Understanding Note and Mortgage from Form: A Comprehensive Guide

Understanding the note and mortgage

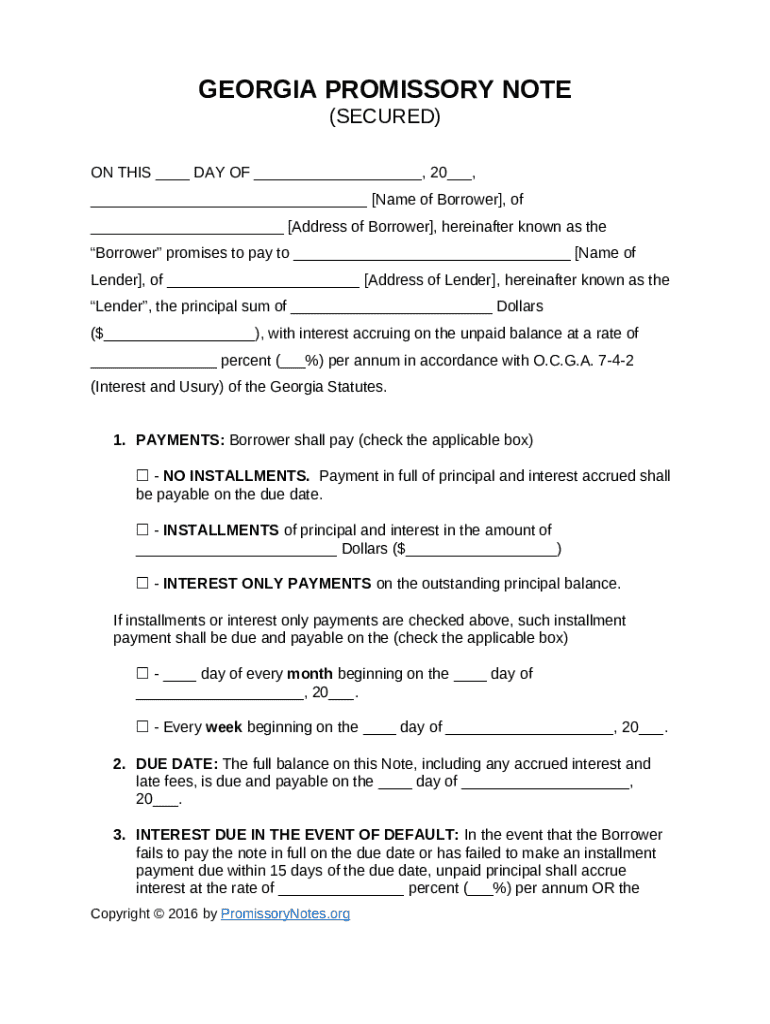

A note and mortgage from form are essential components of real estate transactions. Understanding these documents is critical, whether you're lending, borrowing, or purchasing property. A promissory note is a legal instrument that outlines the borrower's obligation to repay a specified amount of money to the lender. The mortgage, on the other hand, serves as a lien on the property, providing the lender with the right to reclaim it if the borrower defaults.

In real estate, the note specifies the financial agreement, including the amount borrowed, interest rate, and the terms for repayment. The mortgage protects the lender's interest in the property, allowing them to enforce their rights should repayment not occur. Both are crucial for a secure transaction.

Key components of note and mortgage forms

When filling out a note and mortgage from form, specific components must be included on both documents. For the note, essential elements encompass the borrower's and lender's information, the loan amount, the interest rate, and clear repayment terms. These items clarify the financial obligations binding both parties in the agreement.

The mortgage form requires equally critical components, outlined as follows: a precise property description to avoid disputes, covenants detailing the rights and obligations of the borrower, and clauses indicating what happens in the event of default or penalties for late payments. Properly completing these forms protects both parties' interests.

Detailed steps for filling out a note and mortgage form

Filling out a note and mortgage from form involves methodical steps that ensure accuracy and completeness. Start by gathering all required personal and financial information. This includes not only the basic identification details but also supporting documentation like income verification or credit reports.

Once you have your information, follow these specific steps for each document. For the note form, proceed as detailed:

Input borrower and lender details along with their contact information.

