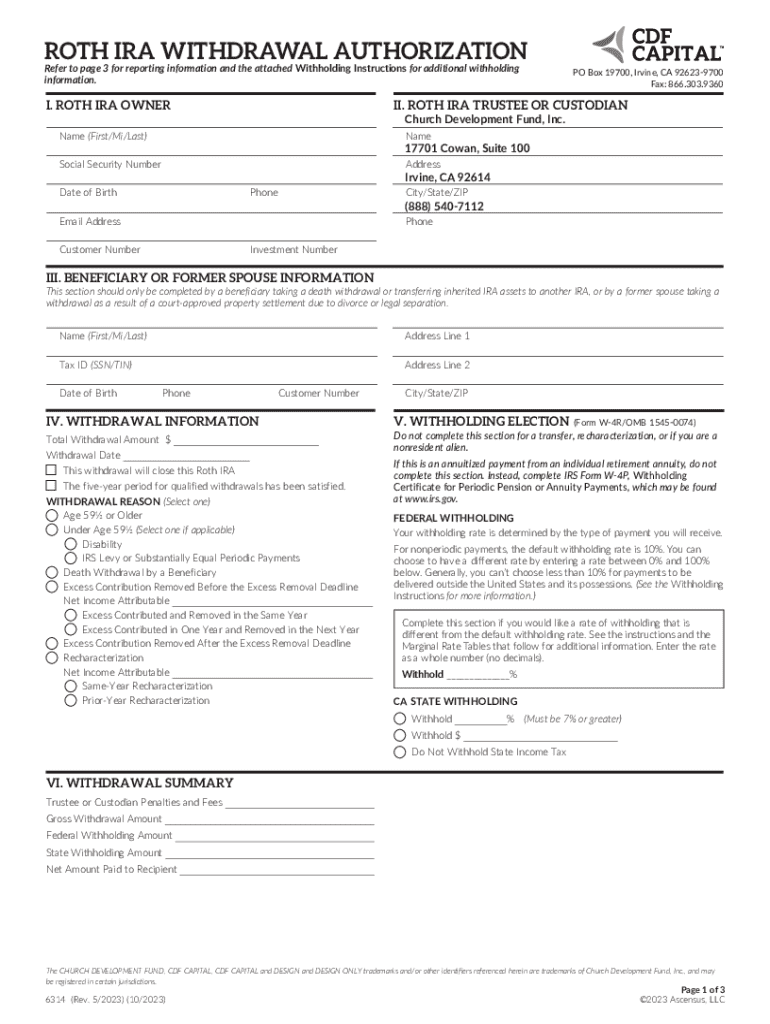

Get the free 6314 Roth IRA Withdrawal Authorization(5/2023)

Get, Create, Make and Sign 6314 roth ira withdrawal

How to edit 6314 roth ira withdrawal online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 6314 roth ira withdrawal

How to fill out 6314 roth ira withdrawal

Who needs 6314 roth ira withdrawal?

6314 Roth IRA Withdrawal Form - How-to Guide

Understanding Roth IRA withdrawals

A Roth IRA is a retirement savings account that offers tax-free growth and tax-free withdrawals in retirement. Established primarily to support individuals making their retirement as financially sound as possible, it allows contributions after taxes have already been deducted, meaning future earnings can be withdrawn without any tax implications. One of the main attractions of a Roth IRA is that it allows for greater flexibility when it comes to withdrawals.

Key Benefits of Roth IRA Withdrawals include tax-free growth, which means you pay taxes on your contributions but none on earnings, making this account potent for long-term savings. Furthermore, contributions (but not earnings) can be withdrawn at any time without penalty, presenting a strong case for those wanting access to cash without hefty fees. Eligibility criteria typically state that you must have held your Roth IRA account for at least five years and be age 59½ or older to withdraw earnings without tax and penalties.

