Get the free Military Tax Return Filing and Extensions - TurboTax - Intuit

Get, Create, Make and Sign military tax return filing

Editing military tax return filing online

Uncompromising security for your PDF editing and eSignature needs

How to fill out military tax return filing

How to fill out military tax return filing

Who needs military tax return filing?

Military Tax Return Filing Form: A Comprehensive Guide

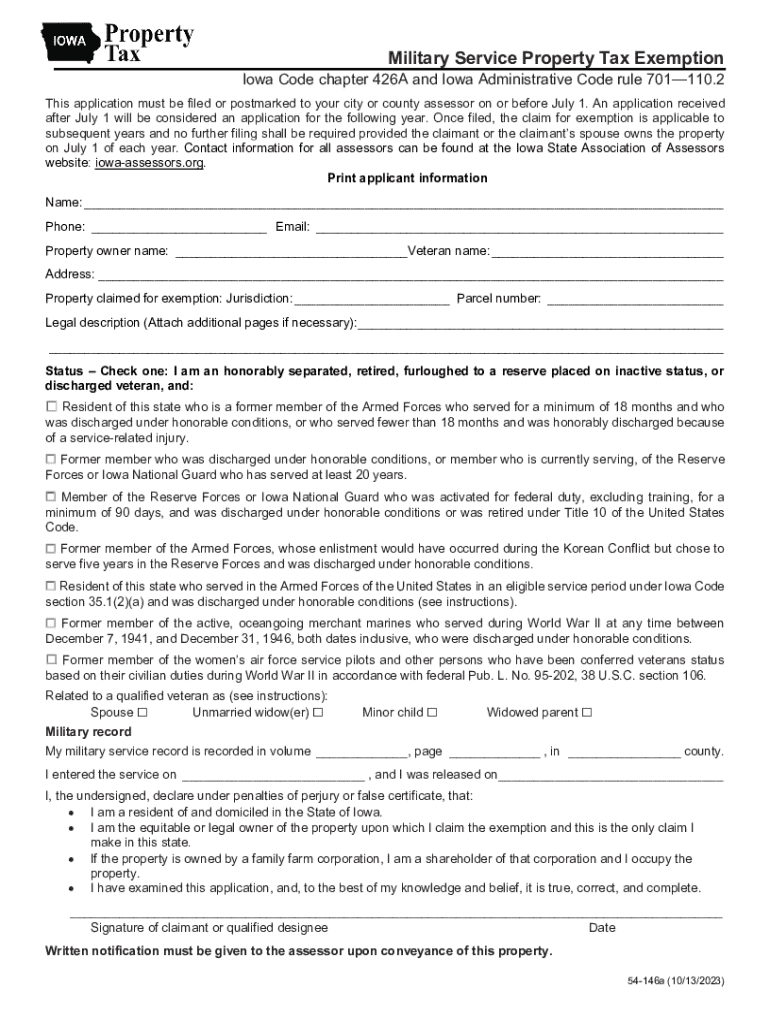

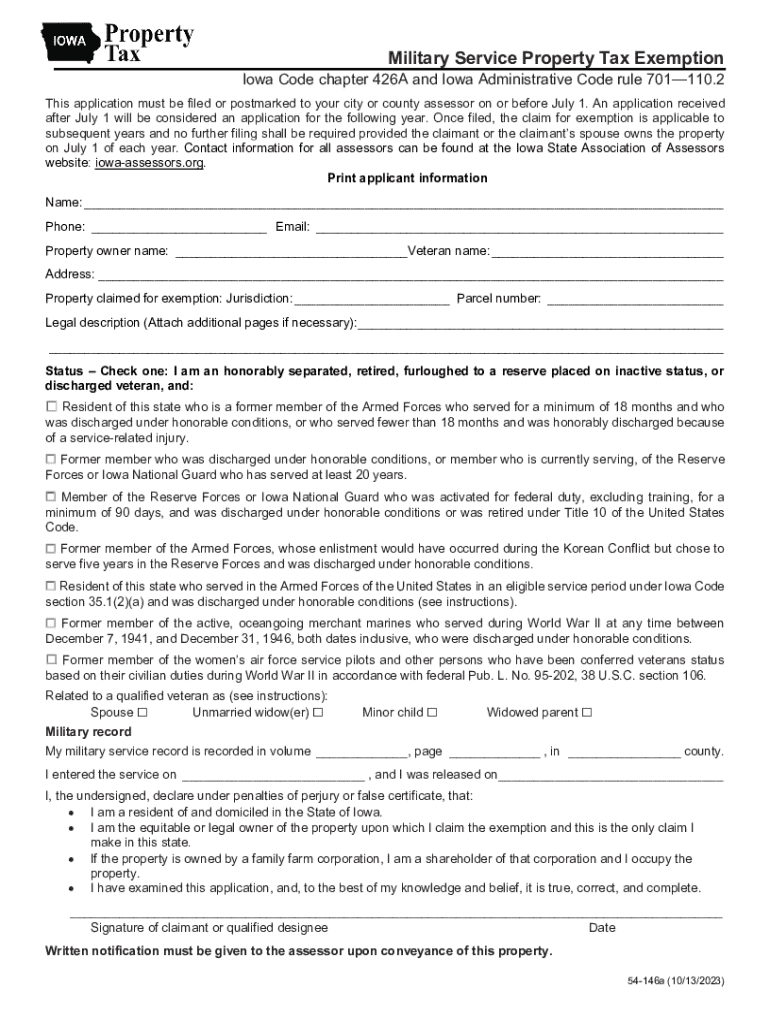

Understanding the military tax return filing form

The military tax return filing form is a specialized document designed to accommodate the intricacies associated with filing taxes for military personnel. This form serves a crucial purpose — it ensures that service members can accurately report their income, claim eligible deductions, and adhere to both federal and state tax regulations.

One of the key aspects that set military tax returns apart from civilian tax returns is the unique nature of military pay and benefits. Factors such as combat pay, deployment status, and various allowances have specific implications for tax calculations, making it imperative for military members to utilize the right filing form.

Filing taxes can be a daunting task for anyone, but military personnel face additional challenges, including frequent relocations and deployments. By using the military tax return filing form, service members can navigate these complexities while ensuring they maximize their eligible tax benefits.

Key benefits of using the military tax return filing form

Utilizing the military tax return filing form provides distinct advantages tailored to the needs of service members. One of the foremost benefits is the streamlined filing process it offers. Military personnel often have busy schedules and may not always be in one place, making a simple and efficient filing process essential.

Additionally, military taxpayers have access to special deductions and credits that are not available to the average taxpayer. These include benefits such as the exclusion of combat pay, deductions for moving expenses related to military assignments, and credits such as the Earned Income Tax Credit (EITC) under specific circumstances.

