Get the free LIEN ENTRY FORM Fee $20.00

Get, Create, Make and Sign lien entry form fee

How to edit lien entry form fee online

Uncompromising security for your PDF editing and eSignature needs

How to fill out lien entry form fee

How to fill out lien entry form fee

Who needs lien entry form fee?

Comprehensive Guide to Lien Entry Form Fee Form

Understanding lien entry forms

A lien entry form is a legal document used to record a lien on a property. This serves as a public notice to inform interested parties that a lienholder has a right to the property due to an outstanding obligation, such as a loan or unpaid services. It is crucial for ensuring that the interests of creditors are protected. Recording a lien is especially important in financial transactions, as it allows lenders to claim rights to the property should the borrower default on their payments.

Common scenarios that require a lien entry include situations involving unpaid property taxes, mechanics' liens for unpaid contractor services, and mortgage liens. In each case, the lien provides legal leverage to the creditor to facilitate recovery of the owed amounts through potential foreclosure or asset liquidation.

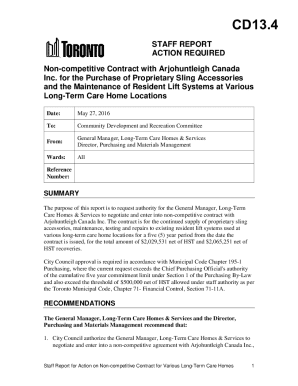

Overview of fees associated with lien entry forms

Filing a lien entry generally involves certain fees, which can vary by state or region. These fees are necessary to process and record the lien in public records, ensuring its validity and enforceability. Typically, the fees can range from $10 to over $100, depending on your location and the type of lien being filed.

In some cases, there may also be variations in fees based on the complexity of the lien or if there are multiple lienholders involved. Certain state regulations may allow fee waivers for qualifying individuals, such as low-income applicants or those filing for a specific type of lien as part of a governmental assistance program.

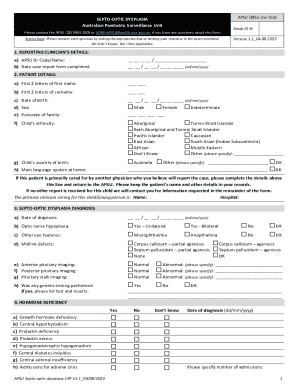

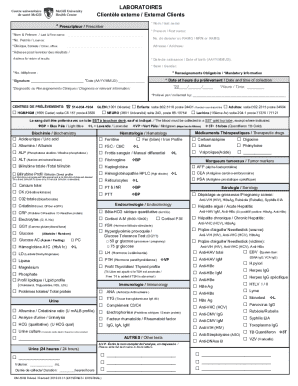

Preparing to fill out a lien entry form

Before filling out a lien entry form, it's essential to gather all the necessary information to ensure its completion without error. Key details typically include personal identification information, property address, a description of the property, and lienholder's details. This data collection phase is vital since omitting any critical information can lead to delays or rejection of your application.

Make sure to verify that you have accurate information, especially regarding the legal descriptions of the property involved, as inaccuracies can complicate the filing process and potentially invalidate the lien.

Step-by-step guide to completing the lien entry form

Completing a lien entry form may seem daunting, but by breaking it down into manageable steps, you can navigate the process with ease.

Submitting the lien entry form

Once your lien entry form is complete and reviewed, the next step is submission. Depending on your preference, there are various options available.

What happens after submission?

Understanding the timeline for processing your lien entry form is essential to managing your expectations. Generally, you can expect to receive confirmation of your lien entry within a few days to several weeks, depending on the jurisdiction and workload.

To check the status of your submission, many offices provide online tracking tools. You can input specific details such as your name or property address to determine the current status of your lien entry. Once processed, you should receive official confirmation, which may be sent via mail or email, depending on the submission method.

Managing your lien entry

Managing your lien entry is not just about filing it but also involves knowing how to modify, release, or correct it if necessary. If you need to update an existing lien, most jurisdictions allow for modification processes that will require filing specific forms.

Requesting a lien release also follows particular protocols. Conditions may vary widely, often hinging on the satisfaction of prior obligations. In many instances, you will need to submit a release form and provide documentation to prove the debt was satisfied.

If mistakes occur on the lien entry form, knowing how to address them promptly is crucial. Contact the corresponding office immediately to inquire about corrective actions since timely adjustments can prevent any potential complications.

Interactive tools and resources

Utilizing pdfFiller's resources can significantly streamline your document management process. The platform offers a variety of tools designed for efficiency.

Additionally, frequently asked questions (FAQs) about lien entry forms can provide clarity and answer common concerns, further supporting a seamless experience in managing your documentation.

Additional considerations for lien entries

It's essential to consider state-specific regulations, as they can significantly impact the lien entry process. Each state has its own laws regarding lien filings, potential fees, and required documentation.

Understanding the legal implications of liens is also crucial. Liens can affect the creditworthiness of a borrower and may influence property transactions. Gaining insight into the consequences helps in making informed decisions during the lien management process.

Lastly, for individuals or teams seeking assistance, various resources exist to provide guidance, ensuring confidence in navigating the lien entry process effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send lien entry form fee to be eSigned by others?

Can I create an electronic signature for the lien entry form fee in Chrome?

Can I create an eSignature for the lien entry form fee in Gmail?

What is lien entry form fee?

Who is required to file lien entry form fee?

How to fill out lien entry form fee?

What is the purpose of lien entry form fee?

What information must be reported on lien entry form fee?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.