Get the free SECT 116 Liability of vehicle owner for parking offences on ...

Get, Create, Make and Sign sect 116 liability of

How to edit sect 116 liability of online

Uncompromising security for your PDF editing and eSignature needs

How to fill out sect 116 liability of

How to fill out sect 116 liability of

Who needs sect 116 liability of?

Understanding Sect 116 Liability of Form

Understanding Sect 116: An overview

Sect 116 of the Income Tax Act plays a critical role in determining the tax obligations of non-residents in Canada transferring property to residents. This section ensures compliance with tax regulations and protects the interests of both the government and the parties involved in the transaction. Understanding Sect 116 is vital for anyone engaging in real estate or similar property transactions, as compliance directly impacts tax liabilities. Key terms related to Sect 116 include 'non-resident', 'withholding tax', and 'excluded property', which serve as foundational concepts in discussing liability.

Legal implications of Sect 116 liability

The nature of Sect 116 liability revolves around the responsibilities of non-residents transferring property within Canada. This liability typically arises during real estate sales or significant asset transfers. When a non-resident sells property in Canada, they must ensure appropriate withholding taxes are deducted to avoid compliance issues. Common misconceptions about Sect 116 include the belief that it only applies to residential properties, while in reality, it applies to various property types, including commercial properties.

Examination of Sect 116 in various contexts

When analyzing Sect 116 in different legal contexts, it’s essential to understand its implications for trusts and estates. In such cases, the distribution of assets must comply with Sect 116 requirements, potentially affecting how beneficiaries receive their shares. Trusts need to ensure that distributions adhere to tax obligations, especially when dealing with excluded properties, such as certain land interests.

In commercial transactions, Sect 116 liability often surfaces where businesses owned by non-residents transfer assets. Legal precedents show that failure to comply can result in significant penalties and delays. Understanding these legal precedents is crucial for business entities to navigate potential liabilities effectively.

Detailed steps for analyzing Sect 116 liabilities

Analyzing Sect 116 liabilities can be broken down into several critical steps:

Case studies on Sect 116 liability

Analyzing landmark cases can provide invaluable insights into how Sect 116 is enforced. For instance, in 'R v. CBC Holdings', the court ruled on liabilities involving non-resident transactions, highlighting the importance of proper compliance. Each case offers lessons that can guide future transactions; understanding the circumstances of these rulings can help to avoid similar pitfalls.

A practical example includes a non-resident selling an interest in a Canadian-based company. If proper protocols are not followed, the resulting tax implications could be severe, emphasizing the need for careful compliance with Sect 116.

Best practices for managing Sect 116 compliance

To effectively manage Sect 116 compliance, consider the following best practices:

Potential challenges and solutions

Navigating Sect 116 can present various challenges, including misunderstandings regarding the law's scope and application. Common pitfalls stem from ambiguities that can lead to substantial penalties for non-compliance. Strategic solutions include ongoing education about tax obligations and staying abreast of legislative changes that affect Sect 116. Establishing a reliable support network of tax professionals can also mitigate risks.

Insights from experts on navigating Sect 116 liability

Input from legal professionals experienced in Sect 116 liability reveals the evolving nature of tax compliance regulations. Specialists highlight the importance of proactive measures in transaction planning, emphasizing the necessity of reviewing all potential liabilities before any transfer occurs. Recent interviews with tax experts suggest an emerging trend where increased scrutiny on non-resident transactions is likely to intensify, urging those involved to adopt rigorous compliance strategies.

Interactive tools and resources

For individuals and teams seeking to navigate Sect 116 liability effectively, several interactive tools can simplify the process. These include:

Frequently asked questions (FAQs) about Sect 116

Understanding common queries regarding Sect 116 can illuminate the complexities for those involved. For instance, the implications of non-compliance can lead to penalties, making it crucial to understand your obligations.

Additionally, many wonder how to contest a Sect 116 liability assessment. Engaging with a tax professional familiar with the legal nuances can provide a path to contesting unjust assessments effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

