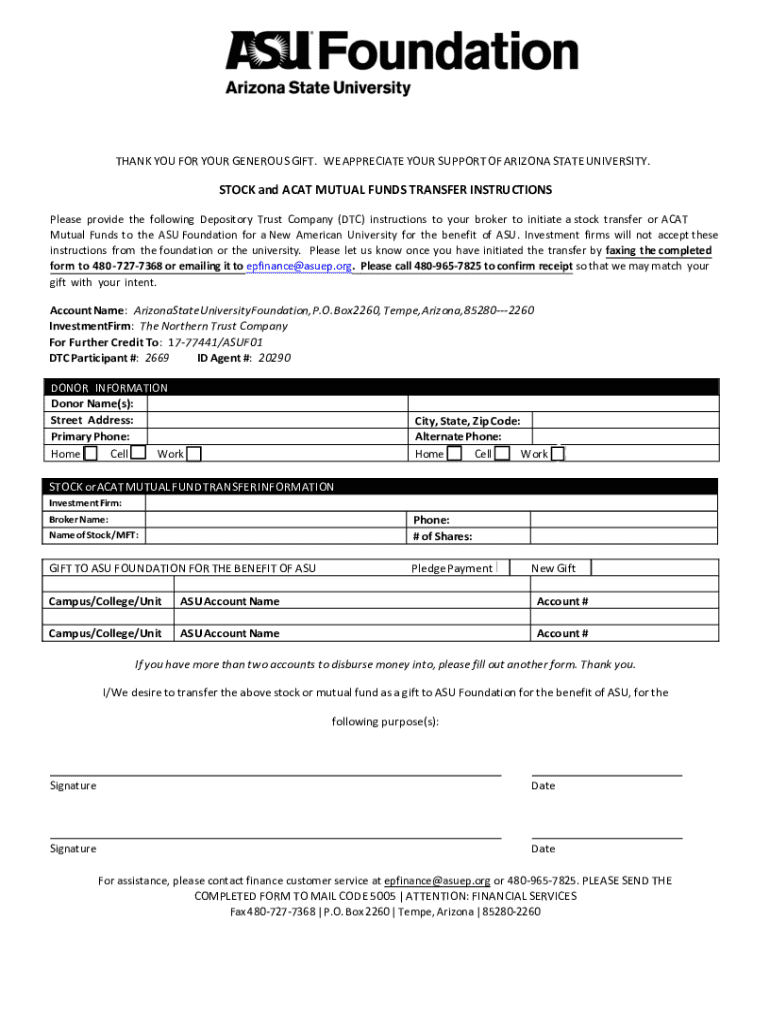

Get the free Mutual Fund Transfer Form ASUFV3121021.docx

Get, Create, Make and Sign mutual fund transfer form

Editing mutual fund transfer form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mutual fund transfer form

How to fill out mutual fund transfer form

Who needs mutual fund transfer form?

The Ultimate Guide to Using a Mutual Fund Transfer Form

Understanding mutual fund transfers

A mutual fund transfer refers to the process of moving investments from one mutual fund account to another. This might occur when an investor wishes to change funds for better performance, lower fees, or simply to adjust their investment strategy. Transferring mutual funds is a critical task for individual investors looking to optimize their portfolios.

The importance of utilizing a mutual fund transfer form cannot be overstated. It standardizes the process, ensuring that all pertinent information is collected uniformly and reduces the risk of errors that can prolong the transfer.

Types of mutual funds

Mutual funds come in various categories, each catering to different investment goals. The most common types include equity funds, which primarily invest in stocks, debt funds that focus on fixed-income securities like bonds, and hybrid funds that blend both equity and debt.

When to use a mutual fund transfer form

There are several situations that may require you to use a mutual fund transfer form. One common reason is when you decide to change your investment strategy—perhaps shifting from growth to income-oriented funds, or vice versa.

Consolidating accounts is another scenario where transfers come into play, simplifying management and reducing fees. Additionally, if you've inherited a fund or are dealing with an estate settlement, transferring ownership is often necessary.

Benefits of using the transfer form

Utilizing a mutual fund transfer form has several benefits, principal among them being the simplification of the transfer process. When using an official form, you ensure that all necessary information is accounted for, such as your personal details and both the existing and new account information.

This mitigates errors that could lead to delays and ensures a smooth transition of your funds.

