Get the free Transfer on Death Supplemental Registration Form. Accessible PDF

Get, Create, Make and Sign transfer on death supplemental

How to edit transfer on death supplemental online

Uncompromising security for your PDF editing and eSignature needs

How to fill out transfer on death supplemental

How to fill out transfer on death supplemental

Who needs transfer on death supplemental?

Understanding the Transfer on Death Supplemental Form

Understanding the Transfer on Death concept

Transfer on Death (TOD) allows individuals to designate a beneficiary for their assets upon their death, bypassing probate. This designation ensures that the property is transferred directly to the named beneficiary, enabling a smoother transition and often reducing costs associated with estate settlement.

The primary purpose of a TOD is to simplify the transfer of assets. Unlike traditional wills or trusts, which may require more extensive procedures upon the owner's passing, TOD arrangements allow beneficiaries to receive assets without delays or the potential for disputes that can arise in the probate process.

Additionally, the Transfer on Death concept allows for greater control over one’s assets, contrasting with wills and trusts that may require legal oversight or court involvement after death. This control can greatly simplify estate planning for individuals and families.

The Transfer on Death Supplemental Form explained

A Transfer on Death Supplemental Form is a legal document used alongside a TOD deed to specify further details or conditions surrounding the asset transfer. This form supplements the main TOD deed, providing clarity and comprehensive instructions for the distribution of assets.

Using this supplemental form is crucial as it ensures that any specific requests or conditions laid out by the property owner are documented and adhered to. Common scenarios necessitating this supplemental form include unique situations where additional instructions are required, such as the division of property among multiple beneficiaries or conditional transfers based on certain events.

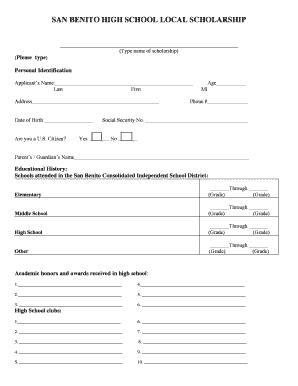

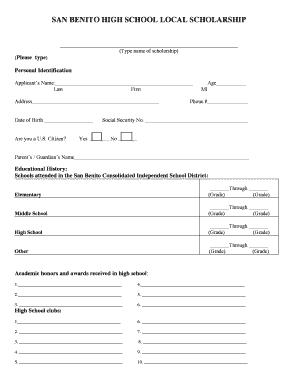

How to complete the Transfer on Death Supplemental Form

Completing the Transfer on Death Supplemental Form requires careful attention to detail. Start by gathering all necessary information, including the legal description of the property, the names and contact information of the beneficiaries, and any specific conditions for the transfer.

Next, fill out each section of the form accurately. Pay special attention to any legal language and ensure that beneficiary designations are clear. If opting to name multiple beneficiaries, specify the percentage of the asset that each will receive to avoid ambiguity.

Common errors to avoid include incorrectly naming beneficiaries, failing to account for multiple owners, and not specifying conditions clearly. For greater accuracy and compliance, consider seeking advice from a legal professional before submission.

Legal considerations surrounding Transfer on Death deeds

When utilizing Transfer on Death deeds, certain legal requirements must be fulfilled. Each state has specific regulations that govern how TOD deeds are executed and recorded, which may vary significantly. It's essential to confirm that all state mandates regarding the drafting and signing of the deed and the supplemental form are observed.

Validation processes for Transfer on Death deeds often involve notarization or registration with the appropriate government office. Checking on state-specific regulations is crucial, as some jurisdictions might require witnesses or additional documentation for the deed to be legally binding.

Differences between Transfer on Death and other deeds

Transfer on Death deeds offer unique advantages and specific conditions that differentiate them from other types of deeds, such as Lady Bird Deeds and Payable on Death (POD) accounts. Lady Bird Deeds allow the asset owner to retain control while avoiding probate, but they also come with specific stipulations that may not suit everyone’s needs.

In contrast, a POD designation applies mostly to financial assets, such as bank accounts, and does not accommodate real estate. The primary advantage of a TOD is the seamless transfer process, while a POD offers simplicity in naming beneficiaries for liquid assets.

Eligibility and restrictions for Transfer on Death

Any individual of legal age and sound mind can designate a Transfer on Death beneficiary. This flexibility allows property owners to have control over determining who inherits their assets, regardless of familial relationships. Specific state laws may dictate additional eligibility criteria, such as residency requirements.

In terms of assets, the types of property that can be transferred via TOD include real estate, vehicles, and certain types of investment accounts. However, there are limitations: some states may exclude specific asset types or require that only certain assets be utilized with a TOD.

Frequently asked questions about the Transfer on Death Supplemental Form

Many property owners have questions regarding the practical implementation of Transfer on Death provisions. Understanding what happens if a beneficiary predeceases the owner is critical; in such cases, assets typically revert to the estate unless alternate beneficiaries are designated.

Changing beneficiaries on a TOD can often be done through an amendment process, which varies by state. Owners can typically name multiple beneficiaries by clearly defining their respective shares in the TOD deed or supplemental form.

Maintenance and management of Transfer on Death deeds

To maximize the benefits of a Transfer on Death deed, regular management and updates are essential. Ensure that your TOD deeds are current with your intended beneficiaries and any changes in your circumstances.

Effective communication with beneficiaries regarding your estate plan can eliminate confusion and potential conflict. It's also wise to monitor any legislative changes that may impact how TOD deeds are handled to remain compliant with state and federal regulations.

Essential considerations and reminders for users

Consulting with a financial advisor or attorney specializing in estate planning is critical to avoiding common pitfalls in TOD management. Failing to appreciate state-specific nuances can lead to complications or invalidate the intended transfers.

Some common pitfalls to watch for include incorrectly recording beneficiary details or not updating information following major life changes, such as divorce or relocation, which might impact asset distribution.

Interactive tools and resources available on pdfFiller

pdfFiller offers an array of tools dedicated to streamlining the use of Transfer on Death documents. Users can quickly fill, edit, and sign forms with an intuitive interface that simplifies the entire process. Whether creating a new Transfer on Death Supplemental Form or managing existing documents, pdfFiller empowers users to take charge of their estate planning.

To effectively utilize pdfFiller, follow these steps: access the template for a Transfer on Death Supplemental Form, fill in the required fields, and secure signatures electronically. This cloud basis allows for easy collaboration and ensures that all documents are readily available, which is essential for proper planning.

Current trends and insights in Transfer on Death planning

Recent trends indicate a growing acceptance of Transfer on Death arrangements as effective estate planning tools. More individuals understand the significance of minimizing probate processes and the advantages that TOD provisions can afford in managing their estates.

Current discussions around changing laws surrounding estate planning also emphasize the importance of staying informed and adaptable. Furthermore, the integration of technology in document management facilitates not just the execution of these forms but also eases the communication between parties involved in the estate planning process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send transfer on death supplemental to be eSigned by others?

Can I create an eSignature for the transfer on death supplemental in Gmail?

How do I fill out transfer on death supplemental on an Android device?

What is transfer on death supplemental?

Who is required to file transfer on death supplemental?

How to fill out transfer on death supplemental?

What is the purpose of transfer on death supplemental?

What information must be reported on transfer on death supplemental?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.