Get the free Tax Liability: Definition, Calculation, and Example

Get, Create, Make and Sign tax liability definition calculation

How to edit tax liability definition calculation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax liability definition calculation

How to fill out tax liability definition calculation

Who needs tax liability definition calculation?

Understanding Tax Liability: Definition Calculation Form

Understanding tax liability

Tax liability refers to the total amount of taxes that an individual or business owes to the government, which is determined based on income, property, and applicable exemptions or deductions. The calculation of tax liability is essential in understanding financial obligations and ensuring compliance with tax laws. For individuals, tax liabilities might stem from personal wages and investments, while businesses face a more complex scenario, including various available deductions and credits.

Being aware of your tax liability helps in effective financial planning and avoiding potential penalties for underpayment. Understanding it requires analyzing different factors, such as gross income and applicable tax brackets. This understanding is fundamental both for individuals managing personal finances and for businesses strategizing for future growth.

Types of tax liability

Tax liabilities take various forms, notably depending on the income source or business activities. Here’s a breakdown of common tax types:

Each type has specific implications on how tax planning should be approached, necessitating tailored strategies to optimize financial outcomes.

Tax liability calculation: step-by-step guide

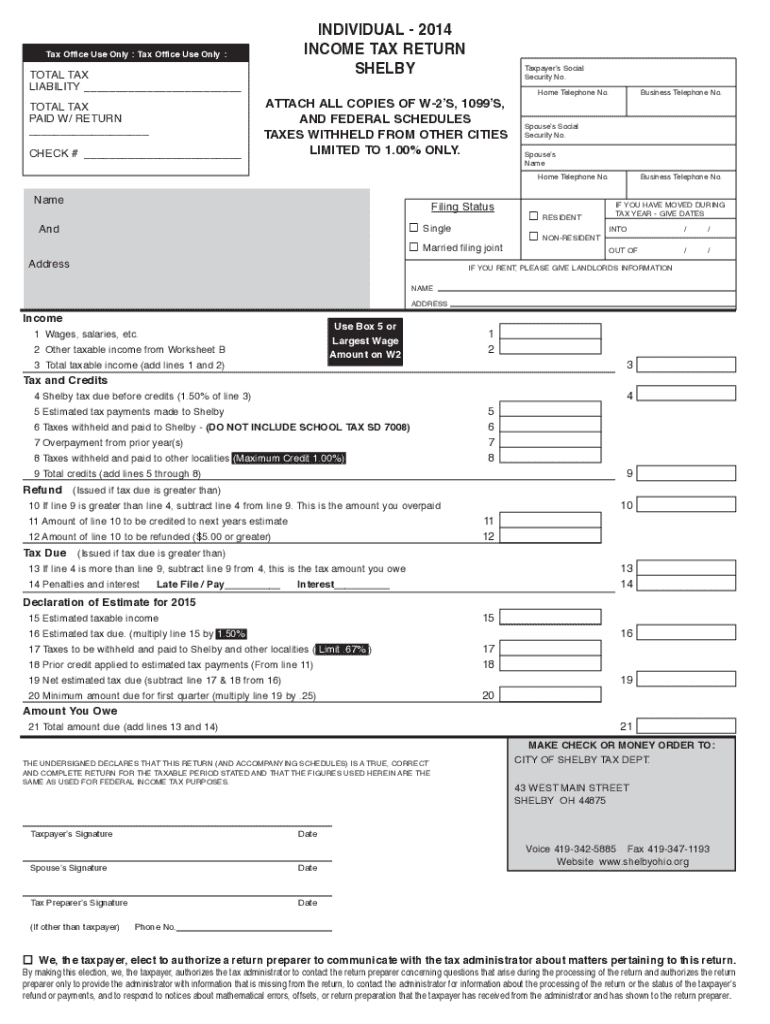

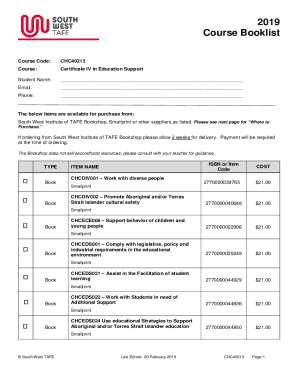

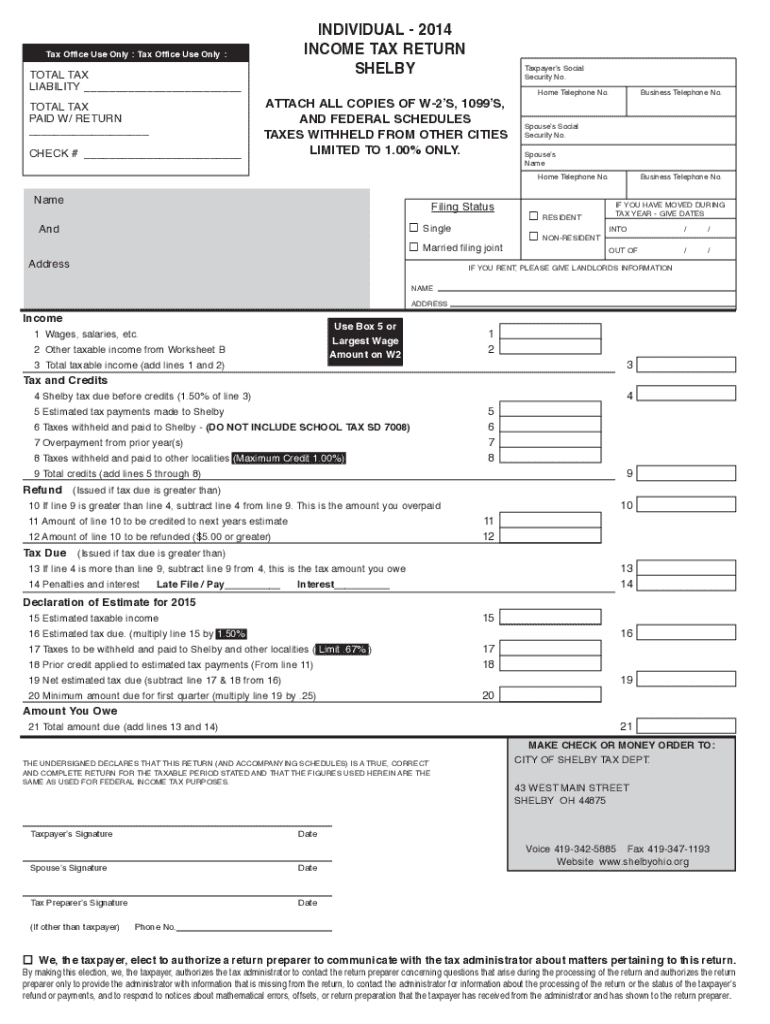

Calculating tax liability starts with gathering necessary financial documents that give insights into gross income, deductible expenses, and credit eligibility. The primary forms needed usually include W-2s for earned income, 1099s for freelance work, and records of deductions like mortgage interest or educational expenses.

For example, a single income earner may find their tax bracket and applicable deductions lead to a different final liability than a couple filing jointly. Similarly, a business owner could incorporate multiple streams of income, requiring a more intricate approach.

Utilizing the tax liability calculation form

Creating an accurate tax liability calculation form is simplified with tools like the pdfFiller Tax Liability Calculation Form. This form offers an interactive platform where users can input their financial data and see their tax liability calculated in real-time.

These functionalities are tailored to enhance the user experience, making tax calculations seamless and stress-free.

Strategies for reducing tax liability

