Get the free Revised 8/2/22

Get, Create, Make and Sign revised 8222

Editing revised 8222 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out revised 8222

How to fill out revised 8222

Who needs revised 8222?

A Comprehensive Guide to the Revised 8222 Form

Overview of the Revised 8222 Form

The Revised 8222 Form, often referred to in tax circles, is a pivotal document used for claiming specific tax exemptions and credits. It provides the IRS with the necessary information to determine eligibility for various tax treatments, such as those related to charitable contributions.

Typically, individuals and organizations alike may be required to fill out this form. This includes nonprofits seeking exemption status, businesses claiming deductions, and individuals navigating their personal tax obligations. Understanding when and how to use the Revised 8222 Form is crucial for maintaining proper tax compliance.

Reporting inaccuracies can result in penalties or delays in processing returns, making the Revised 8222 Form an integral part of the tax filing process.

Key features and changes in the Revised 8222 Form

The Revised 8222 Form includes newly implemented sections that reflect updates in tax regulations and reporting requirements. From previous versions, the form has been modified to include clearer instructions and more precise requirements for exemptions.

Eligibility criteria for special exemptions have also seen updates. This ensures a streamlined approach for different types of taxpayers, whether they are filing as individuals or organizations. Notably, changes have been tailored to impact specific sectors differently, emphasizing the need for awareness among diverse taxpayer categories.

Understanding these changes will help taxpayers ensure they are accurately filing and reporting, maximizing potential benefits.

Step-by-step instructions for completing the Revised 8222 Form

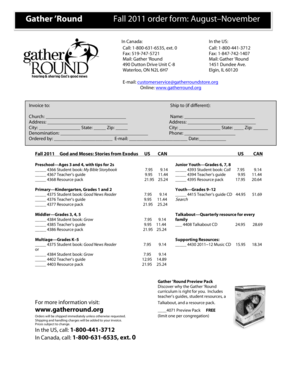

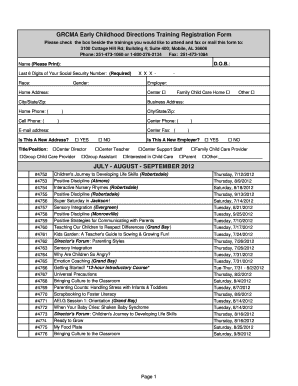

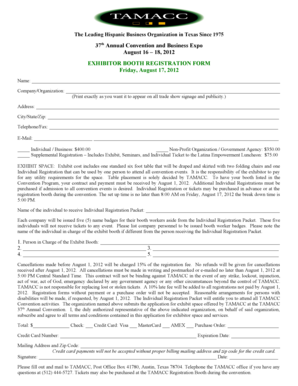

Completing the Revised 8222 Form requires careful attention to detail. Start by gathering the necessary information from your records, including financial statements and documentation pertinent to claims. Ensure that you have personal identification and tax identification numbers ready for inclusion in the form.

Next, begin filling out the form. Each section requires specific data; be thorough in providing accurate details in the personal information section, financial details, and declarations. Watch out for common pitfalls, such as misreporting income or neglecting required signatures.

After completion, it's vital to conduct a review and verification process. Check the entire form against your documents and ensure accuracy, as errors can lead to rejection or delays in processing.

Editing and managing the Revised 8222 Form with pdfFiller

pdfFiller provides exceptional tools for editing the Revised 8222 Form online. With its user-friendly interface, you can easily modify sections of the form, ensuring every detail is accurate. The ability to collaborate with team members makes it easy to share drafts and gather input.

For digital document management, saving and storing the completed form is essential. pdfFiller allows users to store documents securely in the cloud, ensuring you can access them anytime, anywhere.

eSigning the Revised 8222 Form

The eSignature process is crucial for finalizing your Revised 8222 Form. eSignatures hold the same legal validity as traditional handwritten signatures when it comes to tax forms. With pdfFiller, signing your document is both straightforward and secure.

Once signed, pdfFiller allows you to send the form directly for review or submission, simplifying the process of finalizing your tax filings.

Frequently asked questions (FAQs) about the Revised 8222 Form

Many taxpayers have common concerns regarding the Revised 8222 Form, especially regarding changes made in the latest version. Staying informed can alleviate worries and streamline the completion process.

If you encounter issues during completion, resources like pdfFiller's help center can guide you through troubleshooting steps and provide specific answers tailored to your situation.

Additional filing instructions

When it comes to submitting the Revised 8222 Form, accuracy in filing is of the utmost importance. Depending on your circumstances, you may choose between online submission or physical mailing of your completed form. Each method has its own set of advantages and requirements.

Important dates vary year by year, and keeping track of submission deadlines is key to preventing any unintended consequences.

Related forms and documentation

Understanding how the Revised 8222 Form interacts with other tax documents is essential for comprehensive tax reporting. There are several forms that may be required alongside it, such as the 1040 and various state-specific forms, depending on your situation.

Utilizing these forms in conjunction with the Revised 8222 ensures a well-rounded and compliant filing experience.

Interactive tools and resources

pdfFiller offers an array of interactive tools designed to assist users in effectively managing tax forms. With tutorials and guides, you can quickly learn how to optimize your use of the platform for the Revised 8222 Form.

These tools not only alleviate the challenges of form management but also ensure a smooth filing process.

Key takeaways on the Revised 8222 Form

Navigating the Revised 8222 Form can seem daunting, but understanding its purpose and structure significantly enhances the process. Key best practices include maintaining accuracy, meeting deadlines, and leveraging resources like pdfFiller for a more streamlined experience.

Utilizing pdfFiller transforms the task of filling out and managing the Revised 8222 Form into a user-friendly experience, enabling you to focus on what matters most – ensuring compliance and optimizing your tax benefits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find revised 8222?

How do I execute revised 8222 online?

Can I sign the revised 8222 electronically in Chrome?

What is revised 8222?

Who is required to file revised 8222?

How to fill out revised 8222?

What is the purpose of revised 8222?

What information must be reported on revised 8222?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.