Get the free Beneficial ownership & controller certification form - BlackRock

Get, Create, Make and Sign beneficial ownership amp controller

Editing beneficial ownership amp controller online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficial ownership amp controller

How to fill out beneficial ownership amp controller

Who needs beneficial ownership amp controller?

Understanding the Beneficial Ownership and Controller Form

Overview of beneficial ownership

Beneficial ownership refers to the person or entity that ultimately owns or controls an asset, even though the asset may be held in another name. This concept is crucial to ensure transparency in financial transactions and corporate governance. Recognizing who the beneficial owners are helps in combating money laundering, financing of terrorism, and other illegal activities. The importance of beneficial ownership is evident in compliance regulations worldwide, making it imperative for businesses to disclose true ownership details, enhancing accountability.

Who should use the beneficial ownership and controller form?

The beneficial ownership and controller form is designed for a variety of users, including individuals seeking clarity on personal asset ownership, businesses required to maintain compliance with legal norms, and organizations that must ensure their operations align with industry regulations. For individuals, this form can clarify personal ownership and inform tax implications. Businesses are mandated to disclose beneficial ownership to fulfill compliance requirements, especially in financial sectors. Teams responsible for regulatory reporting must ensure accurate submissions to maintain operational integrity.

Understanding the beneficial ownership and controller form

The beneficial ownership and controller form serves a critical purpose in collecting detailed ownership information. Its primary goals include maintaining accurate records of ownership, verifying ownership structures, and facilitating compliance with regulatory obligations. By gathering comprehensive data, it ensures that companies disclose their true ownership dynamics, which is essential for compliance with anti-money laundering regulations and other monitoring frameworks.