Alleviating tax liability can greatly enhance financial health; thus, knowing the ins and outs of deductions and credits is essential. Deductions work by reducing the amount of income that is taxable, while credits directly lower the overall tax owed.

Integrating these strategies into financial planning can lead to notable savings and optimized tax outcomes over time.

FAQs about tax liability

Common questions often arise regarding tax liabilities, especially surrounding terms and situations. A few noteworthy inquiries include the following:

Recent trends in tax legislation

Tax legislation continually evolves, and recent changes have implications for how tax liabilities are calculated for both individuals and businesses. Notable adjustments include updates to tax brackets, changes in allowable deductions, and credit eligibility revisions.

For instance, changes in the Child Tax Credit have significant implications for families, potentially altering tax liability substantially. Keeping informed about these shifts is crucial for effective tax planning and preparation, as this ensures compliance and optimization of available benefits.

Navigating complex tax situations

For those handling multiple revenue streams, like freelancers and gig workers, tax liability calculations require a nuanced approach, including self-employment tax considerations. Special situations, such as taxation for non-residents or expats, often introduce additional complexities.

In these cases, professional consultation can often yield the best approach to ensuring compliance while expertly managing tax liabilities.

Utilizing pdfFiller for tax document management

Leveraging a cloud-based solution like pdfFiller can simplify the management of tax documents. Users can create, edit, and manage their tax-related forms from anywhere, enhancing accessibility and efficiency.

This can alleviate much of the stress associated with tax filing, allowing for a more organized approach to managing financial obligation.

Tax stories and personal experiences

Real-life experiences often shed light on the importance of accurate tax reporting. Many taxpayers have learned—sometimes the hard way—that miscalculating their tax liability can lead to costly penalties or audits.

These anecdotes illustrate that proper tax preparation is not just about compliance; it is about proactive financial management and securing peace of mind.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify tax liability definition calculation without leaving Google Drive?

Can I create an electronic signature for the tax liability definition calculation in Chrome?

Can I edit tax liability definition calculation on an Android device?

What is tax liability definition calculation?

Who is required to file tax liability definition calculation?

How to fill out tax liability definition calculation?

What is the purpose of tax liability definition calculation?

What information must be reported on tax liability definition calculation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.