Get the free Nebraska form 22: Fill out & sign online

Get, Create, Make and Sign nebraska form 22 fill

Editing nebraska form 22 fill online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nebraska form 22 fill

How to fill out nebraska form 22 fill

Who needs nebraska form 22 fill?

Nebraska Form 22 Fill Form: A Comprehensive How-to Guide

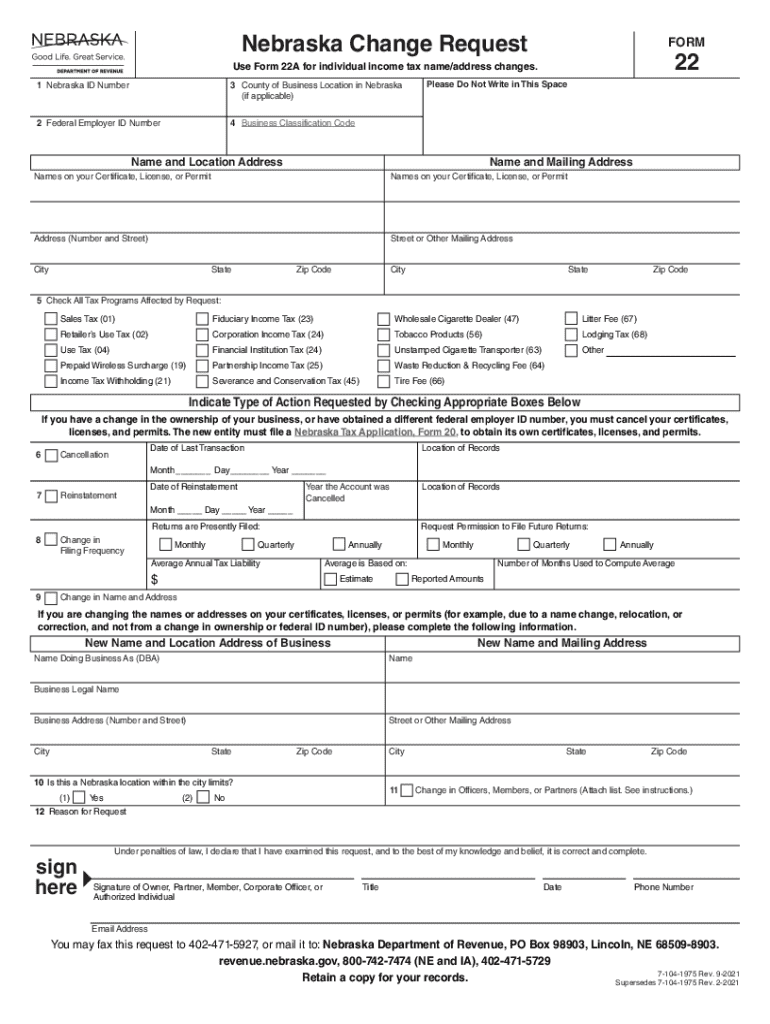

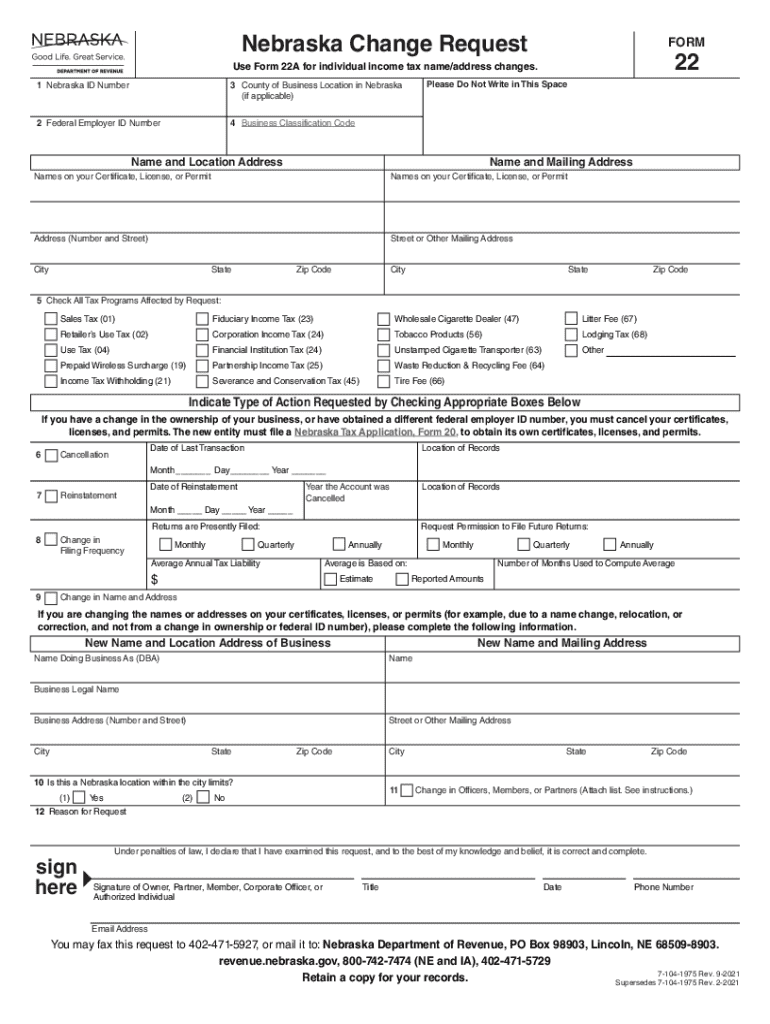

Understanding Nebraska Form 22

Nebraska Form 22 is a critical document primarily used for reporting information in accordance with the Nebraska Workers' Compensation Act guidelines. This form plays a significant role in ensuring that claims for rehabilitation services or benefits mandated by the state are processed correctly. Understanding its purpose is crucial for both claimants and employers to maintain compliance with labor laws.