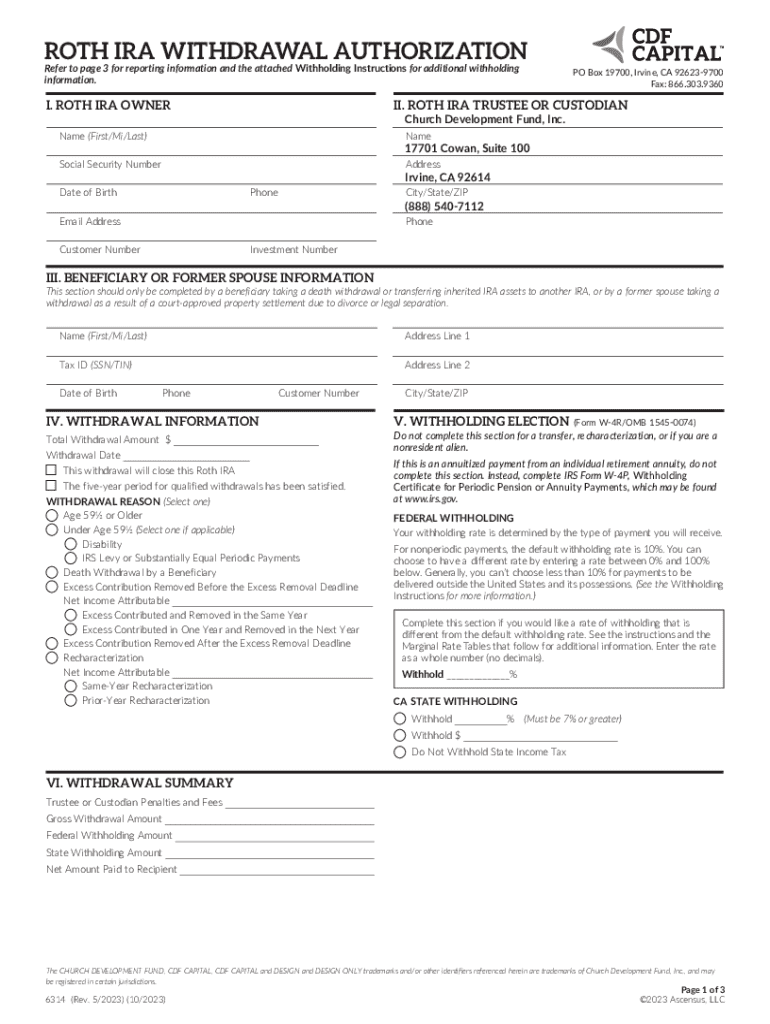

The importance of the 6314 Roth IRA withdrawal form

The 6314 Roth IRA withdrawal form is a critical document required for processing withdrawals from your Roth IRA. With this form, account owners can formally request to withdraw funds, ensuring they adhere to IRS regulations. Filling out this form accurately is essential to prevent processing delays or financial penalties.

Common issues arise when individuals rush to fill out the form. Misplacing necessary information, failing to understand specific withdrawal conditions, or submitting incomplete applications can lead to delays. Ensuring that you are fully informed and accurately document every requirement reduces confusion and expedites your withdrawal process.

Step-by-step guide to completing the 6314 Roth IRA withdrawal form

To effectively navigate the 6314 Roth IRA withdrawal form, follow these carefully structured steps.

Tips for editing and managing your Roth IRA documents

Leveraging pdfFiller's tools can enhance your experience when managing the 6314 Roth IRA withdrawal form and other financial documents. Their platform permits easy editing, allowing you to make necessary adjustments on-the-fly. For instance, you can highlight text, add comments, or adjust sections of your form to ensure clarity and completeness.

Additionally, you can electronically sign your form. This modern approach eliminates the need to print and physically sign documents, making the submission process more efficient. If you work as part of a team, pdfFiller also offers collaboration options which allow multiple individuals to contribute to and review documents without the usual bottlenecks associated with team workflows.

Frequently asked questions about Roth IRA withdrawals

Many individuals considering withdrawals from their Roth IRAs often ask pertinent questions that can impact their financial decisions. One of the first queries is about the implications of withdrawing before the age of 59½. In general, if you withdraw earnings from your Roth IRA before this age, you could face a 10% early withdrawal penalty, alongside owing taxes on those earnings.

However, contributions can be withdrawn without penalty at any time, offering some flexibility. Users frequently inquire about tax implications related to withdrawals; if the account hasn't been held for five years, earnings may be taxable. Understanding these nuances can help individuals make informed decisions regarding their finances.

Real-life scenarios: when to use the 6314 Roth IRA withdrawal form

Certain life events may warrant the use of the 6314 Roth IRA withdrawal form. For instance, if you’re planning for retirement needs, such as funding a great lifestyle or supporting healthcare costs, this form becomes all the more relevant. Additionally, educational expenses also provide a compelling reason for withdrawals. Funds can be used for higher education costs, thus easing financial burdens.

Another scenario is accessing funds for emergency situations. Whether it’s an unexpected medical emergency or a necessary home repair, having access to your contribution funds can provide vital financial relief.

Navigating challenges with Roth IRA withdrawals

Despite the advantages, there are numerous challenges associated with Roth IRA withdrawals. Complications can arise due to unforeseen errors on the withdrawal form. For instance, if you submit a form with incorrect information, it may delay the distribution of funds. Knowing how to amend an incorrect submission quickly becomes crucial.

Keeping well-informed of the requirements and processing times for your specific financial institution can help mitigate these challenges.

Expert insights on Roth IRA strategies

Financial advisors often emphasize the importance of strategic planning when it comes to Roth IRA withdrawals. Speaking about effective withdrawal strategies, advisors recommend considering your tax situation before making any withdrawals, especially when it is potentially beneficial to leave funds in the account to grow tax-free longer.

Timing can also play a crucial role. It is prudent to evaluate the optimal time to withdraw funds based on market conditions and personal financial needs. Taking the time to review these factors may better position you to enhance your overall financial standing.

pdfFiller's commitment to your document needs

As you embark on your journey to manage forms like the 6314 Roth IRA withdrawal form, pdfFiller stands out as a dedicated partner. Their cloud-based platform not only allows you to edit and manage documents seamlessly but also integrates tools that can streamline the signing and collaboration processes.

Features such as easy-to-use templates, flexible e-signature options, and collaborative capabilities empower users to take control of their document management experience. Numerous testimonials reflect satisfaction with the efficiency and effectiveness of pdfFiller’s comprehensive toolset.

Additional support resources

When encountering difficulties or needing assistance with your 6314 Roth IRA withdrawal form, diverse support resources are available. pdfFiller offers live chat and customer service options to address immediate concerns. Moreover, community forums and user support groups can provide shared insights and problem-solving strategies among peers.

Video tutorials particularly shine in their ability to guide you through using the 6314 Roth IRA withdrawal form effectively. These resources ensure that you not only complete forms correctly but also maximize the use of tools available on pdfFiller.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 6314 roth ira withdrawal to be eSigned by others?

How do I edit 6314 roth ira withdrawal straight from my smartphone?

Can I edit 6314 roth ira withdrawal on an Android device?

What is 6314 roth ira withdrawal?

Who is required to file 6314 roth ira withdrawal?

How to fill out 6314 roth ira withdrawal?

What is the purpose of 6314 roth ira withdrawal?

What information must be reported on 6314 roth ira withdrawal?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.