Get the free FARNSWORTH LUCY C TR U/WILL

Get, Create, Make and Sign farnsworth lucy c tr

Editing farnsworth lucy c tr online

Uncompromising security for your PDF editing and eSignature needs

How to fill out farnsworth lucy c tr

How to fill out farnsworth lucy c tr

Who needs farnsworth lucy c tr?

Your Comprehensive Guide to the Farnsworth Lucy Tr Form

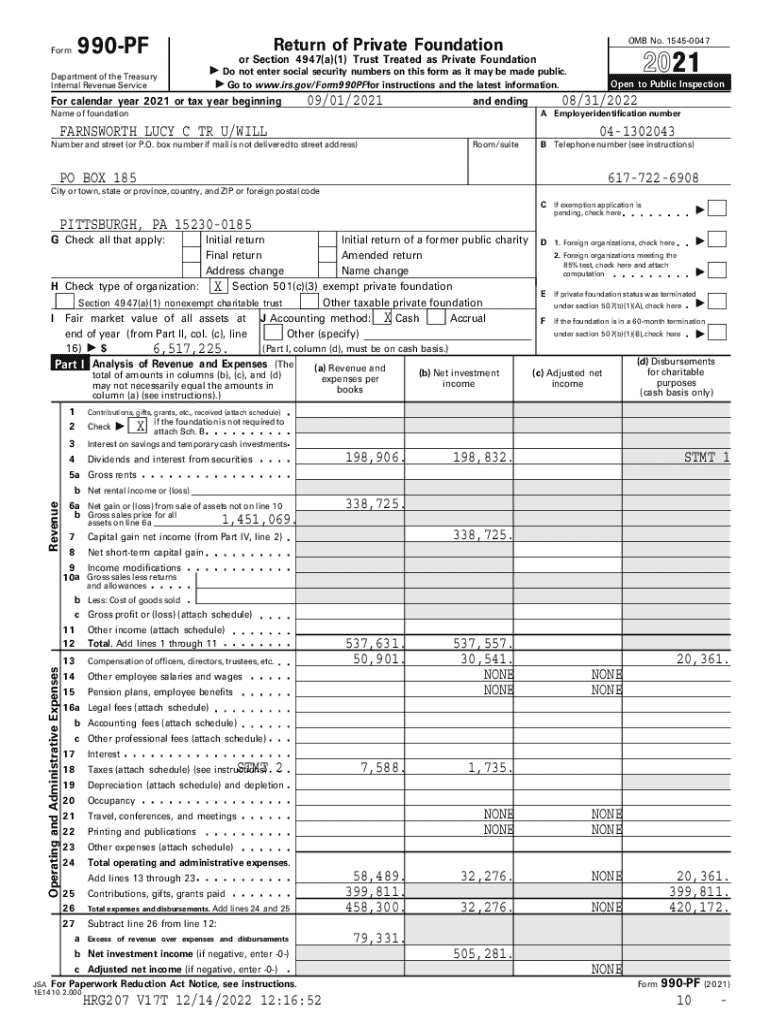

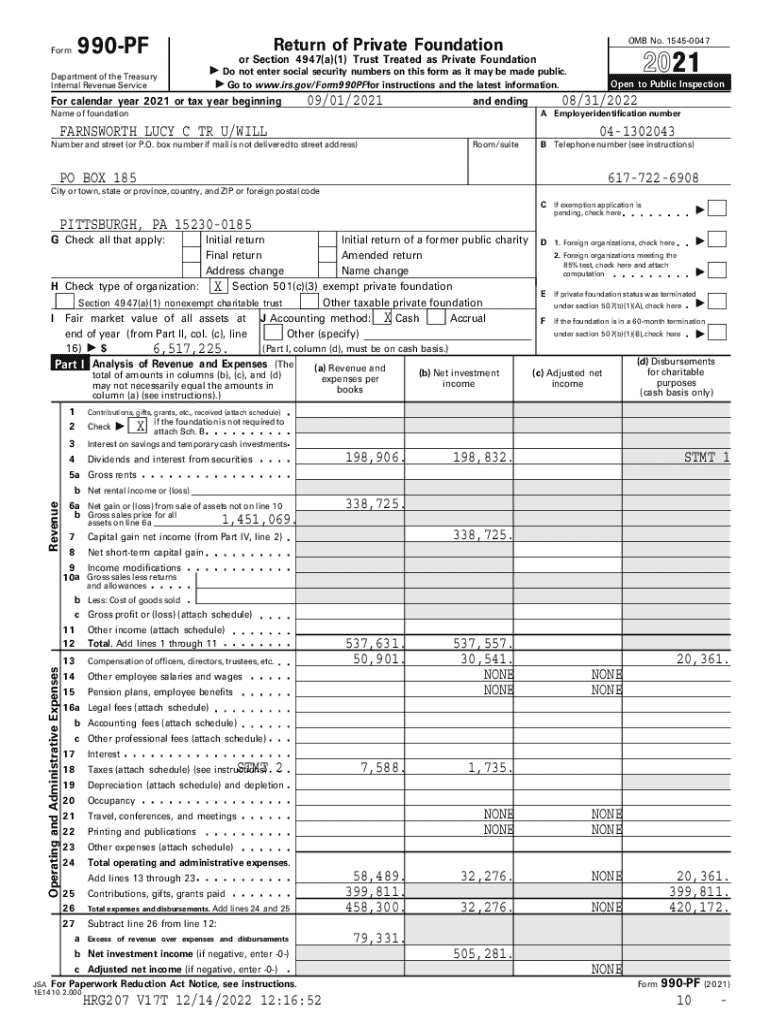

Overview of the Farnsworth Lucy Tr Form

The Farnsworth Lucy C Tr Form plays a vital role in estate planning and trust management, allowing individuals to designate their estate’s handling and distribution posthumously. By establishing a trust, you can ensure that your financial legacy is maintained according to your wishes, minimizing potential disputes and complications among beneficiaries.

