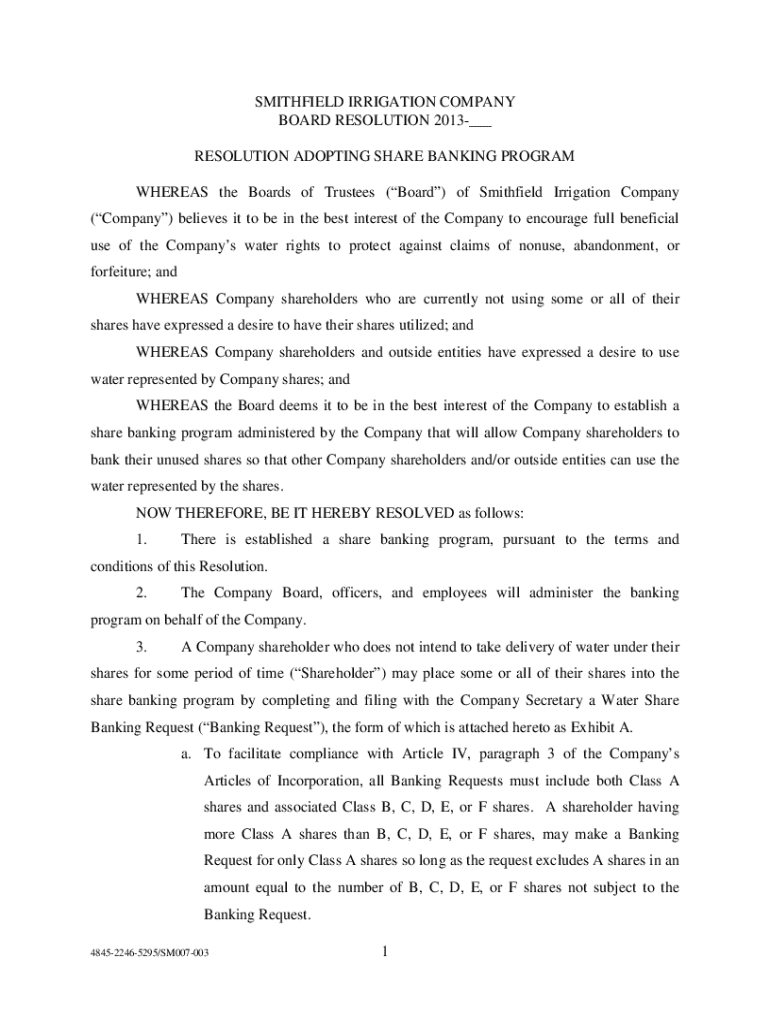

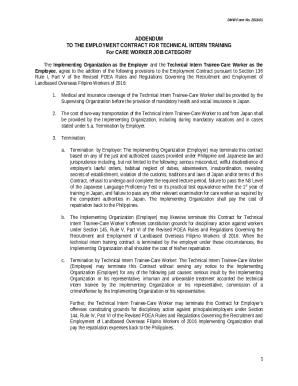

Get the free RESOLUTION ADOPTING SHARE BANKING PROGRAM.pdf

Get, Create, Make and Sign resolution adopting share banking

How to edit resolution adopting share banking online

Uncompromising security for your PDF editing and eSignature needs

How to fill out resolution adopting share banking

How to fill out resolution adopting share banking

Who needs resolution adopting share banking?

Resolution Adopting Share Banking Form: A Complete Guide

Understanding a banking resolution

A banking resolution is a formal document that outlines the authority given by a company's shareholders or board of directors to specific individuals to act on behalf of the entity regarding its financial matters. This resolution provides clear direction about who can engage in banking transactions, sign contracts, or open bank accounts. The importance of banking resolutions cannot be overstated, as they protect both the financial institution and the company by ensuring that all actions taken on its behalf are sanctioned and legitimate.

In financial transactions, having a banking resolution in place helps prevent unauthorized dealings. With identity theft and corporate fraud on the rise, financial institutions require robust verification of authority before granting access to funds or sensitive account information. Therefore, a banking resolution acts as a safeguard for both parties, fostering trust and security in the business banking relationship.

What is a resolution adopting share banking form?

The resolution adopting share banking form is a specific type of banking resolution focused on authorizing specific individuals within a company to manage shares and banking transactions linked to those shares. This form is particularly vital for companies that issue shares, as it clearly delineates who has the authority to purchase, sell, or transfer shares and handle related financial transactions. It is essential in ensuring that corporate actions regarding shareholder management comply with state regulations and company bylaws.

Key components of the form typically include the name of the company, details of the authorized individuals, the specific authority granted (e.g., to sign documents on behalf of the company), and any limitations placed on that authority. Situations where this form is necessary include during the onboarding of new shareholders, changes in company structure, or when a company seeks financing that requires bank authorization and share dealings.

Do need a resolution adopting share banking form for my business?

Certain business entities particularly benefit from having a resolution adopting share banking form in place. Corporations, limited liability companies (LLCs), and partnerships that hold shares or securities should have a formal resolution to ensure compliance with financial regulations and internal governance policies. This form helps volunteer decision-making during shareholder meetings and establishes clear accountability among designated officers.

The benefits of having such a resolution are manifold. It fosters transparency among shareholders, mitigates risks associated with unauthorized access to shares and banking information, and aligns all parties regarding the protocols of share management. Common scenarios that necessitate this form include appointing a new CFO, restructuring existing shares, or when embarking on any significant financial undertakings that engage bank transactions.

