Get the free Key Fixed Deposit Rules and Regulations in India

Get, Create, Make and Sign key fixed deposit rules

Editing key fixed deposit rules online

Uncompromising security for your PDF editing and eSignature needs

How to fill out key fixed deposit rules

How to fill out key fixed deposit rules

Who needs key fixed deposit rules?

Key fixed deposit rules form: A comprehensive guide

Overview of fixed deposits

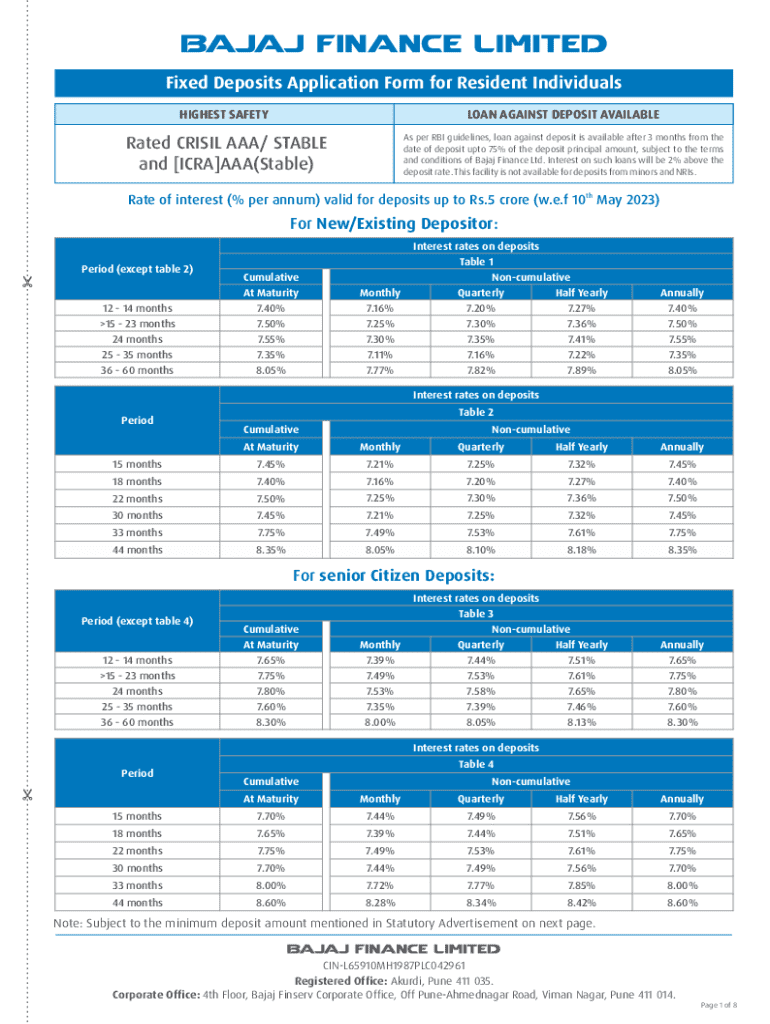

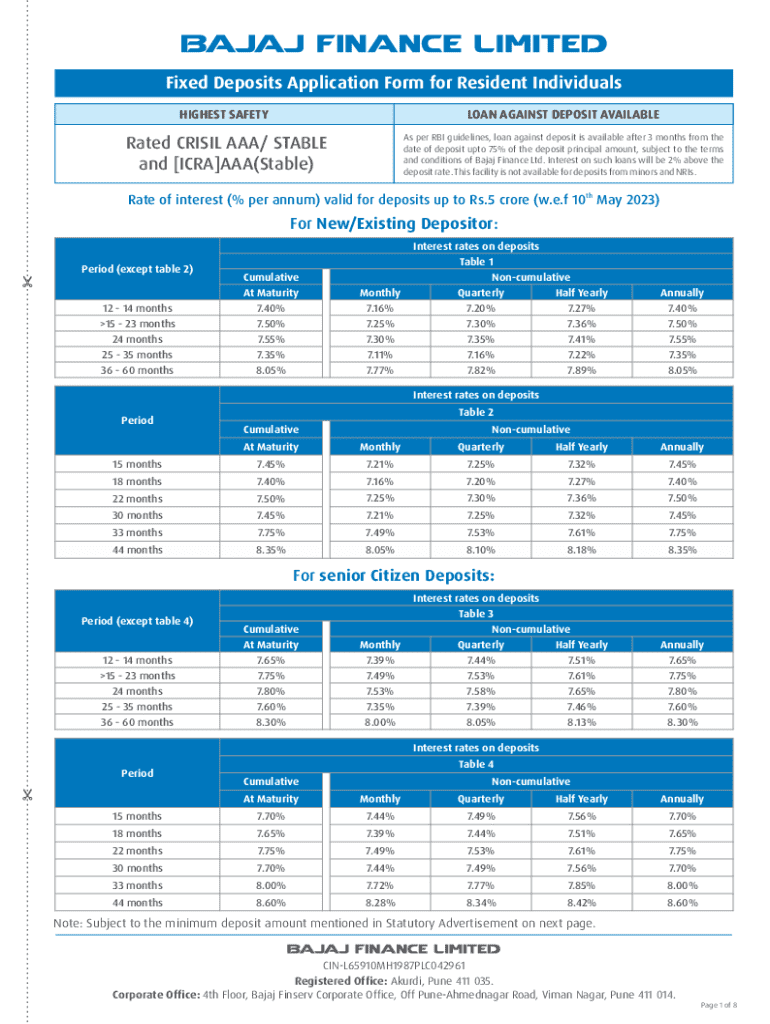

Fixed deposits (FDs) are investment vehicles offered by banks and non-banking financial companies (NBFCs) that provide a safe way to save money while earning interest over a fixed tenure. Each investor can deposit a lump sum amount for a predetermined period, during which the funds are locked in, and interest accumulates, usually higher than that of regular savings accounts. FDs play a crucial role in personal finance as they help build capital, provide tax benefits, and offer a predictable return on investment.

Key features of fixed deposits include guaranteed returns, diverse tenure options ranging from a few months to several years, and fixed interest rates determined at the time of opening the account. Importantly, fixed deposits provide a hassle-free way of managing investments, offering the security that assets will not fluctuate like market-based instruments.

Understanding fixed deposit rules and regulations

Fixed deposits are governed by specific regulations that safeguard both the depositor's interests and the bank's operations. Typically, the rules cover various aspects, from the eligibility criteria for opening an FD account to the prevailing interest rates. These regulations ensure a standardized approach, allowing investors to make informed decisions.

How to fill out the fixed deposit rules form

