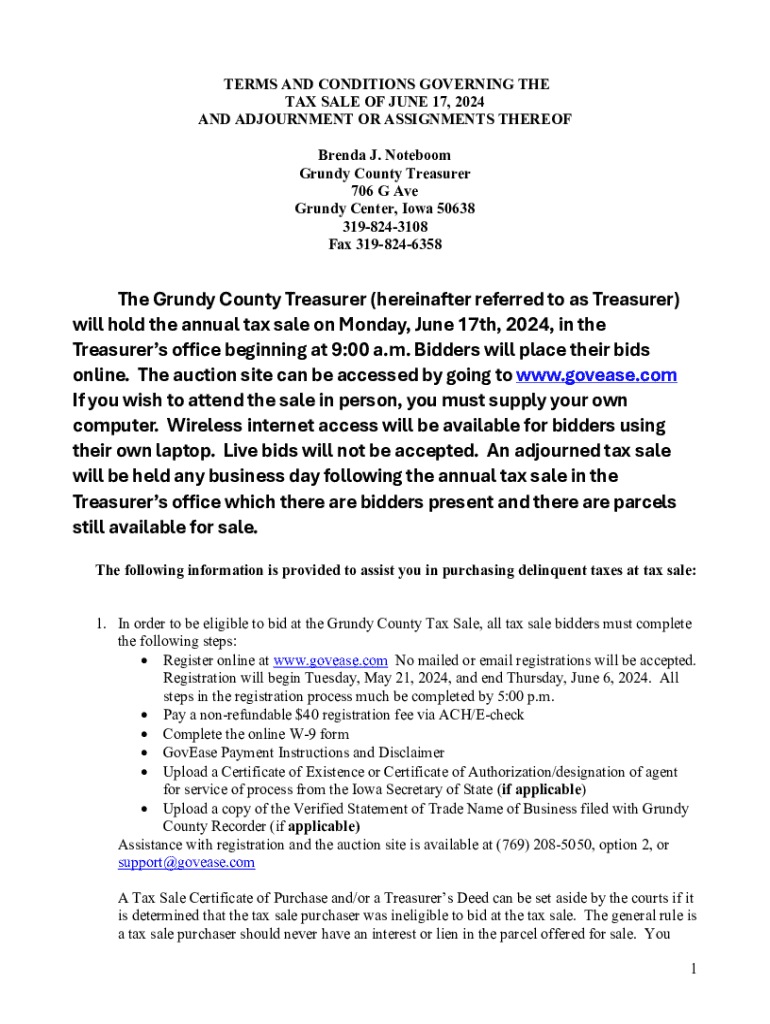

Get the free INFORMATION GOVERNING TAX SALES

Get, Create, Make and Sign information governing tax sales

How to edit information governing tax sales online

Uncompromising security for your PDF editing and eSignature needs

How to fill out information governing tax sales

How to fill out information governing tax sales

Who needs information governing tax sales?

Information Governing Tax Sales Form

Understanding tax sales forms

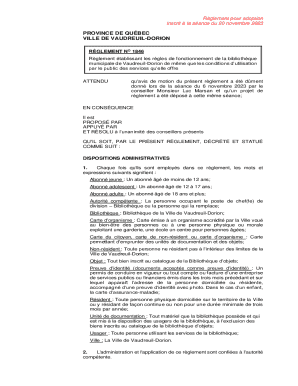

Tax sales forms are crucial documents in the property tax system, representing the processes related to the sale of properties due to unpaid taxes. When property owners fail to pay their taxes, tax authorities may place liens on their properties, ultimately leading to tax sales. These sales allow the government to recoup the unpaid taxes, making tax sales forms vital in documenting ownership transfers, lien placements, and the public sale of properties.

There are various types of tax sale forms, including applications for tax deeds, bid forms, and notices of tax lien sales. Each form serves a specific purpose in the tax sales process, providing essential details required by local and state law. Terminology related to tax sales forms—like 'redeemed property' or 'tax certificate'—is also essential for understanding the complexities involved in tax sales and ensuring compliance.

Navigating the tax sales process

Completing a tax sales form requires understanding the specific information needed and adhering to local regulations. Typically, required details include the property address, the amount of tax owed, and the name of the property owner. It is essential to provide accurate and clear information to avoid delays or rejections. One common mistake is failing to check for the latest form version; using outdated documents can lead to complications.

To ensure your form is correctly completed, consider these steps: First, gather all necessary documentation and verify that you have the latest form. Second, fill out each section diligently, double-checking for accuracy. Finally, submit the form before the given deadline. Each jurisdiction has differing deadlines, so checking local regulations beforehand is vital.

State-specific tax sales forms

Tax sales requirements can vary widely from one state to another. Some states may have specific forms tailored to their tax sale process, while others could use a standardized form applicable across multiple jurisdictions. Understanding these variances is essential for compliance. For instance, in Florida, the tax deed process involves the use of a unique application form, whereas in California, the form used for tax lien sales differs significantly.

Accessing and using the correct state-specific tax sales forms can streamline the process. Users can visit state government websites or pdfFiller to download relevant forms tailored to their jurisdictions easily. It's also important to compare state regulations to ensure you are compliant with all terms and requirements.

