Get the free ANNUAL DISCLOSURE REPORT of the LONG ISLAND ...

Get, Create, Make and Sign annual disclosure report of

Editing annual disclosure report of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out annual disclosure report of

How to fill out annual disclosure report of

Who needs annual disclosure report of?

Understanding the Annual Disclosure Report of Form

Understanding annual disclosure reports

Annual Disclosure Reports serve as crucial documentation for organizations, providing transparency regarding their operations, financial health, and adherence to legal requirements. Typically, these reports aggregate essential information about a company's performance and compliance, making them a key resource for stakeholders such as investors, regulatory bodies, and the general public.

In various sectors, the importance of Annual Disclosure Reports can be seen as they ensure accountability and promote trust among all parties involved. For instance, the financial sector heavily relies on disclosed data to assess the stability of institutions. Publicly traded companies are required by law to furnish these disclosures, ensuring that all stakeholders have access to the same pertinent information.

How to request an annual disclosure report

Requesting an Annual Disclosure Report is a straightforward process, but it requires attention to detail. Follow these steps to ensure you successfully obtain the desired report:

Should you have any questions during the process, it's advisable to reach out to key contact points often listed on the organization’s website for support.

Types of annual disclosure reports

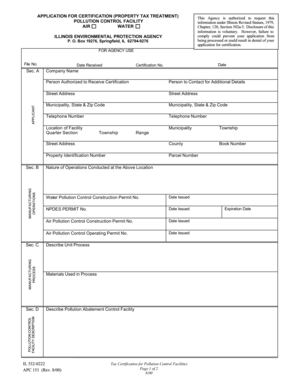

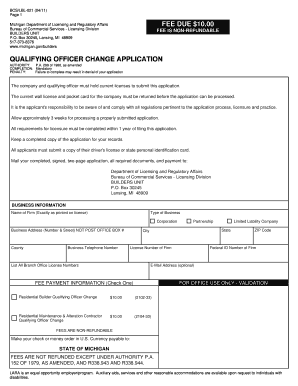

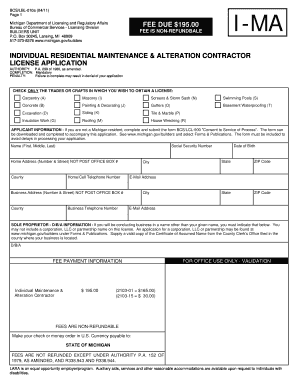

Annual Disclosure Reports can vary across industries, reflecting the unique requirements and regulations applicable to each sector. Here are some common types of reports you may encounter:

Industry-specific examples include the Form 10-K in finance, environmental disclosures for corporations in manufacturing, and health compliance reports in healthcare. Each type caters to specific stakeholders’ needs for transparency and accountability.

Key components of an annual disclosure report

Annual Disclosure Reports generally include several components that provide a comprehensive view of an organization. Understanding these sections can enhance your assessment of the report's overall value:

When reviewing these components, look for clarity and consistency to fully understand not just what was reported, but the implications for the organization moving forward.

Using pdfFiller for annual disclosure reports

pdfFiller streamlines the process of managing Annual Disclosure Reports by providing user-friendly tools for editing and document management. With pdfFiller, users can easily collaborate and share their findings to enhance workflow.

The platform's collaborative features also enable teams to work together in real-time, ensuring all feedback is incorporated efficiently.

Analyzing annual disclosure reports

When delving into Annual Disclosure Reports, focusing on key metrics can yield valuable insights. Look out for common indicators like revenue growth, profit margins, and changes in liabilities. These metrics help draw a complete picture of the organization’s health.

pdfFiller offers analytical tools that facilitate comparisons across different reporting periods. By utilizing these features, users can identify trends, assess performance shifts, and make data-driven decisions for future actions.

Common mistakes to avoid with annual disclosure reports

As you navigate Annual Disclosure Reports, it’s crucial to avoid common pitfalls that can lead to misinterpretation or inaccuracies. Often, users might misinterpret data without a proper understanding of the context, resulting in misguided conclusions.

By staying informed and adhering to best practices, you can significantly enhance the accuracy and reliability of your reports.

Legal and compliance considerations

Filing Annual Disclosure Reports is not just a best practice; it's a legal requirement in many jurisdictions. Companies must adhere to specific regulations, depending on their sector, and are often subject to oversight to ensure compliance.

Failing to comply can lead to significant penalties, including fines and reputational damage. It’s critical for organizations to stay updated on relevant regulations, leveraging resources such as legal counsel or industry associations that can provide ongoing guidance.

Frequently asked questions (FAQs) on annual disclosure reports

Navigating the realm of Annual Disclosure Reports can raise various questions. Here are some commonly asked topics that will guide your understanding:

These FAQs can serve as foundational knowledge for anyone involved in creating or analyzing Annual Disclosure Reports.

Resources for further learning about annual disclosure reports

For individuals and teams looking to deepen their understanding of Annual Disclosure Reports, numerous resources exist. For instance, online platforms like the SEC's official website provide detailed guidelines on what companies must disclose.

Additionally, educational websites often publish articles and white papers that dive deeper into the nuances of these reports, ensuring that stakeholders remain knowledgeable about best practices and regulatory changes.

Staying informed: Current events related to annual disclosure reports

Keeping up with current trends and updates surrounding Annual Disclosure Reports is essential. Industries are continually evolving, and awareness of changes can significantly impact your analysis and strategy.

Recent case studies have highlighted how companies across sectors have thrived or faltered based on their transparency levels. By monitoring high-profile reports and regulatory updates, stakeholders can learn valuable lessons applicable to their situations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my annual disclosure report of directly from Gmail?

How can I send annual disclosure report of for eSignature?

How do I complete annual disclosure report of online?

What is annual disclosure report of?

Who is required to file annual disclosure report of?

How to fill out annual disclosure report of?

What is the purpose of annual disclosure report of?

What information must be reported on annual disclosure report of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.