Employees who are injured at work and are seeking workers' compensation benefits need to fill out this form to formalize their claim either for medical treatment or disability benefits. Employers and insurance companies also utilize this form to document claims, creating a formal record that assists in processing and validating claims efficiently.

Legal obligations associated with Nebraska Form 22

Filling out Nebraska Form 22 comes with specific legal obligations. Nebraska law stipulates that employers must provide adequate information to support the processing of a workers' compensation claim. This ensures that both employees and employers understand their rights and responsibilities regarding workplace injuries. Failure to complete this form correctly or timely can lead to legal repercussions, potentially delaying claim processing or increasing the likelihood of rejected claims.

Notably, Section 48-162.01 of the Nebraska Revised Statutes establishes the necessity for accurate reporting in workers' compensation claims. It's paramount that the form is filled out truthfully and all necessary fields are completed. The consequences can range from fines to loss of benefits for employees, thus highlighting the importance of understanding this documentation thoroughly.

Preparing to fill Nebraska Form 22

Before you begin filling out Nebraska Form 22, it’s essential to prepare adequately. Start by gathering all necessary documents and information that will be required to complete the form accurately. This preparation stage can save significant time and reduce errors, ensuring a smoother filing process.

Understanding the terminology used in Nebraska Form 22 is equally vital. Common terms and acronyms like ‘compensable injury,’ ‘beneficiary,’ or ‘temporary total disability’ are often present in the document and are crucial for correctly filling out your form. Familiarizing yourself with these terms will empower you to navigate the form more efficiently.

Step-by-step instructions for filling Nebraska Form 22

Filling out Nebraska Form 22 requires careful attention. This section will cover each part of the form in detail, outlining what information you need to provide. To begin, make sure you have all your gathered documents and information handy. It is advisable to tackle the form section by section, as this organized approach can prevent confusion and mistakes.

Common pitfalls include overlooking required fields or providing inaccurate information. It's beneficial to review each section thoroughly, as even minor mistakes can result in delays or issues with your claim. To ensure that you’ve completed the form correctly, utilize a checklist to double-check each field.

Editing and modifying your Nebraska Form 22

If you find that changes are necessary after you’ve filled out Nebraska Form 22, editing is manageable using tools such as pdfFiller. Making edits post-filling can be crucial, especially if you discover errors that need immediate rectification. Simply upload your original document to pdfFiller to make any changes swiftly.

For storage and convenience, saving your Nebraska Form 22 in a digital format is essential. Keeping a copy for your records protects you should any questions arise regarding your submission. Options include saving it on your local drive, cloud storage, or through pdfFiller’s secure cloud systems, making it easily accessible when needed.

Signing Nebraska Form 22

Legal validity of electronic signatures has evolved significantly, particularly in Nebraska, where eSignatures are recognized under the Uniform Electronic Transactions Act. This means that signing Nebraska Form 22 electronically is both permissible and often more convenient, especially for individuals and teams on the go.

If you're collaborating with others, pdfFiller provides features that allow you to invite teammates or stakeholders to review and eSign the document. This accountability can enhance the accuracy and compliance of the form submission, facilitating a seamless workflow that encourages collaboration and teamwork.

Submitting Nebraska Form 22

After you've completed and signed your Nebraska Form 22, the next step is submission. Choose whether to submit it online or via physical mail, based on your preference or necessity. Submitting online often expedites processing times, while mail submissions can be handled more traditionally.

After submitting your form, typically, you can expect a confirmation of receipt within a few days. It's advisable to retain any confirmation emails or documents until your claim has been fully processed. If you have inquiries during or post-process, locating the right contact points can help ensure you receive prompt assistance.

Troubleshooting common issues with Nebraska Form 22

While filling out Nebraska Form 22 might seem straightforward, several common issues can arise. Understanding these potential pitfalls will allow you to troubleshoot effectively and maintain the integrity of your submission. Questions frequently encountered by users involve incomplete fields or inaccurate employer information, which can jeopardize the entire claim process.

If issues continue to arise, don't hesitate to contact your employer’s HR department or the Nebraska Workers' Compensation Division for guidance. Having support available can make a significant difference, ensuring your form is rectified and processed as promptly as possible.

Staying updated on changes to Nebraska Form 22

To ensure compliance, it's imperative to stay informed about any updates or changes to Nebraska Form 22 requirements. Regularly reviewing updates from the Nebraska Workers' Compensation Court will help you stay ahead of any modifications and maintain the accuracy of your submissions.

Being proactive in tracking changes ensures you are adequately prepared and can adjust your filing practices as necessary. This vigilance further supports your rights and responsibilities as an employee or employer under the Nebraska Workers' Compensation Act.

Additional features of pdfFiller for document management

Using pdfFiller to manage your Nebraska Form 22 enhances the entire filing experience. With features like cloud storage, easy collaboration, and automatic form filling capabilities, users can streamline their processes. Not only does pdfFiller allow users to fill and eSign documents with ease, but it also provides templates for better organization and document tracking.

Considering these features, pdfFiller stands out as a preferred platform for filling out and managing important forms like Nebraska Form 22, catering specifically to the needs of individuals and teams seeking effective document solutions. Its intuitive interface and comprehensive toolset mean users can expect a reliable and efficient experience every time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find nebraska form 22 fill?

How can I edit nebraska form 22 fill on a smartphone?

Can I edit nebraska form 22 fill on an iOS device?

What is nebraska form 22 fill?

Who is required to file nebraska form 22 fill?

How to fill out nebraska form 22 fill?

What is the purpose of nebraska form 22 fill?

What information must be reported on nebraska form 22 fill?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.