Utilizing pdfFiller for tax sales forms

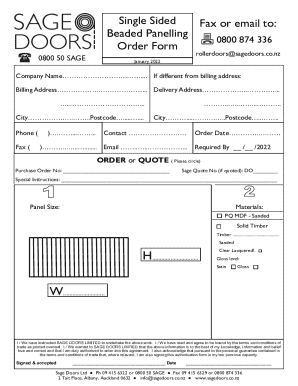

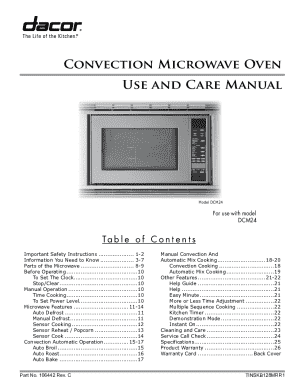

pdfFiller provides an easy and accessible way to manage tax sales forms. Users can upload their documents directly to the platform and utilize interactive tools for seamless form completion. The ability to edit content directly on the PDF ensures that all necessary information can be accurately represented, which is crucial to avoid errors that could complicate the sales process.

Moreover, pdfFiller allows for secure electronic signing (eSigning) of tax sales forms. This feature is especially beneficial, as it enables transactions to be completed swiftly from anywhere, reducing the time spent on gathering physical signatures and expediting the overall process.

Collaborating on tax sales forms with teams

Collaboration is often key in managing tax sales processes, and pdfFiller facilitates teamwork effectively. Users can easily invite team members to view or edit documents, enabling collaborative input to ensure forms are filled out correctly. This collaborative environment is vital for organizations that handle multiple tax sales, where team oversight can dramatically reduce errors.

Another feature is the ability to track changes and view the version history of a document, allowing all collaborators to see who made what changes and when. This transparency is crucial when overseeing multiple contributors. In addition, managing permissions within pdfFiller ensures that only authorized individuals can edit sensitive information, maintaining document integrity.

Maintaining compliance with tax sales requirements

Compliance with tax sales regulations is not merely a best practice; it is a legal obligation. Failing to adhere to stipulated guidelines can lead to penalties, invalidated transactions, or even legal action. Understanding local laws governing tax sales, including the requisite disclosures and timelines, is critical for any participant in this market.

Establishing best practices for record keeping is also essential. This includes maintaining accurate documentation of submitted forms, notices, and transactions. In cases of non-compliance, having thorough records can aid in defending against any claims or irregularities. By actively monitoring compliance, users can mitigate risks associated with tax sales.

Frequently asked questions about tax sales forms

When dealing with tax sales forms, questions are likely to arise. Common issues include what to do if a form submission encounters problems or misunderstanding about specific requirements. If a user experiences issues during submission, they should reach out to the relevant tax authority immediately. Many local governments offer online assistance or phone help lines to guide users through these complications.

Additionally, clarifications regarding eligibility and the use of tax sale forms can often be found in municipal code or guidelines provided by local tax positions. Users should expect that frequent inquiries might pertain to deadlines, appeal processes, and necessary documentation.

Insights from industry experts

Insights from tax professionals reveal common best practices that can enhance the effectiveness of tax sales transactions. For instance, experts recommend thoroughly researching properties before participating in a tax sale to assess their value and potential risks. In addition, understanding the bidding process intimately and preparing a strategic plan can significantly increase success rates. Case studies often illustrate the benefits of collaborative approaches, where teams share knowledge and work in synergy to ensure all aspects of the sale are managed effectively.

Expert recommendations often emphasize the importance of using reliable platforms for managing tax sale forms. Leveraging technology, such as pdfFiller, to streamline documentation integrates well with efficient workflows, allowing teams to focus more on strategy and less on administrative burdens.

Interactive tools and features on pdfFiller

pdfFiller is equipped with various features and functionalities designed to enhance office efficiency. Users can navigate a guided walkthrough of pdfFiller’s tools, making the form completion process intuitive. Navigating through functionality such as form templates, digital signatures, and collaborative capabilities sets pdfFiller apart. Each feature is designed with user-friendliness in mind, empowering individuals and teams to maintain productivity in their document workflows.

Moreover, users can personalize their document workflows to fit specific needs, such as customizing templates for various tax sale forms. Regarding storage, pdfFiller ensures completed forms are safely stored in the cloud, providing easy retrieval without the risk of loss or misplacement.

Legal and financial considerations in tax sales

Navigating tax sales involves understanding the key legal frameworks that govern these transactions. Laws differ by jurisdiction; thus, being well-versed in local regulations is vital to prevent legal complications. For example, in some states, properties that do not sell may undergo foreclosure, affecting the original owner and the bidding parties during the sale.

Financial implications of tax lien sales mean potential returns on investment can be substantial. However, they also come with risks, including the chance of property devaluation or legal disputes. Potential bidders or buyers should evaluate these risks against potential rewards to make informed decisions.

User testimonials and reviews

The impact of efficient document management in tax sales is well-documented through user testimonials on pdfFiller. Many users have reported significant improvements in their workflow management thanks to seamless form editing, secure eSigning, and effective collaboration features. A common theme in reviews indicates that users appreciate the accessibility of pdfFiller, enabling them to complete tax sales forms on-the-go without sacrificing accuracy.

Success stories often highlight how teams have streamlined the tax sales process by adopting pdfFiller, leading to quicker submission times and better compliance with regulatory demands. These testimonials underscore the importance of reliable document management systems in simplifying the complexities associated with tax sales.

Explore additional tax resources

For those looking to expand their knowledge on tax sales, pdfFiller offers a variety of related forms and documents that enhance your understanding and compliance ability. Furthermore, recommended educational materials, including webinars, articles, and guides, are invaluable for anyone engaged in tax sales, providing crucial context and information.

Leveraging links to government and financial guidance websites enhances your research capabilities, ensuring you can find the most relevant materials for your specific tax sales situations. By accessing these resources, users can deepen their understanding of tax sales' legal and financial complexities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find information governing tax sales?

How do I fill out information governing tax sales using my mobile device?

How do I complete information governing tax sales on an Android device?

What is information governing tax sales?

Who is required to file information governing tax sales?

How to fill out information governing tax sales?

What is the purpose of information governing tax sales?

What information must be reported on information governing tax sales?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.