Get the free New Gift Planning Designation for Advisors Now Available

Get, Create, Make and Sign new gift planning designation

Editing new gift planning designation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out new gift planning designation

How to fill out new gift planning designation

Who needs new gift planning designation?

A comprehensive guide to the new gift planning designation form

Understanding the new gift planning designation form

The new gift planning designation form is a crucial document designed to outline a donor's intentions regarding future gifts. By providing relevant details, this form ensures that a donor's wishes are respected and upheld after their passing. Having a clear designation form in place is vital not only for the donor but also for the beneficiaries and estate managers.

This form aids in preventing potential disputes among heirs and simplifies the estate management process. Completing it accurately can be a straightforward process that enables individuals to leave behind meaningful legacies.

Key components of the new gift planning designation form

To ensure clarity and effectiveness, the new gift planning designation form includes several essential components. Initially, the required information sections consist of donor identification details, which may comprise the donor’s full name, address, and contact information. Furthermore, donors must describe the assets or property they intend to donate, whether it involves cash, real estate, stocks, or personal belongings.

Beneficiary information is equally crucial, as it specifies who will receive the gifts. This information will help entities and beneficiaries communicate effectively and respect the donor's intentions. The form also allows for optional sections wherein donors can include specific instructions regarding the use of their gifts or impact statements to express the importance of the donation.

Step-by-step instructions for completing the form

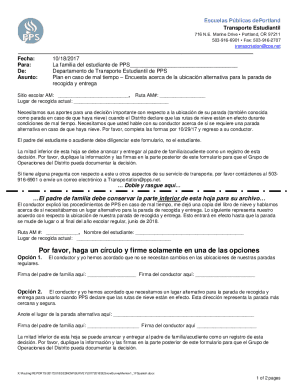

Completing the new gift planning designation form requires careful preparation and organization. Start with a pre-completion checklist, where you gather necessary documentation such as identification, asset valuations, and beneficiary details. Identify who will receive the gifts and note any conditions, such as age requirements or usages.

The detailed steps for filling out the form are as follows: 1. Filling in Personal Information: Enter your full name, address, and contact details. 2. Specifying Gift Assets: Clearly describe the property or assets you are donating. 3. Choosing Beneficiary Designation: Specify the individuals or organizations that will receive your gifts. 4. Additional Instructions and Considerations: Include any specific wishes about how the gift should be used or managed. 5. Providing Signatures: Ensure to sign and date the form for validity.

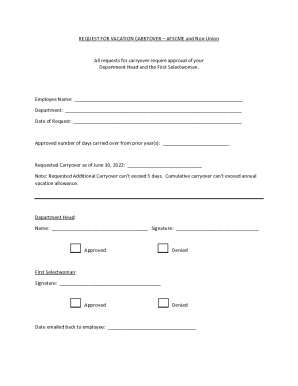

Editing and modifying your designation form

The new gift planning designation form can be easily modified through pdfFiller’s robust tools. Access the form via the cloud, which allows you to edit different text areas and signature fields efficiently. This feature ensures that any changes in your circumstances or intentions can be promptly reflected in the form.

Collaboration is simplified with pdfFiller. You can share the form with relevant stakeholders for their input or electronic signatures, promoting transparency and ensuring that no vital detail is overlooked. This collaborative element enhances both accuracy and trust among parties involved.

Best practices for gift planning

To guarantee successful completion and submission of the new gift planning designation form, adhere to a few best practices. Firstly, always provide accurate information, as this ensures that your wishes are unambiguously communicated and respected. Additionally, it's beneficial to review and update the designation regularly, particularly after significant life events like marriage, divorce, or the birth of a child.

Common mistakes to avoid include leaving out essential beneficiary details and failing to update the form after life changes. An incomplete form can lead to complications and misunderstandings, making it imperative to double-check every section.

Real-life scenarios: how the form works

To provide clarity on how the new gift planning designation form operates, consider these examples: In Example 1, an individual donor, Jane, fills out the form to designate her estate to her children. Step-by-step, Jane records her personal details, specifies her home and savings account as gifts, identifies her children as beneficiaries, and adds notes about her wishes for how the gifts should be utilized.

In Example 2, a team-based approach could involve a family gathering to fill out the form collaboratively. Family members come together, discuss their father’s estate planning, and provide inputs on beneficiaries while ensuring consensus on any special instructions. This collaborative effort can foster understanding and clarity on how to proceed.

Frequently asked questions (FAQs)

Here are some pertinent questions often raised by individuals considering the new gift planning designation form: - What happens if I need to change my designation? Changes to your designation can be made through a new form submission or by updating the existing form. - Are there any tax implications to consider? Consult with a tax professional to understand how your gifts may affect your tax situation. - How can I ensure my form is secure before submission? Utilize pdfFiller’s encryption features to protect your sensitive information. - Can I save a partially completed form to fill out later? Yes, pdfFiller allows you to save your progress and return to the form at a later time, ensuring flexibility.

Legal considerations

When dealing with the new gift planning designation form, it's crucial to be aware of the legal requirements that govern such documents. The regulations may vary by state, making it imperative to familiarize yourself with local laws. It's often advisable to consult with legal experts who specialize in estate planning to ensure that your form adheres to all legal standards.

Understanding state-specific regulations helps avoid potential disputes among beneficiaries and ensures probate processes run smoothly. Legal guidance can also offer strategies for minimizing taxes tied to your gifts, enhancing the overall effectiveness of your estate planning.

Resources for further assistance

If you require additional support, pdfFiller provides various resources: You can contact pdfFiller support for personalized assistance. Tutorials and webinars are also available to guide you thoroughly through the process of filling out and managing the new gift planning designation form, offering insights into best practices and common pitfalls.

Moreover, joining online communities and forums focused on gift planning can connect you with others facing similar situations. This support network provides a platform to share experiences, seek advice, and enhance your understanding of effective gift planning.

Next steps after submission

After successfully submitting your new gift planning designation form, it's vital to track your gift designation progress. This involves ensuring that intended beneficiaries have a copy of the form and that estate managers are aware of your wishes. Maintain clear communication with all parties involved to minimize any confusion regarding the distribution of gifts.

Expect to receive confirmation after submission, which serves as proof of your designation. Adopting document retention best practices is also essential; securely store a copy of the completed form and any correspondence related to your gift planning to ensure ease of access in the future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send new gift planning designation to be eSigned by others?

How do I edit new gift planning designation online?

How do I complete new gift planning designation on an Android device?

What is new gift planning designation?

Who is required to file new gift planning designation?

How to fill out new gift planning designation?

What is the purpose of new gift planning designation?

What information must be reported on new gift planning designation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.