Business Credit Application Form: A Comprehensive How-to Guide

Understanding the business credit application form

A business credit application form is a vital document used by lenders and credit issuers to assess the creditworthiness of businesses applying for credit. This form collects essential information about the business's financial status, credit history, and other crucial details that help determine the risk associated with lending to the applicant. The significance of a well-structured application cannot be overstated, as it serves as the first step in establishing a business's credit profile.

In today's competitive marketplace, having good credit is essential for businesses of all sizes. A business credit application form not only facilitates the lending process but also plays a pivotal role in fostering a trustworthy relationship between creditors and borrowers. It allows businesses to access the necessary funds for operational growth, inventory purchasing, and managing cash flow.

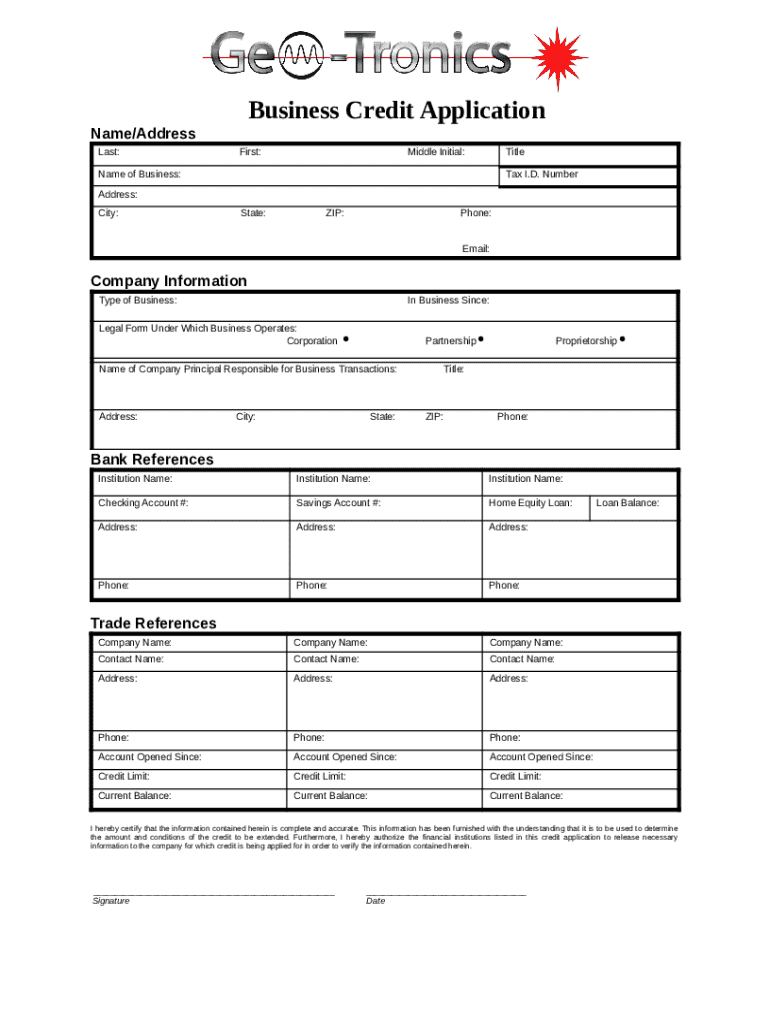

Components of a business credit application form

Understanding the key components of a business credit application form is crucial for both applicants and lenders. The form typically includes several key elements that are essential for evaluating the application accurately.

Company information including name, address, and contact details.

Financial history, typically showcasing previous loans, credit lines, and repayment behavior.

Trade references that can affirm the reliability and creditworthiness of the business.

Ownership structure detailing the individuals or entities that own and operate the business.

Customization options also exist, allowing businesses to tailor their forms to capture industry-specific information or unique requirements pertinent to their financial evaluation process.

The purpose of business credit applications

The primary purpose of business credit applications is to assess the creditworthiness of a business. Creditworthiness directly correlates with a company's ability to repay loans or credit, making this evaluation critical in the lending process. Lenders analyze the information provided to mitigate risk, ensuring they do not extend credit to businesses that may default.

Moreover, a well-constructed business credit application can help establish stronger customer relations. By allowing potential borrowers to present their business in a structured format, it opens opportunities for discussions about financing that may lead to long-term partnerships and mutual benefit.

