Understanding the Appeals South African Revenue Form

Understanding appeals in South African revenue context

An appeal is a formal request to a higher authority to review a decision made by a lower authority. In the context of the South African Revenue Service (SARS), filing an appeal typically arises from dissatisfaction with tax assessments, rulings, or penalties. The importance of filing an appeal cannot be overstated, as it allows taxpayers the opportunity to contest decisions that they believe to be unjust or incorrect. Knowing key terminology such as 'assessment', 'objection', and 'appeal' is crucial for understanding the process.

An official determination of tax liability.

A request to review an assessment before escalating it to an appeal.

A formal challenge to an assessment or SARS decision.

When can you lodge an appeal?

There are specific conditions under which you can lodge an appeal against the decisions made by SARS. A taxpayer may file an appeal if they have received an assessment notice that they believe to be incorrect. Common situations that warrant an appeal include disputes over the amount of tax owed, disagreements regarding deductions and credits, or penalties imposed by SARS for compliance failures.

Discrepancies between your records and SARS determinations.

Imposed fines for non-compliance that you believe to be unjust.

Concerns over owed amounts based on mismatched information.

How to lodge an appeal

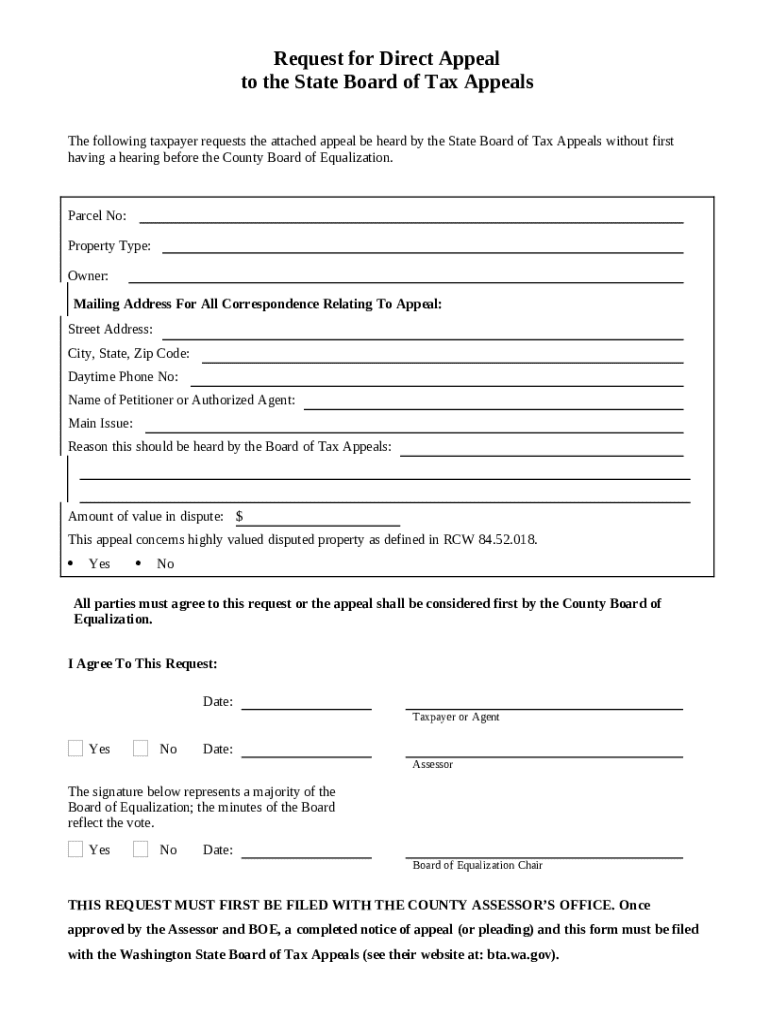

The process of submitting an appeal to SARS involves several clear steps. Begin by preparing the Notice of Appeal, which needs to be accompanied by any supporting documents that substantiate your case. You can submit your appeal either through the SARS eFiling platform or via post. It’s essential to adhere to deadlines to avoid the risk of rejection due to late submissions.

Review the assessment and determine the reason for the appeal.

Complete the Notice of Appeal form and gather supporting documents.

Submit the appeal through eFiling or by post.

Monitor the status of your appeal through your SARS eFiling dashboard.

Essential information for a valid appeal

To ensure your appeal is valid, it's important to include specific information in your Notice of Appeal. This includes your personal details, the assessment number you are contesting, and coherent grounds for your appeal. Supporting documents must be attached to substantiate your claims and clarify your position.

Your name, ID number, and contact details.

The reference number of the assessment being appealed.

Detailed explanation of why the assessment is wrong.

If you need to upload supporting documents on eFiling, navigate to the designated section of the submission portal and follow the instructions provided. Ensure to format your documents correctly for easy review.

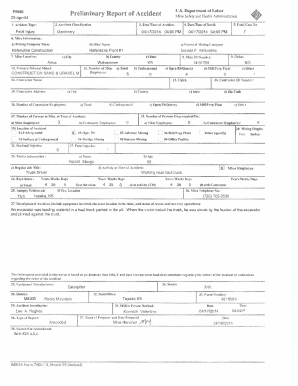

Understanding the appeals process

Once an appeal is submitted, the SARS Appeals Committee will review your case. The appeals process typically takes some time, and it is important for taxpayers to maintain communication with SARS throughout this period. Taxpayers should also be prepared for the possibility of additional requests for information from SARS during the review process.

