Get the free Pension Verification Request

Get, Create, Make and Sign pension verification request

How to edit pension verification request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pension verification request

How to fill out pension verification request

Who needs pension verification request?

Pension Verification Request Form Guide

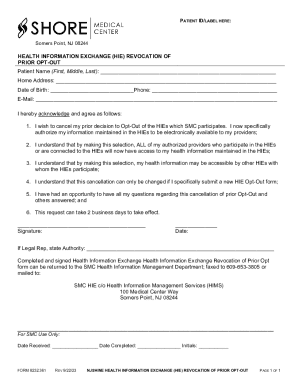

Understanding the Pension Verification Request Form

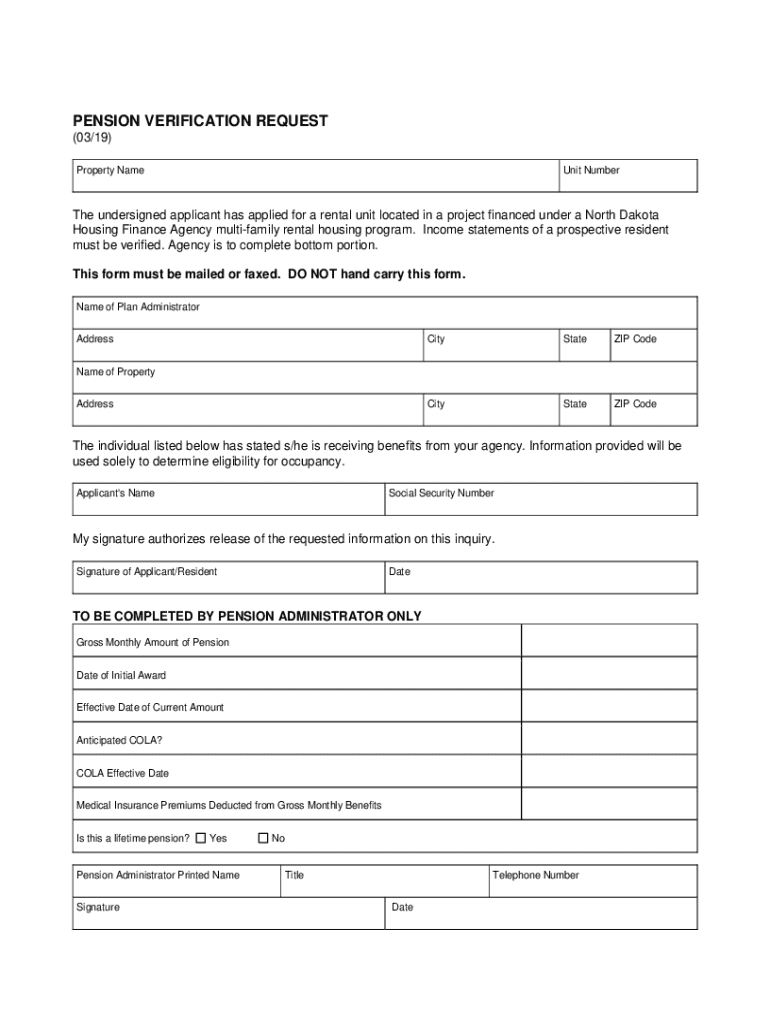

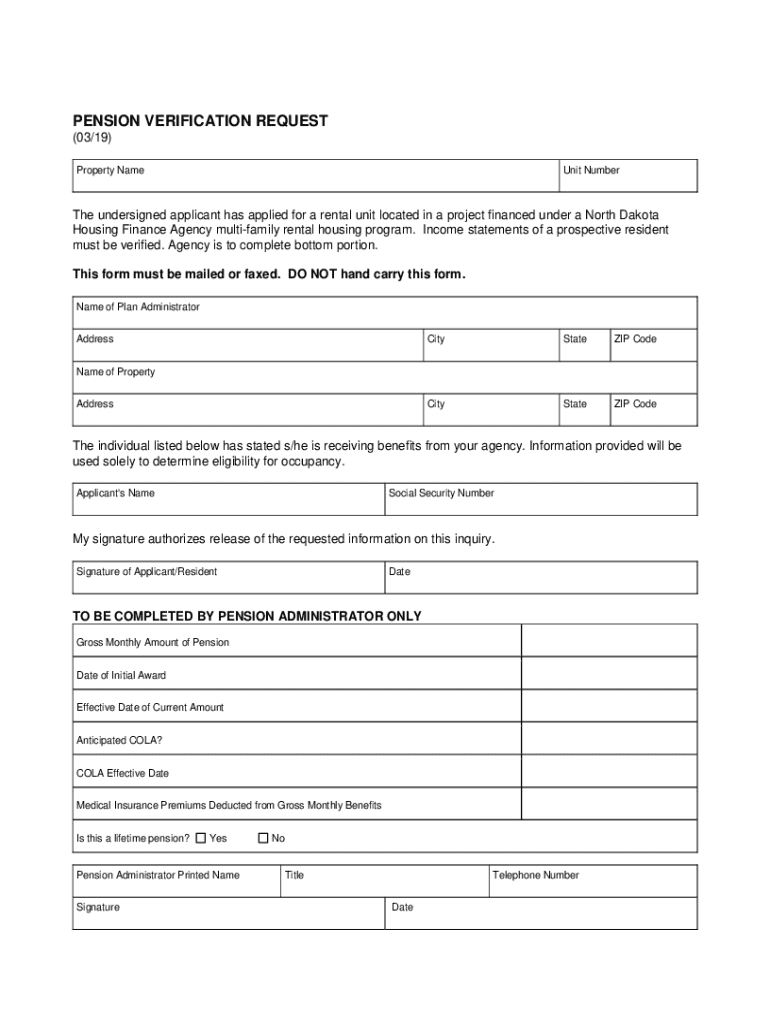

A pension verification request form is a crucial document that individuals use to confirm their pension status, benefit amounts, and eligibility. This form is typically required by banks, lending institutions, or government entities for various purposes, such as loan applications or assistance programs. Completing this form accurately ensures that all necessary information is conveyed to the verification agency or institution handling the pension.

The importance of filling out the pension verification request form accurately cannot be overstated. Incorrect or incomplete information may lead to delays in processing or even rejection of your verification request. It is essential for individuals preparing this form to understand who requires it — typically retirees, beneficiaries, or even employers who need to confirm an employee's pension status.

Key components of the pension verification request form

To successfully complete the pension verification request form, you must include several key components. First, personal identification details are crucial. This typically includes your full name, Social Security number, and other identifiers to clearly link the request to your pension record.

