DRA Share Buy-Back Offer Form: A Comprehensive Guide

Understanding the DRA share buy-back concept

A share buy-back is a corporate action wherein a company repurchases its own shares from the existing shareholders, typically at a premium. This action can reduce the number of outstanding shares, potentially increasing the value of remaining shares and distributing excess cash back to shareholders. In the context of DRA, which stands for Directors' Approval, this is a crucial step, as it ensures that the buy-back aligns with corporate governance principles and shareholder interests.

There are primarily two types of share buy-back offers: open market buy-backs and tender offers. Open market buy-backs allow companies to purchase shares from the market at prevailing prices, while tender offers invite shareholders to sell a specified amount of shares at a predetermined price. The DRA is critical as it incorporates management approval, ensuring that the buy-back serves the company's best interests and adheres to regulatory guidelines.

Engaging in a share buy-back can offer multiple benefits to both companies and shareholders. Companies may enhance shareholder value, improve financial ratios, and have a mechanism to utilize surplus cash effectively. For shareholders, a buy-back can increase their ownership percentage and offer liquidity options, especially if they choose to sell their shares back to the company.

Key considerations before initiating a share buy-back

Before a company embarks on a share buy-back, it is essential to consider various regulatory frameworks governing such actions. This often includes compliance with both local securities regulations and corporate governance standards. Companies must assess their financial health to determine if they have the necessary cash reserves and whether market conditions are suitable for a buy-back.

Valuing shares appropriately is also critical in ensuring that the buy-back price reflects fair market conditions. Setting a buy-back price too low might discourage shareholders, while a price that's too high could diminish the company's financial positioning. It's also vital to evaluate the implications of the buy-back on shareholder equity and earnings per share (EPS), as these elements can impact future investment decisions.

The DRA share buy-back offer form: An overview

The DRA share buy-back offer form is an essential document designed to initiate and formalize the buy-back process. The primary purpose of this form is to provide a structured way for the company to express its intention to repurchase shares, while also ensuring compliance with the regulatory requirements that necessitate transparency in financial dealings.

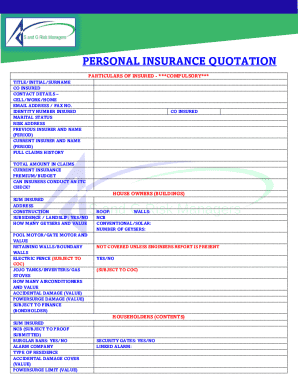

The form typically encompasses various critical sections that must be filled out accurately, indicating details such as the company's identification information, the number of shares to be repurchased, and the buy-back pricing strategy. Completed by company officers with adequate authority, it signifies the approval of the buy-back plan.

Step-by-step guide to completing the DRA share buy-back offer form

Step 1: Gather necessary information

Before diving into filling out the DRA form, gather all necessary documentation. This includes the company’s financial statements, the current number of outstanding shares, and any directives from the board of directors. Make sure to confirm current share prices and seek required approvals from fiduciaries or compliance committees.

Step 2: Fill out the form

The next step involves carefully filling out the form. Include essential company details such as name, registration number, and contact information. Shareholder information must also be provided, including names and amount of shares held. Be specific about the number of shares you wish to repurchase and detail the buy-back price, ensuring it is strategically set based on current market valuations.

Step 3: Review and verify

Accuracy is critical when dealing with financial information. Review the filled-out form multiple times for any discrepancies. It's advisable to have an internal audit or compliance officer verify it to maintain strict governance and reduce the risk of regulatory backlash.

Step 4: Submit the form

After reviewing, the form should be submitted as per your company’s internal processes. Typically, there are designated deadlines for submission, so ensure your compliance department is aware of the timeline to avoid any potential setbacks.

Step 5: Follow up on the buy-back execution

Once submitted, monitor the progress of the buy-back execution closely. Track the effects on share price and shareholder responses continuously. Understanding these impacts can provide insights for future buy-back initiatives and improve your overall strategy.

Tools and features to enhance your buy-back submission process

Utilizing interactive forms can simplify the buy-back submission process considerably. Platforms like pdfFiller offer functionalities that make filling out the DRA share buy-back offer form efficient. These interactive tools often allow for easy editing and include eSigning capabilities, which streamline the approval process.

Moreover, collaboration features enable teams to work together seamlessly when managing buy-backs, ensuring everyone is aligned. Cloud-based storage further enhances this process by allowing users to access documents from anywhere, thus making workflow management much simpler.

FAQs regarding the DRA share buy-back offer form

Understanding the intricacies of the DRA share buy-back offer form may raise several questions. For instance, what happens if the buy-back offer is oversubscribed? Generally, shares may be allocated on a pro-rata basis, ensuring fairness among shareholders. Another frequent inquiry revolves around the legal obligations tied to the buy-back; it’s crucial to understand the legal ramifications and rights associated with this process.

Support options are usually available for form-related inquiries, offering guidance through customer support services or online resources, ensuring that users get the help they need promptly. This assistance can greatly simplify the submission process.

Best practices for successful share buy-backs

Maximizing the benefits of a buy-back requires strategic considerations. For instance, timing the buy-back to coincide with favorable market conditions can enhance share prices significantly. Companies should thoroughly analyze their financial metrics to ensure the buy-back aligns with overall business goals.

Utilizing real-life case studies can provide insights into which strategies worked for others in similar circumstances. By understanding different approaches — including the factors that led to successful share buy-backs — companies can refine their techniques and recognize any pitfalls they should avoid.

Resources for further insight

Diving deeper into share buy-back strategies and regulations can illuminate best practices and provide guidance on handling the DRA share buy-back offer form. Engaging with comprehensive educational articles and industry-specific regulations can elevate a company’s approach to buy-backs.

Moreover, pdfFiller offers users access to various templates and working documents that can aid in navigating the complexities of financial documentation, ensuring teams stay ahead of the regulatory landscape and optimize their document management solutions.

Engage with our community

We invite individuals and teams interested in share buy-backs and financial management to join our community discussions. Engaging with fellow users can provide valuable insights and share experiences, which can prove to be beneficial for those navigating the share buy-back landscape.

Moreover, professional development opportunities are available within our network, allowing you to enhance your skills in financial management and stay informed about best practices in your sector.