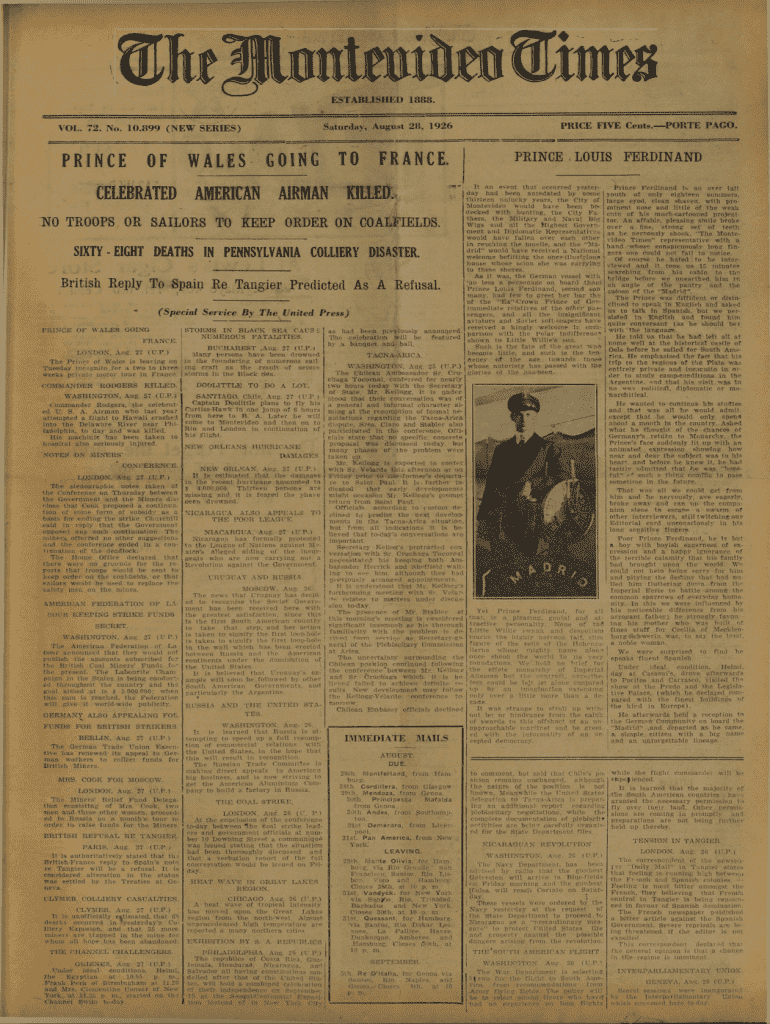

Get the free 899 (N E W SERIES)

Get, Create, Make and Sign 899 n e w

How to edit 899 n e w online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 899 n e w

How to fill out 899 n e w

Who needs 899 n e w?

Comprehensive Guide to the 899 n e w Form

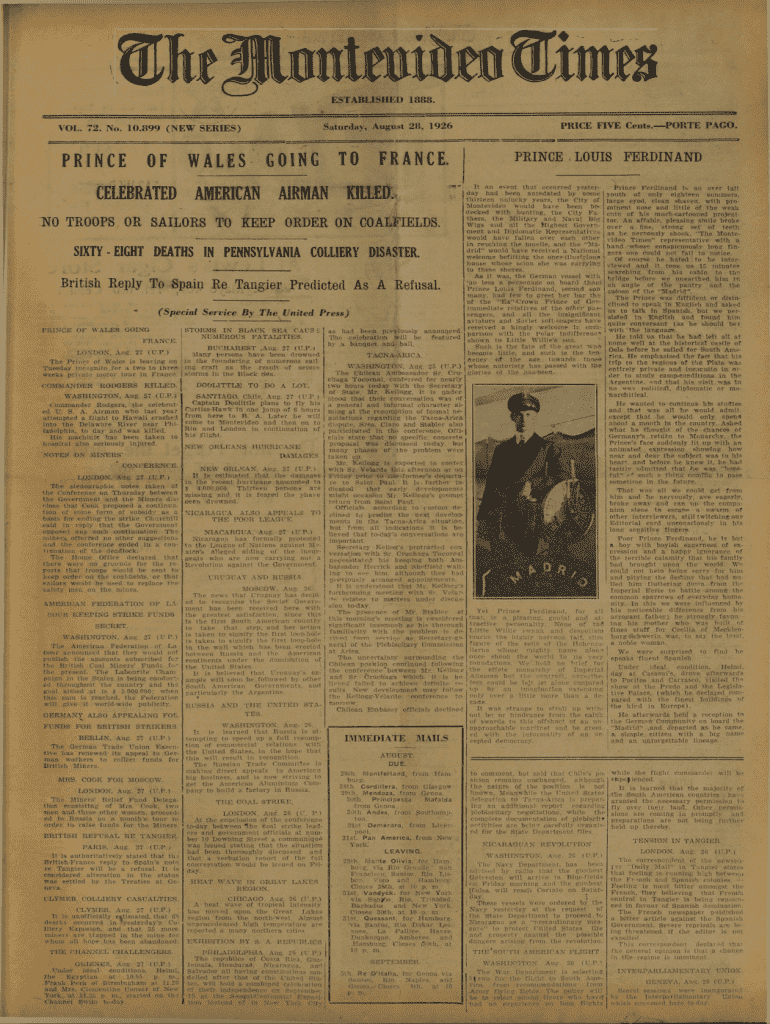

Overview of the 899 n e w form

The 899 n e w form is a critical document used primarily to streamline reporting and compliance in specific regulatory frameworks. Purposefully designed for both individuals and organizations, this form helps facilitate the collection and processing of crucial information mandated by various legal obligations.

