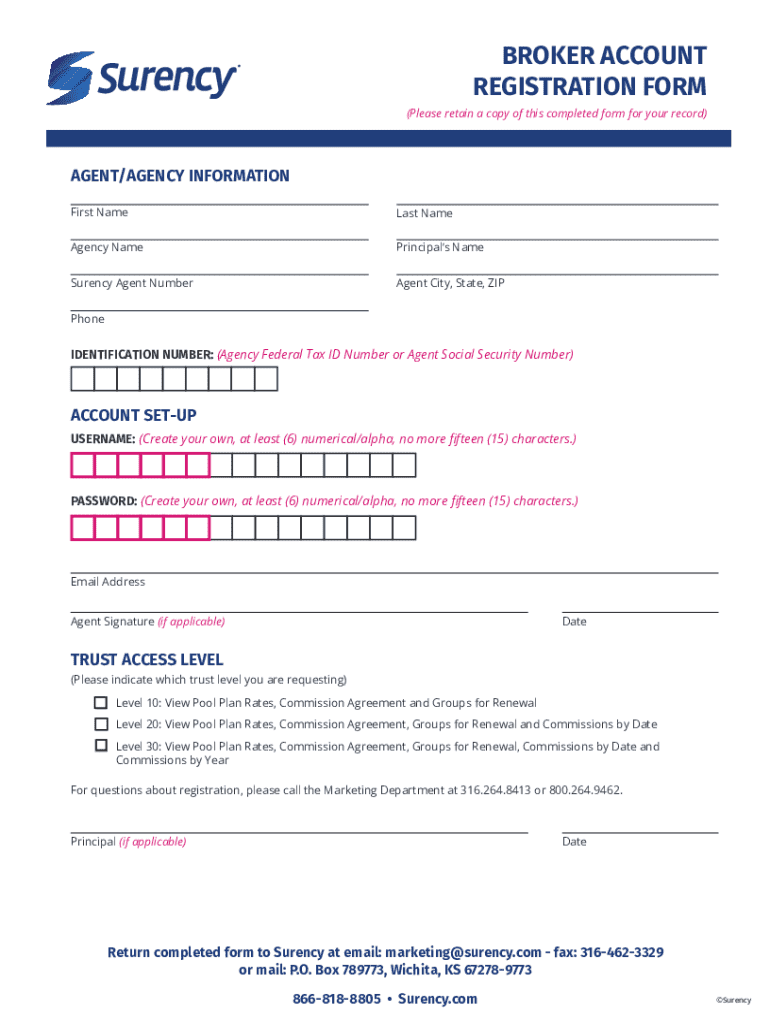

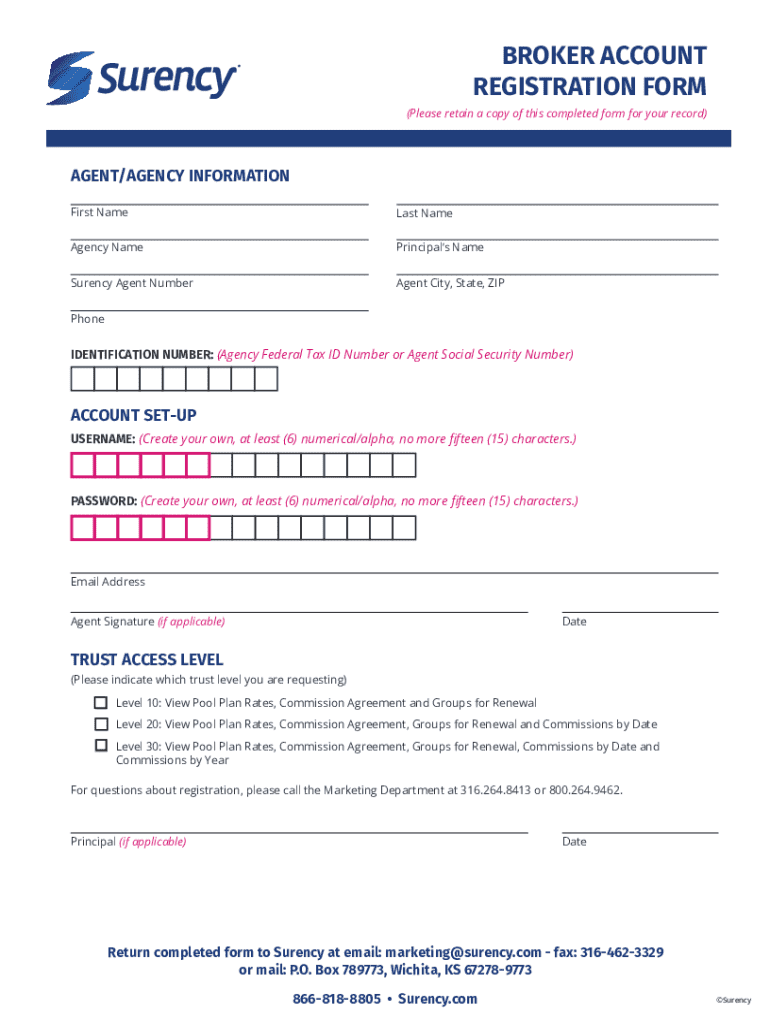

Get the free BROKER ACCOUNT

Get, Create, Make and Sign broker account

How to edit broker account online

Uncompromising security for your PDF editing and eSignature needs

How to fill out broker account

How to fill out broker account

Who needs broker account?

Broker Account Form: Comprehensive Guide

Understanding the broker account form

A broker account form is the essential document that allows individuals and entities to open an account with a brokerage firm. This form serves multiple purposes, primarily enabling you to trade securities such as stocks, bonds, and mutual funds. Completing the broker account form is one of the first steps in initiating your investment journey, as it establishes a formal relationship between you and the brokerage.

The importance of the broker account form extends beyond mere formalities. It includes vital information that helps the brokerage assess your suitability for various investment products. Understanding the nuances of this form can significantly impact your investing experience.

Types of broker account forms

Broker account forms come in various types to cater to different investor needs. Familiarizing yourself with these types will enable you to choose the most appropriate option for your financial goals.

Preparing to fill out your broker account form

Before diving into the process of filling out your broker account form, preparation is key. Gathering the necessary documents will streamline the process and help you provide accurate information.

Equally important is developing a good grasp of key terminology associated with investment and brokerage practices. Familiar terms like 'margin accounts' or 'dividend reinvestment' can often be encountered on the form.

Step-by-step instructions for completing your broker account form

Completing your broker account form can seem daunting, but breaking it down into manageable sections makes the process simple. Let's review each segment of the form.

Personal information section

In this section, you provide basic details such as your full name, address, and contact information. Accuracy is crucial here, as any discrepancies can delay the account opening process.

Account type selection

Your choice of account type has significant implications regarding tax benefits and investment strategies. Take time to review your options carefully and select the one that aligns with your financial needs.

Financial information disclosure

Providing comprehensive financial information is essential for regulatory compliance and suitability assessments. This section may request details on your income, net worth, and investment experience.

