Get the free About Us - Tax Happens LLC CPA

Get, Create, Make and Sign about us - tax

How to edit about us - tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out about us - tax

How to fill out about us - tax

Who needs about us - tax?

About Us - Tax Form: Your Comprehensive Guide

Understanding the importance of tax forms

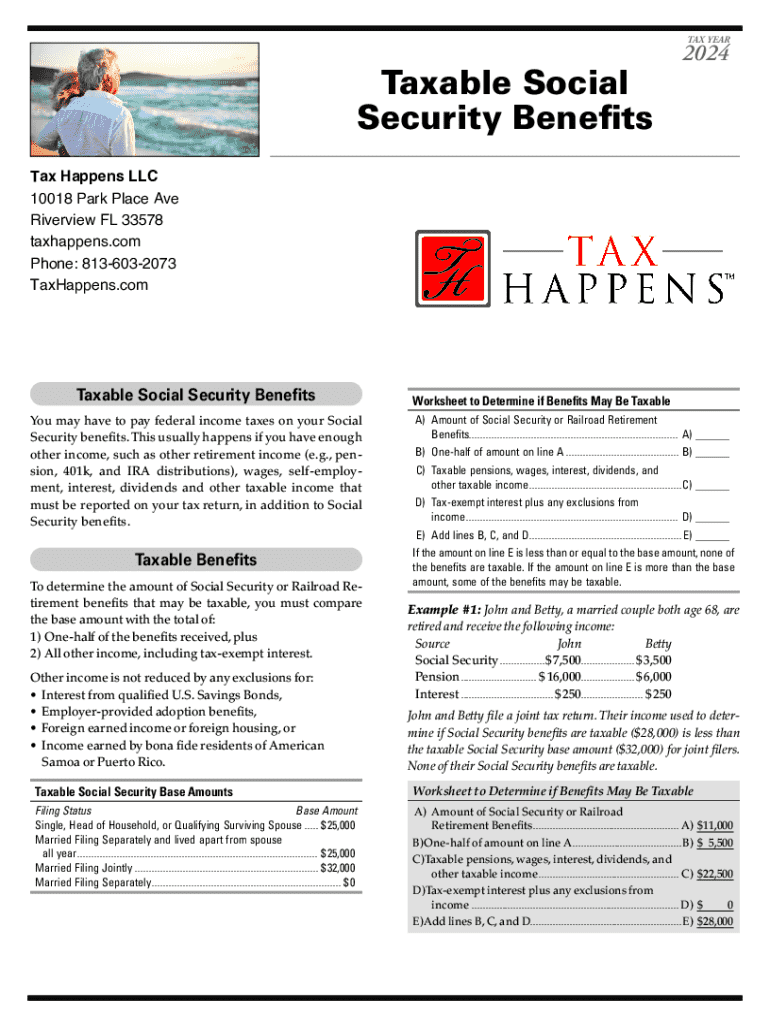

Tax forms play a pivotal role in both personal and business finance. They serve as official documents required by the IRS and state tax authorities to assess a taxpayer's liabilities. Understanding the significance of these forms is essential for compliance, accurate reporting, and avoiding penalties. Whether you're an individual filing your taxes or a business preparing annual returns, tax forms are the cornerstone of financial transparency.

Various tax forms exist to cater to different needs, including income reporting, deductions, and credits. Examples include personal forms like the 1040 for individuals and business forms like the 990 for non-profits. Knowing the types of tax forms and their implications can save you time and money while helping you navigate the sometimes complex landscape of tax regulations.

Overview of pdfFiller's tax form services

pdfFiller simplifies the management of tax forms through its user-friendly platform. One of the key challenges of tax season is dealing with multiple forms and ensuring accurate submissions, but pdfFiller offers a variety of solutions to streamline this process. Users can edit, sign, and collaborate on documents from anywhere, making it easier to manage tax-related paperwork.

The platform hosts a myriad of features specifically designed for tax preparation. With pdfFiller, users can fill out forms intuitively, track changes made to documents, and access templates for various tax forms. The convenience of having all necessary tax documentation in one cloud-based service cannot be overstated.

