Comprehensive Guide to the 2021 Employee Stock Purchase Form

Understanding the Employee Stock Purchase Plan (ESPP)

An Employee Stock Purchase Plan (ESPP) enables employees to purchase their company's stock at a discounted rate, often through payroll deductions. The primary purpose of an ESPP is to align the interests of employees with that of shareholders, creating a sense of ownership and investment in the company's success. By offering employees a chance to buy shares at a lower price, companies aim to foster loyalty and incentivize higher performance.

One major benefit of participating in an ESPP is the potential for substantial financial returns. Employees can purchase shares at a discount—typically 10% to 15% below market price—allowing for immediate equity. Furthermore, earnings from these stock purchases can be tax-advantaged, depending on how long the stocks are held, which can result in long-term capital gains instead of regular income tax rates.

Potential tax advantages: Holding period requirements can reduce tax liability.

Discounts on stock purchases: Direct reduction in purchase cost increases investment potential.

Long-term investment growth: Stocks can appreciate in value significantly over time.

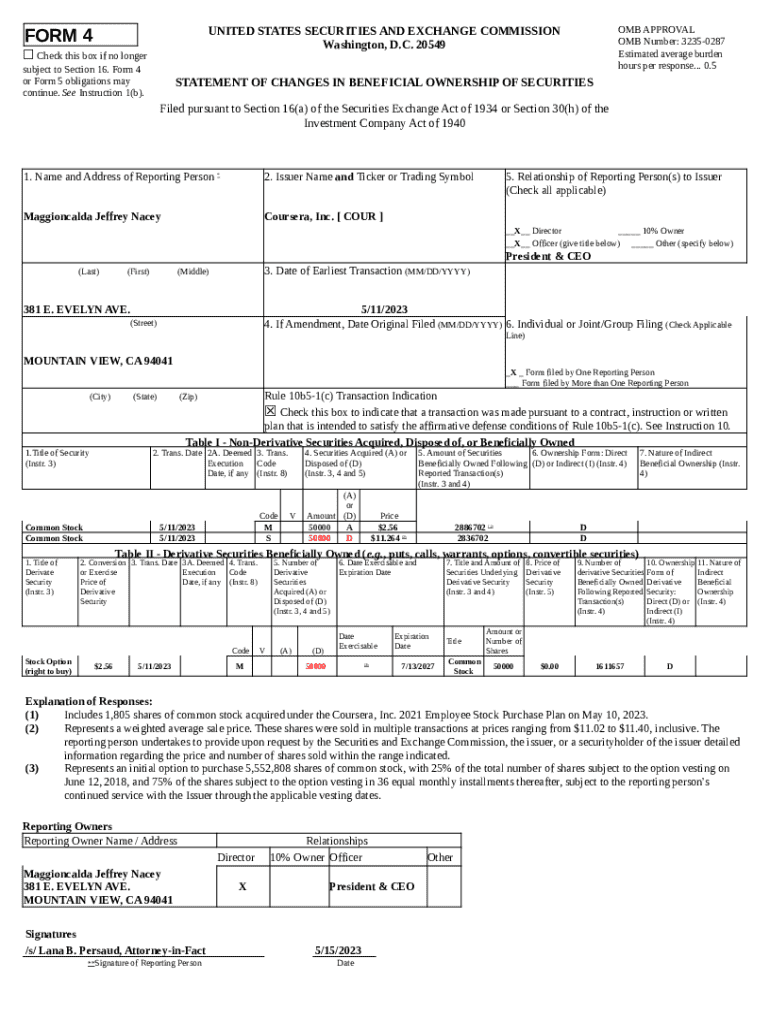

Overview of the 2021 Employee Stock Purchase Form

The 2021 Employee Stock Purchase Form is a crucial document that outlines both the employee’s and employer’s roles in the stock purchase process. This form ensures compliance with IRS guidelines and corporate policies, providing essential information required for the effective administration of an ESPP.

Completing this form accurately is vital to maximize benefits and avoid potential complications during filing seasons or audits. It includes essential sections where both parties can record personal information and details pertaining to stock purchases, ensuring a streamlined process.

Employee information: Collection of personal, employment, and payroll details.

Employer information: Company name, address, and relevant contacts.

Stock purchase details: Specifics on shares being purchased, price, and purchase date.

Step-by-step guide to filling out the 2021 Employee Stock Purchase Form

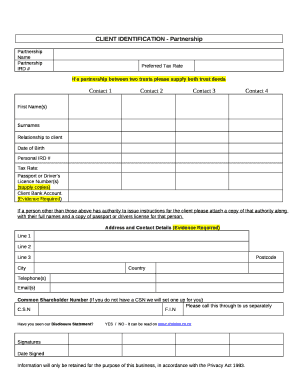

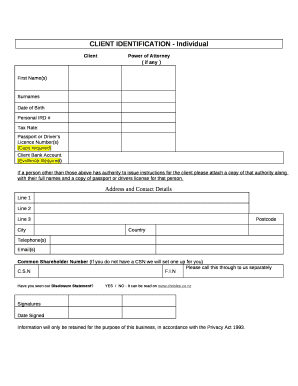

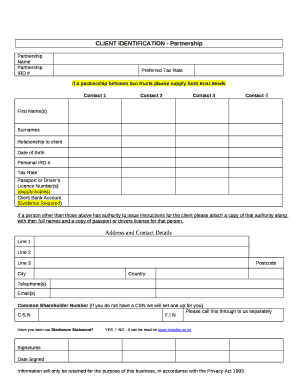

To successfully fill out the 2021 Employee Stock Purchase Form, the first step is to gather all necessary information. This includes personal identification details such as Social Security numbers, employment status, and the specifics about stock options you intend to utilize. Ensuring that all data is accurate will help prevent delays or issues during processing.