Specify the loan amount, including any points or fees attached.

Outline the repayment schedule, specifying the frequency and method of payments.

Seal the note with signatures and dates from both parties for legal validity.

For the mortgage form, ensure you differentiate your steps:

Describe the property accurately, including legal descriptions or parcel numbers.

Detail any financial obligations, listing all covenants that outline the rights of each party.

Review all legal terms to ensure clarity before signing.

Finalize by acquiring signatures and notarization, confirming both parties agree to the terms.

Interactive tools for document management

In the modern digital era, utilizing tools like pdfFiller can streamline the process of managing your note and mortgage forms. By using pdfFiller, you can take advantage of an intuitive platform that makes document editing, signing, and sharing incredibly straightforward.

To begin, simply upload the note and mortgage forms, follow the integrated step-by-step process for filling them out, and utilize the capabilities to edit or adjust details as necessary. The platform also allows you to securely eSign documents, eliminating the need for printing and scanning, which enhances both security and convenience.

Collaboration features can help teams work together efficiently. The following capabilities enhance teamwork:

Multiple users can make edits or leave comments, ensuring comprehensive input.

Review all modifications made by collaborators for clarity and accountability.

Common pitfalls to avoid when filling out a note and mortgage

Filling out a note and mortgage can be daunting, and avoiding common pitfalls is crucial for a successful transaction. One major risk comes from misunderstanding legal terms. Legal jargon can often be confusing, and failing to seek clarification can lead to ambiguities that result in disputes.

It is essential to have a firm grasp on all terms used within the documents. Similarly, neglecting to detail repayment terms thoroughly can lead to complications. Borrowers must ensure that all payment dates, amounts, and methods are explicitly stated to avoid any potential misunderstandings during the life of the loan.

FAQs about notes and mortgages

Understanding the implications of your note and mortgage can help you navigate your responsibilities as a borrower or lender. One significant concern is what happens if the borrower defaults. In this situation, the lender can initiate foreclosure proceedings, reclaiming the property as collateral against the unpaid loan.

Another frequently asked question involves the modification of notes or mortgages post-signing. Should circumstances change, parties can modify these documents, but this process requires agreement from both sides and typically necessitates formal documentation detailing the changes. Lastly, ensuring your documents are legally binding is vital; notarization and proper registration are essential to affirm their enforceability.

Advanced topics in note and mortgage management

As you delve deeper into the world of mortgages, understanding advanced topics such as Adjustable-Rate Mortgages (ARMs) is beneficial. Unlike fixed-rate mortgages, ARMs feature interest rates that fluctuate based on market conditions, which may impact overall loan costs considerably over time.

Moreover, it’s crucial to comprehend how economic changes influence mortgages. Shifts in interest rates or market dynamics can significantly affect your repayment terms, necessitating proactive management of mortgage payments. Being informed about these factors can help you navigate potential economic downturns effectively.

Related templates and resources available on pdfFiller

When managing real estate transactions, a wealth of additional documents may be required. pdfFiller offers various templates, including lease agreements and purchase agreements, which can be invaluable for homeowners and real estate professionals alike. These templates ensure that all legal requirements are met while simplifying the documentation process.

Beyond templates, pdfFiller houses various resources for homeowners looking to optimize their financial dealings. Guides on home financing, links to financial tools, and calculators enhance your understanding of complex financial scenarios and help you make informed decisions.

Conclusion and actions after completing your forms

After successfully signing your note and mortgage, there are key next steps to ensure everything is in order. Proper filing is tantamount; secure copies of all documents in safe locations, both digitally and physically, to retain proof of your agreements.

Furthermore, monitoring your payment schedules is crucial. Establish reminders or use financial management tools to ensure that you remain on top of your obligations. Awareness and proactivity can help prevent potential complications down the line.

Additional support for your document needs

If you encounter challenges while filling out your forms, seeking assistance is readily available through support services designed to assist users with document needs. pdfFiller provides access to customer support, offering guidance through the process of completing your forms.

The mobile capabilities of pdfFiller make it easy to manage your documents on the go, empowering you to edit, sign, and share important files from anywhere. With such features, you can stay organized and maintain control over your important paperwork whenever required.