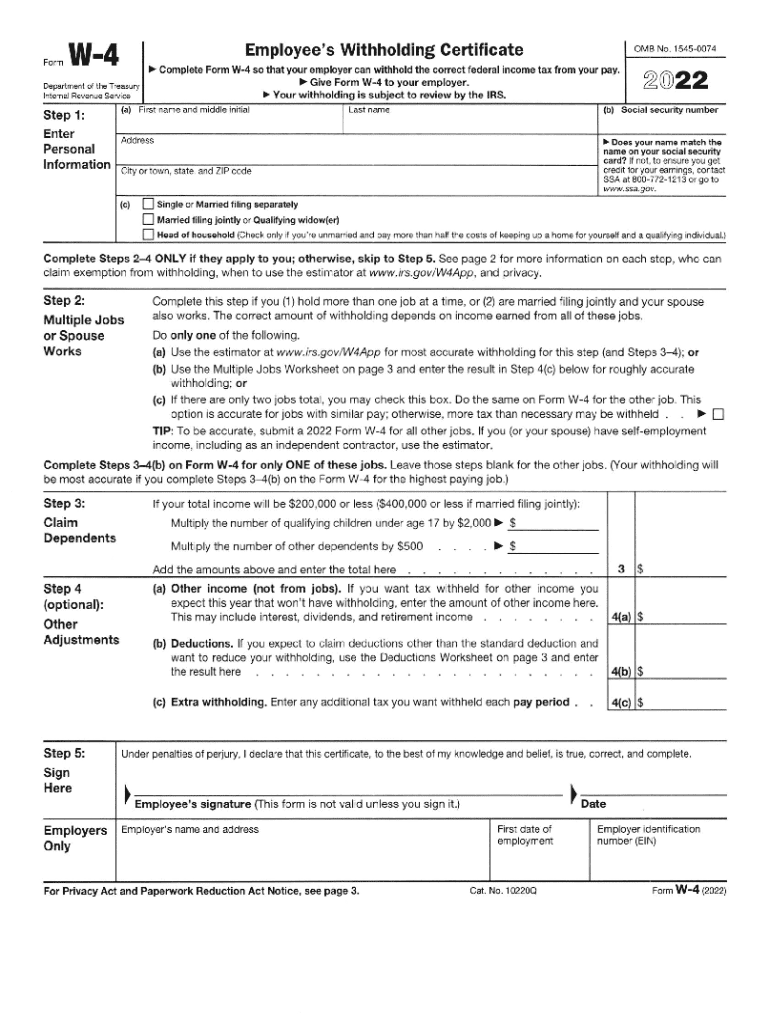

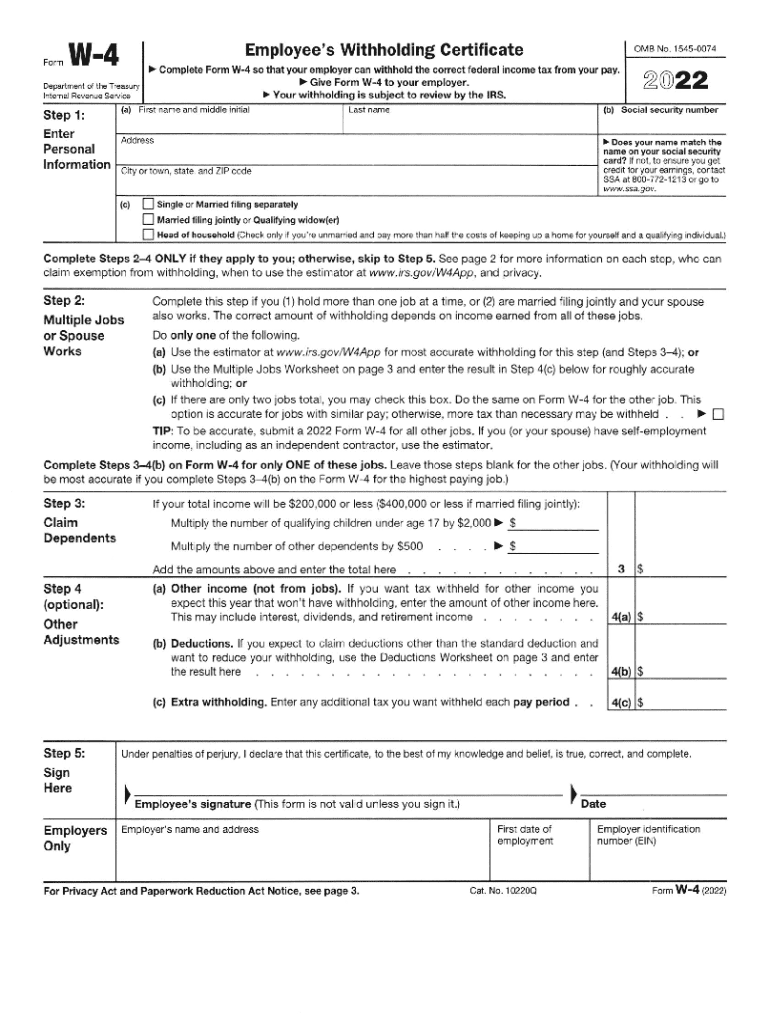

Get the free W-4 Employee Federal Withholding Form

Get, Create, Make and Sign w-4 employee federal withholding

How to edit w-4 employee federal withholding online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-4 employee federal withholding

How to fill out w-4 employee federal withholding

Who needs w-4 employee federal withholding?

