Get the free Form C/A UNDER THE SECURITIES ACT OF 1933 ( ...

Get, Create, Make and Sign form ca under form

Editing form ca under form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form ca under form

How to fill out form ca under form

Who needs form ca under form?

Form CA Under Form: A Comprehensive Guide

Overview of Form CA Under Form

Form CA serves as a detailed submission document required primarily for specific California tax filings and legal documentation. Its purpose is to ensure accurate representation of financial conditions, transactions, or status for individuals and entities within the state. Proper completion of Form CA is not just essential; it could also significantly impact the outcome of a submission, potentially leading to favorable assessments or avoiding penal consequences. This form is commonly utilized in various scenarios including property tax exemptions, business license applications, and tax amnesty programs.

Inaccurately filled forms can lead to delays in processing, additional fines, or even legal ramifications. Form CA has become a key player in tax proceedings, legal frameworks, and business registrations across California. Individuals and businesses need to understand its requirements thoroughly to leverage it effectively in their dealings with governmental entities.

Understanding the structure of Form CA

Form CA is constructed of several sections, each designed to capture crucial information intended for review by state officials. The primary segments usually encompass personal identification, financial details, and relevant legal information. Each area requires precise entries, and missing or wrong data could result in form rejection or further inquiries. For effective user engagement, many platforms, including pdfFiller, provide interactive elements such as tooltips which guide users through complex fields.

Prerequisites for filling out Form CA

Before diving into the form, ensure you gather the necessary documentation and information. Essential documents often include tax returns from previous years, proof of identity, and financial summaries. Understanding eligibility criteria is crucial, as various factors define who can submit Form CA, including the type of business entity or individual tax circumstances.

Organizing documents efficiently can save time and reduce stress when filling out the form. Keeping everything categorized into folders or labeled sections can make referencing details easier while addressing the different sections of Form CA.

Step-by-step guide to completing Form CA

Filling out Form CA can be straightforward when approached methodically. Here’s a detailed step-by-step guide:

Interactive tools for editing and signing

Utilizing platforms like pdfFiller offers significant advantages when managing Form CA. These tools allow users to edit PDF content directly, streamlining the completion process. With features for e-signatures and digital certificates, document signing becomes simple and efficient, ensuring that required approvals do not delay your submissions.

Collaboration features enable teams to work together seamlessly on document management. Users can share forms, track changes in real time, and ensure everyone is aligned during the submission process.

Frequently asked questions about Form CA

Form CA can raise several queries during the preparation process. Typically, users seek clarification regarding submission deadlines, acceptable submission formats, and troubleshooting common issues. It's beneficial to familiarize yourself with these aspects beforehand to avoid frustration.

For additional assistance, pdfFiller offers a dedicated customer support team ready to help users navigate through common query scenarios or any submission-related challenges.

Related forms and publications

In the context of Form CA, other related forms may also come into play. Understanding these documents, including state-specific regulations relevant to business and taxation in California, can provide valuable context and streamline your filing experience.

Tips for effective document management

Managing Forms like CA is crucial for ongoing compliance and efficiency in operations. Establishing best practices, such as regular backups and secure storage solutions, can keep your paperwork organized and readily accessible when needed.

Utilizing pdfFiller’s security features adds an additional layer of protection for sensitive information, helping users share forms without compromising data integrity.

User testimonials and success stories

Real-life experiences from users of Form CA often highlight the efficiency gained through substantial time savings and reduced stress levels. Countless individuals have shared how pdfFiller transformed their document management, allowing for easier collaboration and faster completions of forms.

Many testimonials emphasize the ease of use of the platform’s features, which enhance the overall experience of filling out vital documents, including Form CA.

Explore further: keeping your knowledge updated

Staying informed about recent changes to Form CA is essential, especially considering evolving tax laws and state regulations. Regular checks on tax advisory sites or subscribing to relevant newsletters can ensure you remain compliant with the latest guidelines.

Using pdfFiller for your ongoing document needs offers not just convenience but also an educational component; engaging with the community forums can provide insight and support that helps users maintain awareness and proficiency in form completion.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form ca under form in Gmail?

Can I edit form ca under form on an iOS device?

How do I fill out form ca under form on an Android device?

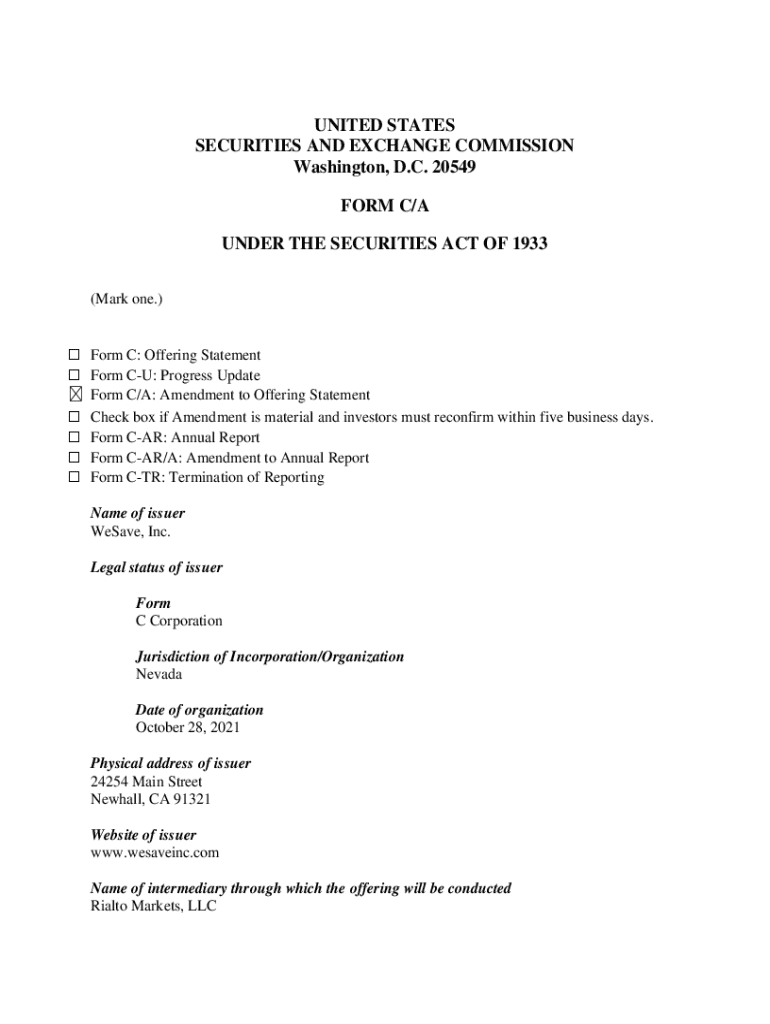

What is form ca under form?

Who is required to file form ca under form?

How to fill out form ca under form?

What is the purpose of form ca under form?

What information must be reported on form ca under form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.