Creating your business credit application form

Designing an effective business credit application form requires a methodical approach. Here’s a step-by-step guide to help you.

Identify required information, ensuring you cover all essential details necessary for a thorough credit evaluation.

Choose the right format: consider whether an online form or paper form would serve your needs best.

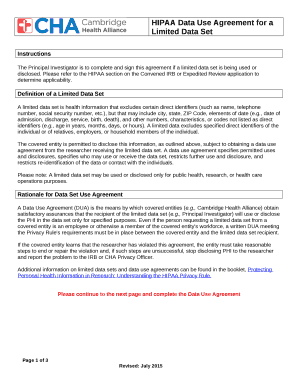

Incorporate any legal requirements, such as data privacy laws and financial disclosure regulations, to ensure compliance.

For added convenience, interactive tools such as pdfFiller offer customizable templates that assist in designing and managing your forms, making the process seamless.

Common challenges in the credit application process

Navigating the credit application process can present several challenges. Incomplete applications often delay the approval process and can lead to miscommunication between the lender and the applicant. To mitigate this, it's essential to have clear guidelines and communication strategies set in place.

Additionally, it’s crucial to have a strategy for detecting red flags and potential fraud. This involves training your team to recognize unusual patterns in applications and implement practices that reduce the risk of fraudulent submissions.

Enhancing the application process with automation

Automation can significantly enhance the efficiency of the credit application process. By integrating automation tools, businesses can streamline their workflow, drastically cutting down on processing time and minimizing human error.

pdfFiller provides features that support this automation, allowing users to manage, edit, and sign documents all within a single cloud-based platform. This empowers your team to focus on assessing applications instead of getting bogged down in administrative tasks.

Evaluating and approving credit applications

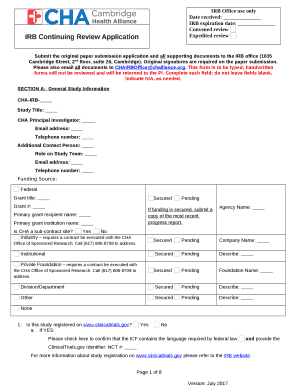

Once a credit application is submitted, there are several steps involved in the approval process. First, the submitted information needs to be carefully reviewed, ensuring all details align with the expectations set in the application.

Reviewing submitted information thoroughly to ensure accuracy.

Conducting credit checks to verify the applicant’s credit history and assess risk.

Making informed decisions based on the data collected and analysis of key metrics for approval.

Utilizing analytical tools can further enhance this process, allowing lenders to evaluate potential risks more accurately.

Best practices for businesses handling credit applications

To ensure efficiency and compliance in handling credit applications, adopt best practices such as streamlining the application process. This can be achieved by creating clear guidelines and resource materials for both applicants and your internal team.

Maintain compliance with local and national regulations regarding credit applications.

Uphold ethical standards in evaluating applications to foster trust with customers.

Invest in training your team on handling credit applications effectively and adhering to best practices.

Staying informed about changes in regulations and market conditions ensures that your credit process remains robust and efficient.

FAQs on business credit application forms

To address common concerns regarding business credit application forms, here are some frequently asked questions:

What are the different types of credit application forms? Business credit applications vary based on the lender and type of credit requested.

How can I determine an applicant’s creditworthiness? Through their financial history, credit scores, and trade references.

What measures can mitigate risks in credit applications? Comprehensive assessments and fraud detection measures help reduce risk.

What should I include in a well-structured business credit application? Company information, financial history, and trade references are essential.

What are the common mistakes to avoid when filling out a credit application? Incomplete data, missing signatures, and inaccuracies can lead to delays.

Transforming your credit application process

Transforming the business credit application process requires a commitment to continuous improvement. Utilizing feedback from both applicants and your team can enhance the overall quality of applications you receive.

Additionally, leveraging tools and templates available through platforms like pdfFiller can provide ongoing improvements, making your process not only efficient but also user-friendly.

Tips for future business success

Utilizing credit applications strategically can contribute to business growth. Establish a reputation for reliability in credit management, which fosters long-term customer relationships. Continuous learning about best practices in credit evaluation and management is crucial for adapting to changing market conditions.

By remaining committed to effective credit management, organizations can build and sustain a solid credit profile that benefits both the business and its clientele.