Get the free Notice of Trust - Fifth Judicial Circuit

Get, Create, Make and Sign notice of trust

Editing notice of trust online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notice of trust

How to fill out notice of trust

Who needs notice of trust?

Understanding the Notice of Trust Form: A Comprehensive Guide

Understanding the notice of trust form

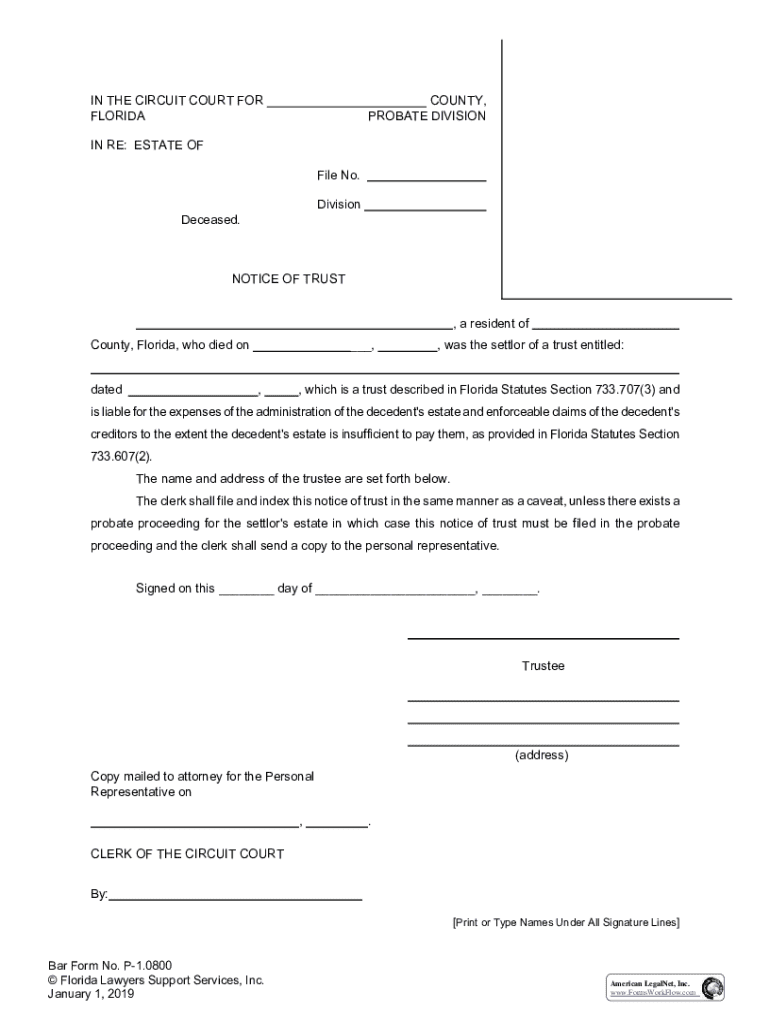

A notice of trust form serves as a crucial legal instrument used in estate management and property transactions. This document outlines the existence of a trust and delineates the rights and responsibilities of the parties involved, namely the trustee and the beneficiaries. Without this form, it might be challenging to ensure that trust assets are properly handled, or even to prove the trust’s existence when necessary.

Who should use the notice of trust form?

The notice of trust form is suitable for a variety of parties involved in trusts, estates, or property transactions. Individuals establishing a trust or those managing an estate frequently utilize it to communicate essential information to beneficiaries and interested third parties.

Real estate transactions often necessitate a notice of trust to provide clear ownership and management details when property titles are being transferred. This clarity is crucial for avoiding future disputes regarding property ownership.

Components of the notice of trust form

Understanding the essential components of the notice of trust form is critical in ensuring its effectiveness. The document must contain comprehensive information related to the trust to serve its purpose.

Moreover, the form includes sections that must be filled out properly, such as the trust name and date, a statement of the trust terms, and relevant signatures. Notarization is also commonly required to authenticate the document legally.

Step-by-step guide to completing the notice of trust form

Completing the notice of trust form requires careful attention to detail. Before filling out the form, it’s crucial to gather all required documentation to ensure accuracy.

Filing the notice of trust form

Once the notice of trust form is completed and notarized, the next step is filing it with the appropriate authorities. The location and method of filing can vary based on jurisdiction.

Managing your trust after filing

Once the notice of trust form has been filed, ongoing management of the trust becomes vital. Keeping records up to date ensures the trust functions as intended.

Frequently asked questions (FAQs) about the notice of trust form

Despite efforts to ensure proper filing, issues or uncertainties may arise concerning the notice of trust form. Understanding these challenges can help ease the process.

Additional considerations

As you navigate the process of creating and managing a trust, it’s crucial to consider state-specific laws and the benefits of modern document management tools.

Related documents and forms to consider

In addition to the notice of trust form, there are other essential documents that are vital in trust management and estate planning.

Contacting pdfFiller for support and resources

Utilizing the right document management resources can streamline the process of handling notices of trust and other legal documents. pdfFiller offers live support options to assist users in navigating their needs effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find notice of trust?

How do I edit notice of trust online?

How do I edit notice of trust straight from my smartphone?

What is notice of trust?

Who is required to file notice of trust?

How to fill out notice of trust?

What is the purpose of notice of trust?

What information must be reported on notice of trust?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.