Application - Financial Accountant: Education Gov Form

Understanding the financial accountant position

Financial accounting is the discipline concerned with the assessment and reporting of an organization’s financial performance. A financial accountant is tasked with preparing financial statements that reflect an organization's economic activities while adhering to specific regulations. Given the importance of accurate financial reporting, financial accountants play a crucial role in helping organizations make informed decisions.

The significance of financial accountants extends beyond mere compliance; they help drive strategic planning and operational efficiency. Their expertise in interpreting financial data not only aids in stakeholder communication but also supports management decisions. Thus, understanding the core principles is essential for aspiring financial accountants.

Double-entry accounting: This system ensures that every financial transaction affects at least two accounts, maintaining the accounting equation.

Debits and credits: These are the foundational elements of financial transactions, impacting how accounts are balanced and reported.

Financial statements overview: This includes balance sheets, income statements, and cash flow statements, which provide insight into an organization’s financial health.

Overview of the application process

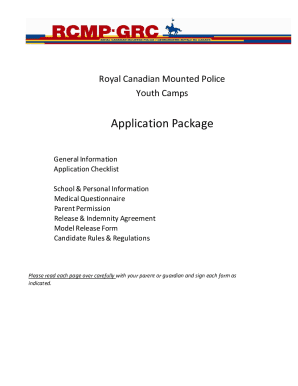

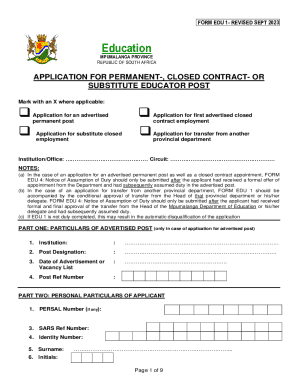

Applying for a financial accountant position requires careful preparation. Key requirements typically include academic qualifications, relevant experience, and specific documents that validate your credentials. Understanding how to effectively complete the Education Gov form is essential for a successful application.

The Education Gov form serves a critical purpose; it is specifically designed to collect detailed information from applicants, ensuring that organizations access essential data for their selection process. Target audiences for this form include recent graduates and professionals seeking job transitions in the financial accounting domain.

Minimum qualifications typically require a degree in accounting or finance.

Required documents often include transcripts, resumes, and proof of certification or licenses.

Being aware of the application submission timeline is crucial. Most organizations have specific cut-off dates that applicants must meet to be considered for their financial accounting positions.

Detailed application instructions

Completing the Education Gov form entails meticulous attention to detail. First, it’s advisable to break down the sections of the form: personal details, educational background, work experience, and references. Each section demands specific information, and understanding the requirements of each can simplify the process.

Applicants frequently make common mistakes such as providing incomplete information or failing to adhere to formatting guidelines. By double-checking submissions and ensuring accuracy, applicants can avoid unnecessary delays.

Be concise and precise in answering each question.

Ensure all attached documents are relevant and correctly formatted.

Review for any grammar or spelling errors before submission.

Utilizing interactive tools, such as online form fillers and document templates available on platforms like pdfFiller, can ease the form completion process. Moreover, eSigning features facilitate efficient document submission, allowing candidates to swiftly sign and send their applications.

Education and experience requirements

Minimum educational requirements for financial accountants typically include various degrees in accounting or finance. Relevant degrees range from an associate degree to a master’s degree, with many employers favoring candidates who hold advanced qualifications.

Additionally, pursuing certifications, such as Certified Public Accountant (CPA) or Chartered Financial Analyst (CFA), can enhance a candidate’s employability. Gaining relevant experience through internships, job shadowing, and entry-level positions is also important. Networking with accounting professionals can yield valuable insights and potential job leads.

Internships: Engaging in internships can provide hands-on experience and valuable networking opportunities.

Entry-level positions: Starting in roles such as bookkeeping or auditing can build foundational skills.

Networking: Attending accounting seminars or local meetups can connect you with industry professionals.

