Sample QCD Donor Request Form: Your Comprehensive Guide

Understanding qualified charitable distributions (QCDs)

A Qualified Charitable Distribution (QCD) allows individuals aged 70½ and older to donate directly from their Individual Retirement Accounts (IRAs) to qualified charities, thus satisfying their required minimum distribution (RMD). This process can be notably beneficial for both donors and charities, setting it apart as an essential tool in philanthropy.

Eligibility to make a QCD is straightforward, rooted primarily in age and account type. To qualify, participants must be at least 70½ years old at the time of the donation. Furthermore, only traditional IRAs, Roth IRAs, and inactive defined contribution plans may facilitate QCDs; however, 401(k)s generally do not qualify unless rolled over to an IRA.

From a tax perspective, QCDs present significant advantages by potentially lowering taxable income. This is particularly critical for individuals aiming to minimize tax liabilities while supporting causes they care about. Not only do QCDs remove funds from taxable income, but they can also bolster the financial positions of charities, providing them with essential resources to fuel their missions.

Overview of the QCD donor request form

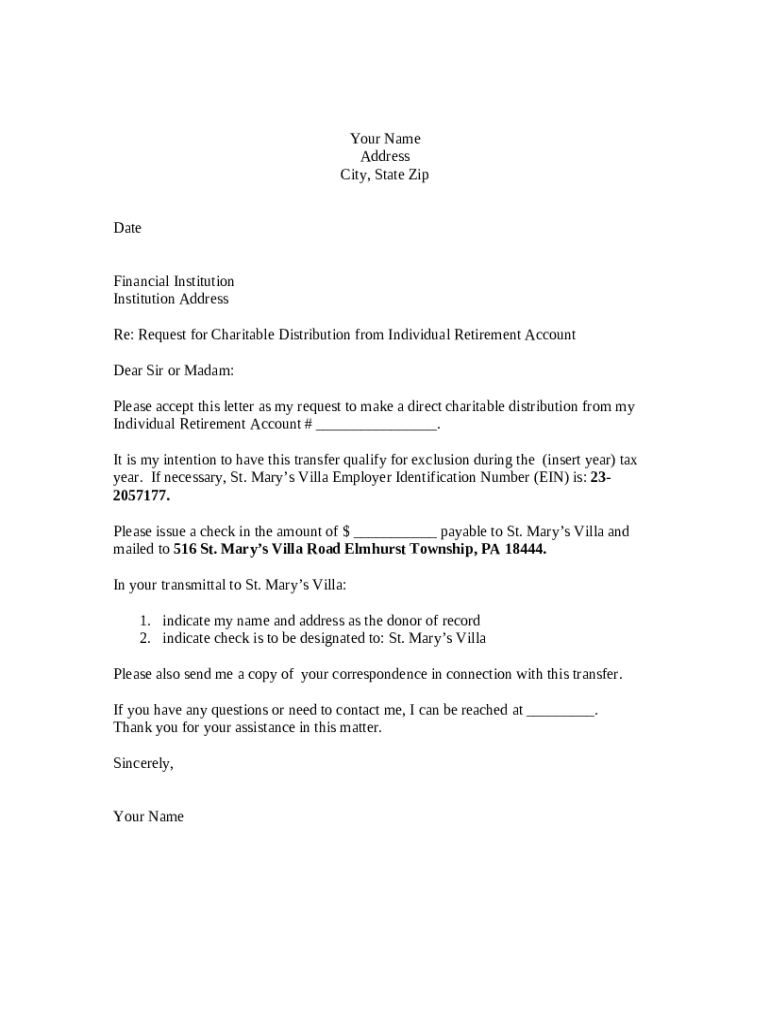

The QCD donor request form serves as a formal mechanism to initiate a charitable distribution from your IRA. Its primary purpose is to communicate essential information between you, your financial institution, and the charity. Ensuring accuracy on this form is vital for smooth transaction processing and timely delivery of funds.

Key components of the QCD donor request form include:

Donor Information Section: This part включает name, address, and social security number details of the donor.

