Get the free Municipal Tax MapsAtlantic County, NJ

Get, Create, Make and Sign municipal tax mapsatlantic county

How to edit municipal tax mapsatlantic county online

Uncompromising security for your PDF editing and eSignature needs

How to fill out municipal tax mapsatlantic county

How to fill out municipal tax mapsatlantic county

Who needs municipal tax mapsatlantic county?

Municipal Tax Maps: Atlantic County Form

Overview of municipal tax maps

Municipal tax maps serve as essential tools for local governments and property owners, outlining the various properties within a municipality. These maps not only provide a visual representation of property boundaries but also indicate critical zoning classifications and other vital information that influence property taxes.

The importance of municipal tax maps in property assessment cannot be underestimated. They ensure fair and accurate tax assessments based on property identification and valuation. In Atlantic County, these maps play a pivotal role as the county's Tax Division relies on them to aid in the accurate collection and allocation of tax revenue.

Atlantic County’s role in tax collection and mapping is vital to maintaining local services and infrastructure. An understanding of how these maps operate is crucial for any property owner or investor wishing to navigate their local tax obligations.

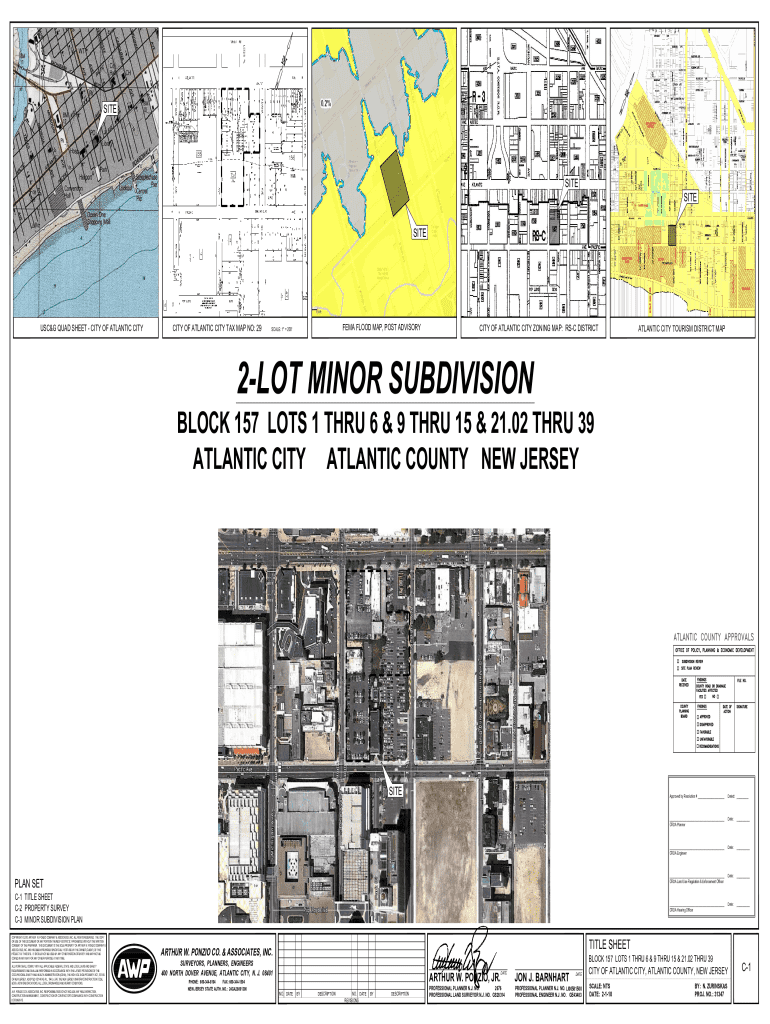

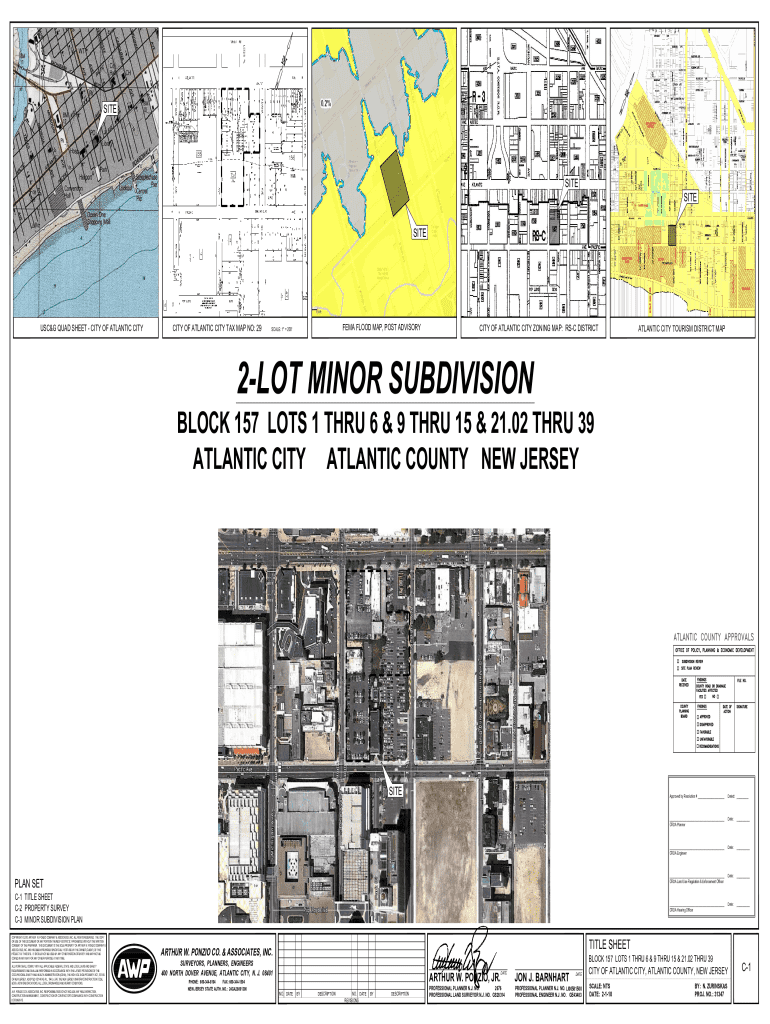

Understanding the Atlantic County municipal tax map

The Atlantic County municipal tax map boasts specific features that differentiate it from other counties. Its layout is designed for clarity, allowing users to seamlessly navigate through various sections of the map. Users can easily locate their property and understand different zoning classifications at a glance.

The information displayed on the tax map includes property boundaries, unique block and lot numbers, and zoning classifications, giving property owners a comprehensive understanding of their land and its tax implications. Historically, tax maps in Atlantic County have evolved to incorporate advancements in technology and user needs, reflecting updates in municipal planning and development.

Accessing the Atlantic County tax map

Accessing the tax map for Atlantic County is straightforward, mainly thanks to the county’s commitment to transparency. Users can find municipal tax maps through the Atlantic County's official website, where they can explore accessible online options. To find your specific tax map online, follow these steps:

For those who prefer physical forms or need assistance, local government offices and libraries also house copies of these tax maps. The staff at these locations can help guide you through the information you seek.

How to fill out the municipal tax map form

Filling out the municipal tax map form is a crucial step for those looking to validate or appeal their property taxes. The required information often includes personal details, such as your name and address, alongside specifics about the property, including its block and lot number.

To complete the form successfully, it’s essential to provide accurate details. Here’s a comprehensive step-by-step guide:

Common mistakes to avoid include misreading the lot and block numbers, failing to sign the form, or providing outdated personal information. Ensuring that you meticulously verify each entry will streamline the submission process.

Editing and managing your municipal tax map documents

Managing municipal tax map documents can be simplified using tools like pdfFiller. This platform allows for easy uploading and editing of PDF forms, making it a favorite among users who require flexibility in document handling.