Special considerations in financial accounting applications

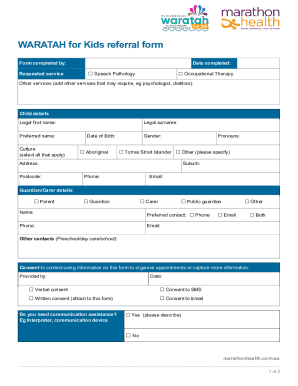

Certain applicants might require special testing arrangements based on their circumstances, such as disabilities. Understanding organizational policies regarding these accommodations is crucial for applicants desiring to highlight their skills without barriers.

Equal Opportunity Employment (EOE) implications are another important consideration. Many organizations are committed to inclusivity and creating diverse work environments. Applicants should be aware of these practices, ensuring compliance with non-discrimination policies.

Inquire about special accommodation processes early in the application.

Familiarize yourself with the EOE statement of the organization.

Be prepared to discuss any specific accommodations during interviews if necessary.

All applicants must adhere to policies that promote a drug-free workplace. This statement often accompanies job applications and is a standard expectation for professional roles, including financial accountants.

Preparing for interviews and assessments

Preparation for interviews begins with understanding commonly asked questions for financial accountants. Familiarity with situational queries that assess problem-solving skills and knowledge of financial reporting standards is beneficial.

Additionally, aspiring accountants should be ready for practical assessments where they may be asked to analyze financial statements or perform calculations. Practicing with sample tests can be invaluable in boosting confidence.

Review typical interview questions, focusing on technical accounting queries.

Engage in mock interviews with peers for practice.

Research the organization’s financial practices and culture.

Ultimately, the right preparation can enhance confidence, enabling candidates to present their qualifications effectively during interviews.

Financial accounting career pathway

The career opportunities available within the financial accounting field are diverse. Financial accountants can specialize in areas such as tax accounting or forensic accounting, each offering unique challenges and rewards.

Moreover, related career paths exist, including positions like auditors or personal financial advisors. Each pathway presents different prospects for growth and specialization, allowing professionals to carve their career trajectories based on their interests.

Types of financial accountants: Examples include tax accountants who focus on tax regulations and forensic accountants who investigate financial discrepancies.

Opportunities for advancement: Gaining certifications and experience can lead to higher-level positions and specialized roles.

Future trends: The rise of technology, such as accounting software, is transforming the field, requiring ongoing education and adaptation.

Frequently asked questions (FAQs)

A common question pertains to the role of a financial accountant, which primarily involves preparing financial statements, analyzing data, and ensuring regulatory compliance. In terms of salary, specialized accountants focused on tax strategies or forensic investigations tend to earn higher wages due to the complexity of their work.

Many individuals also wonder about the differences between financial accounting and managerial accounting. While financial accounting focuses on external reporting, managerial accounting is concerned with internal financial processes and support.

What does a financial accountant do? They prepare and analyze financial statements and reports.

What type of accountant gets paid the most? Tax accountants and forensic accountants generally have higher earning potentials.

How to prepare for a financial accounting career? Prospective accountants should pursue relevant education, certifications, and internships.

Additional tools and resources

To support financial accounting professionals, various resources are available. Academic institutions and online learning platforms offer specialized courses and certifications in related disciplines, which can help refine skills and enhance knowledge.

Tools such as pdfFiller play a vital role in efficient document management. With features that allow users to create, edit, and eSign documents, pdfFiller enhances the application experience for financial accountants.

Links to relevant financial accounting resources: Consider organizations like the AICPA for guidance.

Overview of pdfFiller features: Users can manage and collaborate on documents from a centralized platform.

Importance of continuous learning: Engaging in workshops and courses can keep accountants updated with industry standards.

Exploring financial accounting education options

Finding the right academic program can aid individuals in their journey to becoming successful financial accountants. Institutions offer a variety of degrees and certification programs tailored to the needs of aspiring accountants.

Pros and cons exist for both online and traditional learning formats. Online programs offer flexibility, whereas traditional ones provide more direct interaction with faculty and peers. Financial aid and scholarships are also available for accounting students, making education more accessible.

Academic Program Finder: Explore different degrees and certifications available in accounting.

Pros and Cons of Online vs. Traditional Learning: Assess which format suits your learning style and needs.

Financial Aid and Scholarships: Research opportunities to assist with educational expenses in accounting.