Second, the pension fund information must be accurately filled in. You’ll need to provide the name of the pension fund, your account number, and any identification number assigned to you by the pension provider. These details allow the verifier to quickly locate your information in their systems.

Additionally, there are common sections in the form that play a vital role in its processing, such as specifying the type of verification requested. This can range from simple employment verification to detailed retirement benefit confirmation. Finally, a signature and date are essential, as they confirm that the information presented is accurate and authorized by you.

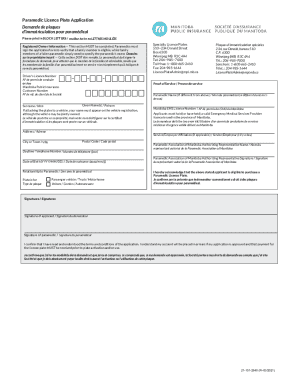

How to request a pension verification

The process of requesting a pension verification begins with gathering necessary information. Before filling out the pension verification request form, gather documents that outline your pension details, identity, and any previous correspondence related to your pension.

Next, you can access the pension verification request form on pdfFiller. This platform provides a user-friendly interface for both creating and editing forms. Open pdfFiller and search for the form template, ensuring you select the correct version required for your needs.

When filling out the form on pdfFiller, make sure to enter all the information accurately. Double-check for typos and ensure that every required section is completed. A tip to avoid common mistakes is to review the form guidelines provided by pdfFiller, which can help clarify any specific terms or requirements.

