Get the free Term Life Insurance - For Financial Professionals

Get, Create, Make and Sign term life insurance

How to edit term life insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out term life insurance

How to fill out term life insurance

Who needs term life insurance?

Comprehensive Guide to Term Life Insurance Form

Understanding term life insurance

Term life insurance is a straightforward and affordable option designed to provide financial protection for your loved ones in the event of your premature death. Unlike whole life insurance, term policies are temporary and only remain in force for a specified duration, typically ranging from 10 to 30 years. This type of insurance pays a death benefit if the insured passes away during the policy term.

Choosing term life insurance offers pivotal benefits. Primarily, it allows you to ensure your family’s financial stability by covering expenses such as mortgage payments, education costs, and everyday living expenses in your absence. The affordability of term life insurance often results from its temporary nature and the fact that it doesn’t build cash value, making it an attractive choice for many.

Key features of term life insurance policies include flexible terms, adjustable coverage amounts, and the option to renew or convert to a permanent policy as financial needs change. The premiums for term life insurance can vary based on several factors.

The importance of properly completing your term life insurance form

Filling out a term life insurance form accurately is crucial. Inaccurate information can result in policy denial at the time of a claim, ultimately leaving your beneficiaries without financial support when they need it most. Such scenarios can be legally contentious, as insurers might assert misrepresentation, complicating the claim process and potentially leading to policy cancellations.

Additionally, the legal implications of misrepresentation on insurance forms can be severe. Inferring false or misleading information, whether intentional or unintentional, may lead to investigations and complications with coverage. Furthermore, it can compromise your relationship with the insurer and overall peace of mind, as your family’s financial security might hang in the balance. Thus, ensuring accuracy on the term life insurance form is not just a procedural step; it is a crucial part of the policyholder's responsibility.

Step-by-step guide to filling out the term life insurance form

Completing your term life insurance form requires careful attention to detail. Here’s a step-by-step guide to assist you in this essential task.

Navigating the term life insurance form

The form will generally comprise several sections that request various types of information. Familiarize yourself with each section to streamline the process. Platforms like pdfFiller offer interactive tools, enabling you to fill forms seamlessly while ensuring compliance with required data.

Filling out each section

Tips for editing and reviewing your term life insurance form

Utilizing pdfFiller’s editing tools can simplify the process significantly. After filling out your insurance form, take advantage of features to review and edit your submission for accuracy. Ensuring the elimination of any common mistakes is key to a successful application.

Verifying information before submission is paramount. A small oversight could lead to significant consequences later on, stressing the necessity of a meticulous review process.

Submitting your term life insurance form

You can submit your term life insurance form through various methods, including online submissions via insurance company websites or through traditional paper applications. Each method has its advantages and considerations.

After submission, expect a processing timeline which can vary greatly among providers, often taking anywhere from a few days to a few weeks. Staying proactive by checking your application status can ease any anxieties regarding coverage activation.

Managing your term life insurance after form submission

Once your term life insurance is in effect, proactive management is essential. It is imperative to keep your policy updated with any significant changes in your life, such as a change of address, updating beneficiaries, or altering coverage due to changing financial circumstances.

Frequently asked questions about term life insurance forms

From the moment you consider a term life insurance policy to when you start filling out the form, numerous questions may arise. Often, common queries include the impact of health on premiums, the best coverage amounts, and the process of updating beneficiary information.

Customer service is another crucial resource; connecting with representatives can clear up any uncertainties you encounter during your insurance form completion process.

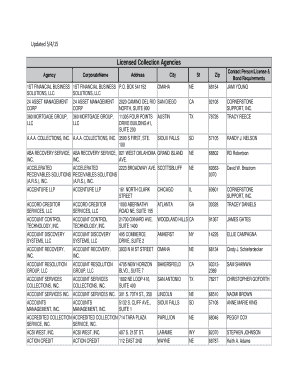

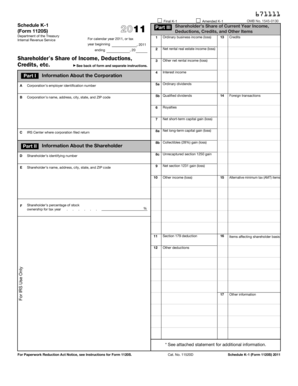

Accessing useful resources and forms

Using the correct forms for updates, applications, or other modifications can often save time and effort. Many insurers provide downloadable forms on their websites simplifying this process.

Extra assistance and support

Navigating the pdfFiller platform for first-time users can seem daunting, but various resources are available. Tutorials often guide you through the essential tools and functionalities to ease your process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my term life insurance in Gmail?

How do I edit term life insurance on an iOS device?

How do I edit term life insurance on an Android device?

What is term life insurance?

Who is required to file term life insurance?

How to fill out term life insurance?

What is the purpose of term life insurance?

What information must be reported on term life insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.