Get the free How to Handle Claims Administrators and Injury Investigators

Get, Create, Make and Sign how to handle claims

Editing how to handle claims online

Uncompromising security for your PDF editing and eSignature needs

How to fill out how to handle claims

How to fill out how to handle claims

Who needs how to handle claims?

How to Handle Claims Form

Understanding claims forms

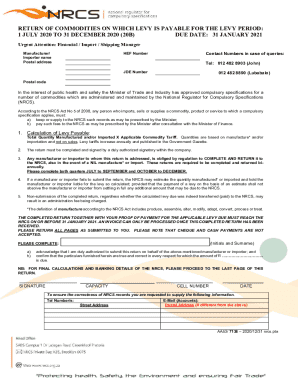

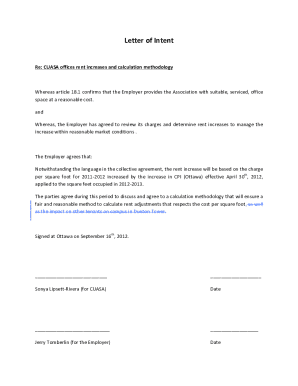

A claims form is a document that individuals or organizations submit to request compensation or benefits from an insurance company, government agency, or other entities. These documents play a crucial role in various contexts, including health insurance, property claims, and vehicle accident reports. Understanding how to properly handle claims forms can significantly impact the outcome of your request.

The importance of claims forms cannot be overstated. They facilitate the assessment process by providing necessary information to the claims adjusters, enabling them to make informed decisions. Each claims form typically contains key components such as claimant identification, claim type, incident details, and supporting documentation submission guidelines.

Preparing to complete your claims form

Before filling out your claims form, it's essential to gather all required documents. This includes identification documents such as a driver's license or government ID, as well as supporting evidence relevant to your claim. For instance, if you're filing a health insurance claim, you might need medical records or bills to substantiate your request.

Understanding the flow of the claims process is also vital. The general timeline begins with the submission of the claim, followed by assessment and processing by the claims adjusters, and finally, resolution with a decision being communicated to you. Familiarizing yourself with common terms like 'deductible,' 'coverage,' and 'exclusions' will help you navigate the process more efficiently.

Step-by-step guide to filling out a claims form

Navigating the claims form format can seem daunting at first. Different types of claims forms have varying layouts, but they generally follow a similar structure. Familiarize yourself with the specific layout of the form you're dealing with; it often includes sections for personal information, claims details, and any additional supporting information.

Breaking down each section can simplify the process. The personal information section will require your name, contact information, and identification details. The claims details section is where you describe the incident or claim, including dates and nature of the event. Finally, the supporting information section is where you attach any documents or examples that support your claim.

Enhancing your claims submission

Clear and effective communication is key in filling out your claims form. Use straightforward language, being specific about the details of your incident and what you’re claiming. Including the who, what, when, where, and why can significantly improve clarity. This level of detail assists the claims adjuster in understanding your case.

The role of documentation cannot be stressed enough. Attaching relevant documents reinforces your claim's validity. High-quality copies of receipts, photographs of damages, or any previous correspondence regarding your claim should all be included to establish a strong case.

Utilizing interactive tools on pdfFiller can streamline this process further. The platform allows users to fill, edit, and sign claims forms, making it easier to gather all necessary documentation and maintain organization.

Managing and tracking your claim

After you've submitted your claims form, it's important to know what happens next. Typically, the processing of claims can take anywhere from a few days to several weeks, depending on the complexity of the claim and the policies of the organization handling it. Staying updated on your claim status involves checking in with the claims office or referring to online tracking tools if available.

Effective follow-up is crucial. Best practices include preparing a list of pertinent details before you contact a representative, such as your claim number and submission date. Keeping organized records of your correspondence will also help you track your interactions and enable you to follow up as necessary.

Handling disputes and rejections

Sometimes, claims can be denied, which can be frustrating. Typical reasons for claims denial include lack of documentation, exceeding coverage limits, or discrepancies in reported information. Being aware of these common issues can help you avoid pitfalls when submitting your claim.

If your claim is rejected, reviewing the denial letter is your first step. Understanding the reasons behind the denial can provide insight into the next action to take. In most cases, initiating the appeal process involves gathering additional documentation or clarifying misunderstandings before resubmitting for reconsideration. Resources for further assistance, such as guides from pdfFiller, can provide valuable insights during this process.

Best practices for future claims

Learning from past experiences can greatly enhance your future interactions with claims forms. Every claim provides an opportunity to identify areas for improvement in how you document and communicate your requests. Keeping your claims organized simplifies the process for both you and the claims adjuster. Utilizing pdfFiller's tools for tracking documents can significantly contribute to better management practices.

Continuing to educate yourself about the claims process is beneficial. Many organizations provide updates or resources that explain changes in policies or procedures related to claims. Familiarizing yourself with these insights can better prepare you for future claims submissions.

Conclusion: Empowerment through documentation

Taking a proactive approach to managing your claims can empower you when facing potentially complex processes. By effectively handling your claims form, you not only increase your chances of a successful resolution but also feel more in control of the situation. Leverage pdfFiller's services to seamlessly edit, manage, and collaborate on your documents so you can focus on what truly matters—achieving the compensation and support you're entitled to.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit how to handle claims in Chrome?

How can I edit how to handle claims on a smartphone?

How do I edit how to handle claims on an Android device?

What is how to handle claims?

Who is required to file how to handle claims?

How to fill out how to handle claims?

What is the purpose of how to handle claims?

What information must be reported on how to handle claims?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.