Charitable Organization Details: Information about the recipient charity’s name, address, and IRS status to verify its qualification.

Distribution Specifics: Amount to be donated, date of transaction, and any restrictions on the donation.

Step-by-step guide to completing the QCD donor request form

To maximize the effectiveness of your QCD donation, it’s essential to follow a systematic approach in completing the QCD donor request form. Start by gathering the necessary documentation: You will need details from your financial institution, including the account type and balance, and verification materials from the charitable organization to ascertain its eligibility.

Filling out the QCD donor request form requires attention to detail. Make sure to:

Double-check personal information to avoid administrative delays.

Verify the charity’s IRS qualification code to ensure compliance.

Clearly specify the amount intended for donation and any special instructions regarding the distribution.

Common pitfalls include incorrect dates and failing to notarize the form if necessary. It's advisable to seek assistance from your tax advisor for any specific concerns regarding eligibility and tax implications.

Utilizing pdfFiller for a seamless QCD process

pdfFiller offers a user-friendly interface for accessing and completing the QCD donor request form. By leveraging this platform, you can ensure an organized and streamlined approach to managing your charitable distributions.

To access the QCD donor request form on pdfFiller, simply navigate to their website, search for 'QCD donor request form,' and select the template you'd like to use.

In addition to filling out the form, pdfFiller provides interactive tools that enhance your experience. These tools include:

Editing capabilities allow you to personalize your form effortlessly.

Adding electronic signatures makes for a faster processing experience.

For team collaborations, pdfFiller's sharing features enable you to share the form with relevant parties. Ensure all stakeholders have access for input and review, which is crucial for maintaing collaborative synergy on charitable efforts.

Managing your QCD transactions

After completing and submitting your QCD donor request form, effective management of your transactions becomes paramount. Keeping meticulous records of your QCD submissions allows you to monitor the impact and maintain accountability for your donations.

You should take specific steps to ensure accurate tracking, including:

Create a dedicated folder for all QCD documentation, including forms and correspondence.

Maintain a summary log of donations that captures dates, amounts, and recipient charities.

Regularly communicate with your charities to confirm receipt of your QCD.

Understanding the timeline for processing your QCD is also essential. Typically, charities require a processing period of a few days, so planning your submissions around key donation times can optimize your contributions.

Common questions and answers about QCDs and donor requests

As with any financial decision, making a QCD can generate questions and concerns. Below are frequent inquiries surrounding QCDs and the donor request process:

What are the age requirements for making a QCD?

Can I make a QCD if I have not yet reached RMD age?

What happens if I mistakenly submit an incorrect form?

It's important to have clear answers for these questions, as they'll help clarify the eligibility and process. If you encounter any issues with forms or submissions, do not hesitate to consult your tax advisor or reach out to your financial institution for support.

Success stories: Donors making a difference through QCDs

Many individuals have seen transformative impacts through their QCD contributions, making a significant difference in their communities. These stories showcase how effective planning and the use of proper documentation can enhance philanthropic results.

Testimonials from donors highlight their experiences while using the QCD donor request form:

One donor shared how a timely QCD aided a local food bank in expanding its outreach, offering meals to more families.

Another donor expressed gratitude for the efficient process provided by pdfFiller, stating it streamlined their approach to charitable giving.

These success stories underscore the importance of utilizing accessible and efficient tools like pdfFiller to facilitate your QCD journey and maximize your impact on charitable causes.

Connect with us for personalized assistance

For any further inquiries about QCDs or the QCD donor request form, pdfFiller offers dedicated resources to assist. Our customer service team is readily available to address your needs and concerns, ensuring a seamless experience throughout your charitable journey.

You can reach out through various channels, whether via email, our website chat feature, or community forums. We encourage engagement and shared learning opportunities regarding charitable endeavors; these connections can enrich your understanding and impact.

The power of charitable giving through QCDs is not just in the donations but also in the community it breeds. Let’s work together to foster a culture of giving!