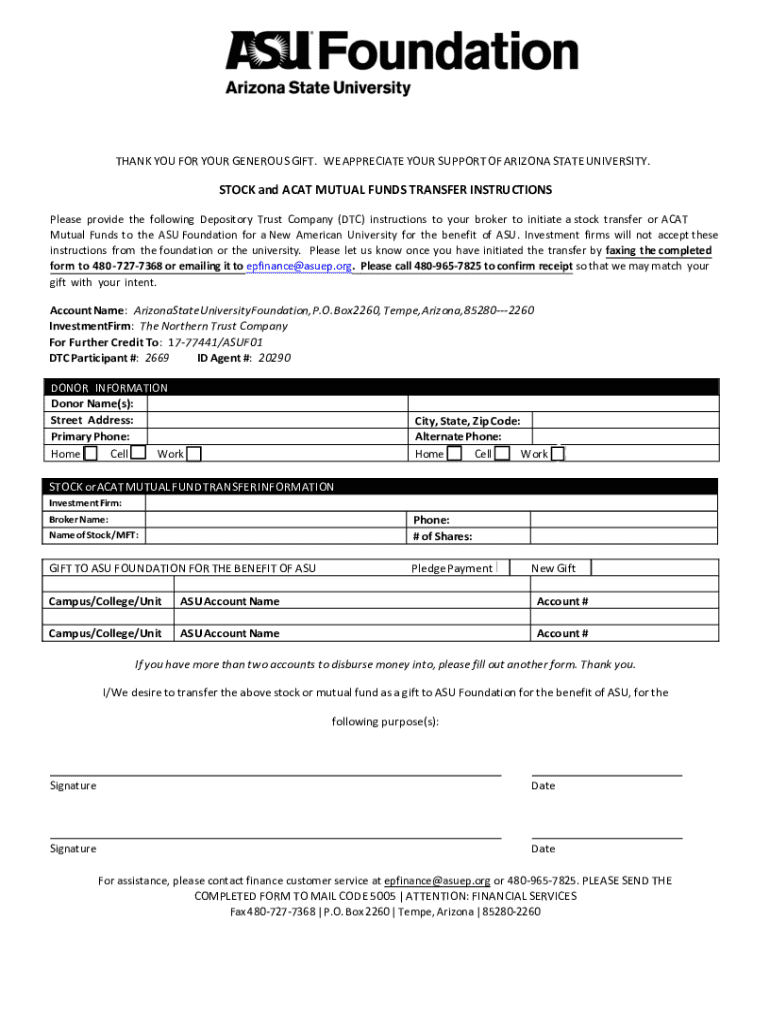

Essential components of the mutual fund transfer form

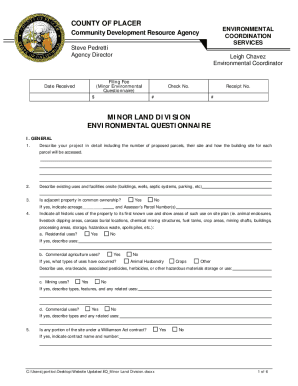

Completing a mutual fund transfer form requires specific information. Primarily, you’ll need to provide personal identification details, including your name, address, and social security number. Then, you’ll need to detail your existing account information along with the new account details where the funds will be transferred.

Typical sections of the form include:

Step-by-step guide to filling out the mutual fund transfer form

Filling out a mutual fund transfer form can either be straightforward or complex, depending on the specific details of your situation. Start by gathering all required documents, including your photo identification and account statements from both the existing and new accounts.

Step 1: Collect required documents

Step 2: Complete the form

Follow the instructions carefully to fill each section of the transfer form. Pay close attention to detail to avoid common pitfalls such as misspelling names or entering incorrect account numbers.

Step 3: Review and verify

After completing the form, it’s crucial to double-check everything. Errors can lead to unnecessary delays in the transfer process. Compare the information on the transfer form against the documents you collected to ensure consistency.

Step 4: Submit the form

Once you are confident that everything is correct, submit the form. Submission methods include online filing or sending it via traditional mail. Different institutions might have varying timeframes for processing transfers, so inquire about what to expect post-submission.

Electronic submission of mutual fund transfer forms

Submitting a mutual fund transfer form electronically has become increasingly popular and offers significant advantages. The speed and convenience of online submission cannot be understated. You can complete the transfer process from anywhere, at any time.

Some platforms, such as pdfFiller, provide real-time tracking features, allowing you to monitor the status of your submission. This ensures transparency and adds a layer of security to your financial transactions.

How to submit online using pdfFiller

Submitting a mutual fund transfer form is easy with pdfFiller. Here’s how to do it step-by-step:

Managing your mutual fund post-transfer

After the transfer is complete, it's essential to monitor your investment performance continually. Use fund performance metrics and tools available on financial platforms to track how well your new investments are doing.

Going forward, you might want to make additional investments or withdrawals. Make sure to familiarize yourself with the fund’s rules regarding future transactions. Additionally, keeping a record is crucial, as you may need documentation for tax purposes or financial planning.

Record-keeping best practices

Proper documentation can safeguard against any tax complications and assist in tracking your investment journey. It is essential to maintain detailed records of transactions, including the dates, amounts, and contexts of all investment movements.

FAQs about mutual fund transfers

As you traverse the mutual fund transfer process, you may have some questions. For instance, what happens if you fill out the form incorrectly? Generally, such errors can delay the transfer process. It is advisable to contact customer service for quick resolutions.

Another common question is how long the transfer process typically takes. While it can vary, most transfers are completed within a few business days. Always check with your fund provider for specifics regarding their processing times.

Troubleshooting common issues

If you encounter issues during your transfer, reaching out to customer service can provide clarity. They can guide you through the process and offer resources for understanding mutual fund policies. Be proactive and don't hesitate to ask for help if you need it.

Additional services related to mutual fund transfers

Engaging in mutual fund transfers might also raise the need for additional services. Professional consulting services can provide valuable insight into your investment choices, especially when dealing with inheritance or significant portfolio adjustments.

Using transaction calculators available on platforms like pdfFiller can simplify decision-making regarding your investments. Furthermore, educating yourself about mutual fund investing fundamentals can empower you to make more informed choices.

Maximizing the benefits of pdfFiller for your mutual fund transfers

pdfFiller offers a plethora of document management features that assist users in organizing their forms and documentation effectively. This cloud-based platform enables you to access your documents from anywhere, allowing for efficient management of your mutual fund transfers.

Collaborative tools on pdfFiller empower users to work alongside financial advisors or team members seamlessly. With robust security measures in place, users can feel confident that their sensitive information remains protected throughout the transfer process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get mutual fund transfer form?

How do I complete mutual fund transfer form online?

How do I edit mutual fund transfer form on an iOS device?

What is mutual fund transfer form?

Who is required to file mutual fund transfer form?

How to fill out mutual fund transfer form?

What is the purpose of mutual fund transfer form?

What information must be reported on mutual fund transfer form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.