Once you have all the information, you can proceed to complete each section of the form. Start with the employee information section, making sure to provide precise personal details. Afterward, if you're a company representative, fill out the employer information section accordingly, including company name and contact information. Lastly, document your stock purchase details. Be explicit about the number of shares you wish to purchase and the corresponding price.

Gather required information: Personal and employment details, stock options.

Complete employee information: Ensure precision in personal details.

Fill in employer information: Record company name and contact data.

Document stock purchase details: Clearly state shares and price.

It’s also crucial to avoid common pitfalls, such as errors in personal and employer information, along with miscalculating stock purchase amounts, which can lead to complications down the line.

Editing and signing the 2021 Employee Stock Purchase Form

The next step after filling out the form is to ensure it is properly edited and signed. Utilizing PDF editing tools can simplify the editing process. For instance, platforms such as pdfFiller allow users to upload their completed form, making adjustments easily and ensuring that all information is correctly presented before submitting.

After editing, signing the document is essential. Electronic signatures are legally accepted across many jurisdictions, making them a convenient option for signing the Employee Stock Purchase Form. Tools like pdfFiller provide straightforward eSigning capabilities; just click on the designated areas to add your signature and date.

Utilizing PDF editing tools: Edit the form online for accuracy.

Overview of legal acceptance of electronic signatures: E-signatures recognized generally.

Instructions on how to eSign: Clear and easy steps to follow.

Managing your employee stock purchase documentation

Properly managing your Employee Stock Purchase documentation is crucial for future reference, especially for tax purposes. Accurate records not only ease the filing process but also ensure compliance with IRS regulations. Keeping track of purchase receipts and relevant transactions can help employees maximize their benefits from participating in an ESPP.

Cloud-based solutions, like those offered by pdfFiller, provide secure storage options. Employees can save their documents in a centralized location, accessing them whenever needed from any device, ensuring that they can provide necessary information to financial advisors or employers swiftly.

Importance of document management: Essential for future reference and compliance.

Storing and accessing documents via cloud-based solutions: Secure storage options.

Collaborating with employers and financial advisors: Sharing documents as needed.

Tax implications and considerations related to the ESPP

Understanding the tax implications surrounding your Employee Stock Purchase Plan is essential for maximizing your benefits. The IRS generally treats purchases under an ESPP favorably, providing tax incentives that can greatly benefit participants. Specifically, qualifying dispositions of ESPP shares can lead to lower tax rates on capital gains, which can be significantly advantageous.

When it comes time to report the earnings on your Federal Tax Returns, accurate documentation is critical. You will need to provide information regarding your stock sales and the specifics of your ESPP purchases. Staying informed about potential tax changes is equally important, as evolving tax laws can affect the advantages offered by these plans, underscoring the need for diligent planning.

Understanding tax obligations: How stock purchases are taxed based on holding periods.

Reporting ESPP on tax returns: Detailed instructions for tax reporting.

Potential impact of tax changes: Awareness of legislative changes affecting tax obligations.

Resources for ESPP participants

Participants in an ESPP can benefit from augmenting their understanding with additional resources. Having the right forms and documentation prepared helps streamline the process. For example, knowing which related IRS forms you may require for compliance can save time and reduce stress during tax season.

It can also be helpful to analyze case studies of successful ESPP participation to see firsthand how individuals have navigated the plan and reaped its benefits. Additionally, accessing expert guidance through financial advisors can provide personalized advice tailored to your specific financial situation. This allows for informed decision-making as you consider future stock purchases.

Additional forms and documentation: List of IRS forms that participants may need.

Case studies of successful ESPP participation: Real-world examples of effective participation.

Accessing expert guidance: How to consult financial advisors for advice.

Interactive tools and features offered by pdfFiller

pdfFiller equips users with various interactive tools designed to simplify document creation and management. For the 2021 Employee Stock Purchase Form, its features enable you to fill out the form online easily, edit necessary sections, and securely store documents for easy access. With pdfFiller, you're essentially equipped with a multi-functional toolkit tailored for efficient document handling.

The user-friendly interface makes it seamless for individuals and teams, facilitating an experience that's both straightforward and efficient. Customers often report satisfaction due to the platform's accessibility and the significant time savings it provides in managing documentation. Moreover, testimonials speak to user experiences where pdfFiller improved productivity and reduced frustrations around form filling.

Innovative features for document creation and management: Tools that enhance form completion.

User-friendly interface for seamless experience: Accessibility and ease of use.

Testimonials from satisfied users: Real feedback on the effectiveness of pdfFiller.

Conclusion and best practices for ESPP participation

Engaging with an Employee Stock Purchase Plan can be a rewarding experience for employees, offering financial opportunities that can significantly enhance overall compensation. To maximize the benefits of the 2021 Employee Stock Purchase Form, remember to keep track of deadlines, gather all required information in advance, and ensure your documentation is complete and accurate.

Looking ahead, it is crucial to remain informed about the evolving nature of tax implications and potential changes in your company's ESPP offerings. Most importantly, always seek professional advice when needed to navigate the complexities associated with stock purchase plans effectively. By implementing these best practices, participants can ensure that they are utilizing their ESPP to its fullest potential.

Key takeaways for efficient ESPP utilization: Summary of important steps.

Future considerations for participants: Planning for future purchases and implications.