Purpose of the form

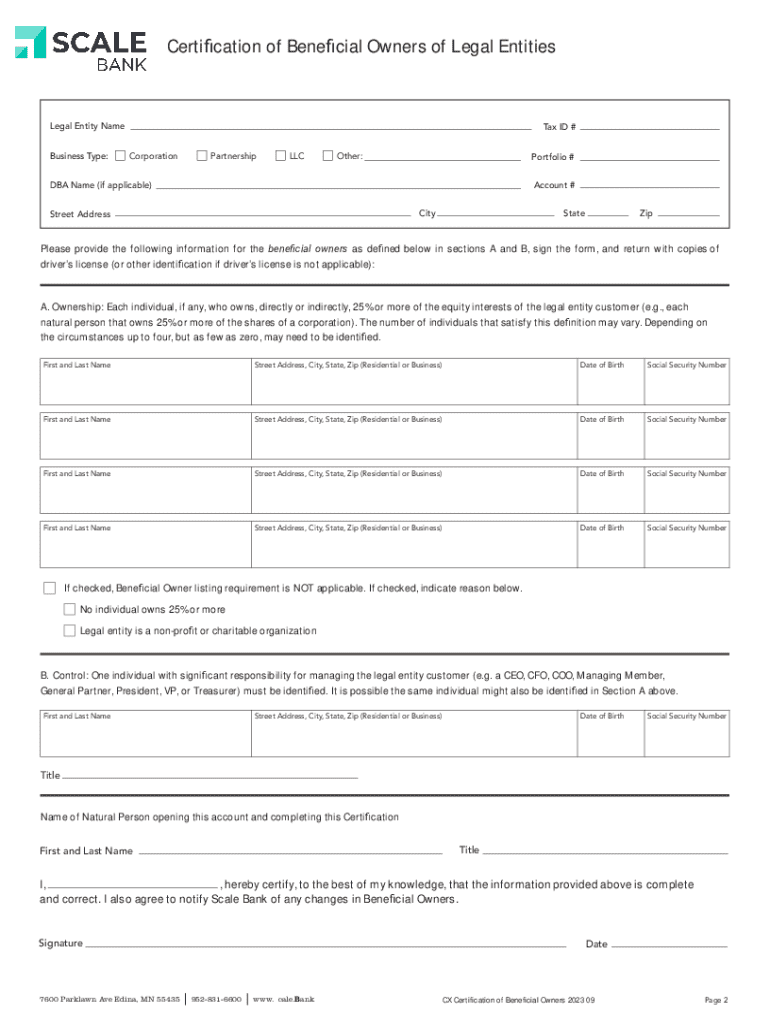

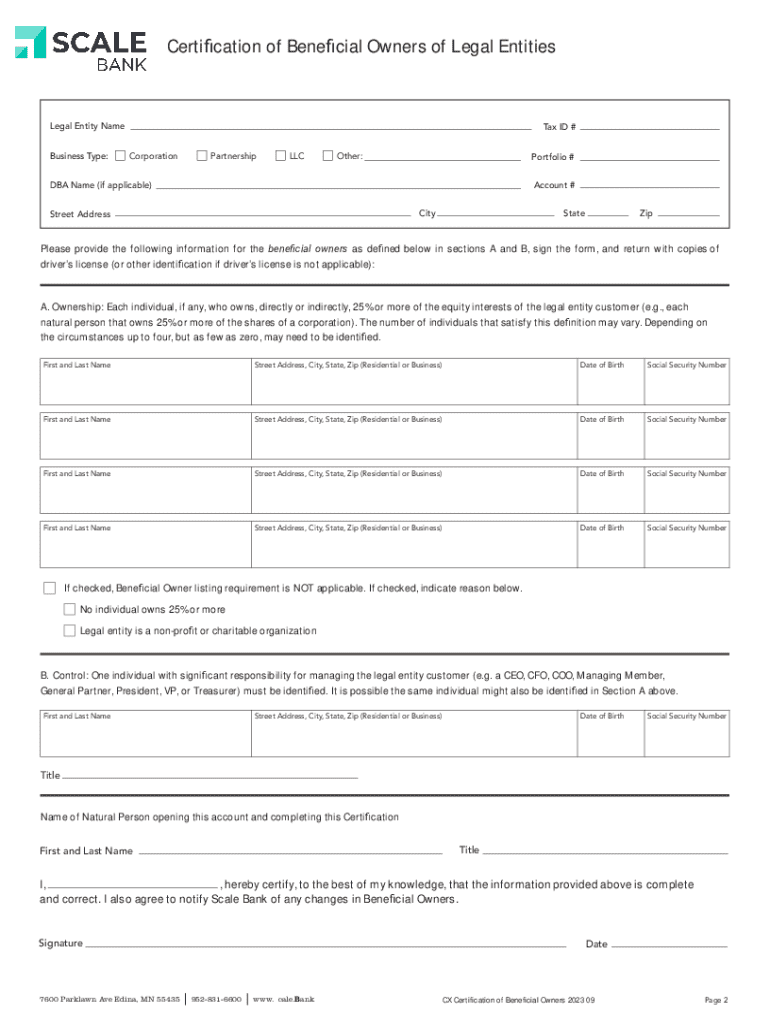

Components of the form

The form typically includes several critical sections that ask for the following information: names of beneficial owners, their contact information, percentages of ownership, and any relevant identifiers. Each section must be filled out with precision to avoid discrepancies during regulatory audits or investigations.

When is the beneficial ownership information required?

There are specific situations where beneficial ownership information is required. These include company registrations where new entities must disclose their owners, various financial regulatory filings, mergers, and acquisitions. Each of these circumstances presents a unique requirement for the beneficial ownership and controller form, ensuring transparency in financial transactions and corporate structures.

How to complete the beneficial ownership and controller form

Completing the beneficial ownership and controller form involves a series of steps that ensure all necessary information is collated accurately. This section outlines a practical guide for individuals and organizations to follow.

Step-by-step guide for individuals

Step-by-step guide for businesses and organizations

Interactive tools for assistance

pdfFiller offers interactive tools that simplify filling out the beneficial ownership and controller form. Users can access editable forms, collaborate in real time, and utilize eSignature capabilities for easy submissions.

Confirming the accuracy of beneficial ownership information

Accuracy is paramount when it comes to beneficial ownership information. Verification mechanisms should be established to cross-check details provided in the forms. Mistaken or inaccurate data can lead to legal repercussions, including fines and sanctions for the reporting organization.

Exceptions and special circumstances

While beneficial ownership information is critical, there are instances where it may not be required. Some entities, such as certain types of trusts or those with confidentiality concerns, may face exemptions. In such cases, it’s essential to follow protocols for reporting an inability to obtain ownership details.

Record-keeping for beneficial ownership

Effective record-keeping is essential for compliance with beneficial ownership regulations. Organizations should maintain thorough documentation, storing forms and verification details. Best practices dictate retaining these records for a considerable duration to facilitate audits and compliance checks.

Frequently asked questions

Individuals and organizations often have questions regarding beneficial ownership reporting. Common queries include how to identify beneficial owners, guidelines for filling the form for trusts, and what steps to take in case of discrepancies in reported information.

Diagrammatic representation of beneficial ownership structures

Visual aids can significantly enhance understanding of beneficial ownership structures. Diagrams illustrating ownership relationships provide clarity, especially in corporate contexts where ownership might be layered or obscured.

Staying compliant with legislation

Compliance with beneficial ownership legislation is crucial for maintaining operational legality. Companies must stay informed about relevant laws, including updates from the Central Beneficial Ownership Register and understand how such regulations affect anti-money laundering efforts. Failure to comply can have significant legal repercussions.

Useful tools and features on pdfFiller

pdfFiller provides numerous tools designed to help users when completing the beneficial ownership and controller form. With optional interactive features, users can access templates, collaborative tools for teams, and cloud-based document management—ensuring that beneficial ownership disclosures are managed efficiently.

Contact support for additional guidance

Users are encouraged to reach out for support when completing the beneficial ownership and controller form. Various channels are available for tailored assistance, ensuring that users have access to the guidance needed to navigate the complexities of beneficial ownership compliance.

Government and regulatory agencies overview

Several key organizations oversee beneficial ownership compliance, providing the framework within which companies must operate. Staying updated with these regulatory bodies is vital for ensuring legal adherence and understanding the implications of regulations related to beneficial ownership.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my beneficial ownership amp controller directly from Gmail?

How do I complete beneficial ownership amp controller online?

How do I edit beneficial ownership amp controller in Chrome?

What is beneficial ownership amp controller?

Who is required to file beneficial ownership amp controller?

How to fill out beneficial ownership amp controller?

What is the purpose of beneficial ownership amp controller?

What information must be reported on beneficial ownership amp controller?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.