Investment objectives and risk tolerance

Understanding your investment goals is crucial to completing a risk tolerance questionnaire. This will help the brokerage suggest appropriate investment strategies that align with your risk appetite.

Reviewing beneficiary designations

Naming beneficiaries on your account is an important step in estate planning. This section allows you to ensure that your assets are allocated according to your wishes after your passing.

Advanced features of the broker account form

Many broker account forms also offer advanced features designed to enhance your investment experience. These services can streamline operations and potentially improve your investment returns.

Additionally, optional add-ons like margin trading and options trading provide enhanced strategies for experienced investors. However, it's essential to thoroughly understand the risks and benefits associated with these options before choosing.

Tips for submitting your broker account form

Ensuring the completeness and accuracy of your broker account form is crucial for a smooth submission process. Here are some steps to follow.

After submission, expect a few days for processing. While waiting, you can proactively follow up with the brokerage if you don't receive any communication.

Managing your broker account post-submission

Once your broker account is established, management becomes key to optimizing your investment experience. Accessing and editing your broker account information is straightforward if you utilize tools like pdfFiller.

FAQs about broker account forms

As you navigate the process of submitting and managing your broker account form, several common challenges may arise. Below are some frequently asked questions that can help clarify possible concerns.

Conclusion

Navigating the broker account form may seem challenging, but with clear instructions and resources like pdfFiller, you can efficiently manage the process. This platform empowers users to seamlessly edit PDFs, eSign, collaborate, and manage documents from a single, cloud-based solution. By understanding the nuances of your broker account form, you are well-equipped to launch your investment journey confidently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit broker account in Chrome?

How can I edit broker account on a smartphone?

How do I complete broker account on an Android device?

What is broker account?

Who is required to file broker account?

How to fill out broker account?

What is the purpose of broker account?

What information must be reported on broker account?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.