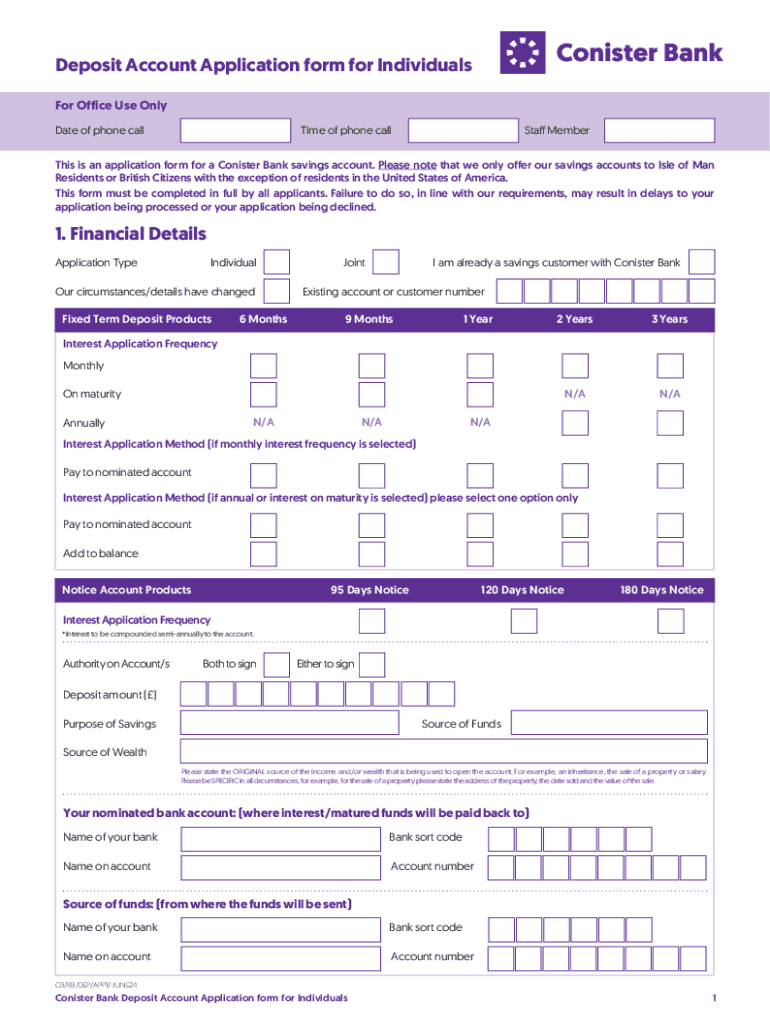

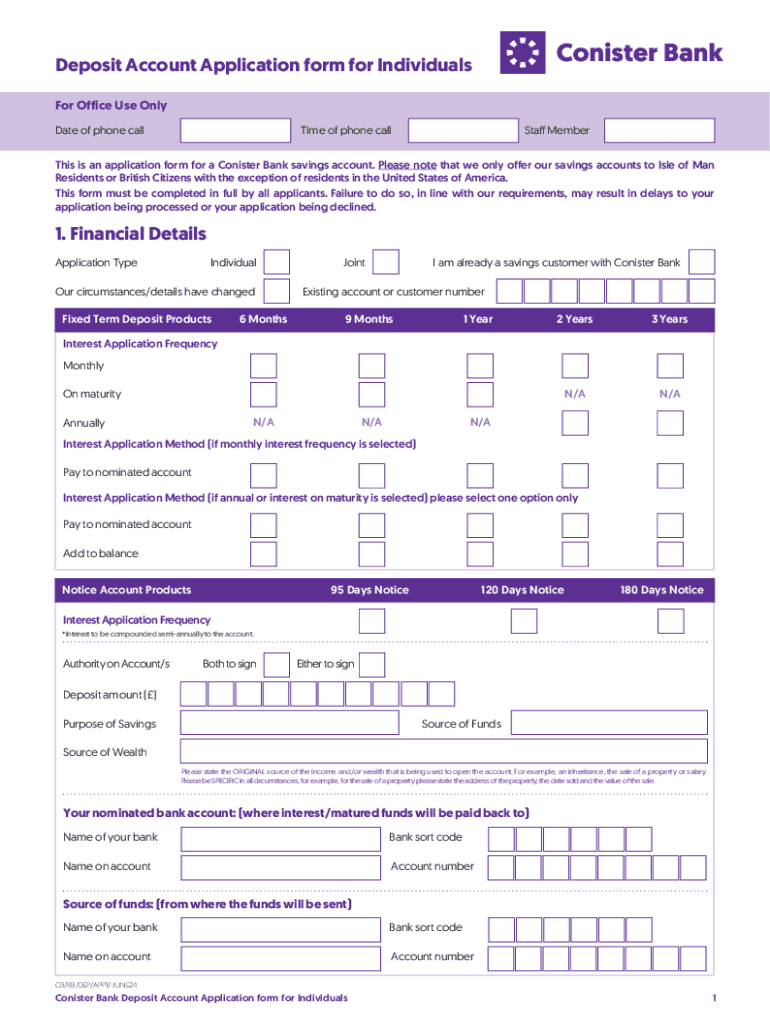

Get the free Deposit Account Application form for Individuals

Get, Create, Make and Sign deposit account application form

How to edit deposit account application form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out deposit account application form

How to fill out deposit account application form

Who needs deposit account application form?

Comprehensive Guide to the Deposit Account Application Form

Understanding deposit accounts

A deposit account is a financial account held at a bank or other financial institution that allows customers to deposit funds, earn interest, and access their balances. These accounts serve as the fundamental building blocks of personal finance, providing a safe place to store money while earning returns.

There are several types of deposit accounts available, each tailored to meet different financial needs:

The benefits of having any type of deposit account are substantial, including safety from theft, the ability to earn interest, and access to convenient banking services such as online banking and automatic payments.

The deposit account application process

The process of applying for a deposit account can vary by institution but typically involves a straightforward series of steps. Prospective account holders must complete an application form, either online or in person, and provide necessary documentation to verify their identity and financial situation.

Online applications are particularly beneficial as many institutions offer streamlined processes that save time and simplify data entry. Users can access forms at any time and often receive instant notifications regarding their application status.

Detailed breakdown of the deposit account application form

The deposit account application form is divided into several key sections, each designed to gather essential information required for account establishment. Understanding these sections can help you prepare and complete the form more efficiently.

Step-by-step instructions for completing the application

To complete the deposit account application form efficiently, start by accessing the form. Many banks provide convenient online access through platforms like pdfFiller, allowing you to fill out the application right on your computer or mobile device.

Submitting your application