With pdfFiller, you can manage your documents collaboratively, which is particularly useful for teams working on property assessments or tax reviews. Here are features that can help you streamline the editing process:

Best practices for document management include creating a consistent naming convention for your files, regularly backing up your documents, and ensuring all collaborators have the latest version. Using pdfFiller enhances document security, making it easier to focus on property management without the stress of lost paperwork.

Signing and submitting your tax map form

Once you’ve completed your municipal tax map form, the next step is signing and submitting it. Using eSign, an integrated feature from pdfFiller, allows you to securely sign your documents electronically. This method is not only efficient but also ensures that your signature is authentic and legally valid.

The submission process to the Atlantic County Tax Division is straightforward. Follow these steps:

Being thorough during this process can help prevent any delays in the review of your submission.

Troubleshooting common issues

As with any process, filling out and submitting the municipal tax map form can come with its challenges. Common issues include difficulties in locating the correct property information, form errors during submission, or payment processing issues.

Should you encounter problems, here are some strategies to address them:

In case more serious complications arise, don’t hesitate to seek assistance from the Atlantic County Tax Office for expert guidance.

Related links and resources

For further enhancing your understanding and capabilities surrounding municipal tax maps, various governmental resources are available. The Atlantic County Clerk’s Office is an excellent place to start for property records and tax information. Additionally, the Property Tax Collector's Office offers specific insights and assistance related to property-related queries.

Tools for property and tax research include the Online Parcel Explorer Tool, providing a user-friendly interface for exploring property-specific details. Detailed instructions for accessing tax maps and related information can further aid users in understanding their responsibilities and rights regarding municipal tax assessments.

Potential changes or updates to tax mapping

The landscape of tax mapping is continually evolving, especially with the introduction of new regulations and technological advancements. Recent changes in tax mapping regulations have focused on improving accuracy and transparency in property assessments. As Atlantic County adapts to these developments, users can expect enhanced tools for more straightforward access to tax map information.

Upcoming technology improvements include mobile-accessible tax mapping tools and interactive map features, which promise to make viewing property information more engaging and user-friendly. Community involvement opportunities also play a key role in refining these services, encouraging local feedback and engagement in planning and mapping efforts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my municipal tax mapsatlantic county in Gmail?

How can I send municipal tax mapsatlantic county to be eSigned by others?

How do I complete municipal tax mapsatlantic county online?

What is municipal tax mapsatlantic county?

Who is required to file municipal tax mapsatlantic county?

How to fill out municipal tax mapsatlantic county?

What is the purpose of municipal tax mapsatlantic county?

What information must be reported on municipal tax mapsatlantic county?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.