Filling out the fixed deposit rules form accurately is essential for seamless processing. Here’s a step-by-step guide to ensure completeness.

Key considerations for fixed deposits

There are several critical considerations prospective depositors should keep in mind while managing fixed deposits. Understanding these factors can maximize the benefits of your investment.

Frequently asked questions about fixed deposits

Investors commonly have several inquiries regarding fixed deposits. Addressing these questions can provide better clarity.

Practical scenarios and examples

Understanding fixed deposits through real-life scenarios can provide insight into their management and benefits.

Interactive tools for fixed deposit management

To optimize your fixed deposit investments, utilize various online tools and calculators, which can streamline your planning.

Benefits of using pdfFiller for fixed deposit rules form

pdfFiller enhances the experience of managing fixed deposits by streamlining the documentation process. Its cloud-based platform is superb for individuals and teams, enabling efficient document handling at any time.

Latest updates and changes in fixed deposit regulations

Keeping abreast of regulatory changes affecting fixed deposits is vital for strategic financial planning. Recent modifications may include spiking interest rates, changes in tax rules, or rules around withdrawals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find key fixed deposit rules?

Can I create an electronic signature for signing my key fixed deposit rules in Gmail?

How do I fill out the key fixed deposit rules form on my smartphone?

What is key fixed deposit rules?

Who is required to file key fixed deposit rules?

How to fill out key fixed deposit rules?

What is the purpose of key fixed deposit rules?

What information must be reported on key fixed deposit rules?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.