How the military tax return filing form benefits military personnel

The military tax return filing form provides targeted advantages for service members that account for the unique nature of military life. For instance, combat pay is generally excluded from taxable income, a significant benefit that can save service members considerable amounts of money.

Furthermore, military personnel can request an automatic extension to file their taxes if they are deployed, ensuring they are not penalized for being away from their primary address. Moreover, unique filing situations arise frequently in dual military households, where both partners may have varying benefits and allowances. The military tax return filing form addresses these scenarios, making it easier to report and cross-reference income.

Accessing and utilizing the military tax return filing form

For military personnel looking to file their taxes efficiently, accessing the military tax return filing form is straightforward. Service members can locate the form on official government websites or through tax preparation resources like pdfFiller, which offers user-friendly access to the necessary documents.

Once located, completing the form is a breeze thanks to interactive tools offered by platforms like pdfFiller. These tools allow for online form editing, real-time updates, and eSignature integrations to streamline the submission process. Utilizing these capabilities minimizes paperwork and maximizes efficiency.

Step-by-step instructions for completing the military tax return filing form

Completing the military tax return filing form requires attention to detail. To begin, service members should gather all necessary documentation to ensure a complete submission. This includes income statements, W-2 forms, and any benefits documentation pertinent to military service.

Once documentation is organized, filling out the form becomes the next step. It is vital to carefully read each section, paying close attention to income and deductions that apply specifically to military personnel. After completing the form, service members have the option to e-file through secure platforms or submit a paper file. Tracking the submission is crucial to confirm the form has been successfully received.