Everything You Need to Know About the W-4 Employee Federal Withholding Form

Understanding the W-4 Employee Federal Withholding Form

The W-4 Employee Federal Withholding Form is a document that employees use to indicate their tax withholding preferences to their employer. This form plays a crucial role in ensuring that the correct amount of federal income tax is withheld from an employee's paycheck. By adjusting your withholding on the W-4, you can manage your take-home pay and potential tax liabilities effectively.

Understanding the W-4 form's purpose is vital, particularly since it impacts overall financial planning and tax obligations. Without accurate withholding, an employee could either owe a significant amount during tax season or receive a large refund. Essentially, the W-4 allows individuals to balance immediate financial needs with future tax liabilities.

Who needs to fill out a W-4 form?

New employees are required to fill out a W-4 form upon starting a job. This ensures that the right amount of federal income tax is withheld from their first paycheck. Additionally, if you experience changes in personal circumstances, such as marriage, divorce, or having children, submitting a new W-4 becomes essential to reflect these changes.

It’s also important for individuals who hold multiple jobs or are in dual-income households to revisit their W-4 forms. Juggling multiple sources of income may warrant adjustments to ensure that the correct total tax is withheld. An incorrect W-4 can lead to miscalculations, resulting in underpayment or overpayment of taxes.

Importance of the W-4 form

The W-4 form significantly impacts your paycheck. The amount withheld for federal taxes directly affects your take-home pay. If you set your withholding too high, you'll receive a smaller paycheck, but you may get a refund at tax time. Conversely, if you set it too low, your paycheck may be larger, but you risk a large tax bill when you file your taxes.

By managing your W-4 effectively, you can avoid underpayment penalties, which can occur if you owe more than $1,000 in taxes at the end of the year. Striking the right balance between tax refunds and END-OF-YEAR liabilities not only helps with budgeting but also aligns with financial goals.

Is the W-4 form mandatory?

Filling out a W-4 form is a federal requirement for employees. Employers are obligated to obtain a W-4 from their employees to comply with tax withholding regulations. Failure to submit a W-4 may lead to your employer withholding at the highest tax rate, which is a legal consequence designed to protect the IRS’s revenue.

While the federal law mandates the completion of the W-4, some companies may have additional policies regarding how often forms need to be updated. Employers are also subject to state regulations, which might vary, so being aware of local laws is crucial.

How to complete the W-4 form

Completing the W-4 form involves several steps, each critical for ensuring proper tax withholding. Here’s a breakdown of the form's sections:

For accuracy, it’s recommended to use online calculators that estimate your withholding based on your financial situation. Common mistakes, such as miscalculating dependents or forgetting to sign the form, can cause delays or inaccuracies in withholding.

Managing your W-4 form

It's important to regularly update your W-4 as your life circumstances change. If you get married, have children, or receive a promotion or raise, these factors could necessitate a revision of your withholding allowances. Remember, it's your responsibility to submit any updates to your employer promptly to ensure accurate withholding.

Monitoring your withholding throughout the year is also essential. Reviewing your pay stubs will provide insight into whether you’re having the right amount withheld. Adjusting your W-4 based on year-end tax implications can save you from an unwelcome tax surprise in April.

Where to submit your W-4 form

Once you have completed your W-4 form, it should be submitted directly to your employer’s payroll department. Understanding the process for submission is crucial to ensure that the adjustments are reflected in your next paycheck. Keeping a copy for your records is a good practice.

In today's digital world, many employers allow digital submission of the W-4 through their human resources portals. Utilizing services like pdfFiller offers an excellent option for electronic filing, making it easy to manage forms and track submissions securely.

Frequently asked questions about the W-4 form

Can I submit a new W-4 at any time? Yes, employees can submit a new W-4 whenever there are relevant changes, such as marital status or number of dependents. Simply communicate with your employer.

What happens if I do not submit a W-4? If you don’t submit a W-4 form, your employer will withhold taxes at the highest rate, which may lead to discomfort during tax time.

How often should I review my W-4? It’s advisable to review your W-4 at least once a year or whenever there are significant life changes to confirm that your withholding aligns with your current situation.

Interaction with other tax forms

The W-4 form interacts closely with other tax forms, notably the W-2 and 1099 forms. Your W-2 provides a summary of your income and tax withholding, which you’ll use for tax filing. Meanwhile, the information provided in your W-4 impacts how much is reported on your W-2.

Understanding how the W-4 fits within your overall tax strategy is a key component of aligning your withholding with financial goals. Properly managing your tax forms can lead to better long-term financial planning and peace of mind.

Leveraging pdfFiller for your W-4 needs

Using pdfFiller facilitates a seamless experience when managing your W-4 form. This cloud-based platform allows users to easily edit, sign, and collaborate on PDF forms. Features like easy editing and signing capabilities make it ideal for individuals and teams that need to manage documents on the go.

A cloud-based solution not only enhances accessibility but also ensures document security and compliance with legal standards. With pdfFiller, users can store and manage their W-4 forms efficiently, making the entire process straightforward and less stressful.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get w-4 employee federal withholding?

Can I sign the w-4 employee federal withholding electronically in Chrome?

How do I edit w-4 employee federal withholding straight from my smartphone?

What is w-4 employee federal withholding?

Who is required to file w-4 employee federal withholding?

How to fill out w-4 employee federal withholding?

What is the purpose of w-4 employee federal withholding?

What information must be reported on w-4 employee federal withholding?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.