Key tax forms you may encounter

In your tax journey, you will likely encounter several key forms. Understanding these documents can help clarify your financial obligations and rights. Here’s a brief overview of some common forms:

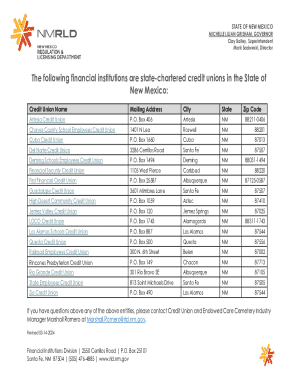

State-specific tax forms must also be considered, as they vary significantly from one state to another. Understanding local tax obligations is crucial for compliance and to take advantage of applicable deductions.

Step-by-step guide to filling out tax forms

Choosing the right tax form for your needs can significantly affect the filing process. Here’s a detailed look at completing the most common tax forms:

Best practices for tax form management

Efficiently organizing your tax documents is vital for a smooth filing experience. Start by categorizing documents based on income, deductions, and notices received. Use digital folders and labels to maintain clarity when retrieving necessary documents quickly.

In addition, ensuring the security of your digital records is crucial. Employ measures such as strong passwords and two-factor authentication to protect sensitive information from unauthorized access. Compliance with data regulations should be top of mind as you manage your documents.

Editing and signing tax forms with pdfFiller

One of the distinct advantages of pdfFiller is its ability to allow users to upload and edit tax forms with ease. The intuitive interface lets you input information quickly, ensuring accuracy and compliance with tax regulations. You can enhance any tax document right from your device, transforming how you manage forms.

Moreover, eSigning documents is simple and secure. The step-by-step process allows for a seamless signing experience, ensuring all parties are in agreement. Collaboration tools enable sharing documents for feedback, which is especially beneficial for teams sharing responsibilities related to tax preparation.

Interactive tools for tax preparation

pdfFiller goes beyond just document management by offering interactive tools that facilitate tax preparation. Users can access various calculators to estimate their tax liabilities, ensuring they're aware of their financial obligations in advance. Checklists available on the platform provide a structured approach to ensure that no necessary form is overlooked.

Utilizing these resources helps maintain organization and clarity, making the overall preparation process more manageable. With everything you need in one place, the stress surrounding tax season is notably reduced.

Addressing common tax form misunderstandings

Many taxpayers frequently make errors when filling out tax forms. Common mistakes include incorrect personal information, missed deductions, and misunderstanding filing requirements. It's essential to double-check all entries to avoid costly repercussions.

Being aware of deadlines is equally important. Each form has specific submission dates, and missing these can lead to penalties. Familiarize yourself with IRS deadlines and create a timeline for preparation to keep your submissions timely.

Handling 'other forms' you might need

In addition to the common forms it's easy to overlook less common tax forms that may be essential for certain situations. For instance, if you have foreign accounts, you may need to fill out the FBAR. Understanding the landscape of less common forms is crucial, especially for compliance.

Resources for finding additional information on these forms often include the IRS website and tax professional advice. pdfFiller can also be a valuable tool in providing templates and guidance for forms not covered in detail.

Support and resources available through pdfFiller

pdfFiller understands that tax season can be overwhelming, which is why robust customer support options are available. Users can access a wide range of online tutorials and guides that can assist in understanding how to manage tax documents effectively.

Additionally, a community forum exists where users can share experiences and tips. This can be particularly helpful for new users navigating tax documents for the first time, leveraging collective knowledge for smoother registrations and filing.

Conclusion: Empowering your tax form experience with pdfFiller

Using pdfFiller’s features will enhance your tax form experience, making it easier to manage crucial documents. From editing to eSigning and collaborating, pdfFiller offers a centralized platform designed to streamline your document management process. As the tax filing deadline approaches, remember that effective organization and management of tax forms are key to a less stressful experience.

Prioritizing clear communication, security, and efficiency in managing tax forms will transform the way you handle your tax obligations, setting you up for success.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit about us - tax from Google Drive?

How do I edit about us - tax online?

How do I edit about us - tax on an Android device?

What is about us - tax?

Who is required to file about us - tax?

How to fill out about us - tax?

What is the purpose of about us - tax?

What information must be reported on about us - tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.