This form is primarily utilized by individuals looking to manage their assets, provide for their loved ones, or streamline the transfer of wealth. Whether you're an individual with complex financial affairs or someone who seeks to ease the burden on your loved ones, this form is essential.

Understanding the importance of accurate completion

Completing the Farnsworth Lucy C Tr Form with precision is critical in estate management. Accuracy ensures that your instructions are correctly understood and followed. Inaccuracies can lead to contested wills or trust disputes, ultimately delaying the distribution of assets and potentially leading beneficiaries to incur unnecessary legal costs.

Legal ramifications can arise from errors such as incorrect names, misidentification of assets, or failure to follow proper procedures. Real-life examples abound, where families have incurred significant losses due to insufficiently documented wishes. Ensuring meticulous completion helps to safeguard your intentions and provides peace of mind for you and your heirs.

Step-by-step guide to filling out the Farnsworth Lucy Tr Form

Filling out the Farnsworth Lucy C Tr Form requires careful attention and sequence. Follow these steps to ensure comprehensive and correct completion.

Step 1: Gathering necessary information

Initially, one must collect personal details like full legal names, addresses, and contact information of all parties involved. Additionally, details about financial assets, such as bank accounts, property, investments, and businesses, are crucial as they determine the trust's contents.

Step 2: Completing the form

As you fill out the form, proceed through sections like the identification of the trust and beneficial parties systematically. Pay special attention to details, ensuring that all names and figures accurately reflect your intentions.

Common pitfalls to avoid

Ensure you avoid common mistakes such as omitting beneficiaries or failing to provide clear descriptions of assets. Misunderstandings in these sections can lead to dispute and confusion.

Step 3: Reviewing for accuracy

After completing the form, review it meticulously against a checklist. Verify that all names are spelled correctly, numbers are entered accurately, and the document is free of typographical errors. Each detail matters, as slight discrepancies can lead to major complications.

Editing and modifying the Farnsworth Lucy Tr Form

Once you have filled out your Farnsworth Lucy C Tr Form, editing and modifications may be necessary as details change over time. Utilizing PDF editing tools such as those offered by pdfFiller can simplify the process.

Utilizing PDF editing tools available on pdfFiller

To begin, upload your filled form onto the pdfFiller platform, where you can easily make modifications to text, dates, and signatures as required. Changes might be needed due to a change in circumstances, such as marriage, new inheritances, or assets transitioning.

Saving and exporting your form

After making your modifications, you can save and export your form in various formats to ensure versatility, such as PDF or DOCX, ready for submission or future reference.

Legal requirements and signatures

Legal compliance when using the Farnsworth Lucy C Tr Form cannot be neglected. Identifying who must sign the form and where it should be signed is crucial for the document's validity.

Typically, the creator of the trust must sign it along with witnesses, who may also have to provide notary validation. Understanding these requirements ensures compliance with state laws and prevents future legal disputes.

Understanding witness and notary requirements

Each state can have unique requirements for witnesses and notaries during the signing of the form. It is crucial to verify local regulations to ensure the trust is enforceable.

Using e-signing tools via pdfFiller for secure signing

With the advancement in technology, e-signatures via pdfFiller offer a seamless solution for signing your trust document. This modern approach provides several benefits, enhancing efficiency and security.

Common mistakes to avoid

When filling out the Farnsworth Lucy C Tr Form, it's fundamental to recognize common mistakes that may lead to rejection by authorities. These include failing to follow specific state guidelines, not securing sufficient witness signatures, or improperly describing the assets.

By understanding these pitfalls, you can take proactive measures to avoid having your form returned, which can delay the proper management of your estate.

Filing and managing your Farnsworth Lucy Tr Form

Organizing and managing your completed Farnsworth Lucy C Tr Form is just as important as filling it out accurately. Best practices for storage include keeping copies both digitally and in hard copy format, ensuring they are stored in a secure location accessible to authorized individuals.

It's also prudent to keep track of your submitted documents, such as filing receipts or confirmation emails, to monitor their processing status. If changes are needed after submission, understanding how to amend your original form will facilitate seamless updates.

FAQs about the Farnsworth Lucy Tr Form

In navigating the complexities of the Farnsworth Lucy C Tr Form, many users have frequently asked questions. Understanding the timeline for processing submissions can be crucial for planning estate transitions efficiently.

Often, queries arise about the capability to make changes to the form post-filing. Familiarizing yourself with the amendment process is essential for those situations when circumstances change after submission.

Leveraging pdfFiller for your document needs

Utilizing pdfFiller provides an outstanding solution for managing the Farnsworth Lucy C Tr Form and other documents with ease. This versatile platform allows users to create, edit, and sign PDFs from anywhere, ensuring you have everything at your fingertips.

The cloud-based benefits of pdfFiller mean you can access your forms anytime, anywhere—perfect for individuals managing their estates and legal documents on the go. Testimonials from users highlight the platform's efficiency in streamlining complex processes, and with ongoing support for various documents, your needs can always be met.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send farnsworth lucy c tr to be eSigned by others?

How do I make edits in farnsworth lucy c tr without leaving Chrome?

Can I create an eSignature for the farnsworth lucy c tr in Gmail?

What is farnsworth lucy c tr?

Who is required to file farnsworth lucy c tr?

How to fill out farnsworth lucy c tr?

What is the purpose of farnsworth lucy c tr?

What information must be reported on farnsworth lucy c tr?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.