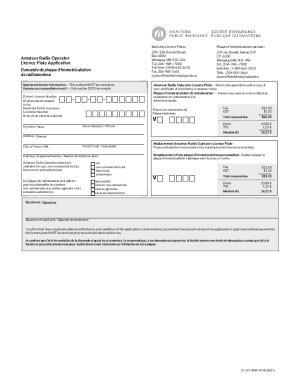

Submitting your pension verification request

After completing the pension verification request form, it's time to submit it. There are several available submission methods, depending on your convenience: you can opt for online submission via the pdfFiller platform, send the form via email directly to the relevant authority, or choose to mail a hard copy of the form through traditional postal services.

Regardless of the submission method, ensure you include identification documents as needed. This may consist of a government-issued ID or other paperwork confirming your identity and right to request the verification. Additionally, check if any supplementary forms are required to avoid delays in processing your request.

Follow-up: what to expect after submission

Once your pension verification request is submitted, it's crucial to understand the typical processing times, which can vary based on the institution handling the request. Generally, you can expect a response within a few weeks, but this could extend during high-volume periods.

To check the status of your request, contact the institution or use any online tracking systems they provide. If your request is denied, don’t hesitate to ask for specific feedback. Understanding the reasons for denial may help you amend your request for resubmission.

Frequently asked questions about pension verification

There are common queries regarding the pension verification request form. For starters, obtaining the form is straightforward. Many organizations make it accessible for download online. Once found, filling it in with accurate information is vital to ensure a smooth verification process.

Typically, the verification will include critical details about your pension, such as the total amount due, duration of the pension plan, and any associated benefits. You can request this verification as often as necessary, but be aware that specific institutions may have policies regarding how frequently they can provide it.

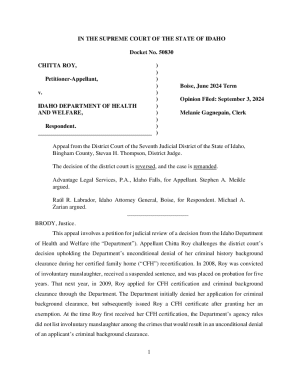

Special circumstances

In special circumstances, such as requests from government agencies, additional documentation may be necessary to support your request. Agencies often need formal proof of identification and authorization to access your pension information.

For requests from non-governmental organizations, like banks or housing authorities, anticipate that they may ask for specific information regarding the mortgage or lease applications. Ensure your pension verification request form is accompanied by the requested documents for a swift approval process.

Additional support options

If obstacles arise during the completion or submission of your pension verification request form, pdfFiller offers customer support for assistance. Reach out to their help desk via chat or email, for prompt answers to your queries. Furthermore, the platform may provide resources and articles related to pension verification, enhancing your understanding and capability to navigate the process.

Utilizing pdfFiller tools for document management

Using pdfFiller’s interactive tools can significantly enhance your experience in managing the pension verification request form. From editing and signing documents to collaborating with others, pdfFiller's capabilities streamline the process. Leveraging their eSigning feature saves time, allowing you to complete forms securely and efficiently.

Additionally, pdfFiller provides help and tutorials that guide you in using their platform effectively. Whether you're a novice or an experienced user, you'll find valuable resources to assist you in managing your documents effectively and securely.

Best practices for document management

Proper document management for your pension verification request form involves securing your information carefully. Start by ensuring that your personal data is stored in a secure location, whether in the cloud through reliable services like pdfFiller or in encrypted physical formats.

Keeping your records updated is also essential. Regularly review your pension statements and any related documents to confirm their accuracy, minimizing the risk of submitting outdated or incorrect information. Consistently verifying your pension details ensures you’re well-prepared for any requests you may have in the future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit pension verification request from Google Drive?

How do I edit pension verification request online?

How do I edit pension verification request on an iOS device?

What is pension verification request?

Who is required to file pension verification request?

How to fill out pension verification request?

What is the purpose of pension verification request?

What information must be reported on pension verification request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.