Its relevance today is underscored by the increasing complexity of regulatory requirements across sectors. The 899 n e w form acts as a standardized medium ensuring that necessary data is communicated clearly and effectively, thereby minimizing the risk of non-compliance.

Key features of the 899 n e w form

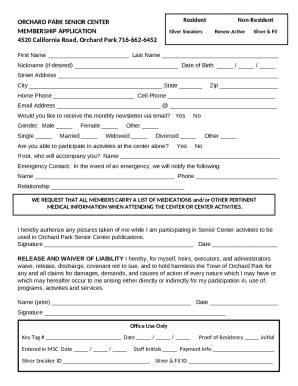

The 899 n e w form comprises several sections, each dedicated to capturing specific pieces of information required for effective processing. Understanding these sections helps users ensure complete and accurate submissions.

Essential information includes personal details, relevant financial data, and compliance verification elements. Certain optional fields can provide additional context but may not be mandatory for submission.

Moreover, the adoption of digital tools like pdfFiller enhances user experience by allowing for easy editing and completion of the form. Users can benefit from features such as auto-saving and cloud storage.

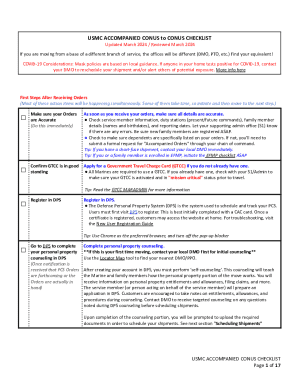

Step-by-step instructions for completing the 899 n e w form

Pre-filling preparation

Before initiating the filling process, gather all necessary documentation and relevant information. This includes financial records, identification documents, and any prior submissions that may serve as references. The more organized your documentation, the smoother the process will be.

Recommended resources include online databases that provide templates, guides on common errors, and checklists for required information. This ensures a thorough understanding of what needs to be filled out.

Filling out the form

When filling out the form, pay careful attention to each section’s requirements. Input data accurately, and avoid leaving any mandatory field blank. Use the interactive features available on pdfFiller to streamline your completion process.

Common pitfalls include overlooking optional fields or misinterpretation of terms. Utilize pdfFiller's clear prompts to guide you through the process effectively.

Editing and modifying the form

Editing options within pdfFiller allow users to make adjustments effortlessly. Tools are available for deleting, adding, or highlighting information as needed. Best practices include saving multiple versions during the editing process to prevent loss of critical information.

Signing and submitting the 899 n e w form

Once the form is completed, it must be signed before submission. pdfFiller provides versatile eSignature options, allowing users to create digital signatures and place them directly on the form.

The submission process varies based on the form's purpose. For regulatory submissions, users should know where to send it, whether electronically or via traditional mail. Keep track of any deadlines, as they can vary significantly depending on jurisdiction and the form’s purpose.

Managing the 899 n e w form after submission

After submission, managing your form is vital for tracking its status. pdfFiller makes it easy to check the application or form’s progress with real-time updates.

Securing copies of submitted forms is crucial as well. Users can easily store and retrieve their documents within the pdfFiller platform, ensuring data remains safe and accessible.

Collaboration tools within pdfFiller also allow multiple users to view and comment on the document, enabling teamwork for future adjustments or discussions regarding the submitted form.

Troubleshooting common issues with the 899 n e w form

Common inquiries surrounding the 899 n e w form often involve understanding specific requirements or resolving discrepancies in submitted data. Familiarity with the most frequently asked questions can accelerate the process, enhancing user experience.

For additional help, pdfFiller offers contact support options. Engaging with their support team can assist in clarifying complex issues and provide insights for resolving any disputes related to the form.

Case studies and examples

Numerous real-life scenarios showcase the benefits of utilizing the 899 n e w form across various sectors. For example, a small business utilizing the form for tax compliance found improved efficiency and reduced errors, thanks to the standardized nature of the document.

User testimonials from pdfFiller highlight instances where easy collaboration and streamlined processes have led to better outcomes and enhanced compliance for organizations.

Additional tips and best practices

Implementing best practices for form management can yield significant advantages. This includes maintaining organized records that are easily retrievable and consistent compliance checks to avoid legal issues.

Leveraging pdfFiller's features allows for ongoing document management, leading to better collaboration and accountability within teams, especially for multi-faceted projects.

Related forms and templates

Users searching for the 899 n e w form may also find other similar forms beneficial. Comparative analysis provides insights into their features and applicability in different contexts.

Resources available through pdfFiller facilitate the exploration of related templates, enhancing the user’s toolkit for compliance and documentation.

Stay updated on changes regarding the 899 n e w form

Keeping abreast of regulatory changes impacting the 899 n e w form is crucial for all users. Subscribing to relevant newsletters and updates can provide timely information on necessary modifications.

Engaging with a community focused on document management and compliance can also yield valuable insights, shared experiences, and proactive strategies for navigating the complexities of the regulatory environment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the 899 n e w electronically in Chrome?

How do I fill out the 899 n e w form on my smartphone?

Can I edit 899 n e w on an iOS device?

What is 899 n e w?

Who is required to file 899 n e w?

How to fill out 899 n e w?

What is the purpose of 899 n e w?

What information must be reported on 899 n e w?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.