How to complete the resolution adopting share banking form

Completing the resolution adopting share banking form involves several steps to ensure it meets legal and corporate requirements effectively. First, gather all necessary information, including the company name, the names of authorized individuals, and the specific powers being granted. Ensure that you accurately consult the bylaws and company policies regarding share management.

Next, complete each section of the form systematically. Clearly state the resolution and authority granted, ensuring there is no ambiguity in the language used. Avoid common mistakes such as failing to include all required signatures, omitting dates, or not specifying the limits of the authority granted. A sample filled form can be a beneficial reference for ensuring you include all pertinent details correctly.

Legal considerations for the resolution adopting share banking form

When preparing a resolution adopting share banking form, it’s essential to consider various legal aspects that differ by jurisdiction. Compliance with state-specific regulations is paramount, as some states may have additional requirements for banking resolutions or specific guidelines governing corporate documents. Thus, familiarity with local laws relating to corporate governance is essential for ensuring that the resolution is enforceable.

Signature requirements can also vary. Some jurisdictions may require that the resolution be signed by all board members or shareholders, while others might allow a simple majority. Additionally, the importance of notarization or having witnessed signatures cannot be understated, as this adds an extra layer of legality and formality that some financial institutions may require before accepting the document.

Editing and customizing the resolution adopting share banking form

Most professionals seeking to complete the resolution adopting share banking form benefit from tools that allow easy editing and customization. Utilizing platforms like pdfFiller can streamline this process, as it offers various interactive features that support modification. Users can add, remove, or adjust sections of the resolution according to specific business needs, ensuring that the form accurately reflects the intended governance structure and operational authority.

When personalizing the resolution form, consider the unique dynamics of your business and the specific requirements of your stakeholders. For example, a tech startup may require different provisions compared to an established manufacturing company. By leveraging tools for customization and editing, you can create a resolution that aligns with both legal obligations and corporate culture.

Signing and managing the resolution adopting share banking form

After completing your resolution adopting share banking form, the next step is managing the signing process. With the rise of digital documentation, options for eSigning using platforms like pdfFiller have made it convenient for multiple stakeholders to approve and execute the document quickly. eSigning not only speeds up the process but also ensures that all parties have immediate access to the final executed document.

Taking the extra step to track document versions and updates is crucial, especially in a business landscape where changes happen frequently. Cloud storage solutions provide the ideal platform for securely storing completed forms, allowing for easy retrieval and audit if the need arises. Ensuring that the resolution is readily accessible while maintaining tight security measures helps in the proper management of corporate records.

Common issues and FAQs regarding the resolution adopting share banking form

As with any legal document, users may encounter various issues while working with the resolution adopting share banking form. Common FAQs include queries about who can authorize changes, when to update the resolution, and how to validate the authenticity of the document. It’s important to have a clear understanding of your company’s governance structure to avoid confusion among shareholders regarding the decision-making process.

Troubleshooting issues during the completion of the form typically revolves around missing signatures or sections. Always double-check the details before submitting the resolution to ensure that everything is in order. If you are uncertain about how to proceed or run into legal complexities, it’s advisable to consult with a legal expert specializing in corporate law.

Resolution tools available on pdfFiller

pdfFiller offers a suite of interactive tools designed to enhance the experience of completing a resolution adopting share banking form. Users can easily integrate this form with other documents, making it simpler to compile necessary paperwork for financial transactions or business restructuring. Collaboration is also streamlined, with tools that allow team members to work collectively on forms without facing version control issues.

These integration capabilities not only save time but also ensure that all relevant information is documented efficiently. By utilizing pdfFiller's features, businesses can maintain thorough, coherent records, making compliance and audits significantly easier down the line.

Managing shareholder changes and updates

Managing changes among shareholders is a common aspect of corporate governance that can significantly influence the structure of financial controls within a business. Procedures for adding or removing shareholders typically require amendments to the resolution adopting share banking form, ensuring that only authorized individuals manage shares and banking transactions moving forward. Documentation of these changes is critical for maintaining proper records.

Amendments to the resolution must be documented clearly, reflecting the specific changes and maintaining a comprehensive historical record. This is vital not only during shareholder transitions but also when preparing for external audits or internal assessments of corporate governance. The importance of maintaining accurate records cannot be overstated, as it ensures transparency and legal compliance.

Ensuring compliance and best practices

Ensuring compliance with local and federal regulations is an ongoing task for businesses, especially in maintaining legal documents like the resolution adopting share banking form. Regular reviews of all legal documents and resolutions are necessary to stay compliant with changes in the law and business practices. Establishing a schedule for updates also helps in keeping corporate governance robust and relevant.

Resources for keeping up-to-date with legislative changes, such as newsletters or legal advisories, can become invaluable over time. By actively monitoring changes and implementing them into your corporate resolution practices, you can ensure that your business operates within the legal framework while fostering trust and efficiency among your shareholders.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send resolution adopting share banking to be eSigned by others?

How can I get resolution adopting share banking?

How do I make changes in resolution adopting share banking?

What is resolution adopting share banking?

Who is required to file resolution adopting share banking?

How to fill out resolution adopting share banking?

What is the purpose of resolution adopting share banking?

What information must be reported on resolution adopting share banking?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.