Get the free Do Corporation

Get, Create, Make and Sign do corporation

Editing do corporation online

Uncompromising security for your PDF editing and eSignature needs

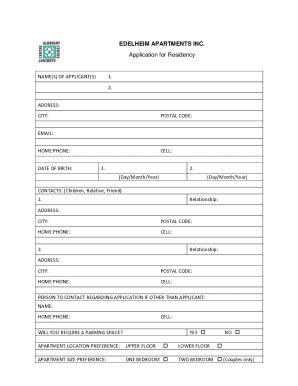

How to fill out do corporation

How to fill out do corporation

Who needs do corporation?

Do Corporation Form: A How-to Guide

Understanding the corporation form

A corporation is defined as a legal entity that is separate and distinct from its owners or shareholders. It is established to conduct business and can own assets, incur liabilities, and enter into contracts. This structure not only provides a shield of limited liability, meaning the personal assets of shareholders are protected from corporate debts, but it also enhances credibility and fosters growth by way of investment opportunities.

The corporate structure is vital for establishing a formal business, as it lays down the framework within which a company operates. It influences taxation, liability, and operational mandates, ensuring that businesses comply with regulations.

Types of corporations

Understanding the types of corporations is crucial when considering how to form a corporation. Here’s a detailed overview:

Key characteristics of corporations

Corporations possess distinct characteristics that set them apart from other business structures. They enjoy legal entity status, which means they can own property, incur debts, and sue or be sued independently of the owners. Another hallmark of corporations is continuity of existence; they continue to operate even if ownership changes or shareholders leave.

Moreover, corporations can raise capital by issuing stock, making it easier to obtain funding from investors. This ability emphasizes their role in larger markets and adds to their overall appeal.

Benefits of forming a corporation

Forming a corporation offers several advantages that can significantly impact the success and longevity of a business.

Drawbacks of forming a corporation

Despite the benefits, there are several potential drawbacks to consider before deciding to form a corporation.

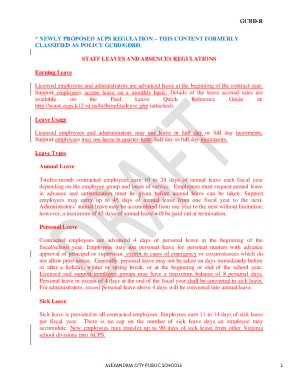

Steps to forming a corporation

Establishing a corporation can be a straightforward process if you follow a clear set of steps.

Managing and maintaining your corporation

Managing a corporation extends beyond its formation, requiring ongoing compliance and careful record-keeping.

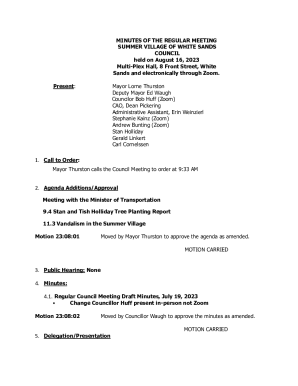

Frequently asked questions about corporation formation

Addressing common queries can clarify the corporation formation process and alleviate potential concerns.

Interactive tools and resources

Utilizing available tools can simplify the incorporation process and enhance document management.

Conclusion and empowerment

Incorporating a business can be a transformative step toward success. By understanding the intricacies of forming a corporation, you not only protect personal assets but also set yourself up for future growth and credibility in the market.

With tools like pdfFiller at your disposal, navigating the document management of your corporation can be seamless. pdfFiller empowers users to edit PDFs, eSign, collaborate, and manage all necessary documents from a unified, cloud-based platform, simplifying the entire corporate formation experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my do corporation in Gmail?

How can I edit do corporation from Google Drive?

Can I create an eSignature for the do corporation in Gmail?

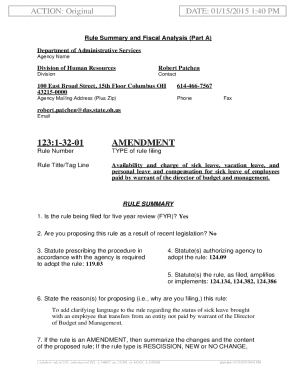

What is do corporation?

Who is required to file do corporation?

How to fill out do corporation?

What is the purpose of do corporation?

What information must be reported on do corporation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.