SARS examines the submitted appeal and supporting documents.

SARS may ask for more evidence or clarification.

SARS will issue a ruling on your appeal, which you can accept or contest further.

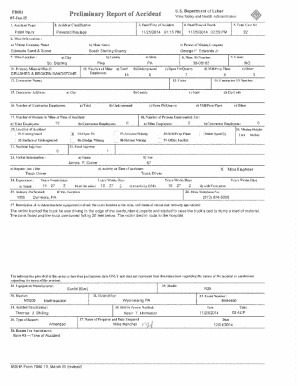

Specialized appeals: Internal administrative appeals (IAAs)

Internal Administrative Appeals refer to a specific layered approach that allows taxpayers to address issues without escalating them immediately to the formal court system. An IAA can be lodged if you wish to challenge administrative decisions made by SARS that do not affect your tax liability directly. This process can be beneficial for resolving disputes efficiently and amicably.

Designed to resolve disputes about administrative decisions.

Involves detailed criteria and timeline set by SARS for resolution.

An IAA can lead to a decision that may resolve the issue without formal appeal.

Frequently asked questions (FAQ) about the appeals process

Understanding specific queries related to the appeals process can provide clarity. Here are some common questions answered:

Taxpayers typically have 30 days from the date of receiving an assessment to submit their appeal.

Yes, taxpayers must use the official Notice of Appeal form provided by SARS.

Generally, when a taxpayer disagrees with an assessment or decision made by SARS.

Objections are filed before a formal appeal and usually within 30 days of receiving an assessment.

The timeline can vary, but taxpayers are usually informed within a few months.

No, all grounds must be stated in the original Notice of Appeal.

SARS will review your appeal and issue a decision based on the provided evidence.

Understanding related appeals processes

Disputing SARS assessments involves knowing your rights as a taxpayer. It is essential to differentiate between an objection and an appeal. While both processes allow for disputes, objections must occur prior to an appeal and are typically regarding specific assessment details. The impact of time is also a critical factor; delays in submissions can affect the outcome.

Every taxpayer has the right to contest an assessment they believe is incorrect.

Objections are first steps and must be filed before an appeal.

Submitting within prescribed periods is crucial for preserving your rights.

Engaging with SARS: communication tips

Effectively communicating with SARS is vital for a successful appeals process. Be polite, clear, and concise in any correspondence. Make sure to reference all relevant assessment numbers and include your personal tax information for easier identification. When disputes arise, staying calm and collected helps maintain professionalism.

maintain a respectful tone to enhance cooperative dialogue.

clearly articulate the grounds of your appeal.

Include specific tax numbers and assessment references.

Transparency and accountability in the appeals process

The appeals process is fundamentally about fairness and transparency. This is essential for public trust in SARS’ operations. Enhancing transparency allows taxpayers to better understand the processes that govern tax assessments and appeals, fostering a more informed public.

Taxpayers must know how decisions are made.

Clear guidelines can improve taxpayer confidence.

Agency should be answerable for its decisions and actions.

Strategic considerations for filing appeals

When considering filing an appeal, it’s vital to assess the potential outcomes and whether professional assistance may be beneficial. Tax laws can be complex, and sometimes, engaging a tax professional or legal advisor can improve your chances of success. Factors influencing the success of your appeal include the strength of your documentation, clarity of your reasoning, and adherence to procedural guidelines.

Ensure all claims are strongly substantiated.

Professional insight can clarify your position.

Plan your appeal approach carefully.

Related services and resources

pdfFiller offers an array of services to assist taxpayers throughout the appeals process. Tools for document creation, editing, signing, and management simplify the submission of forms and supporting documents. Should you require professional support, pdfFiller can connect you with tax experts who can provide tailored guidance and answer your specific concerns.

Easily create necessary legal and tax documents.

Access a wide range of templates related to tax issues.

Engage with professionals for personalized guidance.

Testimonials and success stories

At pdfFiller, we pride ourselves on the success stories of our users who have successfully navigated the appeals process using our platform. Many have shared positive experiences about how our tools and resources helped them achieve favorable outcomes in their dealings with SARS.

John Doe successfully appealed a wrongful assessment.

Jane Smith utilized our templates to streamline her appeal.

A small business effectively resolved a tax penalty with professional support.

Navigating changes in tax legislation

Staying updated on changes in tax legislation is crucial for taxpayers. New regulations can influence the appeals process and impact the strategies you may need to employ. It's best to engage with reliable sources for the latest updates and adjust your tax management approach accordingly.

Be aware of changes that can affect your filings.

Engage with others in the community to share insights.

Get expert opinions on legislative impacts.

Get involved and stay informed

Joining a community focused on tax education and compliance can benefit taxpayers significantly. Engage with platforms that offer ongoing support, information sharing, and updates related to the South African tax landscape. Staying informed is key to effective tax management.

Receive latest news and insights directly to your inbox.

Connect with other taxpayers for shared experiences.

Enhance your understanding through guided sessions.