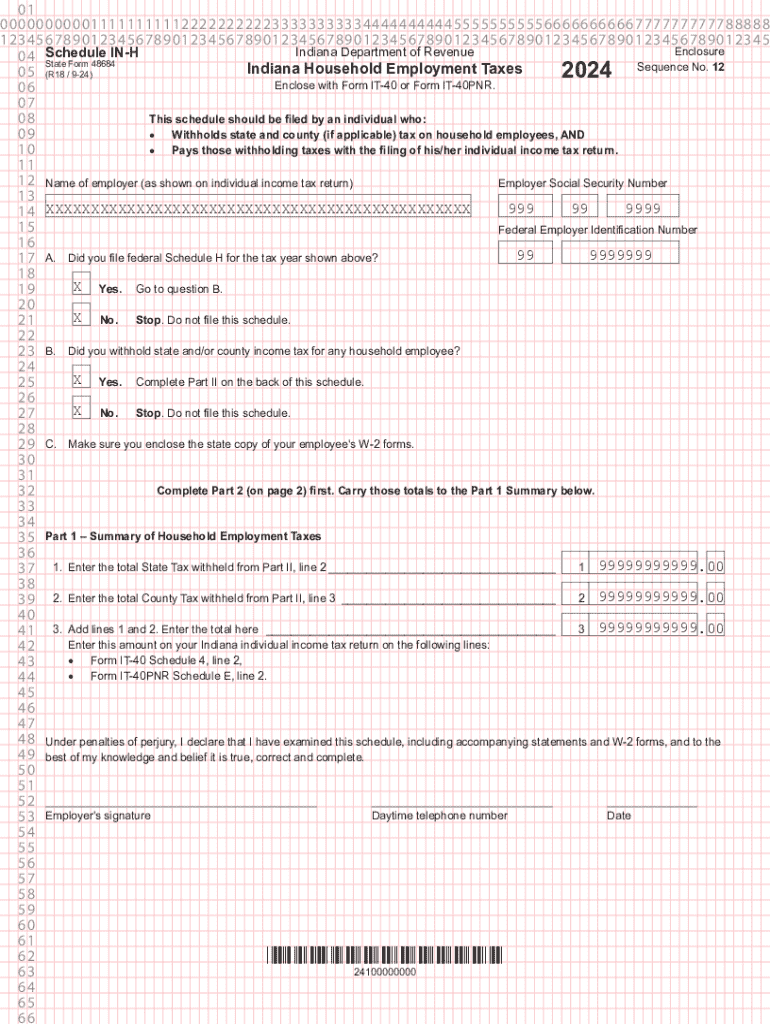

The individual income tax form is divided into several key sections, each serving a distinct purpose. The first section is the personal information segment, where you must include your name, address, and Social Security number (SSN). Notably, your filing status, whether single, married, or head of household, also influences how much you pay in taxes.

In the income reporting section, you’ll list all sources of income, such as wages, dividends, and interest. It's essential to gather relevant documentation, including W-2s from employers and 1099s for freelance work, to ensure accurate reporting.

Deductions and credits are crucial for reducing your taxable income. Taxpayers can choose between standard deductions or itemizing deductions on Schedule A. Common deductions include mortgage interest and medical expenses, while credits like the Earned Income Tax Credit (EITC) can provide additional financial relief.

Finally, you'll calculate your tax due. Understanding how tax brackets work helps in determining the amount owed or any potential refund expected, based on the total income and allowable deductions.

Step-by-step instructions for filling out the form

Before diving into filling out the tax form, it's essential to prepare your documents. Gathering W-2s, 1099s, and any other necessary financial records is a crucial first step. Organizing receipts for any potential itemized deductions will also simplify the process and ensure you don’t miss any possible savings.

As you fill out the form, start with the personal information section. Ensure that your name, address, and SSN are filled out correctly. Next, report your income accurately—double-check numbers against your supporting documents.

Select the appropriate deductions and credits based on your eligibility. If you're itemizing, carefully list out your itemized deductions on Schedule A. After completing the form, take time to review your entries meticulously.

Common errors include incorrect calculations, missing signatures, and unsatisfactory documentation for claimed deductions. Confirm your calculations and ensure all necessary fields are filled before submission.

Tools for editing and signing your tax form

When it comes to managing your individual income tax form, pdfFiller provides a robust suite of tools that make editing, signing, and managing documents seamless. With pdfFiller, users can easily modify their tax form online, ensuring all information is correct before submitting to the IRS.

To edit your tax form online, upload the document to pdfFiller’s platform, use the editing features to adjust any sections, and insert digital signatures as required. Collaboration features enable teams to work together more efficiently, making it ideal for any team efforts in tax submission.

After editing and signing, pdfFiller allows you to save and export your completed form in various formats, ensuring it remains secure and easily shareable with relevant stakeholders.

What to do after filing your individual income tax form

Once you’ve filed your individual income tax form, it's important to track the status of your tax return. The IRS provides online tools where you can view the progress of your return. This transparency can alleviate anxiety as you await processing.

Understanding your tax obligations is equally crucial. Once your return is processed, make sure you follow up on any pending payments or confirmation of your refund. Additionally, be prepared for potential audits; keeping tax records for at least three years is standard practice for safeguarding against any issues that may arise.

Frequently asked questions about individual income tax forms

Filing tax returns can be overwhelming, leading many individuals to wonder whether they should hire a professional or handle their taxes themselves. For those with straightforward financial situations, filing independently is often feasible. However, consulting a tax professional is wise for individuals with complex financial scenarios or substantial business interests.

If you realize you made a mistake on your tax form after filing, don’t panic. Using Form 1040X, you can amend errors on your original tax return. Be sure to submit the amended return as soon as you identify a mistake to avoid any penalties.

Additional forms and resources for individuals

In addition to the individual income tax form, several other forms may be relevant for your specific tax situation. State-specific tax forms vary widely and may have their own procedural requirements, so understanding your local tax laws is necessary for full compliance.

For comprehensive guidance, the IRS provides various instructions and publications that can offer further clarity on tax responsibilities. Online tax calculators and resources can also be beneficial in estimating your tax liabilities or potential refunds.

Using cloud-based solutions for future tax seasons

The benefits of cloud-based tax solutions are manifold, particularly regarding accessibility and security. Utilizing a cloud-based platform like pdfFiller empowers users to manage documents securely from anywhere, making it easier to file taxes on time and access stored documents year-round.

pdfFiller's document management capabilities cater specifically to tax forms, allowing users to store, edit, and collaborate on documents effectively. Tips for efficient document organization include categorizing tax documentation by year and type, to make the filing process smoother moving forward.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my individual income tax directly from Gmail?

How can I modify individual income tax without leaving Google Drive?

How do I make changes in individual income tax?

What is individual income tax?

Who is required to file individual income tax?

How to fill out individual income tax?

What is the purpose of individual income tax?

What information must be reported on individual income tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.