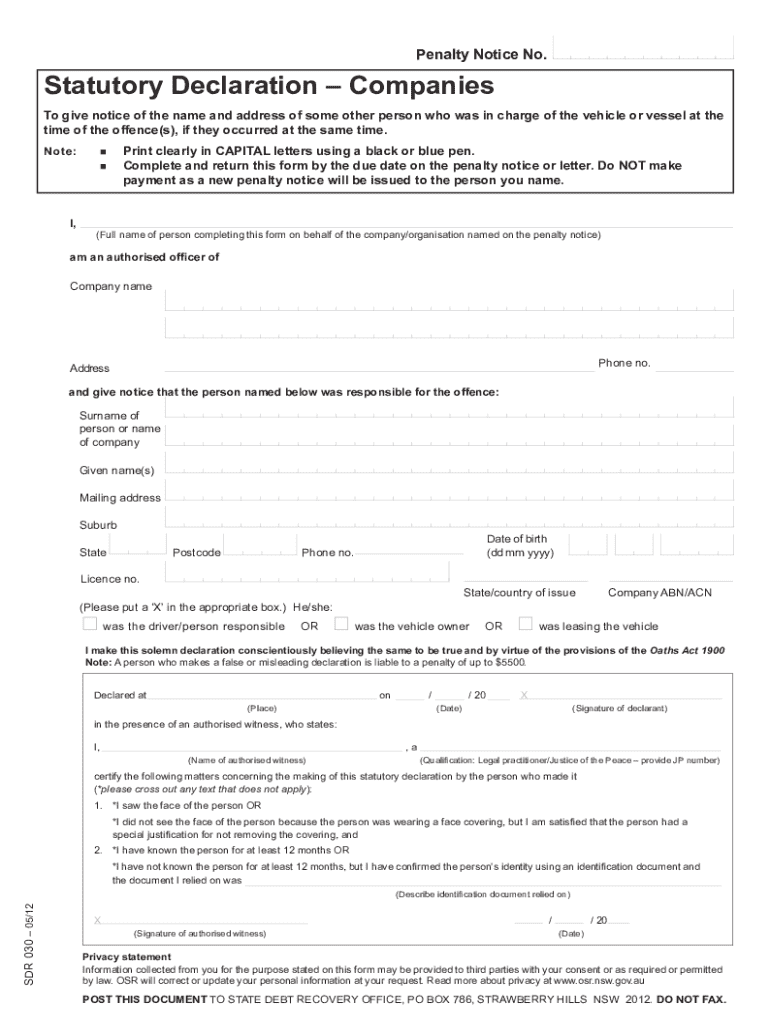

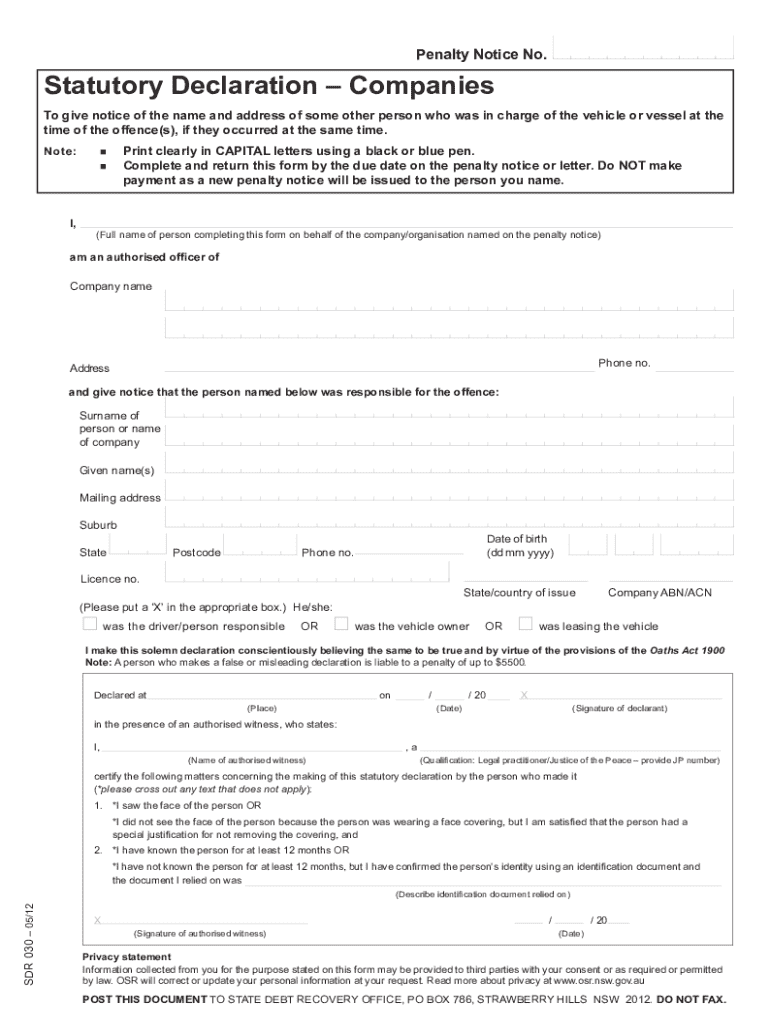

How do I complete sect 116 liability of online?

How can I edit sect 116 liability of on a smartphone?

How do I fill out the sect 116 liability of form on my smartphone?

What is sect 116 liability of?

Who is required to file sect 116 liability of?

How to fill out sect 116 liability of?

What is the purpose of sect 116 liability of?

What information must be reported on sect 116 liability of?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.