Once you have completed your application, you will need to submit it. If you applied online, you could typically submit the application immediately through the bank's website.

Interactive tools available on platforms like pdfFiller can streamline the e-signing process and document management, making submission easier.

After submission: What to expect

After submitting your application, it typically undergoes a review process. Most banks have established processing times, often ranging from a few hours to several business days.

You might receive follow-up communication if there are any issues or delays. Being aware of common reasons for application delays, such as incomplete information or verification issues, can help you stay informed.

Managing your deposit account post-application

Once your deposit account is open, regular management is essential. You can access your account information online to ensure your details remain current and accurate.

Setting up online banking through your bank's platform, which might incorporate pdfFiller for document management, greatly enhances the ease with which you can interact with your account, allowing for efficient oversight and administration.

FAQs related to deposit account applications

When navigating the deposit account application form, questions may arise. Here are some commonly asked questions and their answers:

Contact information and support

If you encounter challenges while completing your deposit account application form, reaching out to customer support is crucial. Most banking institutions offer multiple means of contact including phone support, live chat, or email.

Resources available on pdfFiller can also help guide you through the process, providing templates and additional documentation assistance to ensure a seamless application experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send deposit account application form for eSignature?

Where do I find deposit account application form?

How do I edit deposit account application form in Chrome?

What is deposit account application form?

Who is required to file deposit account application form?

How to fill out deposit account application form?

What is the purpose of deposit account application form?

What information must be reported on deposit account application form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.