Frequently asked questions about military tax return filing

Given the complexities surrounding military tax filing, service members often have many questions. A common concern revolves around the need to file taxes while deployed. It’s essential to understand that all service members need to file their taxes, but extensions are available for those on active duty.

Another frequent inquiry pertains to filing when a spouse is also active duty, which could complicate the process. In such cases, utilizing specialized resources can simplify tax filing by accommodating both partners' unique situations. Clarifying deadlines and available extensions is vital to ensure compliance and avoid unnecessary penalties.

Unique considerations for different military branches

Each branch of the military may have unique tax considerations that can influence the filing process. For instance, Army personnel may have specific special duty allowances or education benefits that differ from those available to the Air Force or Navy. It is crucial for service members to understand how their branch's regulations affect their tax situation.

Understanding branch-specific allowances and deductions can also lead to significant tax savings. For example, Coast Guard members often have different re-enlistment bonuses or travel allowances, impacting how their income is reported. Being aware of these distinctions not only aids in accurate filing but also ensures service members don't inadvertently miss out on potential savings.

Tips for maximizing tax benefits for military families

Military families have access to numerous resources designed to assist them with tax filing. Non-profit organizations frequently offer free tax preparation services specifically for service members, which can guide individuals through the complexities of both state and federal filings.

Moreover, many government programs provide incentives to military families, making it essential to remain updated on eligibility requirements for benefits like the Child Tax Credit and the Earned Income Tax Credit. Engaging with local tax assistance programs can further help in maximizing potential refunds.

Connect with expert help for military tax filing

Navigating the military tax return filing form can be complex, so seeking help from tax professionals who specialize in military returns can be invaluable. These experts possess the knowledge to ensure compliance while helping military families maximize eligible deductions.

Platforms like pdfFiller facilitate communication with tax experts by providing a dedicated space to manage essential documents securely. This connection ensures that service members can quickly access the support they need in one consolidated location, aiding in confidence during the filing process.

Importance of security in handling military documents

Security plays a critical role in the tax filing process, particularly for military personnel who must handle sensitive information. The risk of identity theft or the exposure of confidential data can significantly impact service members, making it vital to choose a secure platform for document management.

pdfFiller incorporates advanced security features to protect essential documents during the filing process. This commitment to security provides peace of mind to service members, allowing them to focus on their financial obligations without fear of data breaches.

Staying updated with military tax regulations

Understanding changes in tax laws that affect military personnel is crucial for accurate and favorable tax filing. Regularly reviewing resources and updates from the IRS and other tax authorities will help service members stay informed regarding their filing responsibilities and any new benefits available.

Signing up for newsletters or email alerts from trusted tax platforms like pdfFiller can also provide timely information about changes in military tax regulations. These updates can be part of a proactive approach to tax preparation, ensuring that service members take full advantage of their benefits.

Share your experiences and insights

Community engagement can provide immense support for service members navigating the military tax return filing process. Sharing experiences, tips, and best practices through forums or social media groups can foster a supportive environment where military families help one another.

Individual insights and stories from fellow service members can highlight effective strategies and lesser-known benefits related to military tax filing. Connecting with others who face similar circumstances not only eases the burden of tax preparation but also encourages knowledge-sharing that enhances the overall experience.

Conclusion: Commitment to supporting military personnel

pdfFiller recognizes the unique challenges that military personnel face, particularly regarding tax preparation. The importance of the military tax return filing form cannot be understated, as it serves as a tool tailored to meet the specific needs of service members. By providing valuable resources, expert assistance, and advanced security features, pdfFiller remains committed to empowering military families during the often-overwhelming tax season.

The goal to optimize benefits while ensuring compliance with tax regulations reflects pdfFiller’s dedication to supporting those who serve. Understanding and leveraging available resources will significantly ease the financial responsibilities of military personnel, affirming their commitment to protecting the country.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find military tax return filing?

How do I edit military tax return filing in Chrome?

How do I fill out the military tax return filing form on my smartphone?

What is military tax return filing?

Who is required to file military tax return filing?

How to fill out military tax return filing?

What is the purpose of military tax return filing?

What information must be reported on military tax return filing?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.