Get the free Unified Managed Account (UMA) Models Client Services ...

Get, Create, Make and Sign unified managed account uma

Editing unified managed account uma online

Uncompromising security for your PDF editing and eSignature needs

How to fill out unified managed account uma

How to fill out unified managed account uma

Who needs unified managed account uma?

Unified Managed Account (UMA) Form: A Comprehensive Guide

Understanding unified managed accounts (UMAs)

A Unified Managed Account (UMA) is an innovative investment structure that allows for a customized approach to managing an individual's or institution's investment portfolio. By integrating multiple account types into a single framework, UMAs provide a streamlined solution for asset management, combining benefits from traditional mutual funds, hedge funds, and separately managed accounts (SMAs).

Key features of UMAs include the ability to allocate investments across various asset classes, including equities, fixed income, and alternative investments, while also ensuring that investments align with the client's specific risk tolerance and goals. This flexibility makes them more versatile compared to traditional account structures that may be limited in customization.

Historically, UMAs have emerged from the need for more personalized wealth management solutions as investors sought greater control over their portfolios. The evolution of technology and investment strategies has allowed wealth management firms to offer customized solutions through UMA frameworks, catering to diverse investor needs and preferences.

The anatomy of a UMA form

A UMA form serves as the foundational document for establishing a unified managed account. Essential components of this form typically include detailed identifying information about the investor, investment preferences that specify desired asset classes and strategies, and a risk tolerance assessment to gauge the acceptable level of risk for the portfolio.

Accurate data entry on the UMA form is crucial for effective performance monitoring. The quality of investment decisions made later in the process heavily relies on the information provided at this stage. Insufficient or incorrect data could lead to suboptimal investment decisions and mismanagement of portfolios.

How unified managed accounts work

The structure of UMA accounts typically features a dual management approach, allowing for discretionary and non-discretionary management styles. Discretionary management delegates investment decisions to portfolio managers, while non-discretionary management involves investor input for investment strategies, ensuring a blend of professional support and client involvement.

The portfolio management process within UMAs is characterized by collaborative efforts between financial advisors and investment teams. Advisors play a critical role in identifying suitable investment opportunities based on client goals, leveraging data analytics and market research to craft strategies that align with the client's risk profile and desired outcomes.

Benefits of using a UMA form

Using a UMA form empowers investors with enhanced customization and control over their portfolios. Tailored portfolio strategies can be developed, aligning investments with the financial objectives and values of the investor. This personalization, combined with the potential for integrated reporting tools, significantly improves efficiency in performance monitoring, enabling investors to stay informed about their accounts.

One of the standout advantages of UMAs is the accessibility to a diverse range of investments, including alternative assets that might be otherwise difficult to access individually. Moreover, professional management allows individuals to leverage the expertise of seasoned investment managers, ensuring optimal returns while mitigating risks.

Common limitations to consider

Despite their advantages, UMAs do present certain limitations. Fee structures can often be complex, and management fees need careful consideration, as they vary widely based on services rendered and the level of account management provided. Investors should conduct a thorough analysis of associated costs to ensure they understand their potential impact on overall returns.

Minimum investment requirements can also pose entry barriers for individual investors, potentially limiting access to those with considerable capital. Additionally, the complexity of the investment decisions involved highlights the necessity for professional guidance, particularly for novice investors who may lack the expertise to navigate intricate market dynamics.

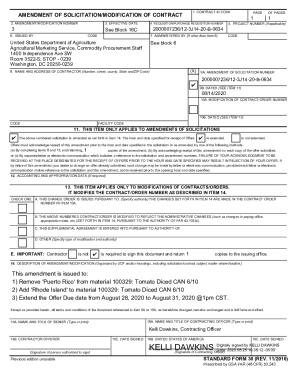

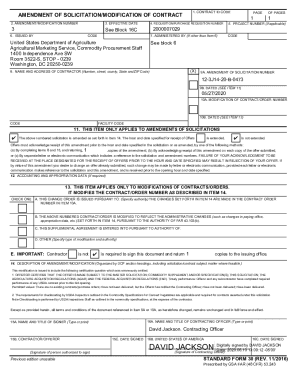

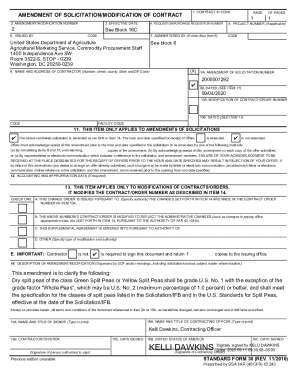

The process of filling out a UMA form

Filling out a UMA form requires attention to detail and a systematic approach. The first step is gathering necessary documents such as proof of identity, financial statements, and any previous investment records. Next, applicants should carefully fill out personal information fields, ensuring all details are accurate to facilitate smooth processing.

When selecting investment options, investors must define their risk preferences clearly and choose appropriate asset classes that align with their investment goals and risk tolerance. Avoiding common mistakes, such as omitting crucial information or misrepresenting financial details, can greatly enhance the accuracy of the submission.

Advanced features of the UMA form

Modern UMA forms come equipped with advanced features that enhance the decision-making process. Interactive tools, such as risk assessment calculators and investment scenario simulations, empower investors to understand the potential outcomes of their choices based on different market conditions and risk levels.

Additionally, collaboration features allow for sharing and reviewing options with financial advisors. This ensures that individuals can seek professional insights and validate their decisions before finalizing investment strategies, ultimately leading to more informed and confident choices.

Managing your UMA after submission

Once the UMA form has been submitted and the account established, ongoing monitoring and rebalancing become essential components of effective management. Periodic reviews of the investment portfolio help ensure alignment with financial goals and market conditions, prompting necessary adjustments to maintain optimal performance.

Techniques for performance evaluation involve understanding key reporting metrics that reflect the health of the portfolio. It's important to know when to adjust your investments, taking into account both market changes and personal financial circumstances that may warrant reallocation of assets.

Transitioning to a UMA management platform

pdfFiller offers numerous advantages for managing UMA forms efficiently. Its seamless document editing and management capabilities significantly simplify the form-filling process, allowing users to make changes easily. eSigning capabilities enable quick transactions, ensuring you can respond to investment opportunities without delay.

To get started with pdfFiller, users can sign up and access a variety of templates for UMA forms. The intuitive user interface makes navigation simple, equipping teams and individuals with essential tools to manage their documents effectively. This functionality enhances productivity while minimizing potential errors during document submission.

The future of unified managed accounts

As the wealth management industry evolves, so too do unified managed accounts. Innovations in UMA management, particularly those leveraging technology, will shape the future of how these accounts are utilized. Increased automation, enhanced data analytics, and more personalized investment strategies driven by artificial intelligence are just a few trends expected to impact UMA usage.

Market predictions suggest that UMAs will continue to grow in popularity as individual investors recognize the benefits of customizable investment solutions. By adapting to evolving market needs and investor expectations, UMAs are positioned to remain a significant player in the wealth management landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the unified managed account uma form on my smartphone?

How do I complete unified managed account uma on an iOS device?

How do I fill out unified managed account uma on an Android device?

What is unified managed account uma?

Who is required to file unified managed account uma?

How to fill out unified managed account uma?

What is the purpose of unified managed account uma?

What information must be reported on unified managed account uma?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.